Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

If you wish to finalize, retrieve, or create sanctioned document templates, utilize US Legal Forms, the largest assortment of sanctioned forms, which are accessible online.

Take advantage of the site’s straightforward and user-friendly search to obtain the documents you require.

An assortment of templates for business and individual purposes are categorized by groups and recommendations, or search terms.

Step 4. After finding the form you need, click on the Get now button. Choose the pricing plan you want and enter your credentials to register for an account.

Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and then click the Acquire button to access the Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/country.

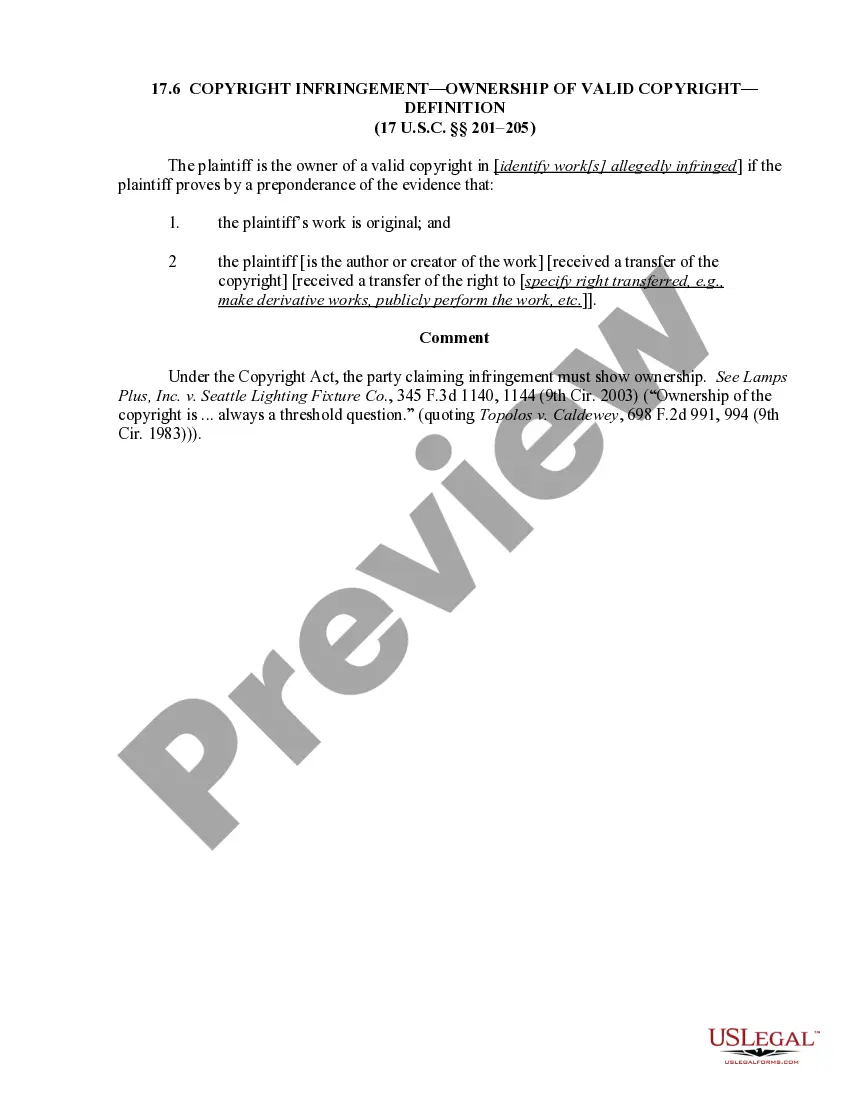

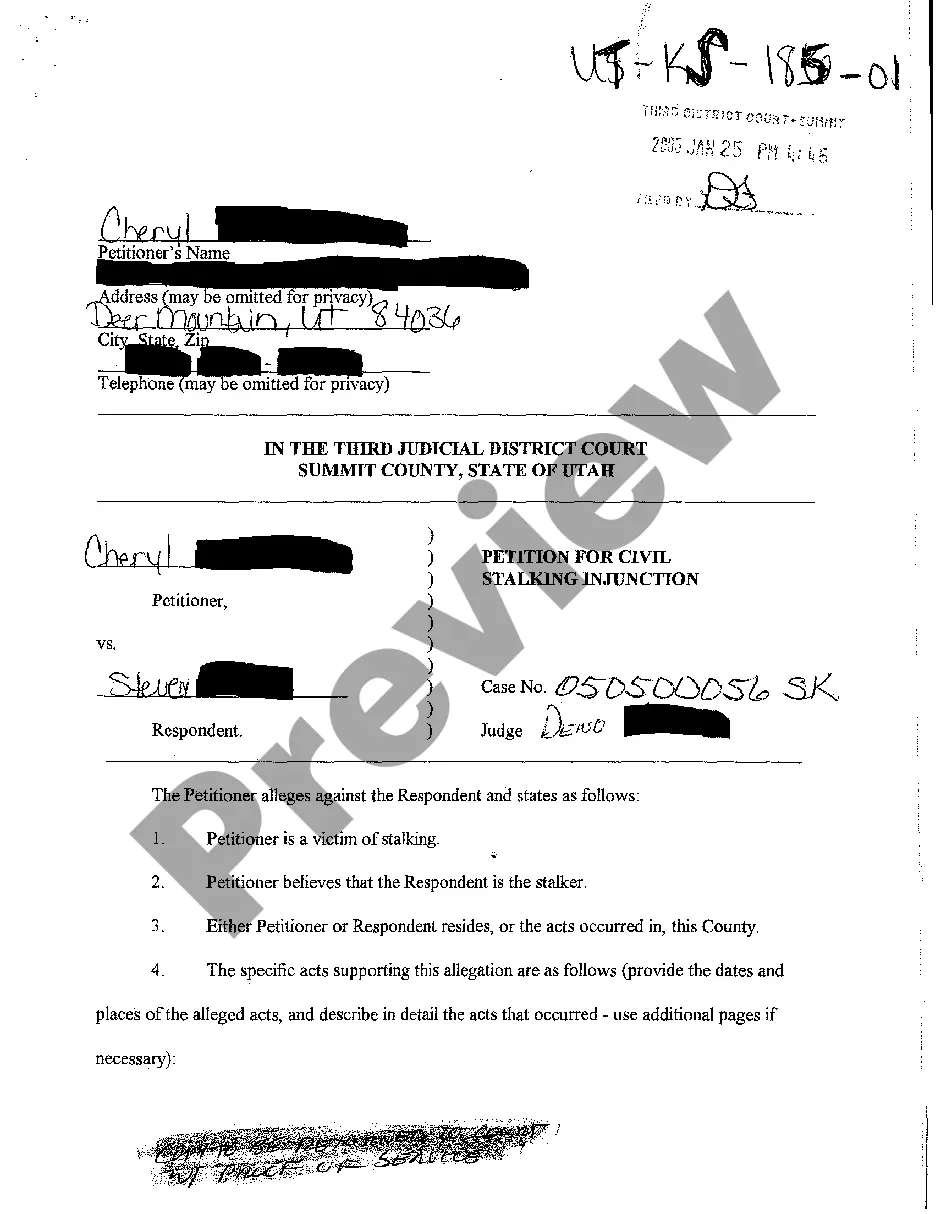

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A consultant provides expert advice and strategy to help clients overcome challenges, whereas a service provider primarily delivers tangible services or products. In Connecticut Business Management Consulting, recognizing these roles can enhance your service approach, whether you are operating as a self-employed consultant or collaborating with others. Clear differentiation can lead to better client expectations and successful project outcomes.

A master service agreement establishes a long-term relationship between a service provider and a client, covering multiple projects or services under one document. On the other hand, a consulting agreement is typically project-specific and focuses on providing expert insights. As you explore Connecticut Business Management Consulting opportunities, understanding these contracts can help you navigate your professional landscape effectively.

Yes, having a contract is essential for consultants. A well-drafted agreement protects your rights and outlines the expectations between you and your client. In the realm of Connecticut Business Management Consulting, this contract can include terms regarding payment, scope of work, and confidentiality, ensuring a smooth professional relationship.

Consulting involves offering expert advice and insights to help a business make informed decisions, while service refers to executing tasks or delivering products. In Connecticut Business Management Consulting, understanding this distinction can enhance your approach to client relationships and project management. As a self-employed consultant, defining your role clearly can lead to better outcomes.

