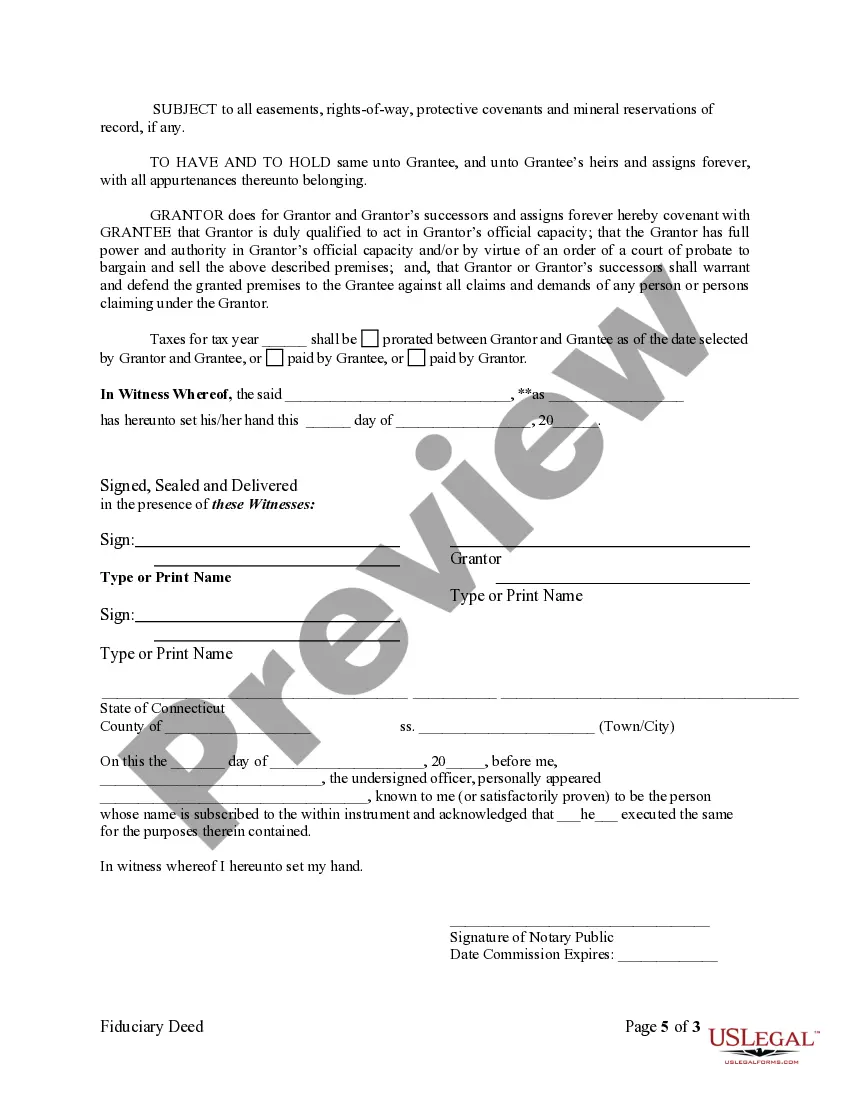

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries

Description

How to fill out Connecticut Fiduciary Deed For Executors, Trustees, And Other Fiduciaries?

Among many complimentary and paid examples that you encounter online, you cannot be sure about their dependability.

For instance, who created them or if they possess the expertise to fulfill your specific needs.

Stay calm and utilize US Legal Forms!

