Connecticut Renunciation of Legacy to give Effect to Intent of Testator

Description

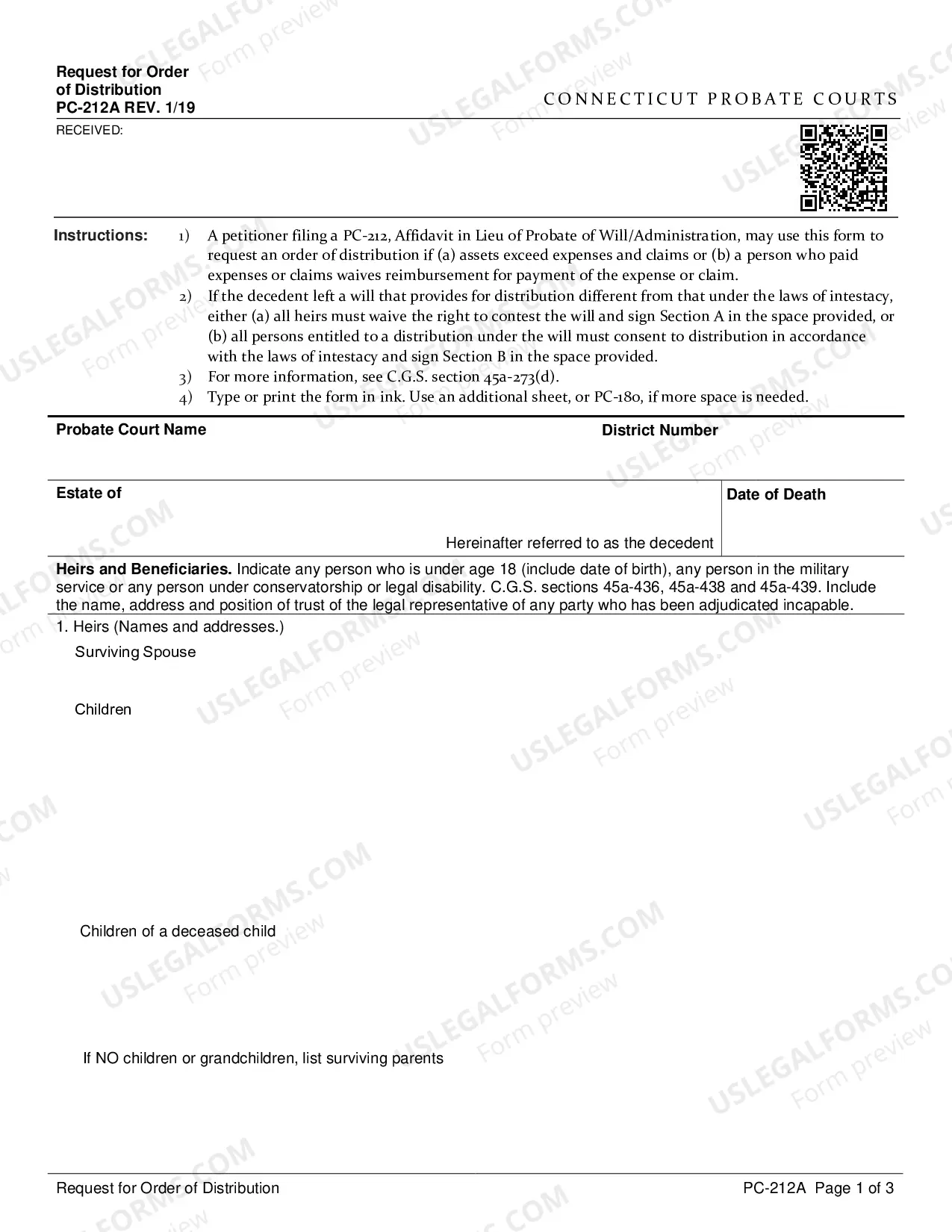

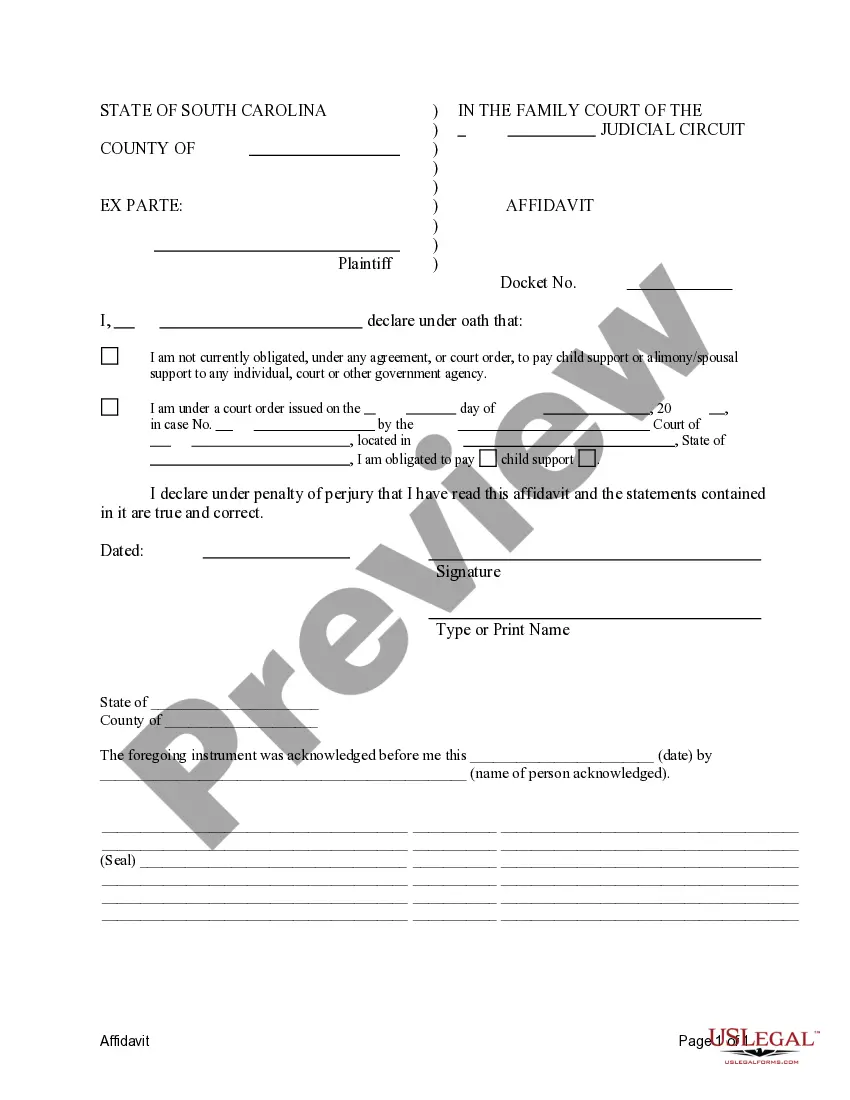

How to fill out Renunciation Of Legacy To Give Effect To Intent Of Testator?

US Legal Forms - one of many most significant libraries of authorized types in the USA - delivers a wide array of authorized papers web templates you can obtain or print out. Making use of the website, you can find thousands of types for company and specific reasons, sorted by classes, suggests, or keywords.You can get the most up-to-date types of types like the Connecticut Renunciation of Legacy to give Effect to Intent of Testator in seconds.

If you currently have a monthly subscription, log in and obtain Connecticut Renunciation of Legacy to give Effect to Intent of Testator from your US Legal Forms local library. The Download key will appear on each develop you look at. You gain access to all formerly saved types in the My Forms tab of the account.

If you want to use US Legal Forms the very first time, here are straightforward recommendations to help you started off:

- Make sure you have picked out the proper develop for the town/state. Select the Preview key to review the form`s content. Browse the develop outline to actually have chosen the correct develop.

- In the event the develop does not suit your specifications, make use of the Look for field at the top of the display screen to find the one who does.

- When you are happy with the form, validate your option by clicking the Purchase now key. Then, pick the pricing strategy you want and give your accreditations to sign up for the account.

- Method the purchase. Use your charge card or PayPal account to finish the purchase.

- Select the formatting and obtain the form in your product.

- Make alterations. Fill up, change and print out and indication the saved Connecticut Renunciation of Legacy to give Effect to Intent of Testator.

Every template you included in your bank account does not have an expiry date and is your own property for a long time. So, if you want to obtain or print out one more version, just proceed to the My Forms section and click on around the develop you want.

