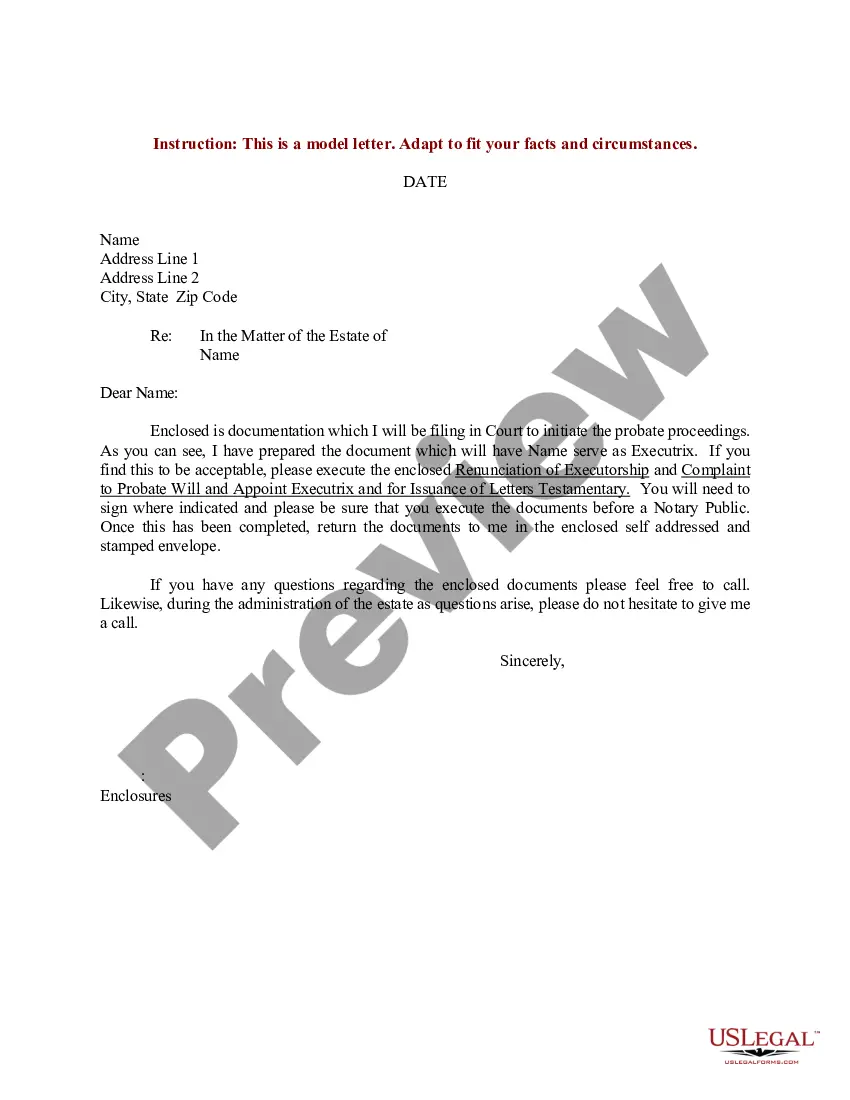

Connecticut Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship

Description

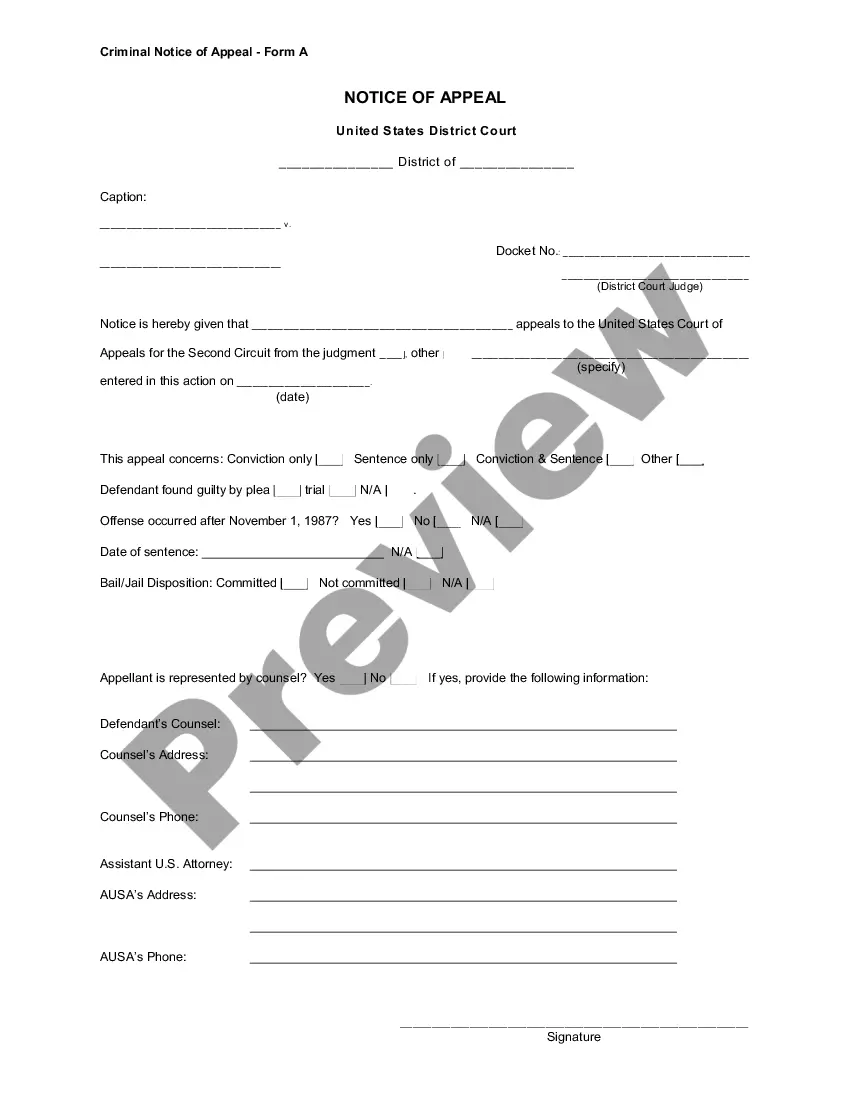

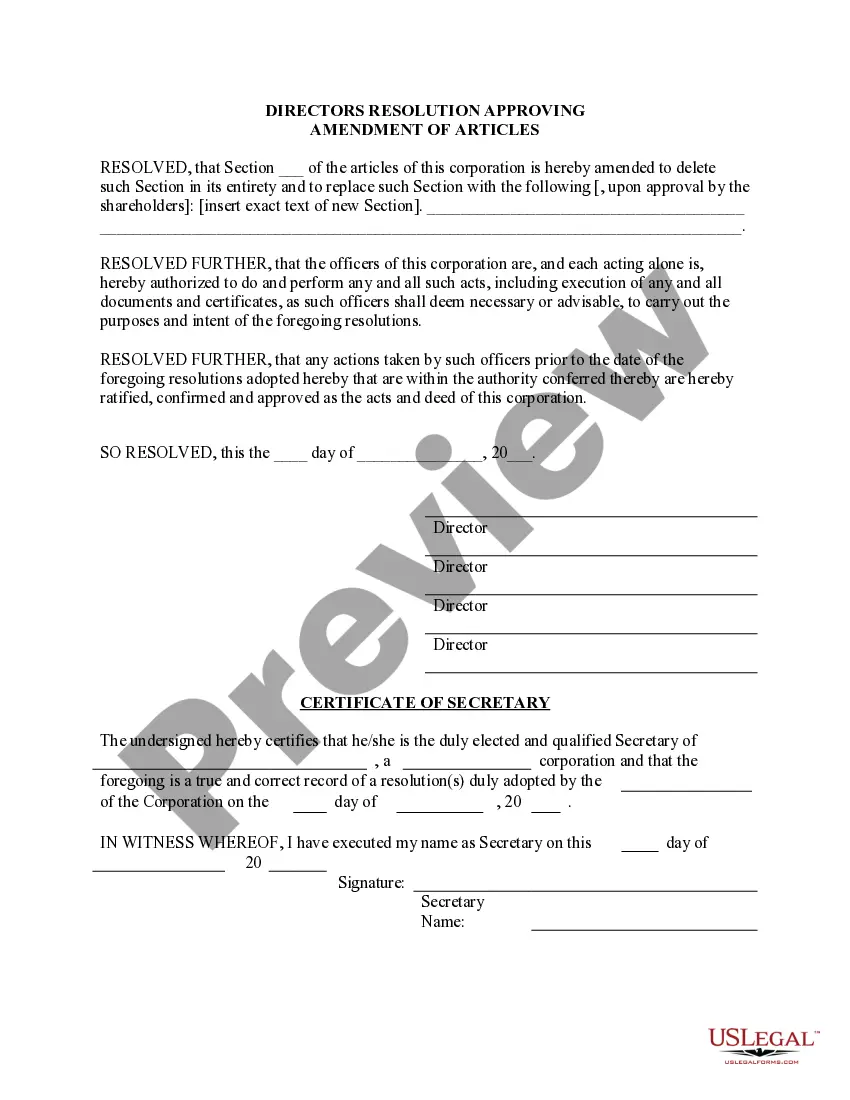

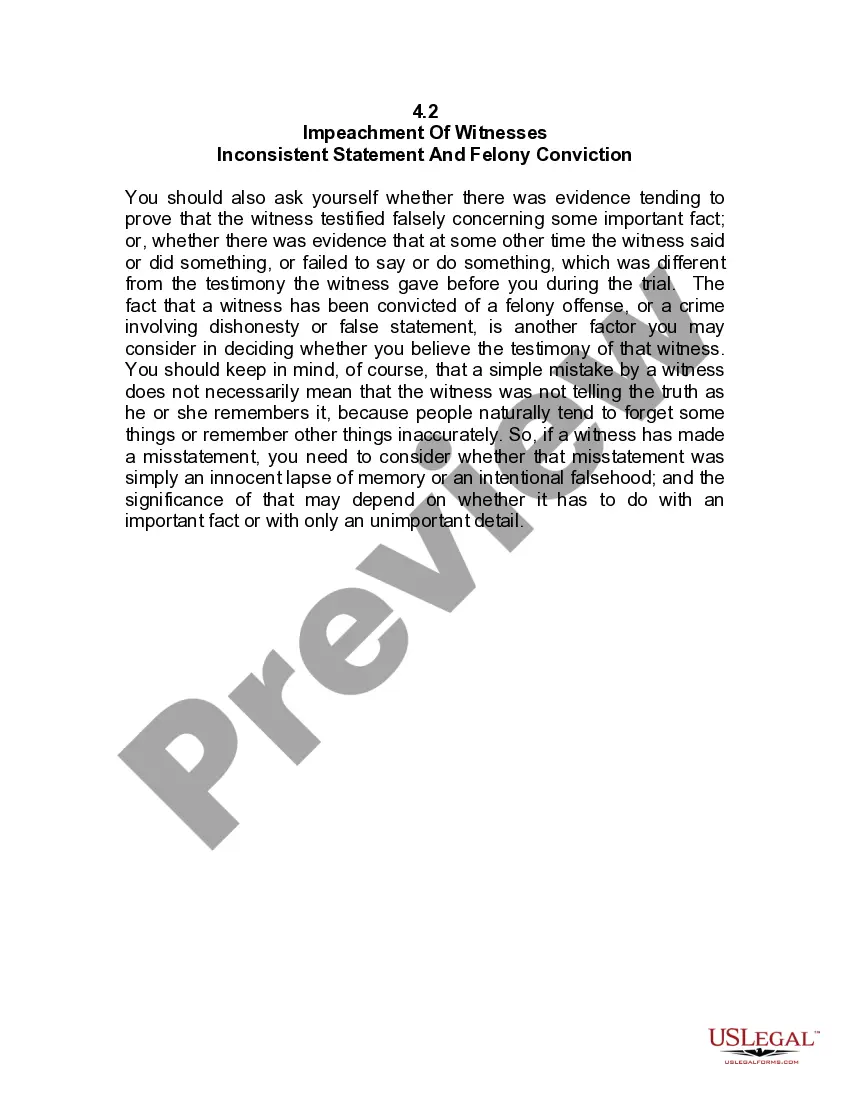

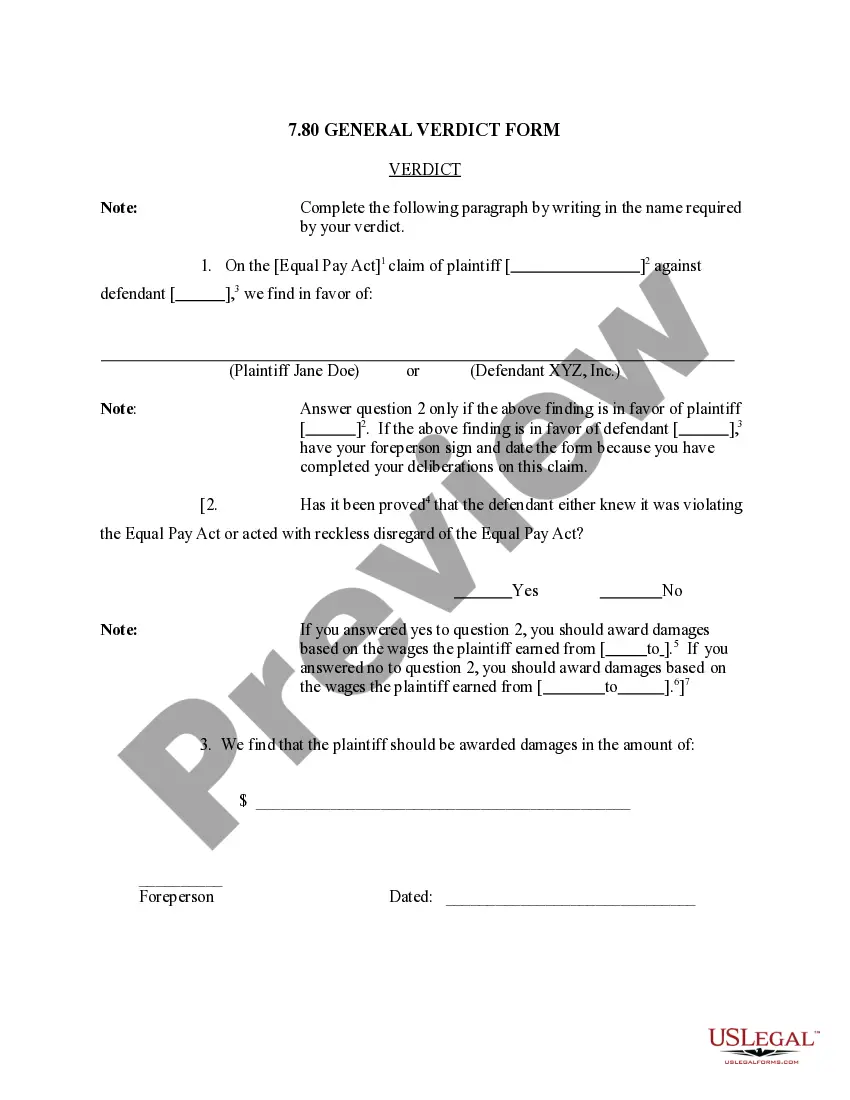

How to fill out Sample Letter For Initiate Probate Proceedings Regarding Estate - Renunciation Of Executorship?

If you need to total, obtain, or printing legal record layouts, use US Legal Forms, the most important collection of legal kinds, that can be found on the Internet. Utilize the site`s simple and easy handy search to find the papers you will need. A variety of layouts for enterprise and specific purposes are categorized by categories and states, or keywords. Use US Legal Forms to find the Connecticut Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship with a couple of mouse clicks.

