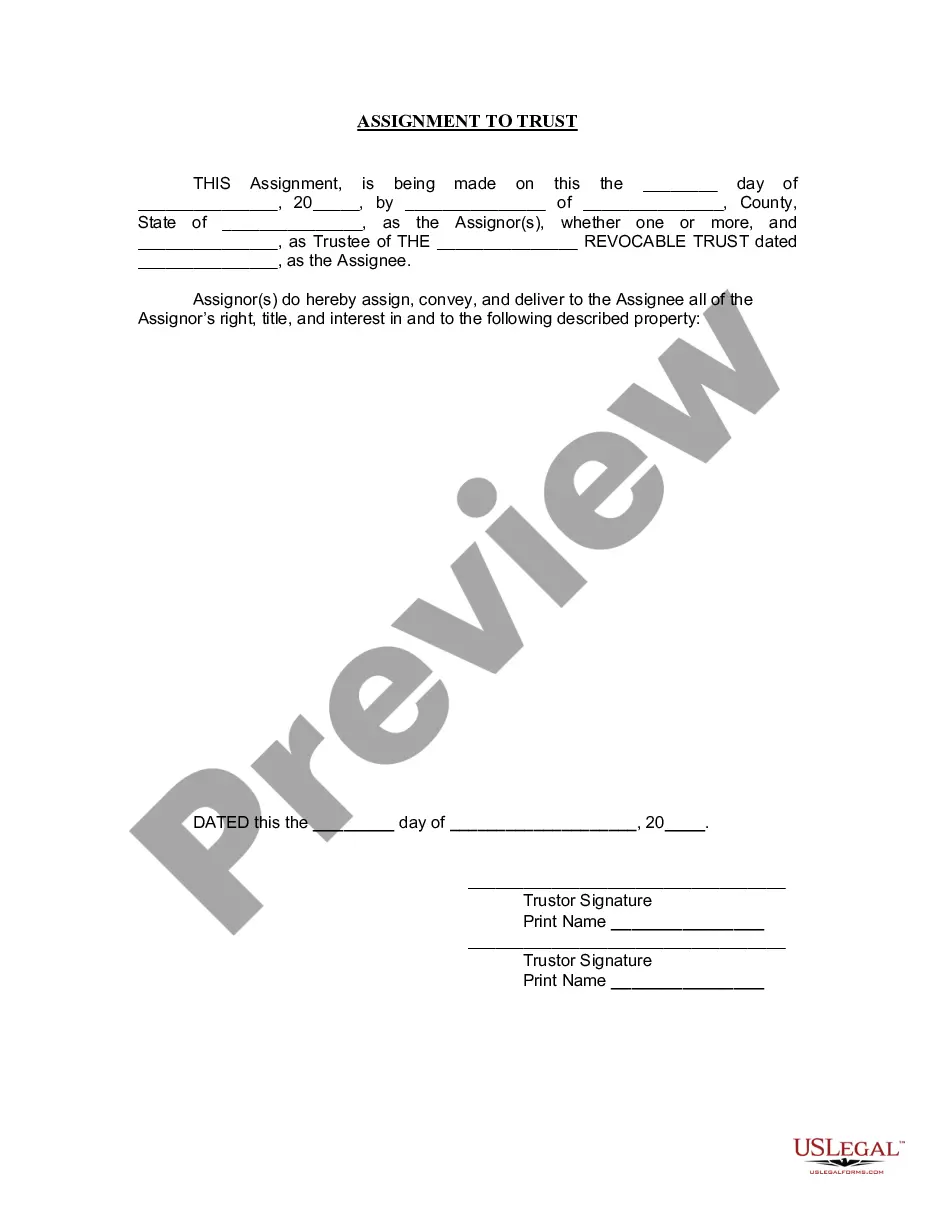

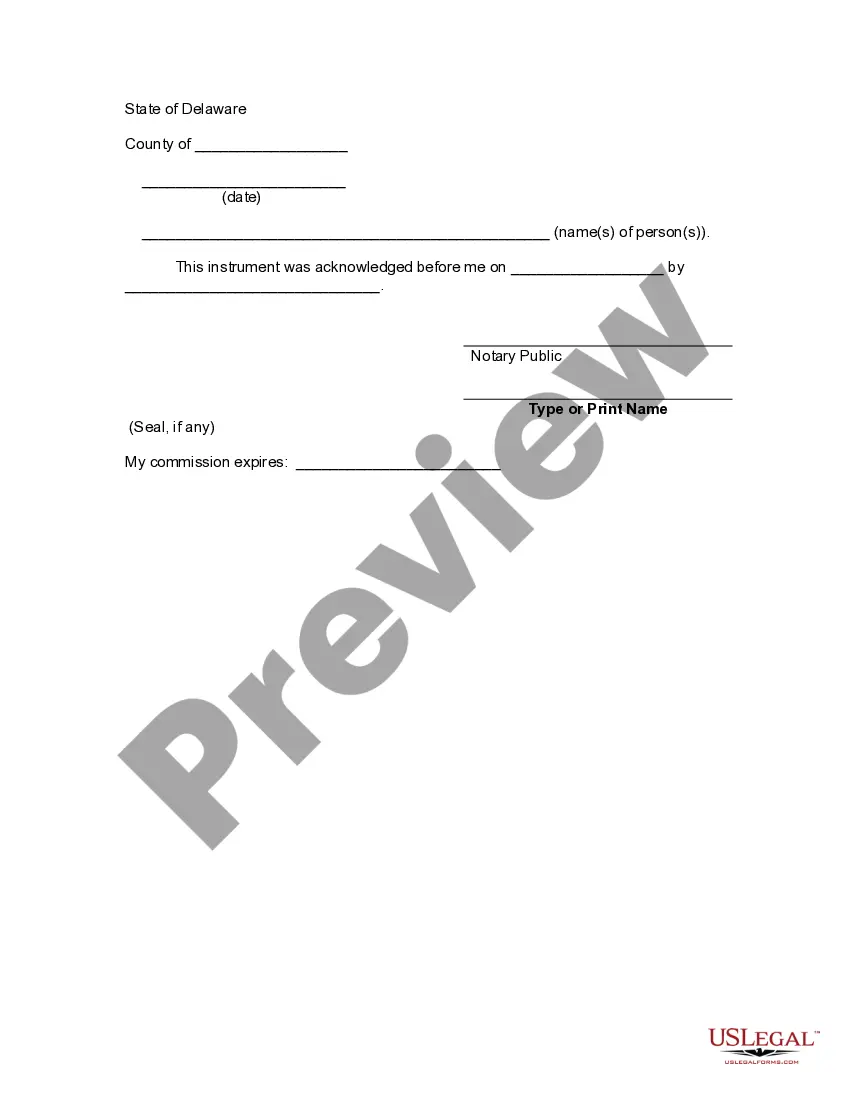

This form is an Assignment to Trust form that is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Delaware Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Assignment To Living Trust?

The higher quantity of documentation you need to prepare - the more anxious you feel.

You can discover countless Delaware Assignment to Living Trust samples online, but you are uncertain which ones to trust.

Remove the hassle to make obtaining templates much simpler by using US Legal Forms.

