Connecticut Revocable Living Trust for Married Couple

Description

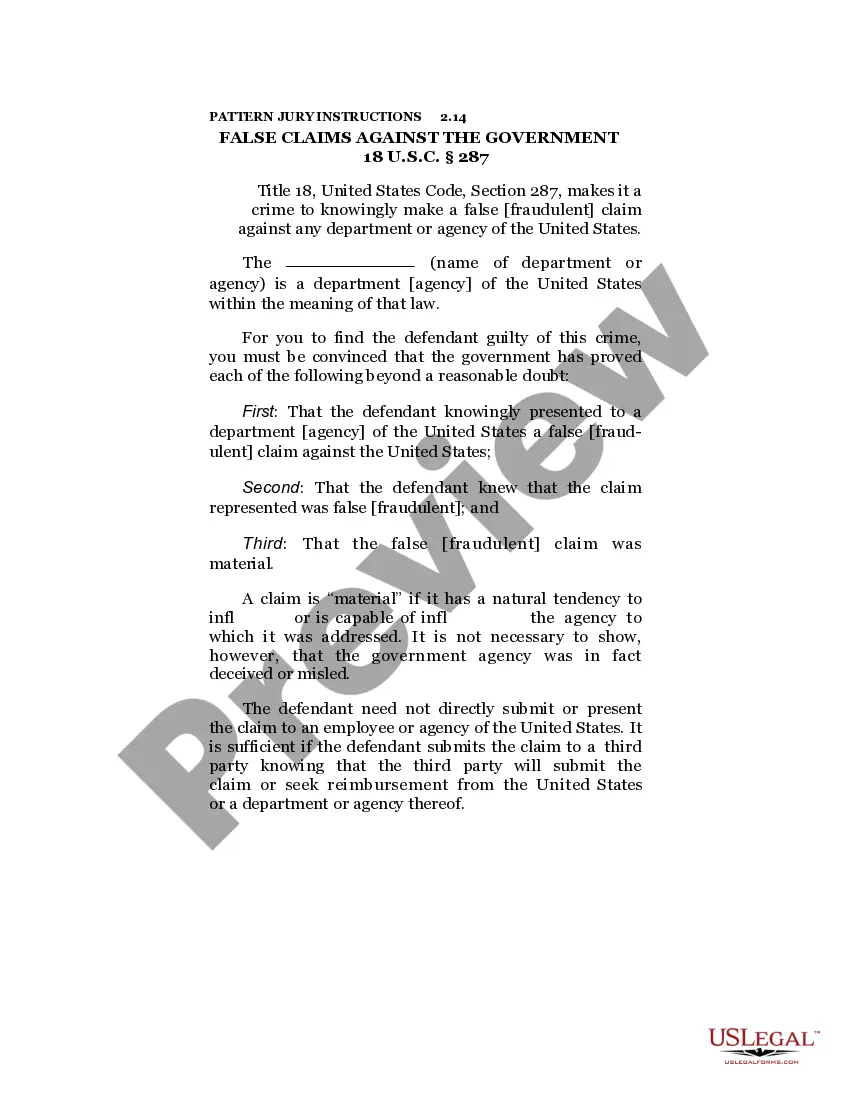

How to fill out Revocable Living Trust For Married Couple?

You might spend hours online searching for the authentic document template that meets the state and federal regulations you require.

US Legal Forms offers a vast array of legal templates that have been reviewed by experts.

You can effortlessly download or print the Connecticut Revocable Living Trust for Married Couple from the services.

If available, utilize the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then select the Download option.

- After that, you can complete, edit, print, or sign the Connecticut Revocable Living Trust for Married Couple.

- Every legal document template you acquire is yours to keep indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and select the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Check the form description to guarantee that you have chosen the right template.

Form popularity

FAQ

A Connecticut Revocable Living Trust for Married Couple can have a few downsides that you should consider. First, there may be upfront costs associated with setting up the trust, which could include attorney fees and administrative costs. Additionally, while the trust avoids probate, it does not protect your assets from creditors. Lastly, if you do not properly fund the trust with your assets, it may not function as intended, which could lead to complications down the line.

One disadvantage of a joint revocable trust is the potential for misunderstandings about asset control. In a Connecticut Revocable Living Trust for Married Couples, both partners must agree on decisions, which can lead to conflicts. Additionally, if the trust is not managed properly, it might complicate the probate process for the surviving spouse, making it essential to establish clear guidelines.

Joint revocable trusts often create complexities during estate planning. For instance, a Connecticut Revocable Living Trust for Married Couples can face challenges if one spouse becomes incapacitated or passes away. This arrangement might also lead to issues regarding asset distribution and management, requiring careful planning and communication between partners.

While no trust can completely avoid all taxes, certain trusts can minimize tax liabilities. For instance, a Connecticut Revocable Living Trust for Married Couples can help manage assets effectively, although it does not provide tax avoidance. Couples may want to consult a tax advisor to explore options like irrevocable trusts or charitable trusts that may offer better tax benefits.

Choosing between a revocable or irrevocable trust depends on your specific needs. A Connecticut Revocable Living Trust for Married Couples offers flexibility, allowing you to change or revoke the trust during your lifetime. In contrast, an irrevocable trust typically provides tax advantages but restricts your control over the assets. Thus, for many couples, the revocable option offers a more adaptable solution.

An appropriate trust for married couples is typically a Connecticut Revocable Living Trust for Married Couple. This trust provides both flexibility and security, making it an attractive choice for partners managing shared assets. It can reduce the complications of probate and ensure each spouse's wishes are respected after death. Engaging with a legal platform, like uslegalforms, can also help simplify the creation and management of your trust.

Yes, a married couple can certainly establish a joint revocable trust, commonly known as a Connecticut Revocable Living Trust for Married Couple. This type of trust allows both spouses to jointly manage their assets while retaining the ability to modify or dissolve the trust as they see fit. It's an advantageous option for couples looking to maintain control over their estate planning. Additionally, it simplifies the process of asset distribution upon their passing.

The best living trust for a married couple typically is a Connecticut Revocable Living Trust for Married Couple. This trust supports both parties in managing shared assets while allowing for adjustments based on changing needs. By establishing this trust, couples can protect their estate and ensure a clear plan for asset distribution after passing. Consulting with a professional can help you set it up effectively.

Suze Orman often recommends a revocable living trust for couples, aligning with the concept of a Connecticut Revocable Living Trust for Married Couple. This trust structure supports effective estate planning and allows for significant control over your assets. Orman emphasizes the importance of having a living trust to avoid probate and ensure a smooth transfer of wealth. Her approach focuses on empowering individuals to make informed financial decisions.

When you are married, a trust, such as a Connecticut Revocable Living Trust for Married Couple, allows both spouses to jointly manage and control their assets. This trust can be modified or revoked during the couple's lifetime, providing flexibility in changes as needed. Essentially, it helps ensure a seamless transfer of assets while protecting each spouse's interests. Discussions with a legal advisor can further clarify its benefits.