Connecticut Deed of Trust - Multistate

Description

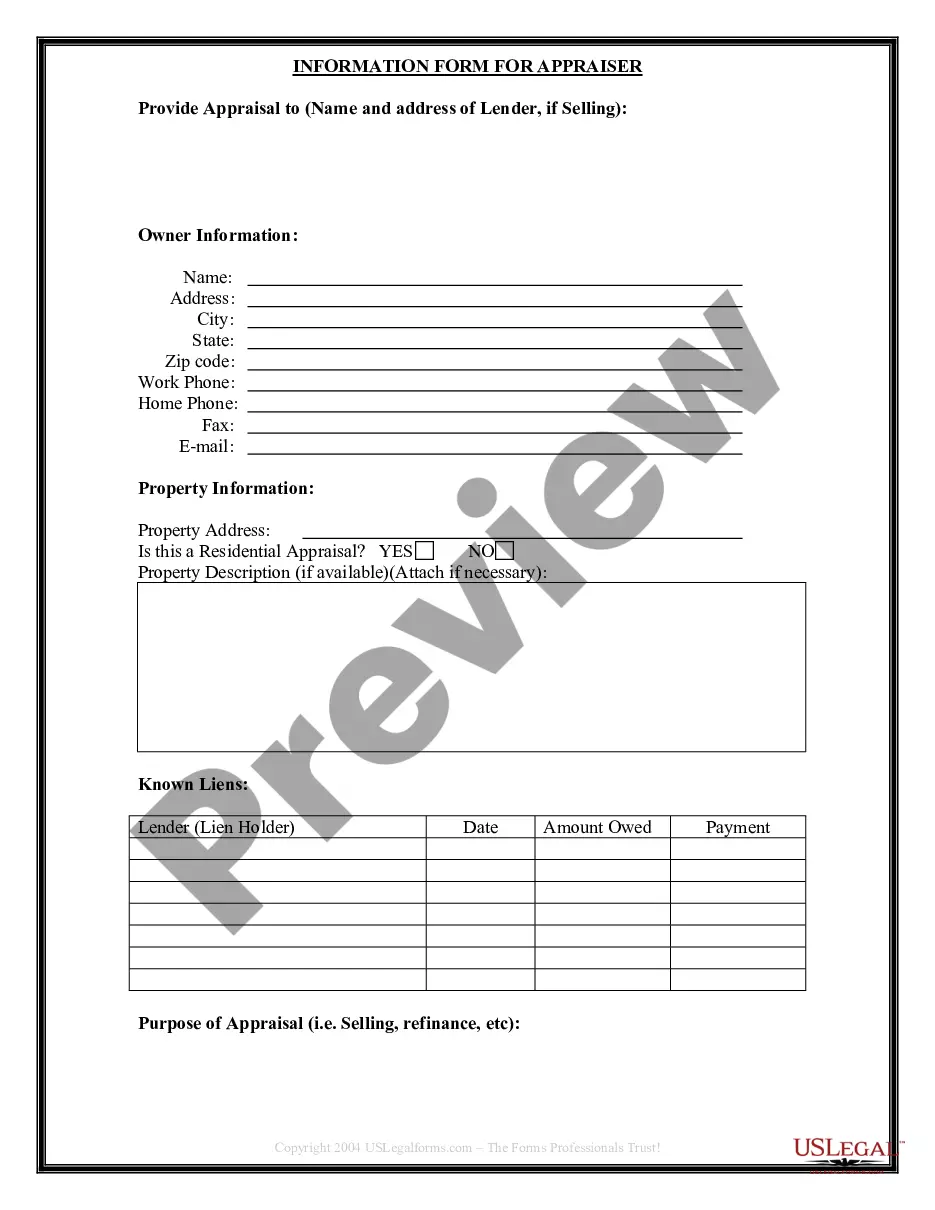

How to fill out Deed Of Trust - Multistate?

If you want to finish, acquire, or print sanctioned document formats, use US Legal Forms, the largest collection of legal templates available online.

Utilize the site's user-friendly search feature to find the documents you require.

A variety of templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to locate the Connecticut Deed of Trust - Multistate in just a few clicks.

Each legal document format you purchase is yours forever. You have access to every document you downloaded in your account. Click the My documents section and select a document to print or download again.

Stay competitive and obtain, and print the Connecticut Deed of Trust - Multistate with US Legal Forms. There are millions of professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Connecticut Deed of Trust - Multistate.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form's content. Remember to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Connecticut Deed of Trust - Multistate.

Form popularity

FAQ

NOTARY REQUIREMENTS In Connecticut, there is no requirement that the settlor's or the trustee's signatures be notarized unless the trust agreement conveys real property (Conn. Gen. Stat. Ann.

The tax rate is the lesser of 19% of adjusted federal tentative minimum tax or 5½% of adjusted federal alternative minimum taxable income.

Hear this out loud PauseDo I Need to Have My Will Notarized? No, in Connecticut, you do not need to notarize your will to make it legal. However, Connecticut allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that.

Hear this out loud PauseWhen you make a living trust that can manage your assets during your lifetime and afterward, the law calls you the ?settlor.? Whether your living trust is typed or handwritten, you, as the settlor, must sign the document. You do not need witnesses, and the paper does not have to be notarized.

Hear this out loud PauseA Connecticut trust typically costs anywhere between $1,500 and $3,950. At Snug, any member can create a Power of Attorney and Health Care Directive for free.

Hear this out loud PauseLiving trusts in Connecticut A Connecticut living trust is created by a grantor, a person who wishes to have a trust. The grantor first chooses a trustee who will manage all of the trust assets. You can name yourself as trustee, but you need a successor trustee who can take over after you die.

Connecticut does not allow real estate to be transferred with transfer-on-death deeds.

Importantly, all 50 states will recognize a trust regardless of where it was created. This means that out-of-state property placed in a trust in Florida will also escape probate in the property's state.