Obtain access to the Connecticut Renunciation of Legacy to give Effect to Intent of Testator with US Legal Forms, probably the most considerable local library of authorized papers web templates. Use thousands of specialist and state-distinct web templates that satisfy your company or specific demands and specifications.

Form popularity

FAQ

Anti-lapse statutes are laws enacted in every state that prevent bequests from lapsing when the intended beneficiary has relatives covered by the statute.

If my nephew predeceases me, this gift will lapse.? In this example, if John is living when the person creating the Will dies, then John will receive the $5,000. If John has already died, the gift to John ceases and will go to someone else named elsewhere in the Will or as determined by law.

Anti-lapse statutes prevent this from occurring in many circumstances involving relatives. For example, let us say Rachel bequests her $10,000 to her sister Eilene, but Eilene dies before Rachel. In all states, the anti-lapse statute would allow Eilene's kids to take the $10,000.

At common law, the "no residue of a residue" rule controlled when a residuary gift lapsed. This meant that the lapsed residuary gift would fall into the intestate estate, rather than pass to the remaining residuary beneficiary, if any.

45a-318 in 1991; P.A. 93-407 added provision permitting decedent, in a duly acknowledged writing, to designate person other than next of kin to have custody and control of his remains; P.A. 94-25 deleted phrase ?for the time being? in Subsec. (a); P.A.

The act, by the personal representative of a deceased person's estate, of transferring a legacy, or all or part of the residuary estate, to a beneficiary. An assent should only take place once the personal representative is satisfied that: The beneficiary is entitled to the legacy or share in the residuary estate.

Under common law, if a person devised a gift to a devisee and the devisee passed prior to the testator, the gift would ?lapse? or fail, leaving the property to intestacy laws.

Connecticut's "anti-lapse" statute drafted in 1821, provided that the beneficiary's surviving children would take the bequest unless the will effectively directed another result. The crucial question therefore was whether the affirmative condition "if she survives" negated operation of this default statute.