This form can be used as a guide in preparing an agreement involving a close corporation or a Subchapter S corporation buying all of the stock of one of its shareholders.

Connecticut Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument

Description

How to fill out Agreement To Purchase Common Stock Of A Shareholder By The Corporation With An Exhibit Of A Bill Of Sale And Assignment Of Stock By Separate Instrument?

You have the ability to devote several hours online trying to locate the legal document template that satisfies the state and federal criteria you need.

US Legal Forms offers a vast collection of legal forms that are evaluated by professionals.

You can conveniently acquire or print the Connecticut Agreement to Purchase Common Stock of a Shareholder by the Corporation along with an Exhibit of a Bill of Sale and Assignment of Stock through a Separate Instrument.

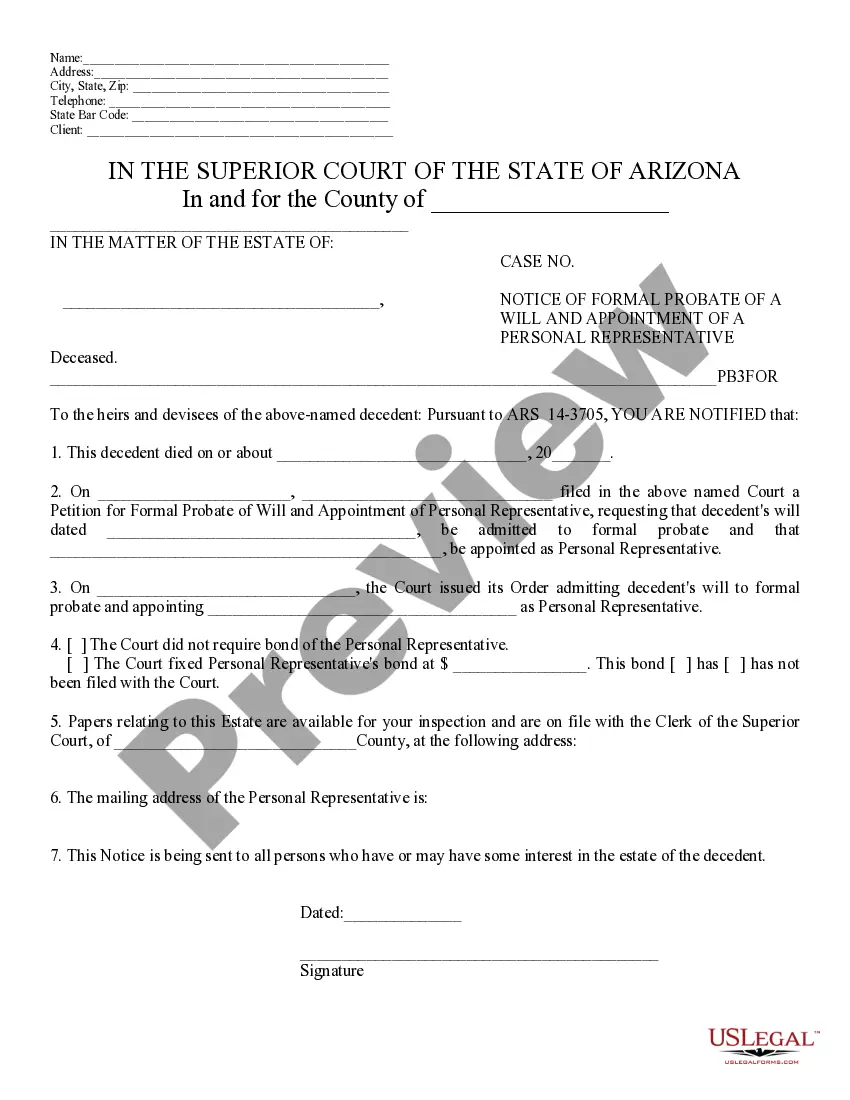

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download button.

- Subsequently, you can complete, modify, print, or sign the Connecticut Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument.

- Each legal document template you receive belongs to you indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents section and click the associated button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your desired state/city.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Another common type of buy-sell agreement is the stock redemption agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.

A stock redemption is a transaction in which a corporation acquires its own stock from a shareholder in exchange for cash or other property. The redeeming corporation generally does not recognize gain or loss, unless it distributes appreciated property.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

A redemption of shares is where the proposed shares to be redeemed are currently redeemable shares in name or are converted to redeemable shares before the redemption. A buyback of shares involved the proposed shares are bought back in its current form and a contract is used for the purchase.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

A restricted stock purchase agreement is a type of written agreement that places restrictions on the stockholder's rights with respect to the shares being issued. The restrictions generally restrict selling, transferring, etc.