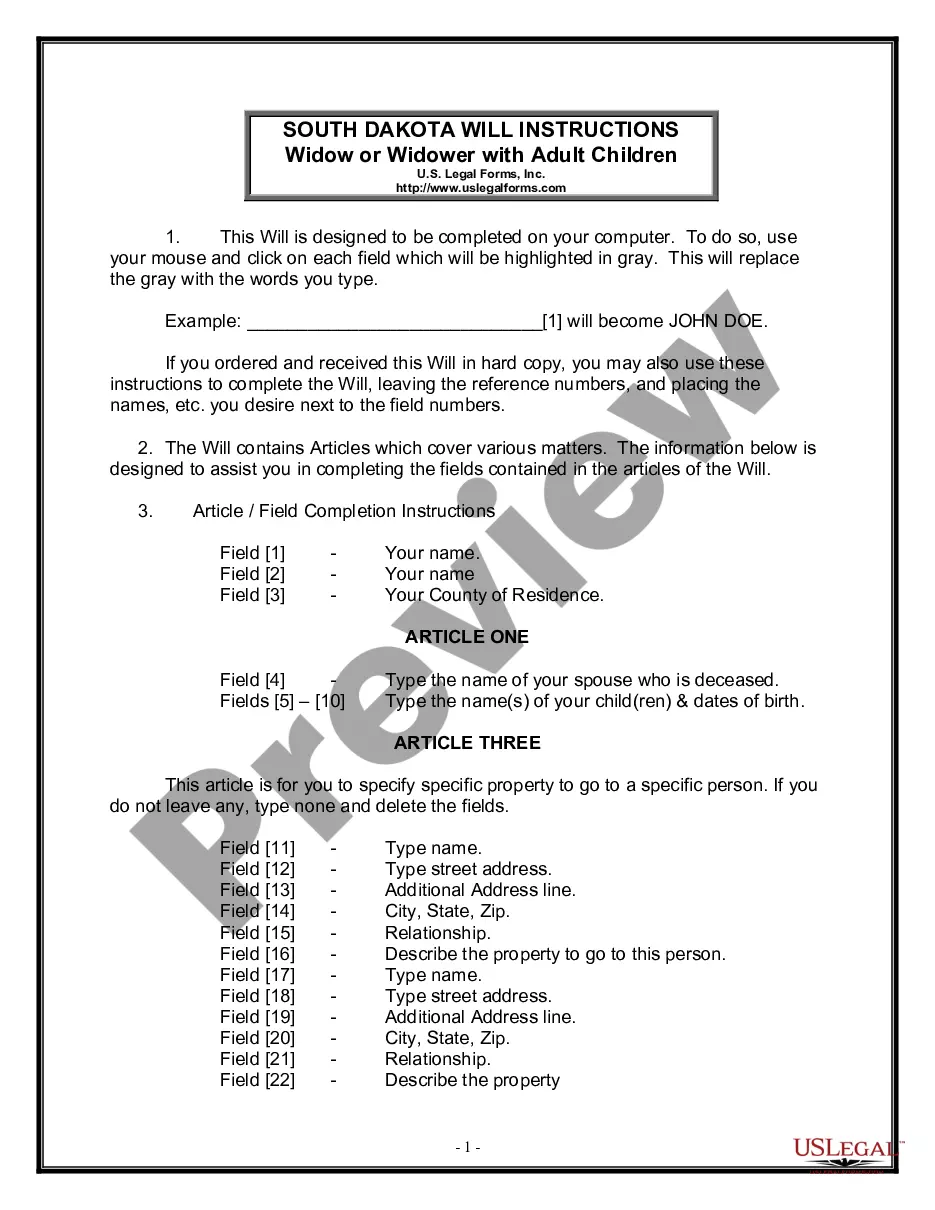

Click Buy Now to initiate the registration process and select a pricing option that suits your needs. Enter the required information to set up your account and pay for the order using PayPal or a credit card. Choose a convenient file format and obtain your sample. Access every document you've downloaded in the My documents section. Simply visit there to create a new copy of your Delaware Assignment to Living Trust. Even with professionally crafted templates, it is still advisable to consult your local attorney to verify that your document is correctly filled out. Achieve more while spending less with US Legal Forms!

- Acquire professionally drafted paperwork that comply with state regulations.

- If you already have a US Legal Forms membership, Log In to your account, and you'll find the Download button on the Delaware Assignment to Living Trust’s page.

- If you haven't utilized our service previously, complete the registration process with these steps.

- Verify if the Delaware Assignment to Living Trust is valid in your state.

- Confirm your selection by examining the description or by utilizing the Preview mode if available for the chosen document.

Form popularity

FAQ

One major mistake parents often make is failing to adequately fund the trust. Without transferring assets into the trust, it won't serve its intended purpose, which can lead to complications later. Additionally, not clearly communicating the trust's terms to beneficiaries can create confusion and conflict. To avoid these pitfalls, consider leveraging the resources available through UsLegalForms when establishing your Delaware Assignment to Living Trust.

Creating a living trust in Delaware involves several key steps. First, you need to gather essential information about your assets and beneficiaries. Next, you can use UsLegalForms to access templates and guidance for drafting your trust document. Once completed, you should properly fund the trust by transferring assets into it, ensuring a smooth Delaware Assignment to Living Trust process.

Having a living trust comes with several pros, including avoiding probate and maintaining privacy regarding your assets. However, there are cons to consider, such as the initial setup costs and ongoing management responsibilities. Taking the time to weigh the pros and cons of a Delaware Assignment to Living Trust can help you decide the best approach for your estate planning needs.

