Connecticut Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

US Legal Forms - one of the most extensive collections of authentic documents in the United States - provides a vast range of legitimate forms templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest revisions of forms such as the Connecticut Revocable Trust for Grandchildren within moments.

If you are a registered user, Log In and download the Connecticut Revocable Trust for Grandchildren from your US Legal Forms collection. The Download button will be visible on every form you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the saved Connecticut Revocable Trust for Grandchildren document. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need. Access the Connecticut Revocable Trust for Grandchildren with US Legal Forms, the most extensive collection of legitimate document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

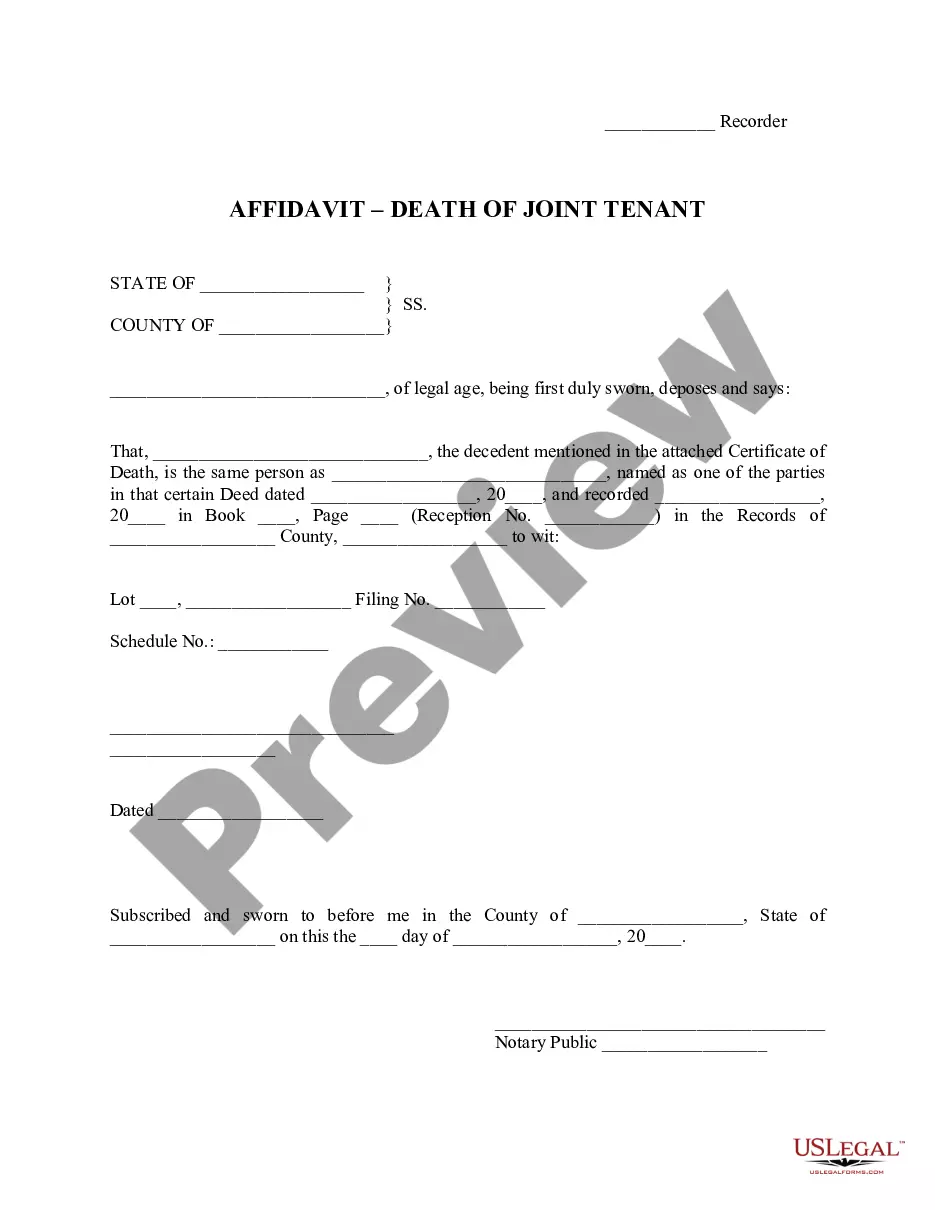

- strong>Ensure that you have selected the correct form for your city/region. Click the Preview button to review the form's details.

