Connecticut Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

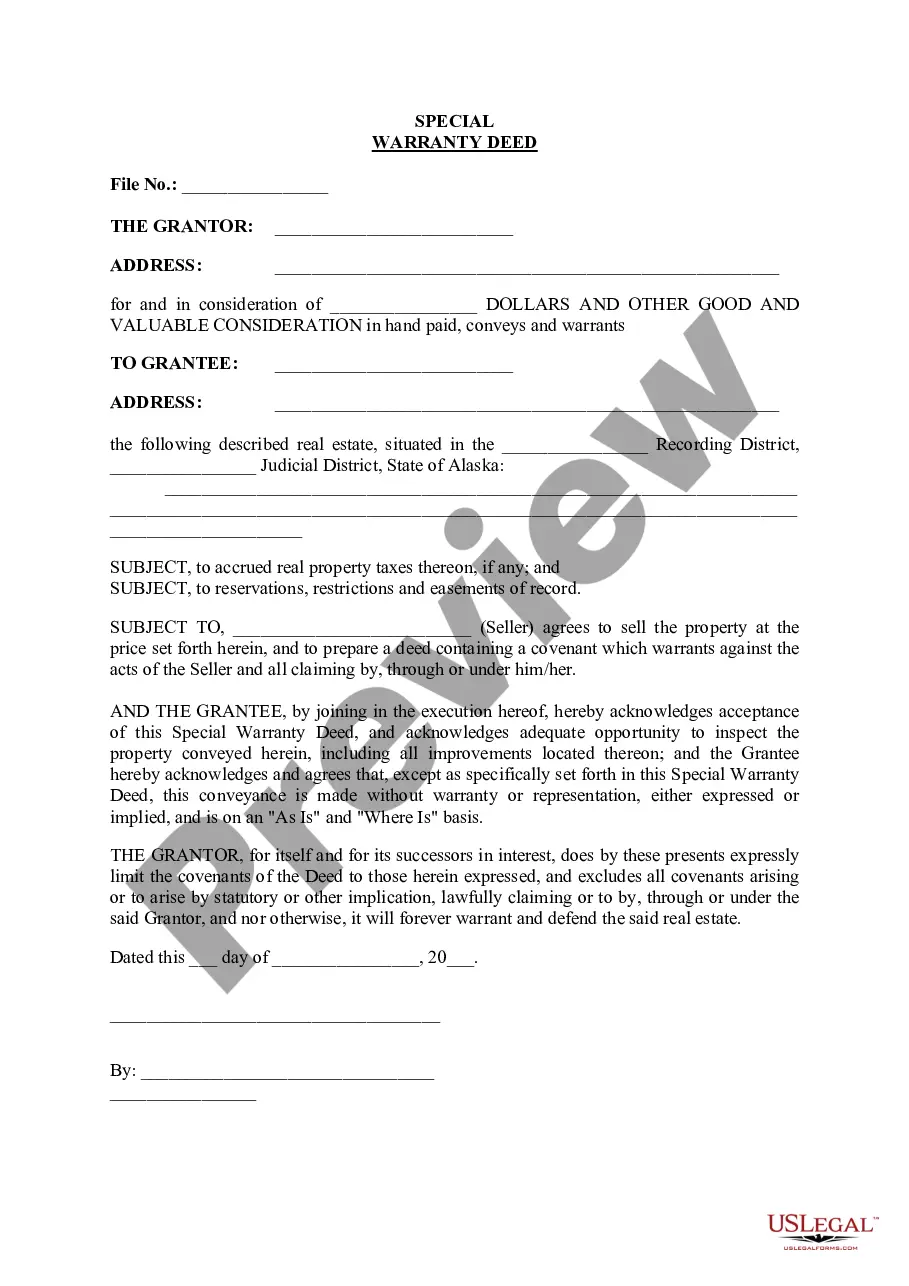

Selecting the appropriate legal document template can be quite a challenge. Naturally, there are numerous formats available online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The service provides thousands of templates, such as the Connecticut Officers Bonus in the form of Stock Issuance - Resolution Form, which can be used for both business and personal purposes. All of the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Acquire button to obtain the Connecticut Officers Bonus in the form of Stock Issuance - Resolution Form. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your locality/region. You can view the form using the Review button and read the form details to confirm it is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and process the payment using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Connecticut Officers Bonus in the form of Stock Issuance - Resolution Form.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to obtain properly crafted documents that meet state requirements.

Form popularity

FAQ

A board resolution for share issue is a formal approval document that allows the company to create and distribute new shares of stock. This resolution is critical as it outlines the specifics of the share issuance, including the total number of shares, the class of shares, and any associated rights. Having this resolution in place safeguards investor interests and maintains corporate governance. You can benefit from the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form to ensure all necessary details are accurately captured.

To issue new shares, a corporate resolution needs to be adopted by the board of directors. This resolution outlines the number of shares being issued and the terms under which they are offered. It is essential for maintaining proper records and informing shareholders. For easy and efficient documentation, consider the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form provided by uslegalforms.

Yes, a resolution is required to issue shares. This resolution serves as official documentation that the board of directors approves the issuance. It protects shareholders and ensures transparency in the company’s operations. Using the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form can simplify your compliance and documentation needs.

The board resolution for printing a share certificate is a formal document that authorizes the issuance and printing of share certificates for stock ownership. This resolution specifies the number of shares to be issued and ensures compliance with state laws. It often includes details such as the certificate's format and security features. If you need assistance with this process, the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form can help streamline your efforts.

In Connecticut, the minimum tax for corporations is set at around $250, regardless of income. This tax is crucial for ensuring all corporations contribute to the state’s budget. If you want to maximize your benefits such as the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form, we provide guidance on managing these taxes efficiently.

The minimum amount to be taxed can depend on your business structure and income levels. For most entities, Connecticut has specific thresholds that trigger tax obligations. It is beneficial to comprehend these limits, especially when closely working with the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form.

In Connecticut, the minimum taxable income varies based on the specific business entity type. For corporations, the taxable income threshold is typically determined by various financial parameters. Understanding these aspects can help in preparing for the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form efficiently, possibly with our guidance.

Form CT 1120 should be sent to the Connecticut Department of Revenue Services at P.O. Box 2974, Hartford, CT 06104-2974. Always ensure you have the right forms and payment included to expedite the process. Our platform offers solutions that are specifically designed to support matters like the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form.

To mail your Connecticut state return, send it to the Connecticut Department of Revenue Services at P.O. Box 2974, Hartford, CT 06104-2974. This mailing address can change, so it's a good idea to confirm on the official website. For assistance with forms related to Connecticut Officers Bonus in form of Stock Issuance - Resolution Form, turn to our reliable resources.

For mailing your federal tax return in Connecticut, use the appropriate IRS address based on your filing method and whether you are enclosing a payment. Typically, the address for those who live in Connecticut is in the Eastern United States. You could also consider discussing the Connecticut Officers Bonus in form of Stock Issuance - Resolution Form with our professionals for personalized guidance.