Connecticut Partnership Resolution to Sell Property

Description

How to fill out Partnership Resolution To Sell Property?

If you wish to finalize, download, or print valid document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Leverage the site's simple and user-friendly search to locate the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to obtain the Connecticut Partnership Resolution to Sell Property with just a few clicks.

Every legal document template you obtain is yours permanently. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and download and print the Connecticut Partnership Resolution to Sell Property with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to obtain the Connecticut Partnership Resolution to Sell Property.

- You can also access forms you have previously downloaded in the My documents section of your account.

- In case you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

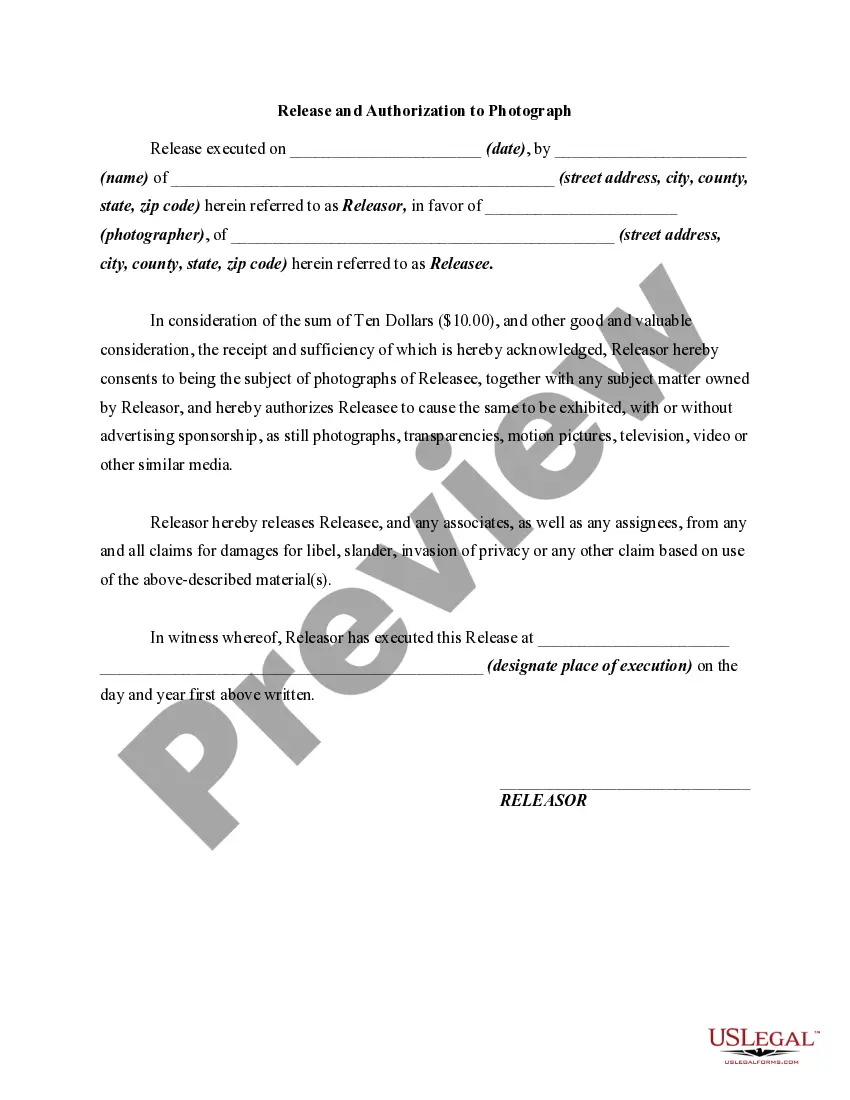

- Step 2. Use the Review option to evaluate the form’s content. Remember to read through the information.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other options of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Connecticut Partnership Resolution to Sell Property.

Form popularity

FAQ

Yes, the Pass-Through Entity (PTE) tax is mandatory for many business entities in Connecticut. Partnerships and S-corporations engaging in business within the state must comply with this tax. This requirement is crucial to consider when addressing a Connecticut Partnership Resolution to Sell Property, as it influences financial liabilities.

Partnership resolution definition refers to resolving a dispute between partners in a business partnership. The way certain disputes in partnership will be handled should be spelled out in the partnership agreement.

Helping business owners for over 15 years. Property of a partnership is owned by its tenants, generally referred to as tenants in common or tenants in partnership. As such, the partnership property is considered the property of each of its partners and they each have equal rights to use it.

