Connecticut Cash Disbursements Journal

Description

How to fill out Cash Disbursements Journal?

Are you in a situation where you require documentation for both business or specific objectives nearly every day.

There is a plethora of legal document templates accessible online, but finding trustworthy ones is challenging.

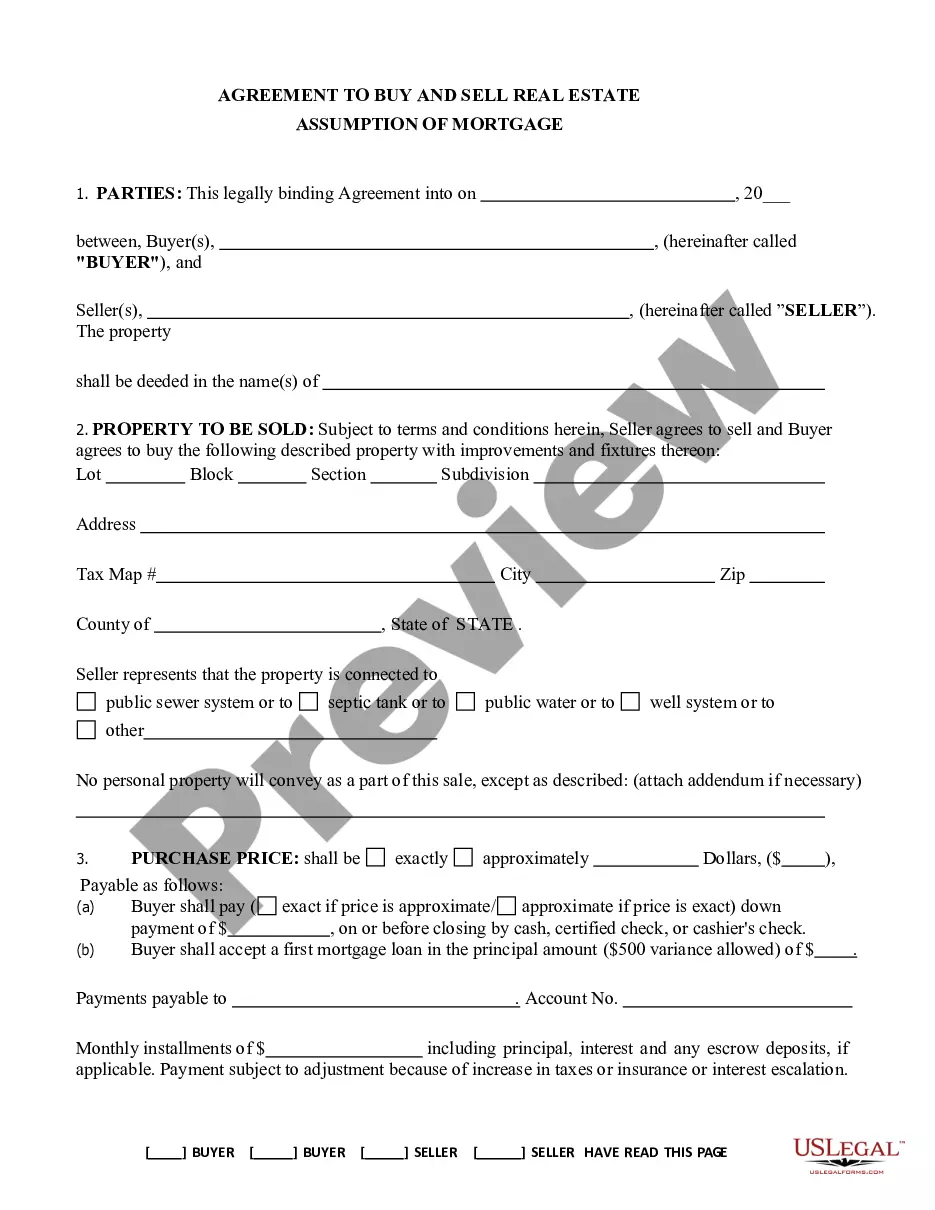

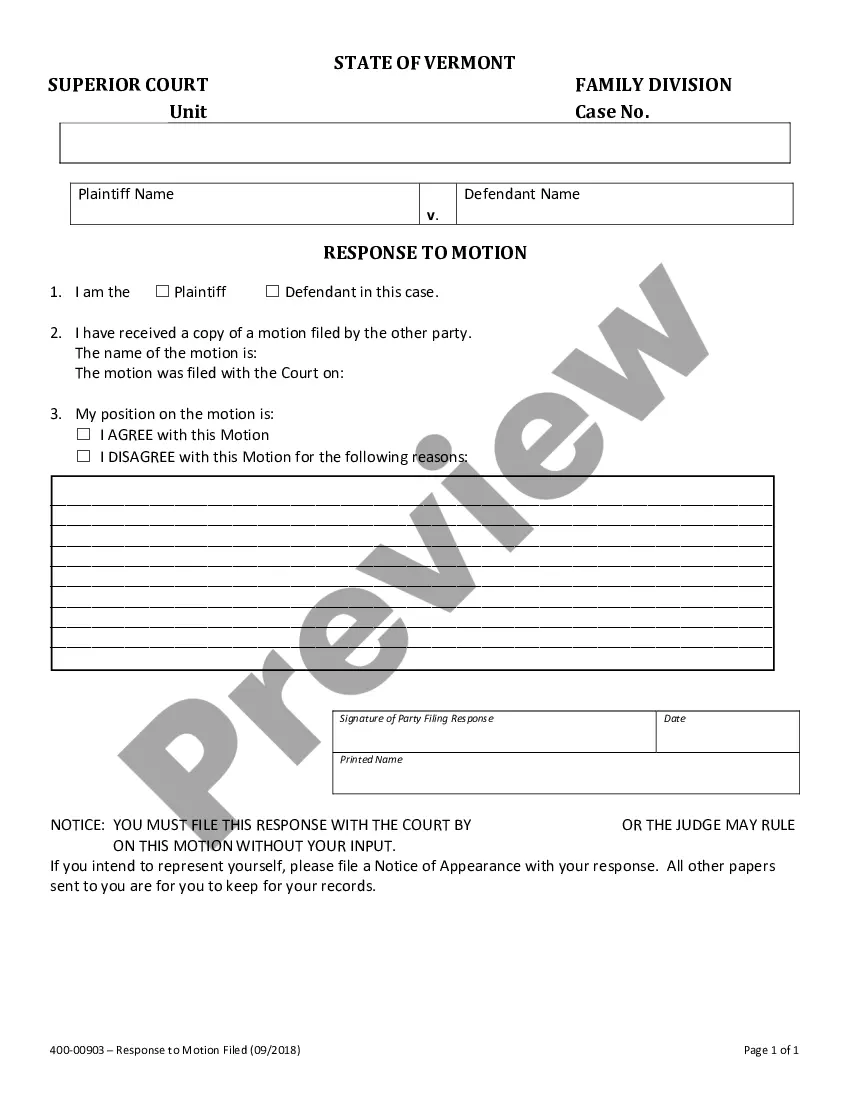

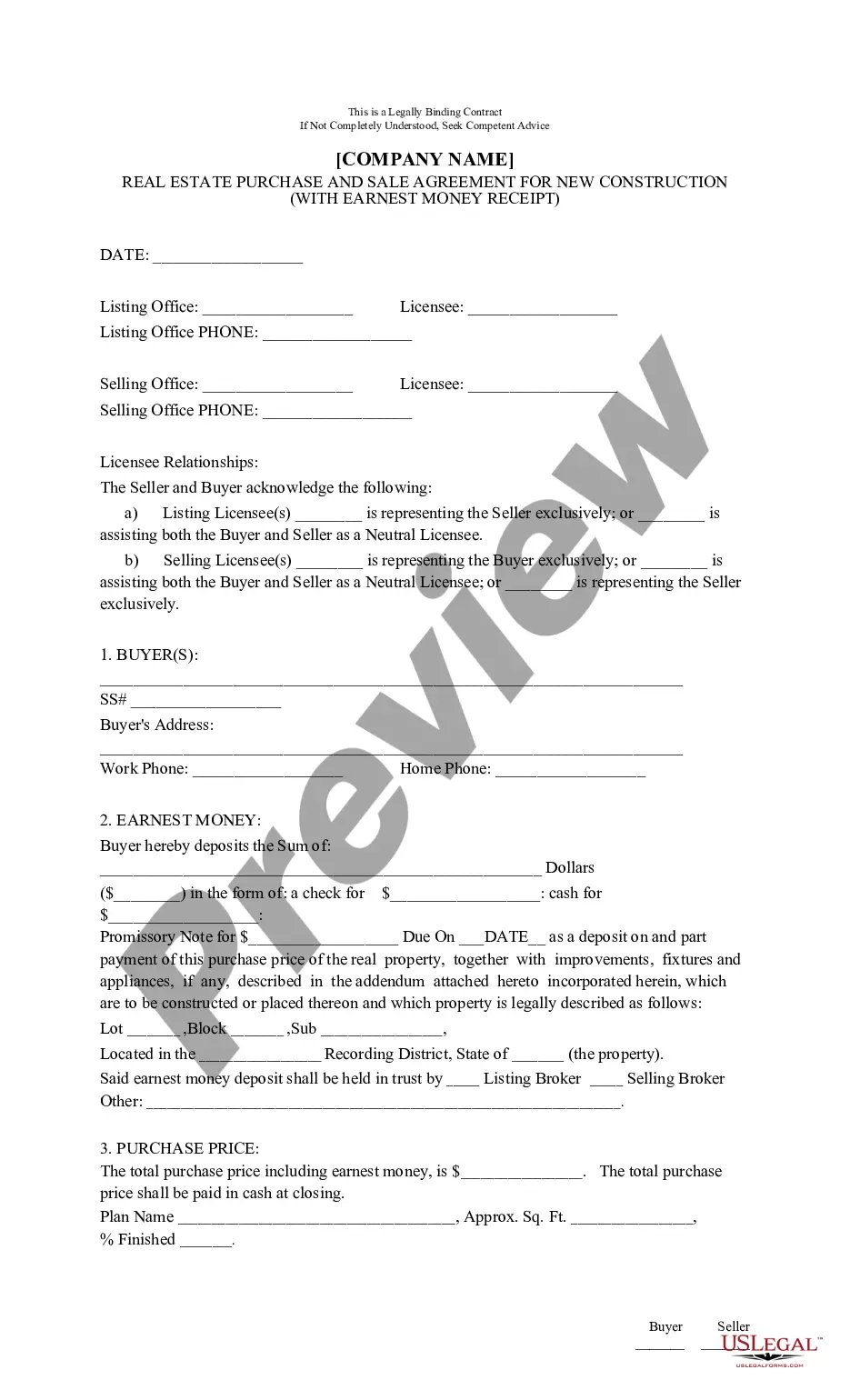

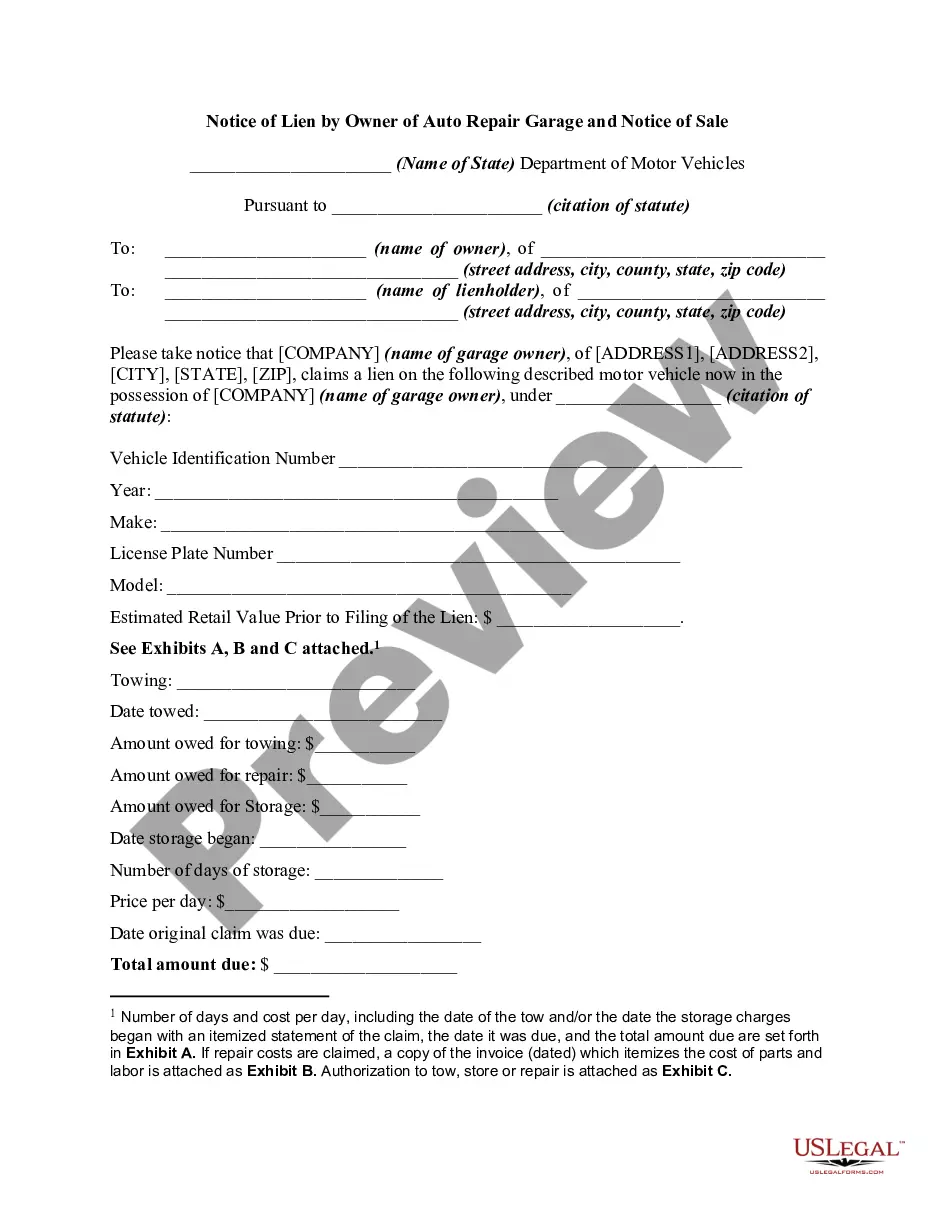

US Legal Forms provides thousands of form templates, such as the Connecticut Cash Disbursements Journal, designed to comply with federal and state regulations.

Once you find the right form, just click Get now.

