Connecticut Assignment of Profits of Business

Description

How to fill out Assignment Of Profits Of Business?

Are you currently in a situation where you require documents for both commercial or specialized purposes almost every day? There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, including the Connecticut Assignment of Profits of Business, designed to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Connecticut Assignment of Profits of Business template.

- Locate the form you desire and ensure it is for your specific area/state.

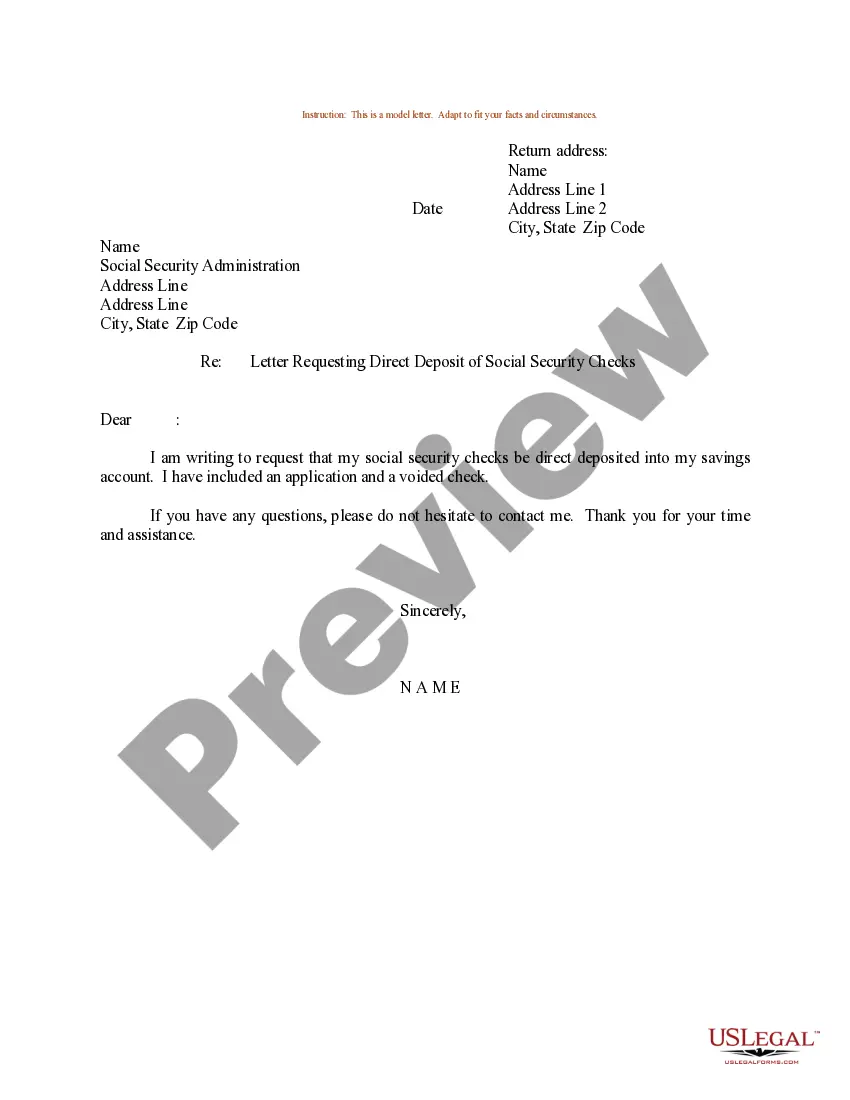

- Use the Preview button to review the document.

- Check the description to confirm you have selected the correct form.

- If the document isn’t what you’re looking for, utilize the Research field to find the form that suits your needs and specifications.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you wish, fill in the required information to create your account, and place an order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Section 33-749 of the Connecticut Business Corporation Act outlines the procedures and requirements for the assignment of profits within a corporation. This section is crucial for business owners to understand as it governs how profits can be allocated and shared among stakeholders. Knowing this law can aid in the successful operation of a Connecticut Assignment of Profits of Business. Make sure to consult legal experts for tailored advice.

Connecticut offers a supportive environment for businesses, with various resources and incentives to foster growth. While costs can be a consideration, many entrepreneurs find the state's infrastructure and skilled workforce beneficial. If you're considering a Connecticut Assignment of Profits of Business, you'll appreciate the state's commitment to supporting innovative enterprises and local startups.

The CT business entity tax is a tax required of all limited liability companies that operate in the state of Connecticut. The business entity tax costs $250 and is due every two years.

Last year, the Connecticut General Assembly enacted the pass-through entity tax at the flat rate of 6.99% on most pass-through entities, including partnerships, S corporations and limited liability companies that are treated as partnerships or S corporations for federal income tax purposes.

Last year, the Connecticut General Assembly enacted the pass-through entity tax at the flat rate of 6.99% on most pass-through entities, including partnerships, S corporations and limited liability companies that are treated as partnerships or S corporations for federal income tax purposes.

The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021.

One of the main tax benefits of electing a pass-through business structure is avoiding double taxation. Business earnings are only taxed once, on the owner or shareholder's personal tax return. One of the first decisions every business owner makes is how to structure their business.

The corporation must file a corporate tax return, IRS Form 1120, and pay taxes at a corporate income tax rate on any profits. If a corporation will owe taxes, it must estimate the amount of tax due for the year and make quarterly payments to the IRS by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

The corporation must file a corporate tax return, IRS Form 1120, and pay taxes at a corporate income tax rate on any profits. If a corporation will owe taxes, it must estimate the amount of tax due for the year and make quarterly payments to the IRS by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Business income may include income received from the sale of products or services. For example, fees received by a person from the regular practice of a profession are business income. Rents received by a person in the real estate business are business income.