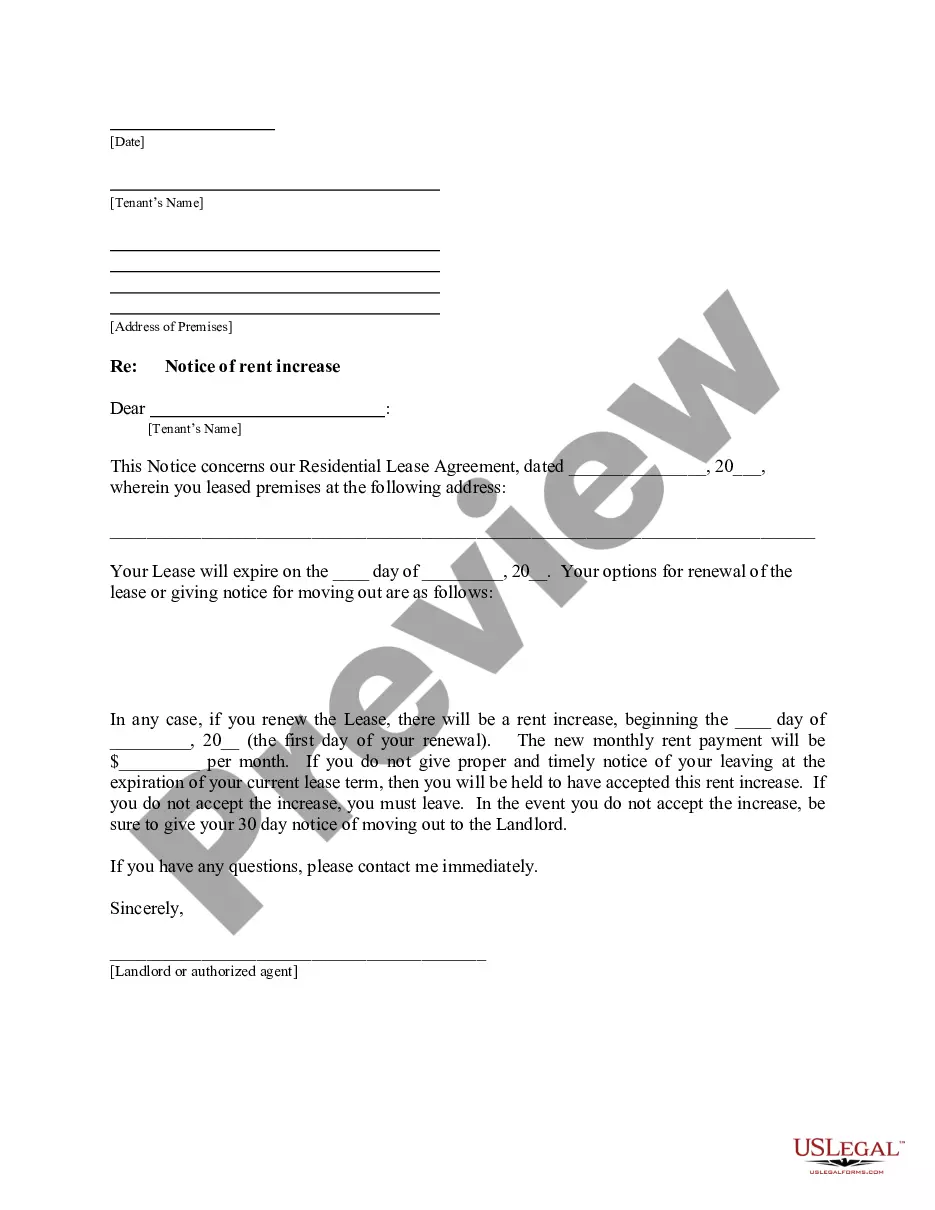

Click Buy Now to initiate the ordering process or search for another template via the Search bar situated in the header. Choose a pricing plan and create an account. Complete the subscription payment using your credit/debit card or PayPal. Download the form in the desired format. Once you’ve registered and paid for your subscription, you may utilize your Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries as often as needed or as long as it remains active in your state. Modify it with your preferred editor, fill it out, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries examples crafted by experienced attorneys and avoid the expensive and lengthy process of searching for a lawyer and then compensating them to draft a document for you that you can effortlessly find on your own.

- If you already hold a subscription, Log In to your account and locate the Download button next to the file you seek.

- You will also have access to all your previously purchased templates in the My documents menu.

- If you are using our site for the first time, adhere to the steps below to easily obtain your Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries.

- Ensure that the document you locate is valid in your jurisdiction.

- Review the file by utilizing the Preview functionality.

Form popularity

FAQ

The benefit of having a fiduciary lies in their dedication to managing affairs responsibly and ethically. They provide expertise and oversight that can help prevent disputes and ensure that assets are managed according to legal and familial wishes. Fiduciaries also streamline processes, making estate management smoother. By utilizing a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries, you can trust that property transfers will be handled properly.

The primary goal of a fiduciary is to act in the best interest of the beneficiaries or clients they represent. This involves managing assets responsibly, ensuring transparency, and following legal guidelines. Fiduciaries must maintain integrity and uphold their duties, as they hold a position of trust. With a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries, they accomplish this mission effectively.

