Connecticut Warranty Agreement as to Web Site Software

Description

How to fill out Warranty Agreement As To Web Site Software?

Are you presently in a situation where you need documents for either business or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Connecticut Warranty Agreement regarding Web Site Software, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Purchase now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Warranty Agreement regarding Web Site Software template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the right city/state.

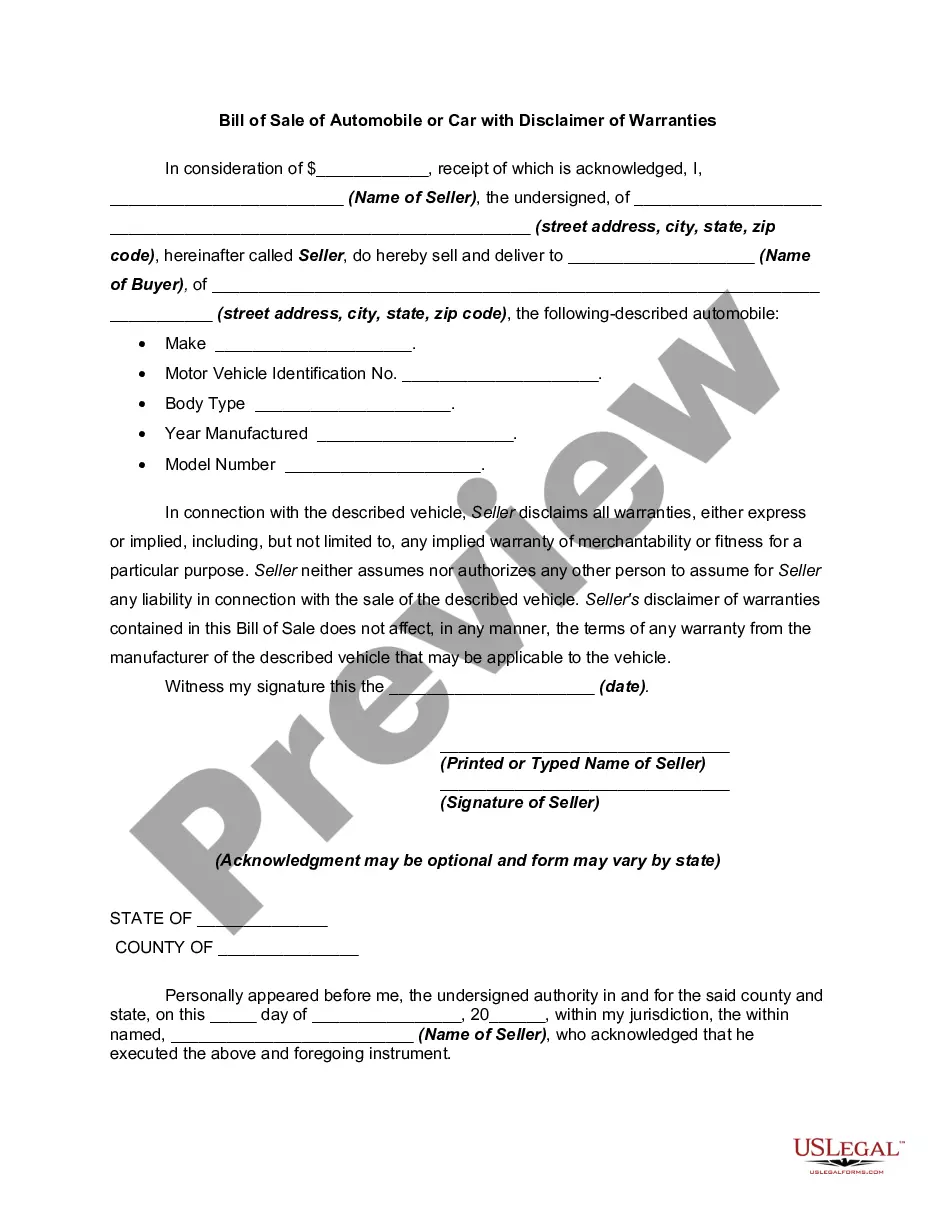

- Utilize the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search bar to find the form that suits your requirements.

Form popularity

FAQ

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

Prewritten computer software is taxable as tangible personal property, whether it is sold as part of a package or as a separate component, regardless of how the software is conveyed to the purchaser.

The definition of SaaS sometimes falls in the gray area of digital service. Connecticut does tax SaaS products, but check the website to confirm that the definition firmly applies to your service.

Sales of canned software - delivered on tangible media are subject to sales tax in Connecticut. In the state of Connecticut, so long as no tangible personal property was delivered to the buyer in addition to downloaded software, the software will be taxed at 1% rate applicable to computer and data processing services.

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

Sales of Computer Software: The tax rate for sales of computer software depends on whether the software is prewritten or custom. Canned or prewritten software. Canned or prewritten computer software is tangible personal property. The sale, leasing, or licensing of the software (including upgrades) is taxable at 6%.

The definition of digital advertising services broadly includes advertisement services on a digital interface, including banner advertising, search engine advertising, interstitial advertising, and other comparable advertising services. The tax rate varies from 2.5% to 10% of the annual gross revenues derived from