If you are presently a US Legal Forms client, log in to your bank account and click on the Download button to have the Connecticut Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship. You can also entry kinds you in the past downloaded inside the My Forms tab of the bank account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape for that correct metropolis/land.

- Step 2. Use the Review choice to look through the form`s content. Do not overlook to learn the explanation.

- Step 3. If you are not happy with all the form, make use of the Research field at the top of the display to find other models in the legal form design.

- Step 4. Once you have found the shape you will need, go through the Purchase now button. Opt for the rates plan you prefer and add your credentials to register for an bank account.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Find the format in the legal form and obtain it on your device.

- Step 7. Full, edit and printing or indication the Connecticut Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship.

Each and every legal record design you buy is your own property for a long time. You might have acces to each form you downloaded inside your acccount. Click the My Forms segment and pick a form to printing or obtain again.

Contend and obtain, and printing the Connecticut Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship with US Legal Forms. There are millions of expert and express-specific kinds you can use to your enterprise or specific requires.

Form popularity

FAQ

Section 5.5 Form of appearance (a) An appearance of an attorney shall: (1) list in the heading the name of the matter, the name of the Probate Court and the date of the appearance; (2) contain the name and mailing address of the client represented by the attorney; (3) be signed by the attorney making the appearance (4) ...

To use the small estate procedure, the surviving spouse, next of kin or other person files what is called an ?Affidavit in Lieu of Probate of Will/Administration,? form PC-212, listing the decedent's solely owned assets, funeral expenses, expenses associated with settling the estate, taxes and the decedent's debts.

A petition for administration or probate of Will should be submitted to the Probate Court within 30 days of the decedent's death. It should be accompanied by the original Will and codicils, if any, and a certified copy of the death certificate.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.

The Estate Settlement Timeline: Although Connecticut law does not specify a particular deadline for this, it is generally advisable to do so within a month to avoid unnecessary delays in the probate process.

Avoiding Probate In Connecticut If assets are jointly owned, they are not subject to probate. If assets pass by beneficiary designation, they are not subject to probate. Finally, if assets are in a Revocable Trust, they are not subject to probate.

In Connecticut, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.