This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Loan Application - Review or Checklist Form for Loan Secured by Real Property

Description

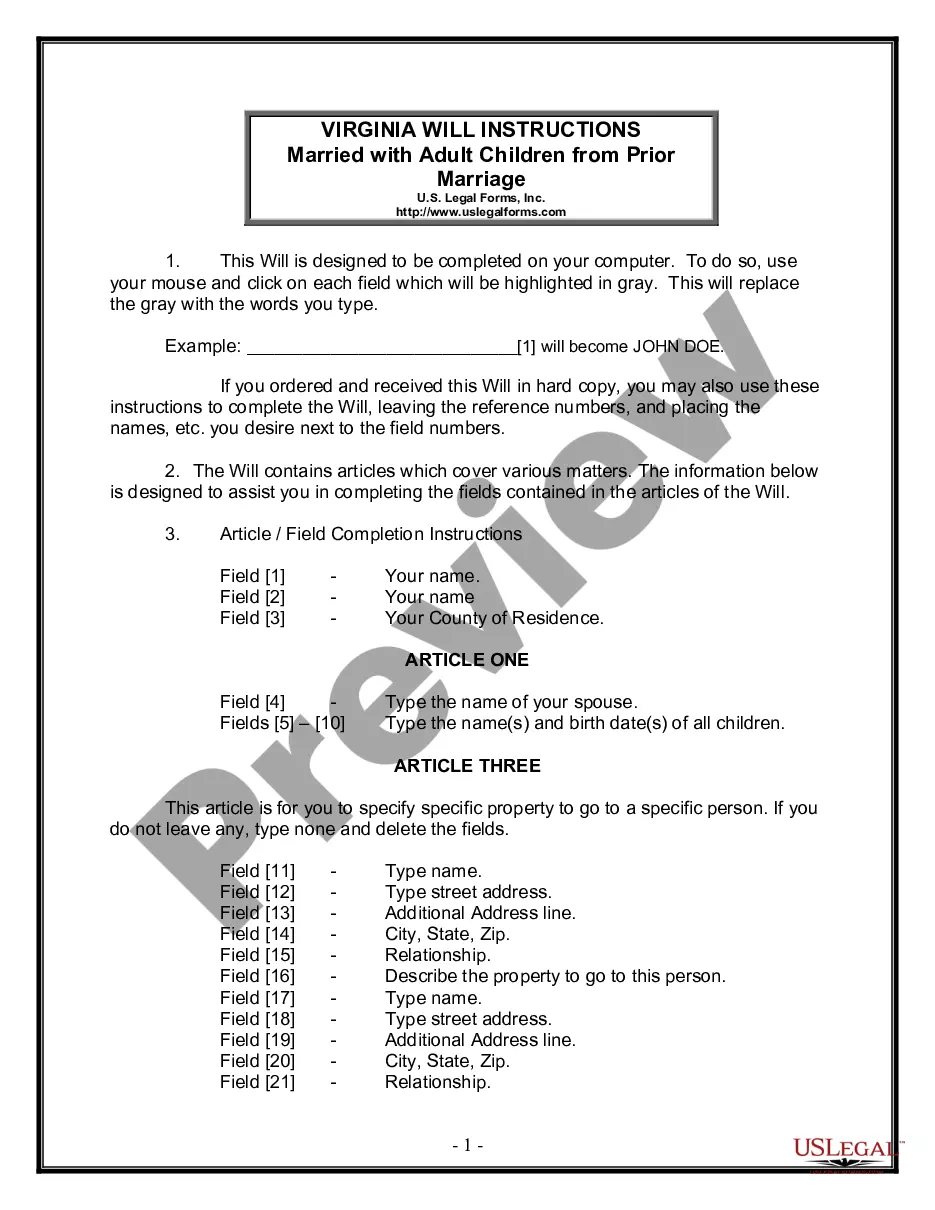

How to fill out Loan Application - Review Or Checklist Form For Loan Secured By Real Property?

Finding the right lawful file web template might be a struggle. Obviously, there are plenty of templates available online, but how do you find the lawful develop you will need? Utilize the US Legal Forms website. The support offers 1000s of templates, for example the Connecticut Loan Application - Review or Checklist Form for Loan Secured by Real Property, which you can use for organization and personal requirements. Each of the types are inspected by specialists and fulfill state and federal needs.

When you are presently listed, log in to the profile and click the Obtain key to have the Connecticut Loan Application - Review or Checklist Form for Loan Secured by Real Property. Make use of profile to check throughout the lawful types you possess bought formerly. Check out the My Forms tab of your respective profile and obtain one more duplicate from the file you will need.

When you are a brand new user of US Legal Forms, here are simple recommendations that you should comply with:

- First, be sure you have selected the correct develop for your area/area. It is possible to examine the shape while using Review key and browse the shape description to guarantee it is the right one for you.

- In case the develop will not fulfill your expectations, take advantage of the Seach industry to obtain the proper develop.

- When you are certain the shape is acceptable, go through the Acquire now key to have the develop.

- Opt for the prices strategy you would like and enter the essential details. Create your profile and purchase your order utilizing your PayPal profile or credit card.

- Opt for the document structure and obtain the lawful file web template to the device.

- Comprehensive, change and print and sign the attained Connecticut Loan Application - Review or Checklist Form for Loan Secured by Real Property.

US Legal Forms is definitely the most significant collection of lawful types in which you can see different file templates. Utilize the company to obtain professionally-created files that comply with status needs.

Form popularity

FAQ

In more practical terms, loan monitoring refers to those activities lenders conduct to assess the risk of a particular loan, once the initial underwriting steps are completed and the loan is booked.

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: Assesses individual loans, including repayment risks. Determines compliance with lending procedures and policies.

A loan review performed by experienced, independent advisors can: Ensure an objective credit risk assessment with a scope determined by your lending institution. Review findings with your organization throughout the entire review process to keep you informed leading up to the exit interview.

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.

When reviewing a bank loan, there are several factors you need to consider to ensure that the loan is suitable for you. Interest Rates - The interest rate is the amount of money the lender charges for borrowing the funds. ... Repayment Terms - The repayment term is the length of time you have to repay the loan.

Under review means that your application has been received and is in the screening or background check process.

Loan Approval ? After the application and supporting documents are analyzed by the lender and Credit Administration, it is presented for review and approval. A decision will be made to reject the loan request, table the discussion pending more information, or approve the loan, generally with conditions.

Key Takeaways. Personal loan applications typically require your Social Security number (SSN) and/or some other form of identification, bank statements, and possibly other financial documents, as well as pay stubs (and potentially tax returns).