- Read the form description to verify that you have selected the correct document.

- If the form does not fulfill your needs, utilize the Search box at the top of the screen to find the one that does.

- If you are content with the form, confirm your selection by clicking the Get now button.

- Next, choose the payment plan that suits you and provide your information to register for an account.

- Proceed with the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

To form a Connecticut Revocable Trust for Grandchildren, start by drafting a trust document that outlines your wishes regarding the assets you want to include. Next, specify the trustee who will manage the trust and the beneficiaries, which in this case are your grandchildren. Once the document is prepared, it needs to be signed and notarized. Finally, transfer ownership of the selected assets into the trust to complete the process.

When considering bonds for a grandchild, U.S. savings bonds are a popular choice due to their safety and guaranteed interest. Series I bonds offer protection against inflation and are a great way to accumulate value over time. Including these bonds as part of a Connecticut Revocable Trust for Grandchildren can help secure their financial future, allowing for even greater growth in a trusted environment.

To set up a Connecticut Revocable Trust for Grandchildren, begin by choosing a trustee, which can be yourself or another individual. Next, draft a trust document that clearly outlines how the assets should be managed and distributed to your grandchildren. It's advisable to consult with an estate planning attorney to ensure compliance with Connecticut laws. Finally, fund your trust by transferring assets into it, which can provide your grandchildren with support in the future.

A Connecticut Revocable Trust for Grandchildren is often considered one of the best types of trusts for grandchildren. This type of trust allows flexibility, giving you the ability to make changes as needed while ensuring that your grandchildren receive their inheritance as intended. You can structure the trust to suit their needs, which adds an additional layer of planning for their future.

A common mistake parents make when setting up a trust fund is failing to clearly outline their wishes or not funding the trust adequately. Without proper funding, the trust cannot serve its purpose, especially a Connecticut Revocable Trust for Grandchildren intended to benefit your loved ones. Clarity and communication about the trust's goals can prevent complications later.

The best way to leave an inheritance to your grandchildren is by establishing a Connecticut Revocable Trust for Grandchildren. This approach enables you to set conditions for the inheritance, like age or milestones they must reach before accessing funds. Additionally, this method ensures that your wishes are carried out exactly as you intended.

In Connecticut, while it is not strictly necessary for a revocable trust to be notarized, having it notarized can provide extra protection and clarity. A notarized document is often easier to validate in court if challenges arise. Therefore, it is wise to discuss notarization with your legal advisor when creating a Connecticut Revocable Trust for Grandchildren.

To avoid inheritance tax, consider establishing a Connecticut Revocable Trust for Grandchildren, as it allows for manageable asset distribution at your death. While revocable trusts themselves do not eliminate taxes, they provide a clear structure for passing on assets exempt from probate fees. Consulting with a tax professional can also guide you on minimizing any potential tax liabilities.

A Connecticut Revocable Trust for Grandchildren can also serve your children effectively, enabling you to name them as beneficiaries. This trust allows for control over how the assets are distributed, which can help protect your children's inheritance from potential creditors. It's a straightforward way to provide for them while maintaining your wishes.

The best trust for a grandchild often depends on your specific goals, but a Connecticut Revocable Trust for Grandchildren can be an excellent option. This trust allows you to outline specific provisions for your grandchildren's inheritance. By establishing this trust, you can ensure that the funds are used for their education and welfare.