Connecticut Private Trust Company

Description

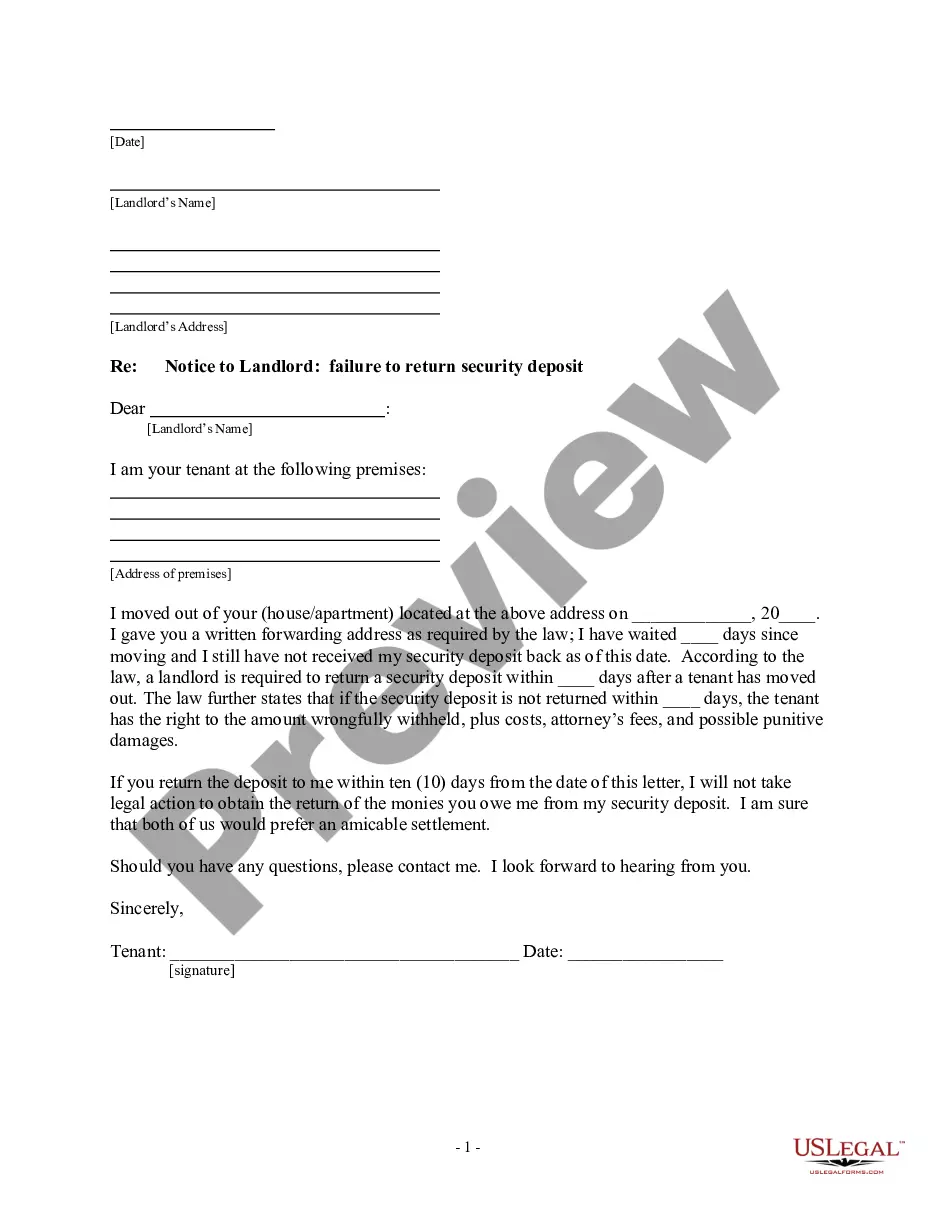

How to fill out Private Trust Company?

If you need to obtain, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's simple and user-friendly search feature to find the documents you require.

A variety of templates for both business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Connecticut Private Trust Company with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to each form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Connecticut Private Trust Company with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Connecticut Private Trust Company.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the information carefully.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to locate other forms from the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Connecticut Private Trust Company.

Form popularity

FAQ

A trust company is typically tasked with the administration, management, and the eventual transfer of assets to beneficiaries. A trust company acts as a custodian for trusts, estates, custodial arrangements, asset management, stock transfer, and beneficial ownership registration.

A trust company is a corporation that acts as a fiduciary, trustee or agent of trusts and agencies. A professional trust company may be independently owned or owned by, for example, a bank or a law firm, and which specializes in being a trustee of various kinds of trusts.

A limited purpose trust company is a trust company that has been chartered by the state to perform specific trust functions. These functions can include acting as a depositor or safekeeper for securities or mortgages. The Participants Trust Company is an example of a mortgage depositor trust.

Why Use a Trust Company? Trust companies can provide a wealth of services to clients from one convenient, centralized location. They save their clients time and effort by eliminating the need to coordinate financial assets and information between brokers, financial planners, tax advisors, tax preparers, and attorneys.

A California-chartered trust company is a non-depository institution and is not authorized to provide commercial banking services. A California-chartered trust company is allowed to engage in the trust business, which has the meaning set forth in Financial Code Section 115.

A trust company is an entity, often a division of a commercial bank, that can serve as an agent or trustee to either a personal or business trust. Rather than choosing an individual to act as trustee, a trust company can fill the same role.

The California Department of Financial Institutions ("DFI") licenses trust companies in California.

The regulation of trusts lies with the responsibility of the state in which the trust is registered. While the Federal Deposit Insurance Corporation insures the money placed in trusts at state-chartered banks, the federal oversight body defers to the authority of the state banking commissions' rules and regulations.

Can an independent trust company in California engage in commercial banking activities, including accepting deposits? No. A California-chartered trust company is a non-depository institution and is not authorized to provide commercial banking services.

From: Financial Consumer Agency of Canada The Trust and Loan Companies Act is the primary legislation governing all federally regulated trust and loan companies in Canada.