Some reasons to consider not having a trust include the simplicity of your estate and the costs associated with setting up and maintaining a trust. If your assets are minimal, the Delaware Assignment to Living Trust may not provide significant benefits for your situation. Furthermore, if you’re comfortable with the traditional probate process, you might find a trust unnecessary.

While placing your house in a trust offers benefits, it also has some disadvantages. One common issue is the potential for increased paperwork and legal complexities during the Delaware Assignment to Living Trust process. Additionally, certain costs may arise, such as maintenance fees for the trust or tax implications, which one should consider before proceeding.

An assignment to a trust refers to the transfer of ownership of assets from an individual to the trust. This process is essential for a Delaware Assignment to Living Trust, as it ensures that the trust legally holds the assets. Completing this assignment allows trustees to manage the assets efficiently and carry out the wishes of the trust creator.

Suze Orman emphasizes the importance of a living trust in personal finance, particularly for estate planning. She points out that a living trust can help avoid probate, ensuring your assets are distributed according to your wishes. By establishing a Delaware Assignment to Living Trust, you gain control over how and when your assets are distributed, making it a practical choice for many.

Setting up a living trust in Delaware involves several key steps. First, you need to determine the assets you want to include in the trust. Next, you create the trust document, which outlines the terms and beneficiaries. Finally, you transfer ownership of the assets to the trust, completing the Delaware Assignment to Living Trust process. You may want to consult with a legal expert or use US Legal Forms to simplify the documentation process.

Transferring accounts to a Delaware Assignment to Living Trust typically requires contacting your financial institutions and requesting a change in account ownership. You will need to provide the bank or financial institution with relevant information about the trust, including its name and date of creation. Using a service like US Legal Forms can guide you through this process, ensuring everything is done correctly and efficiently.

To move assets into a Delaware Assignment to Living Trust, you generally need to retitle them in the name of the trust. This process involves completing a change of ownership document for each asset, such as real estate or bank accounts. Working with a legal professional can ensure that this process is smooth and aligned with your estate planning goals.