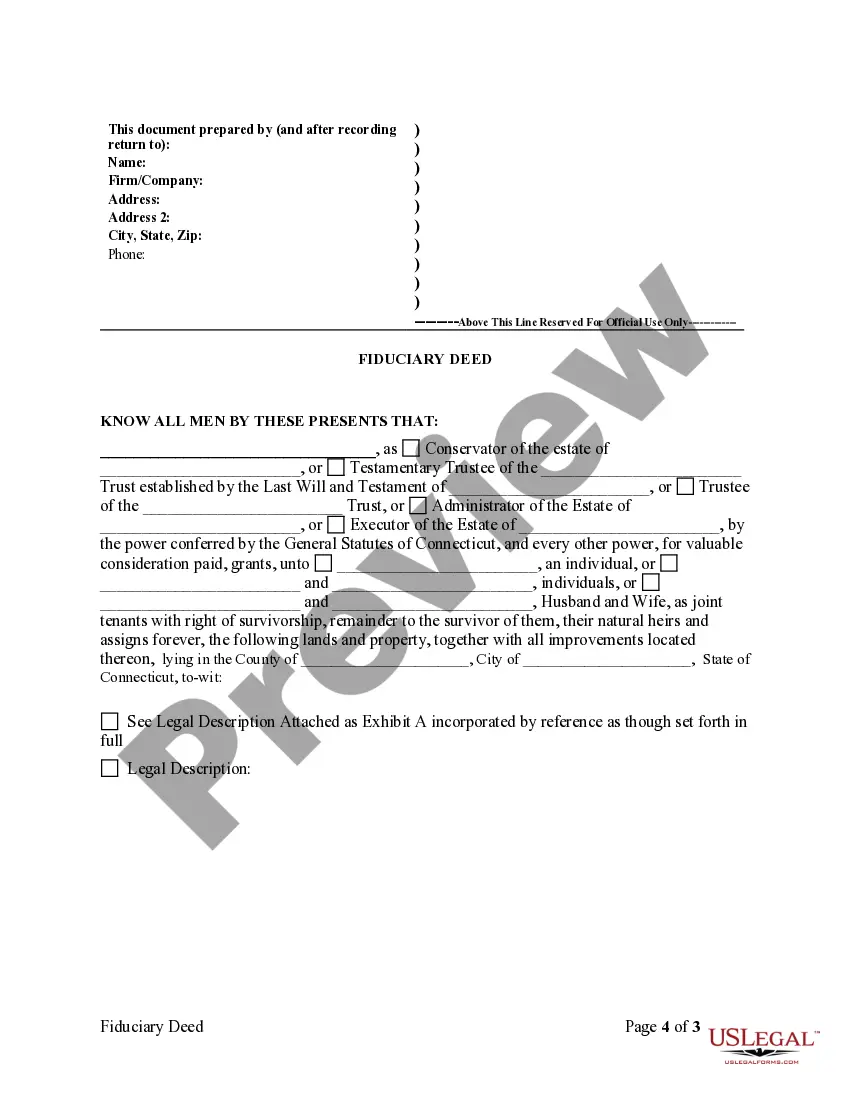

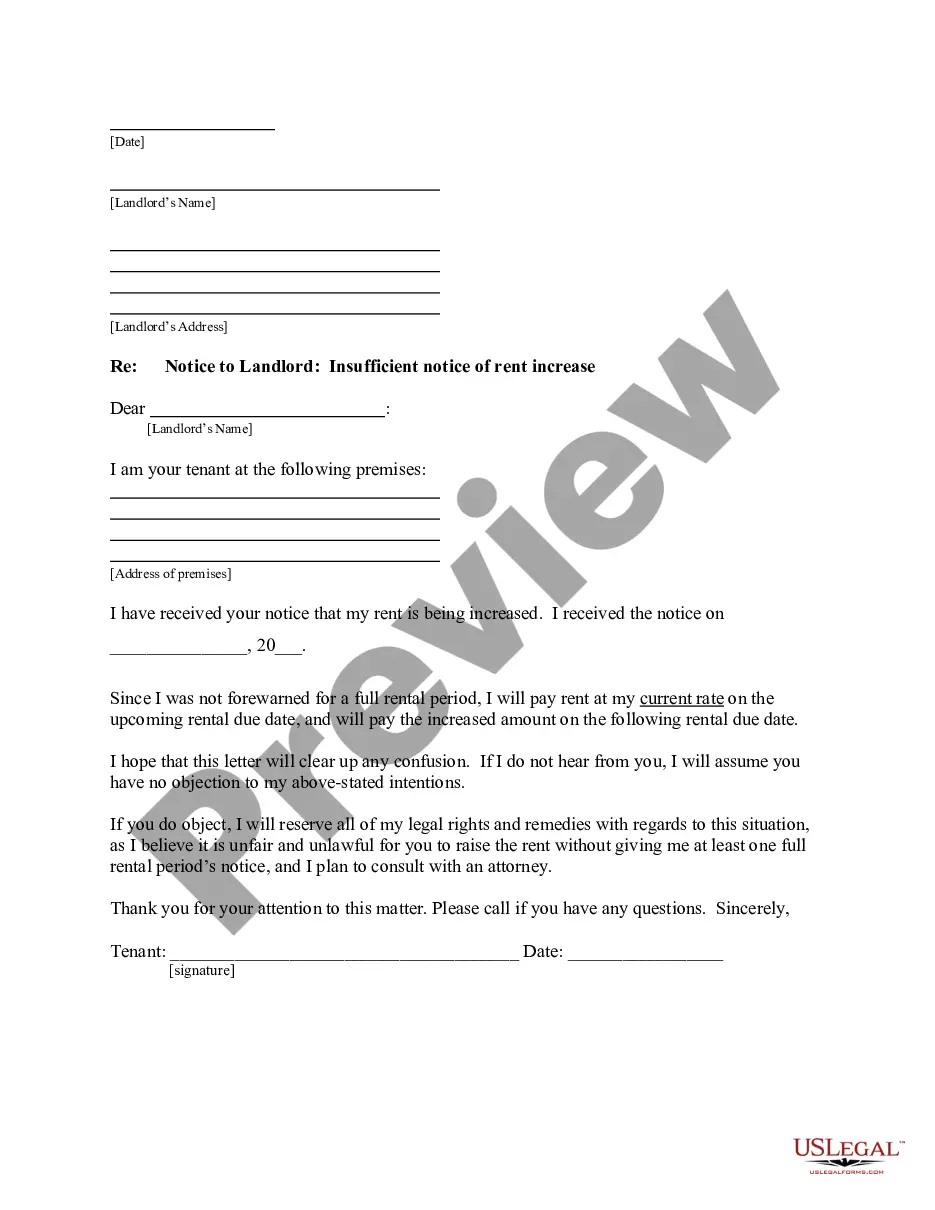

A fiduciary deed is utilized to transfer property when an individual, such as an executor or trustee, acts on behalf of another party. This is critical in estate management, especially when settling a trust or a will. The fiduciary deed provides necessary documentation showing that the fiduciary has authority to act. Using a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries ensures that property transfers are legally recognized.

