Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

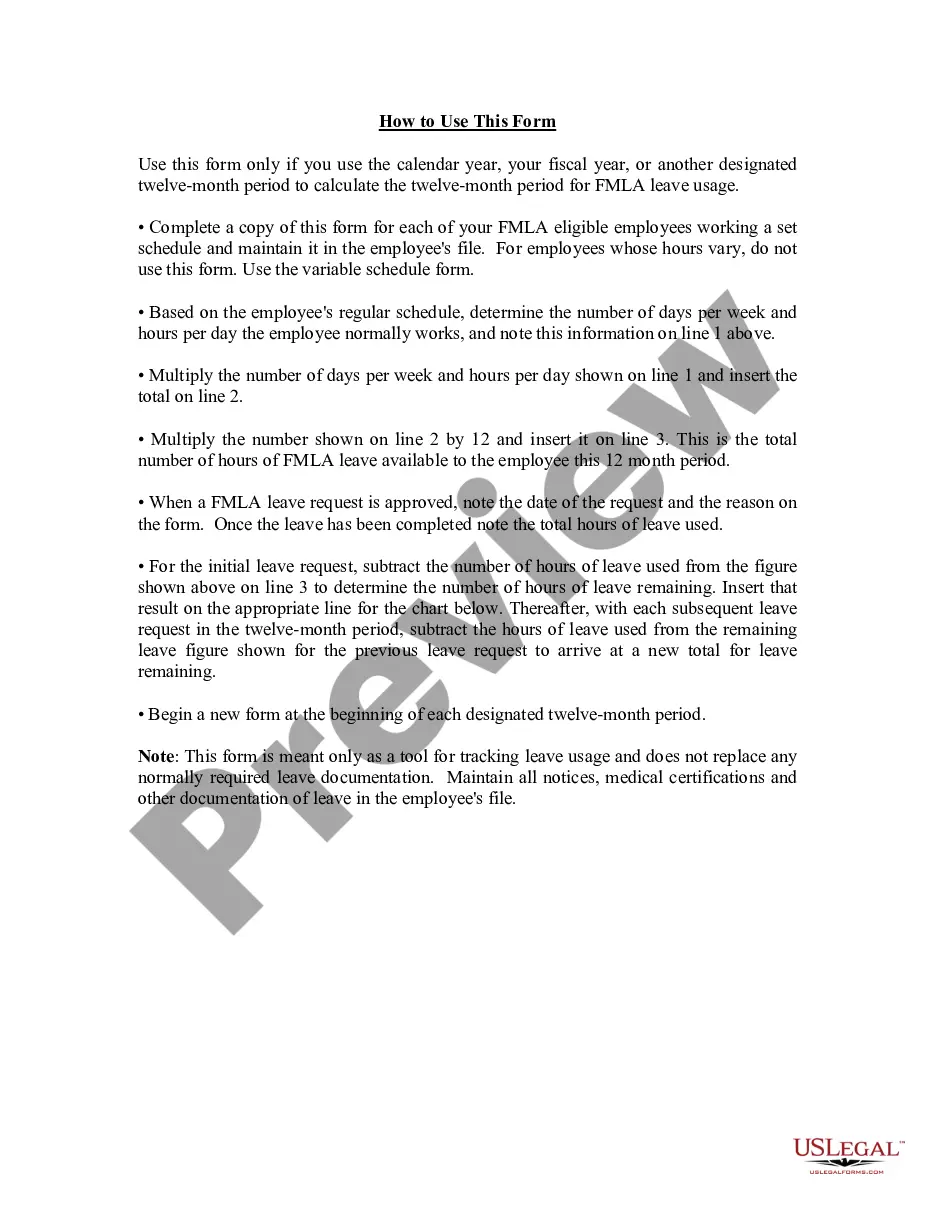

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

You can allocate effort on the internet searching for the valid document template that satisfies the federal and state requirements you will need.

US Legal Forms offers thousands of valid templates that are verified by professionals.

You can easily obtain or print the Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule from the service.

Review the form details to confirm you have selected the accurate template. If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Acquire button.

- Subsequently, you can complete, edit, print, or sign the Connecticut FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule.

- Every valid document template you receive is yours indefinitely.

- To obtain another copy of any acquired form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for the state/city of your choice.

Form popularity

FAQ

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

For the rolling backwards method, each time an employee requests more FMLA leave, the employer uses that date and measures 12 months back from it. An employee would be eligible for remaining FMLA leave he or she has not used in the preceding 12-month period. For example, Mrs.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

An eligible employee may take all 12 weeks of his or her FMLA leave entitlement as qualifying exigency leave or the employee may take a combination of 12 weeks of leave for both qualifying exigency leave and leave for a serious health condition.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

FMLA leave may be taken in periods of whole weeks, single days, hours, and in some cases even less than an hour. The employer must allow employees to use FMLA leave in the smallest increment of time the employer allows for the use of other forms of leave, as long as it is no more than one hour.