A consulting agreement typically centers on strategic advice and the provision of specialized knowledge in areas like business management. In contrast, a service agreement revolves around performing specific tasks or services. When engaging in Connecticut Business Management Consulting, it's important to recognize these differences to protect your interests as a self-employed consultant.

A service agreement outlines the responsibilities and expectations for a specific task or project, while a consultancy agreement focuses on providing expert advice and insights. Both are crucial in Connecticut Business Management Consulting, as they define the scope of work. Understanding these differences can help you choose the right document for your needs as a self-employed consultant.

Yes, consulting services can be taxable in Connecticut, especially if they relate to selling taxable goods or certain professional fields. The key is to assess the specific type of service in question, as tax liability can vary greatly. By reviewing your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed carefully, you can identify which services may be taxable. For further guidance on local laws and requirements, exploring USLegalForms can provide you with the answers you need.

Whether consulting services are taxable depends on the specific nature of the services rendered in Connecticut. Generally, if the service involves professional advice or services that do not result in a tangible product, it might not be taxable. Thus, understanding the tax implications for your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed is crucial. Utilize resources like USLegalForms to obtain more detailed information on your obligations.

Certain items and services are exempt from sales tax in Connecticut, including most services that do not involve the sale of tangible personal property. For example, educational services and certain personal services may be exempt. When preparing your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed, it's vital to identify any exemptions that may apply to your specific services. USLegalForms can provide valuable templates and resources to help clarify these exemptions.

Consulting fees in Connecticut may be taxable based on the type of consulting services offered. For instance, fees related to services that qualify as taxable services under state law will incur tax. This impacts many professionals, so it's advisable to clearly outline your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed. To ensure compliance, consider consulting with a tax advisor or check tools available on the USLegalForms platform for assistance.