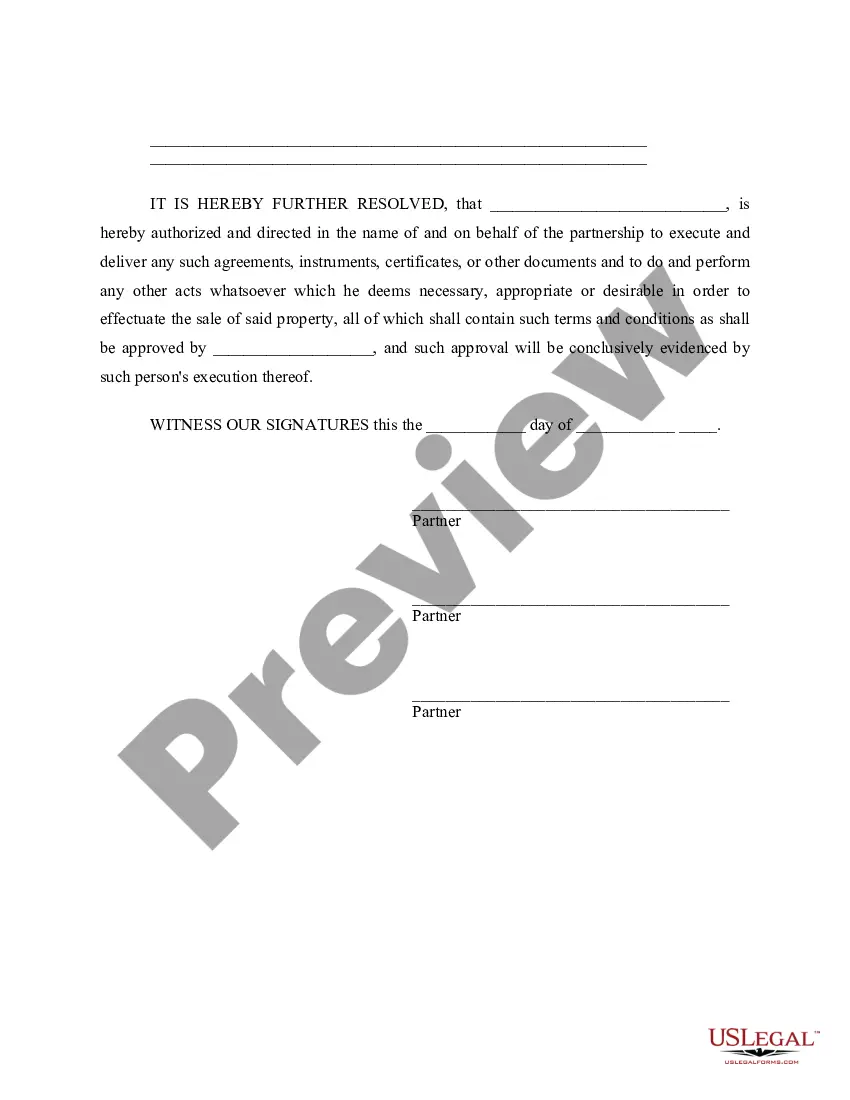

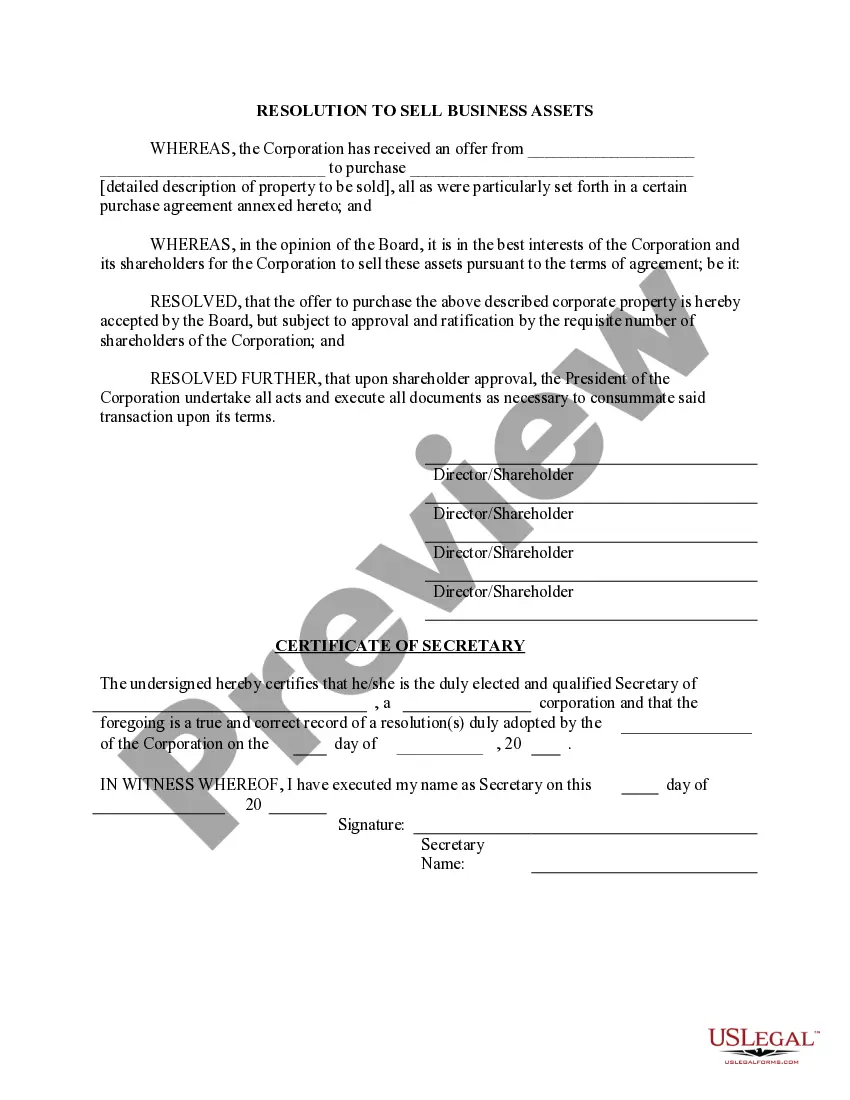

In the event that a company decides to sell its property, it will require a corporate resolution to sell real estate. This is a straightforward document that cites the name of the buyer and the location of the company's property. The location of the real estate sold may be at a street address, section, block, or lot.

The dispute in partnership dispute can be solved by the various methods like arbitration, mediation and negotiation. Court proceeding and awards are also the ways in which a dispute can be settled.

