Connecticut Worksheet - Contingent Worker

Description

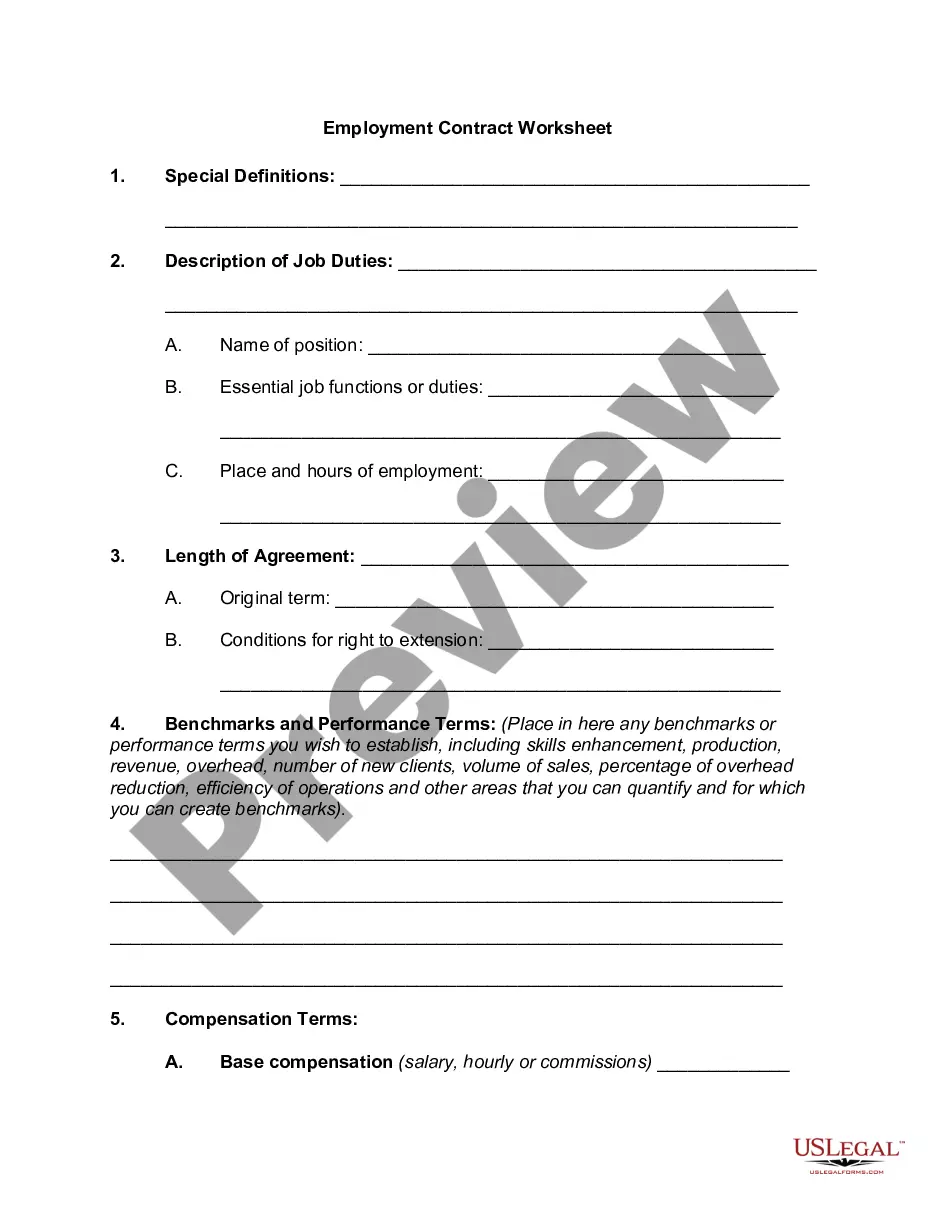

How to fill out Worksheet - Contingent Worker?

US Legal Forms - among the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

While utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will quickly discover the latest editions of forms like the Connecticut Worksheet - Contingent Worker.

