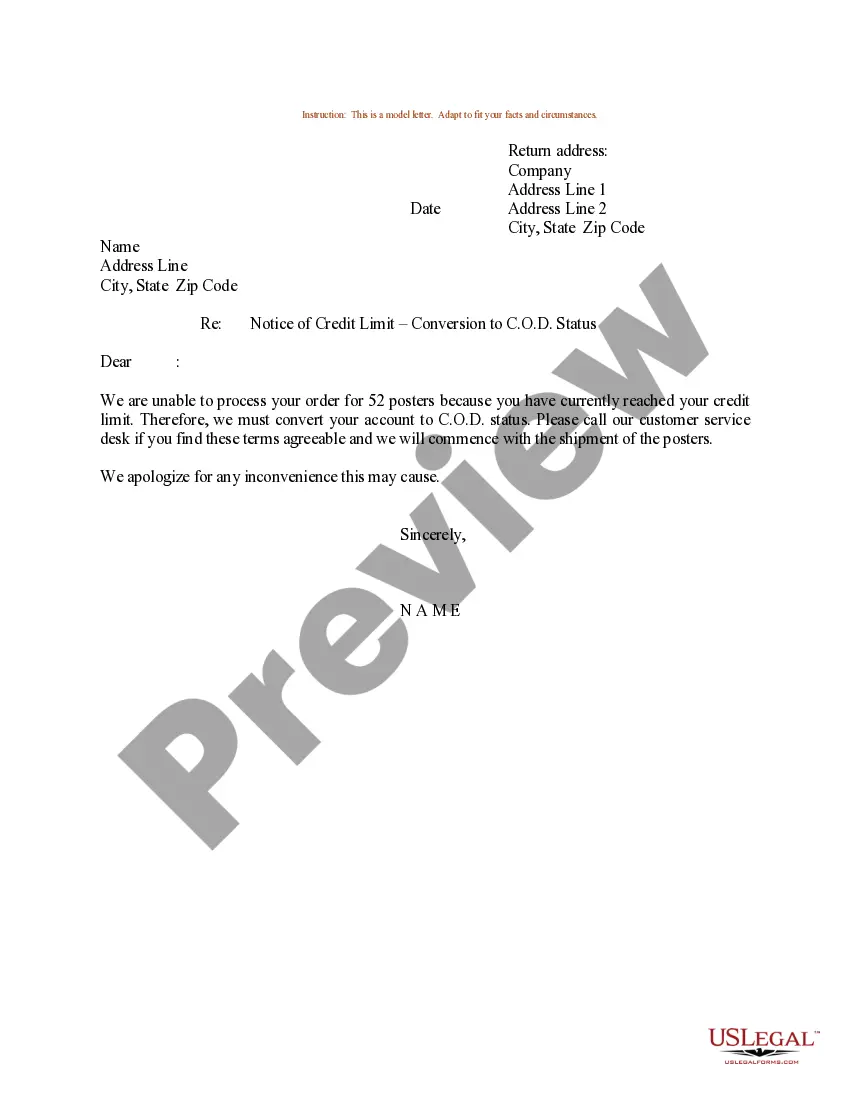

Connecticut Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

If you wish to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the website's straightforward and user-friendly search functionality to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the Connecticut Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click on the Acquire button to get the Connecticut Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status.

- You may also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The credit limit typically varies based on several factors, including your salary, credit history, and lender policies. For an individual earning $50,000, a standard credit limit might range from 10% to 30% of your annual income, but it can differ depending on the lender. To gain clarity, consider utilizing a Connecticut Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status to inquire directly with your credit provider about your specific situation and potential limits.

To, (Name of the Vendor), (Address of the Vendor) Date: // (Date) Subject: Request for Issuance of credit note Dear Sir/Madam, With reference to the material supplied by your company against our purchase order no. , you are requested to provide us credit note for (Amount).

Options for getting a higher credit limitMake a request online. Many credit card issuers allow their cardholders to ask for a credit limit increase online. Sign in to your account and look for an option to submit a request. You may have to update your income information.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

Your credit card issuer can lower your credit limit at any time, regardless of how well you manage your account. Issuers might cut credit limits to minimize risk in an uncertain economy, as many cardholders have experienced during the COVID-19 pandemic in 2020.

Credit card companies generally can increase or decrease credit limits without giving you notice, including reducing your credit limit so that you no longer have any available credit. If you no longer have any available credit, you cannot make any charges until you pay off some of your existing balance.

Your credit card issuer can lower your credit limit at any time, regardless of how well you manage your account. Issuers might cut credit limits to minimize risk in an uncertain economy, as many cardholders have experienced during the COVID-19 pandemic in 2020.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).