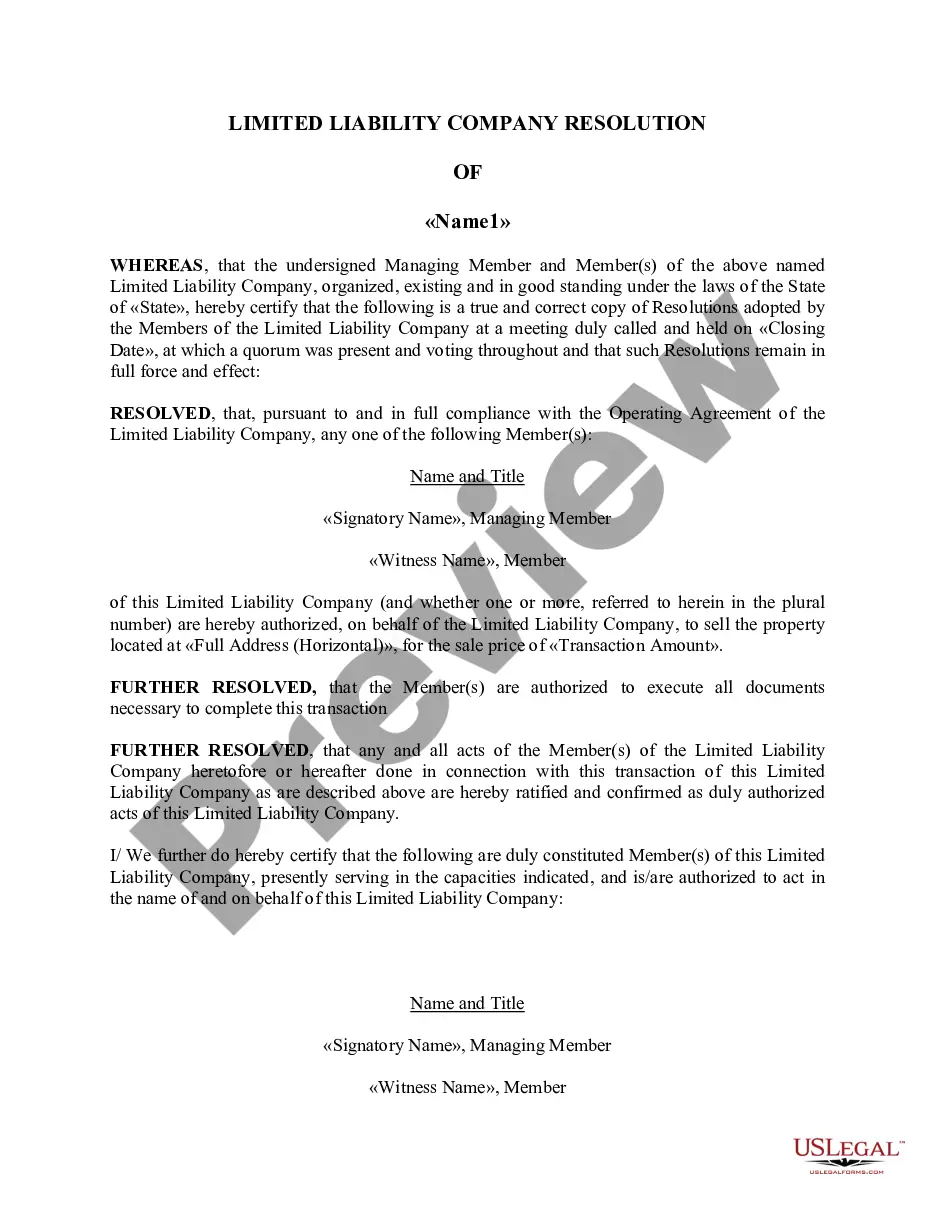

Unless approved by a unanimous Resolution of the Limited Partnership, the Limited Partnership will not engage in any business or activity which is not anticipated by the Purposes, or reasonably incidental to, or gives effect to, the Purposes.

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

Partnerships typically give general partners the authorization to bind the corporation. In limited partnerships, limited partners may not have the same authority to bind the partnership, but in most instances, partnerships do not need to pass a resolution for the partners to act.