If you have a membership, Log In and download the Connecticut Worksheet - Contingent Worker from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents tab of your profile.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the saved Connecticut Worksheet - Contingent Worker. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Connecticut Worksheet - Contingent Worker through US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for the city/state.

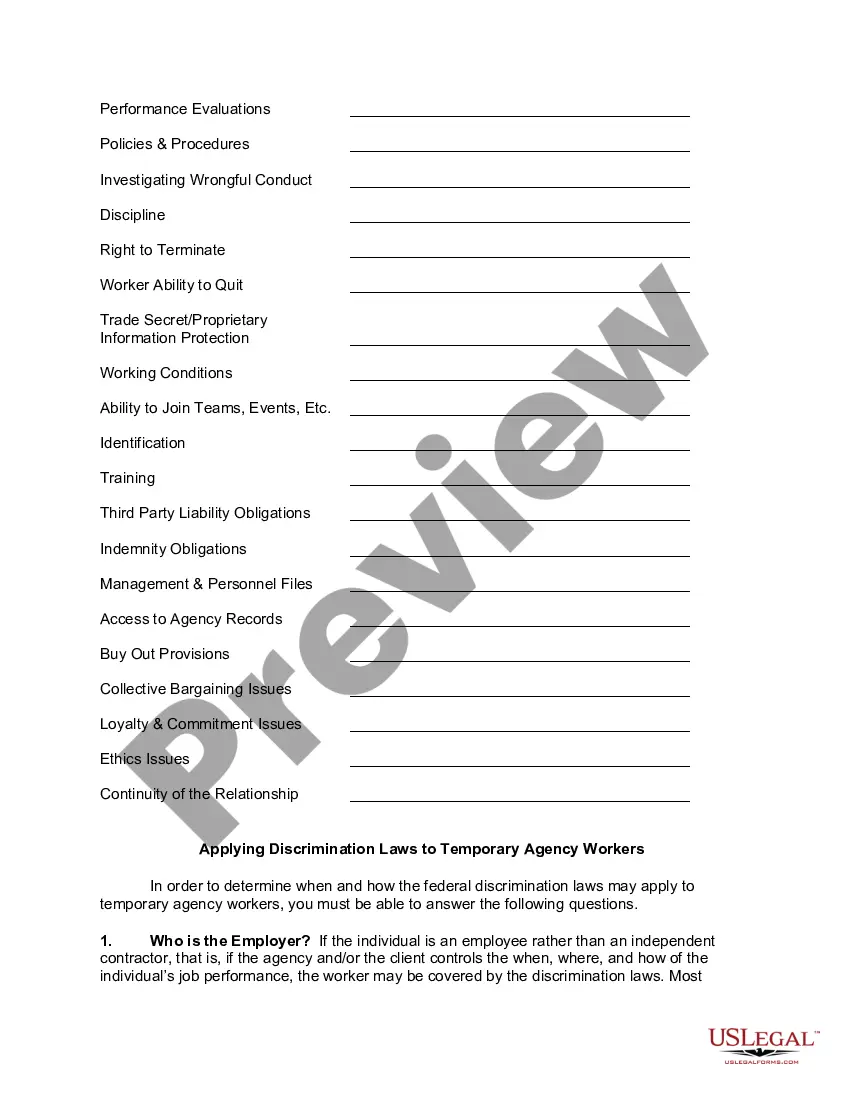

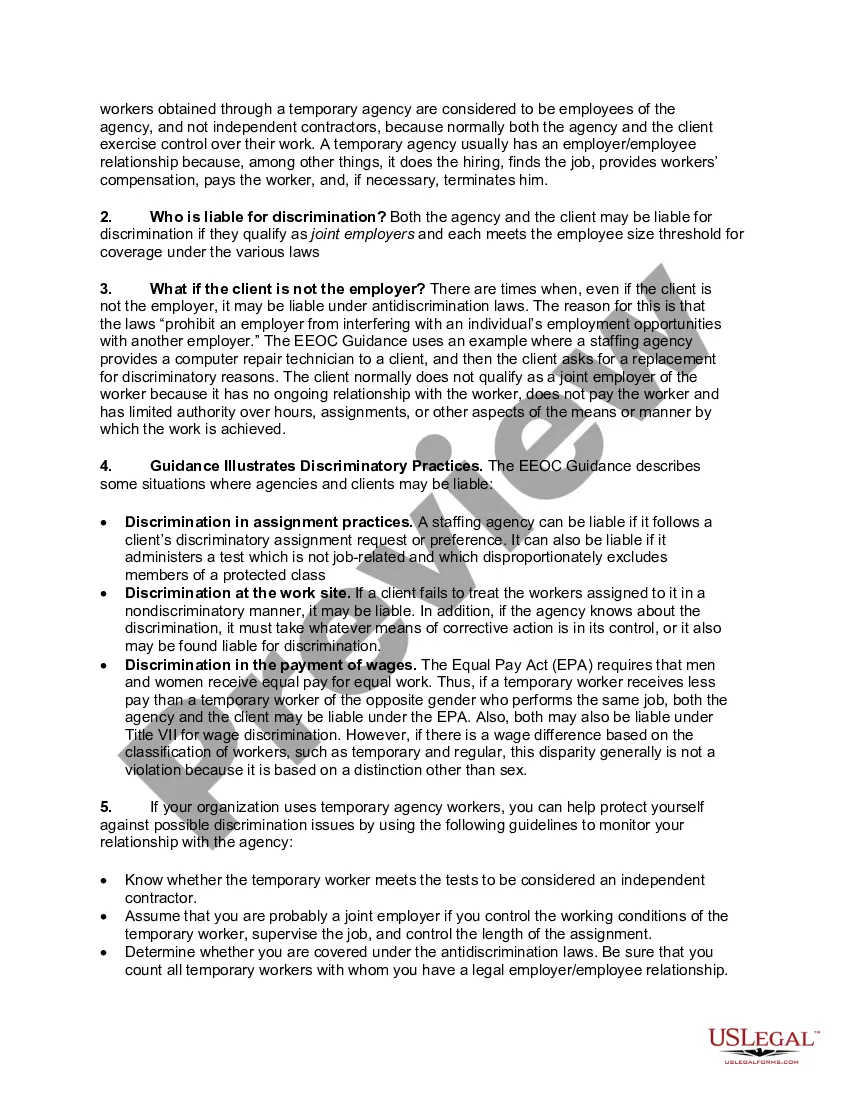

- Click the Preview button to review the form's contents.

- Read the form description to confirm you have selected the appropriate form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Contingent workers are typically issued a 1099 form rather than a W-2, as they are classified as independent contractors. This distinction affects how income is reported to the IRS. For clarity, using the Connecticut Worksheet - Contingent Worker can help you understand the implications of this classification. Ensuring proper documentation helps maintain compliance with tax regulations.

When it comes to contingent workers, there are three main types:Temporary contingent workers. Though these contingent workers are employed by a staffing agency, they typically work onsite at their temporary work assignments.Consultants.Independent contractors.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

Contingent workers are highly skilled experts in their fields. These workers are hired to complete specified tasks under a statement of work (SOW) provision. Once the project is over, they leave, though they may be called back when another project arises.

Independent contractors.on call workers.temporary help agency workers.contract company workers (temps)

As a category, contingent workers may include temporary employees, part-time employees, independent contract workers, employees of the temporary help industry ("temps"), consultants, seasonal employees, and interns. In contrast, full-time, permanent employees frequently are referred to as core employees.

For instance, contingent workers' tax liability and reporting fall under a 1099-M instead of a W-2. The worker is responsible for the employment taxes generally covered by an organization for a traditional employee.

Contingent workers are individuals hired by a company to do role- or project-based work on its behalf, but not as traditional employees. They could include independent contractors, consultants, freelancers, temps, or other outsourced labor such as gig workers.

Contingent workers include independent contractors, freelancers, consultants, advisors or other outsourced workers hired on a per-job and non-permanent basis.

Independent contractors, on-call workers, freelancers, contract workers, and any other type of individual hired on a per-project basis are examples of contingent staffing. In most cases, contingent workers have specialized skills, like an accountant or electrician.