Connecticut Employment Form

Description

How to fill out Employment Form?

If you intend to finish, secure, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms accessible online.

Employ the site's straightforward and user-friendly search to find the documents you need.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Every legal document template you acquire is yours permanently. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Complete and obtain, and print the Connecticut Employment Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Step 1. Make sure you've chosen the form for your specific city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you've located the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Obtain the format of the legal form and download it onto your device.

- Step 7. Fill out, review, and print or sign the Connecticut Employment Form.

Form popularity

FAQ

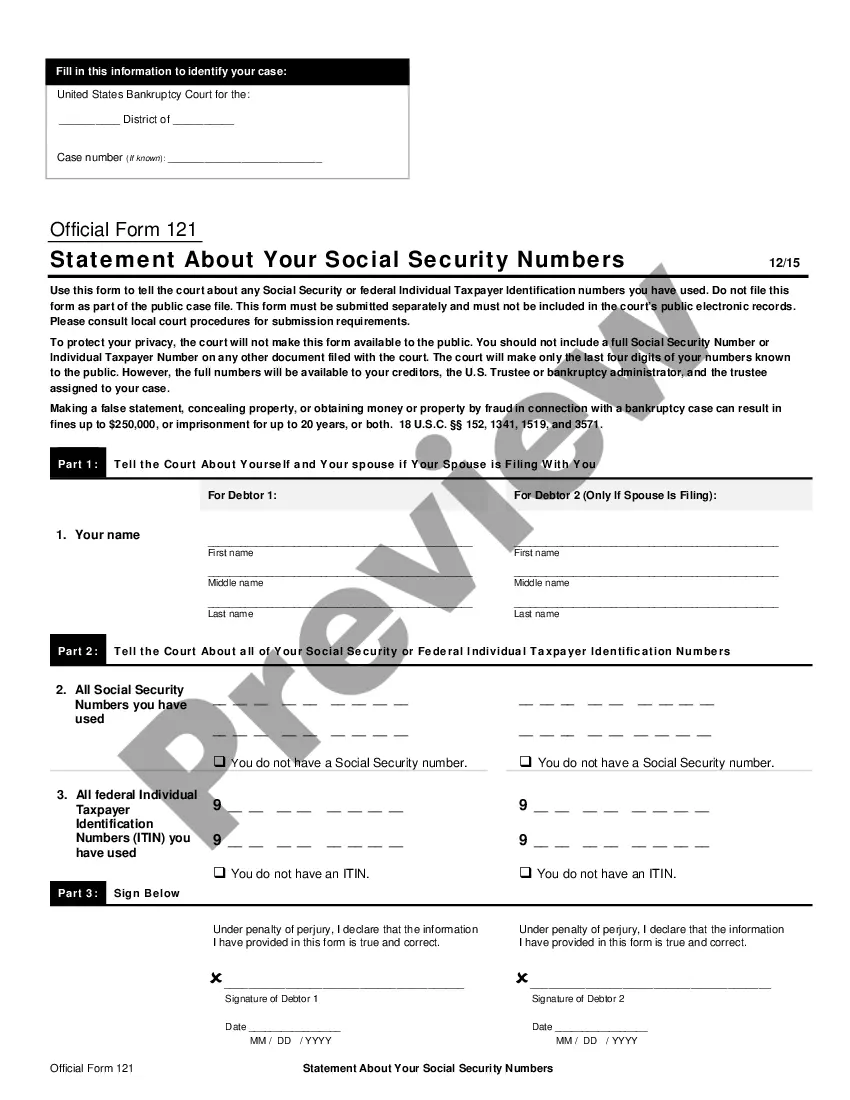

Who needs a W-4? Most employees need to fill out a W-4 for their employer. If you have multiple jobs that withhold tax, you will need to complete a W-4 for each job. In general, you don't need to fill out a W-4 for your employer if you're self-employed, a freelancer, or an independent contractor.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

State Abbreviation: CT. State Tax Withholding State Code: 09.

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

You are required to pay Connecticut income tax as income is earned or received during the year. You should complete a new Form CT-W4 at least once a year or if your tax situation changes.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

The difference between a W-2 and W-4 is that the W-4 tells employers how much tax to withhold from an employee's paycheck; the W-2 reports how much an employer paid an employee and how much tax it withheld during the year. Both are required IRS tax forms.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.