Choose the pricing plan you desire, fill in the required information to create your account, and purchase your order using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Connecticut Cash Disbursements Journal anytime if needed. Just select the required form to download or print the document template. Use US Legal Forms, the largest collection of legal documents, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Cash Disbursements Journal template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and verify that it is for the appropriate city/state.

- Utilize the Preview button to examine the form.

- Check the description to ensure that you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information.

Create a Cash Disbursements Journal reportFrom the QuickBooks Reports menu, select Custom Reports then click Transaction Detail.Enter the appropriate date range.In the Columns box, check off the following columns:Click the Total by drop-down and select an appropriate criteria like Payee, Account or Month.More items...

Cash disbursement journals should include:Date.Payee name.Amount debited or credited.Accounts involved (e.g., payment method)Purpose of the transaction.

The cash disbursement journal includes the columns of date, check number, and name of the payee. The amount of disbursement is recorded in the cash column, and the title is recorded in the corresponding account debited column. Each account has a reference number shown in the posting reference (PR) column.

Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash receipts journal. Do not record the sales tax you collected in the cash receipts journal. You must record this in the sales journal instead.

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.

What information should you include?Date.Payee name.Amount debited or credited.Accounts involved (e.g., payment method)Purpose of the transaction.

Purchasing inventory or office supplies, paying out dividends, or making business loan payments with cash or cash equivalents are examples of disbursements.

A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information.