Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report

Description

the process that organizations have created to ensure the integrity of their message. The following form is a checklist of comments and questions that may help you prepare a user-friendly and informative annual report.

How to fill out Checklist - Dealing With Shareholders And Investors - Preparing A User-Friendly Annual Report?

You could spend hours online looking for the proper legal document template that meets both state and federal standards you need.

US Legal Forms offers thousands of valid templates that can be reviewed by professionals.

You can easily download or print the Connecticut Checklist - Working with Shareholders and Investors - Creating a User-Friendly Annual Report from the service.

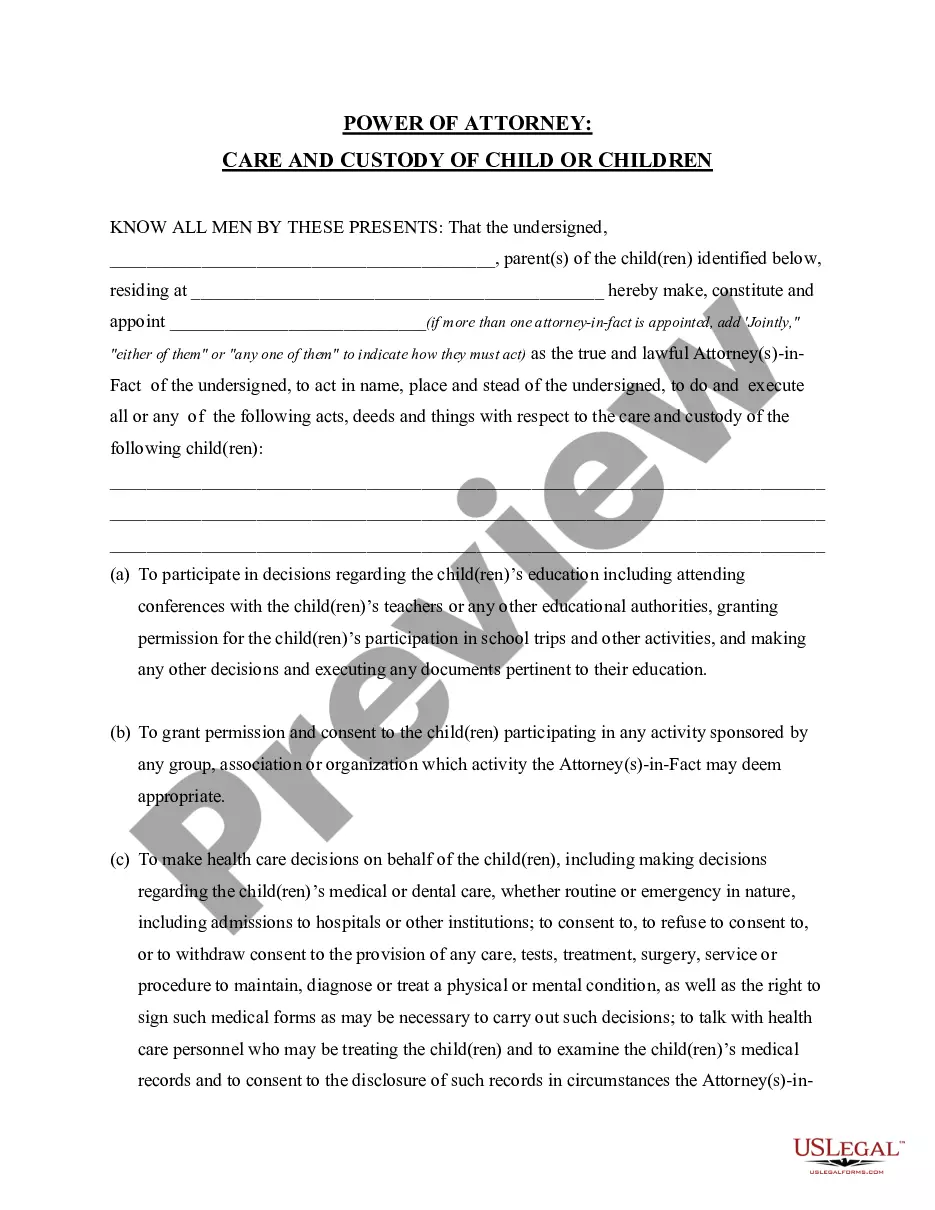

If provided, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can sign in and press the Download button.

- After that, you can fill out, edit, print, or sign the Connecticut Checklist - Working with Shareholders and Investors - Creating a User-Friendly Annual Report.

- Every legal document template you purchase is yours permanently.

- To acquire an extra copy of the purchased document, go to the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the document description to confirm you have selected the right form.

Form popularity

FAQ

Businesses that are structured as corporations or LLCs generally need to file an annual report in Connecticut. This requirement helps the state keep track of business activities and ensures compliance with local laws. Filing your report is not just a legal obligation; it enhances your business’s credibility with stakeholders. For assistance, consult the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report on uslegalforms.

Corporations and some LLCs must produce an annual report in Connecticut to comply with state regulations. This report serves as a formal update on the business’s activities and structure over the past year. Producing a thorough report can impress shareholders and investors by showing your commitment to accountability. Use the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report to help you create a comprehensive document.

In Connecticut, most corporations and LLCs are required to file an annual return. This return is essential for confirming your company’s status with the state and must include accurate details of your business. By filing on time, you can avoid fines or penalties. Make the most of the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report to ensure you meet all necessary requirements.

Typically, corporations and limited liability companies (LLCs) must prepare an annual report in Connecticut. This requirement ensures that the state has up-to-date information about the business. By preparing your report, you also demonstrate to shareholders and investors that your business operates with transparency and accountability. Leverage the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report to streamline this process.

Not every company is required to write an annual report. However, many businesses, especially those registered as corporations or LLCs, must file some version of a report annually. This submission helps keep your business information current with state authorities. Consider the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report to understand your obligations.

Yes, as an LLC in Connecticut, you must file an annual report to maintain your company’s good standing with the state. This process is essential for ensuring that your business complies with state regulations. The report typically includes details about your business's officers and address, reinforcing transparency. Utilize the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report to guide you through this crucial step.

The annual report of stakeholders encompasses detailed content that addresses the interests of all parties involved with the company, including investors, employees, customers, and the community. This report highlights various aspects of the business, such as financial results, project developments, and corporate social responsibility initiatives. By including stakeholder perspectives, companies can make their annual report more comprehensive, aligning with the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report for improved engagement and interaction.

The annual report of shareholders is a formal document that provides shareholders with important updates regarding the company's performance over the past year. This report typically includes financial statements, management analysis, and insights into future strategies. By carefully crafting this report, companies can align with the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, ensuring that shareholders receive clear and concise information about their investments.

The annual report serves several important purposes, including providing essential information about a company's financial health, structure, and operations to shareholders and stakeholders. It enhances transparency and builds trust, as it keeps investors informed about the company's performance and future direction. Moreover, the annual report constitutes a valuable tool in the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, helping businesses communicate effectively with their audience.

To file an annual report in Connecticut, you must complete the form required by the state and ensure you have all necessary information about your business. You can submit this report online through the Connecticut Secretary of State's website or mail it to the designated office. It's essential to adhere to the deadlines to avoid penalties. Utilizing the Connecticut Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report can help simplify this process.