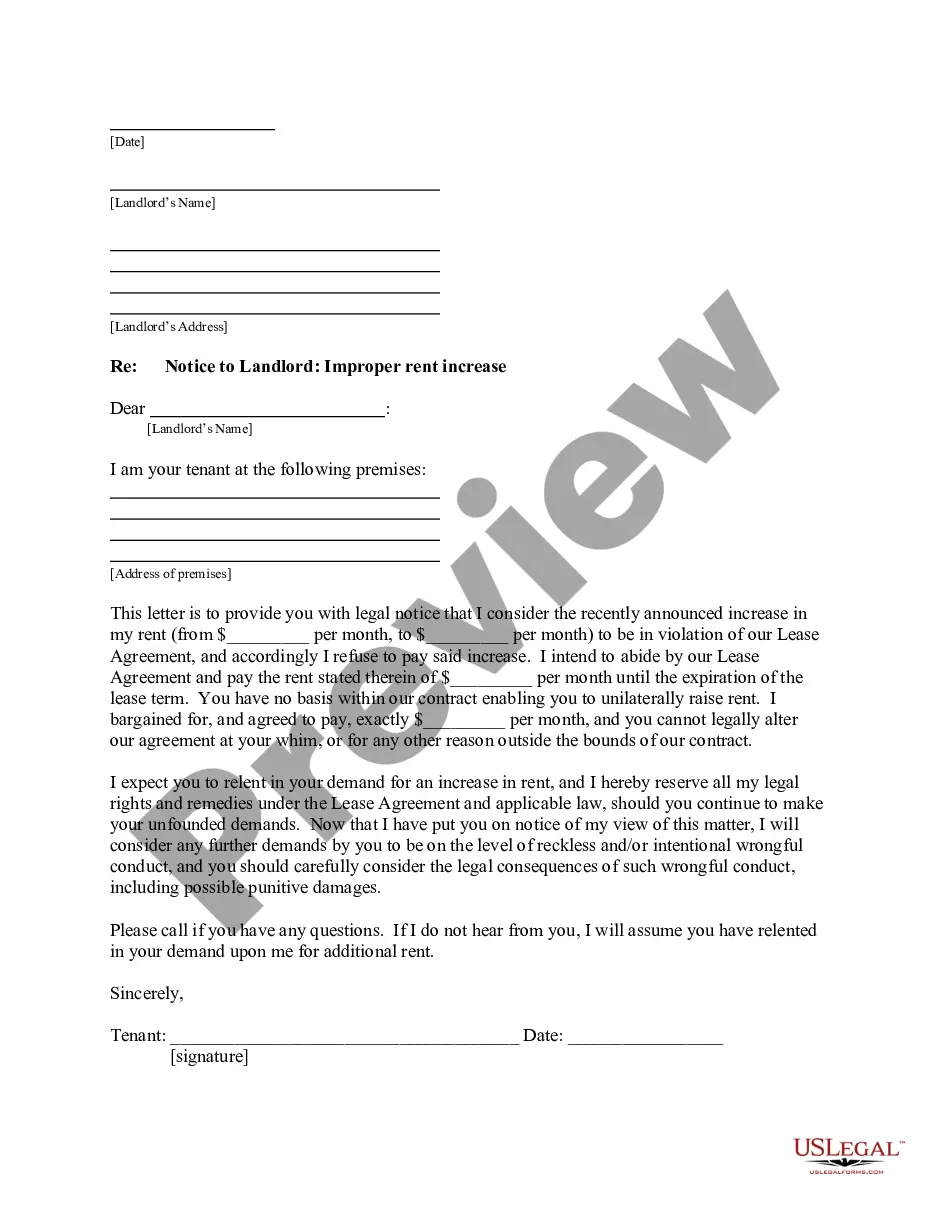

While both fiduciaries and trustees manage assets for others, they are not exactly the same. A trustee is a specific type of fiduciary appointed to manage a trust. On the other hand, fiduciaries encompass a larger group, including executors and agents, who are bound to act in the best interest of their clients or beneficiaries. Understanding these roles is essential when dealing with a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries.

Yes, an executor can certainly be a fiduciary. In fact, the term 'fiduciary' broadly describes anyone who manages assets or property for another person. Executors are tasked with fulfilling the wishes expressed in a will, which includes managing and distributing the estate. A Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries enables executors to perform this function effectively.

A fiduciary deed allows executors, trustees, and other fiduciaries to transfer property on behalf of the estate they manage. This deed ensures that the property changes ownership while adhering to legal responsibilities. The purpose is to provide a clear legal pathway for the fiduciary to act in the best interests of the beneficiaries. In the context of Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries, it simplifies the transfer of estate assets.

The strongest form of deed is often considered to be a warranty deed. A warranty deed guarantees that the grantor has clear title to the property and can transfer ownership. This type of deed offers the highest level of protection to the grantee. For those looking at a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries, understanding the differences in deeds is crucial.

The fiduciary on an estate return is generally the executor or administrator responsible for the estate's affairs. This individual or representative ensures that the estate's income, expenses, and distributions are accurately reported. Their role is critical for maintaining compliance with tax laws and addressing any potential legal issues. Executors may benefit from using a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries to manage these responsibilities efficiently.

The fiduciary of an estate is typically the executor named in the will or appointed by the court. This individual manages the estate's assets and executes the terms of the will. It is their duty to act in the best interest of the estate and its beneficiaries, ensuring proper asset management and distribution. A Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries often plays a vital role in supporting fiduciaries in these responsibilities.

Yes, an estate return is considered a fiduciary return. This document reports the income and expenses of the estate during the probate process, ensuring compliance with tax obligations. Executors and fiduciaries must file this return to provide transparency and accountability. Utilizing a Connecticut Fiduciary Deed for Executors, Trustees, and other Fiduciaries can help clarify the handling of estate assets, making the filing process smoother.