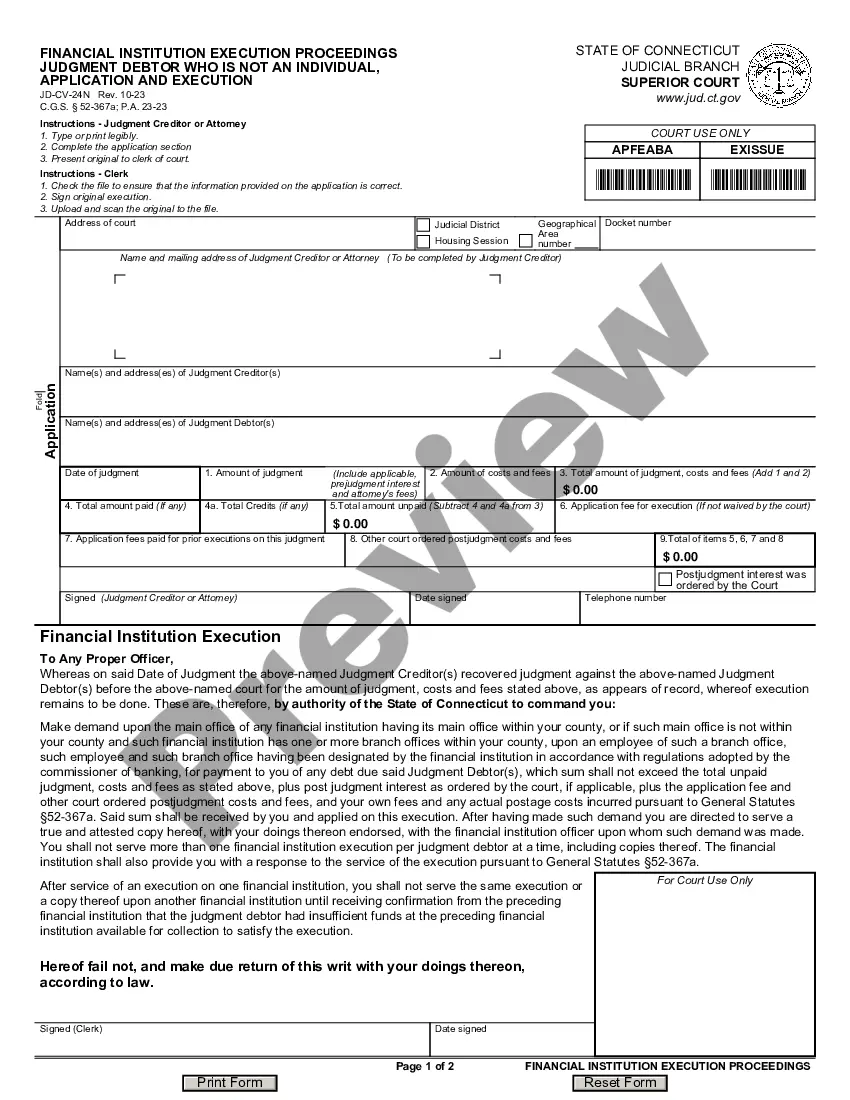

This form is used to provide financial institutions with information regarding the execution proceedings for the person who is the judgment debtor. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is A Natural Person, Application And Execution?

The larger volume of documents you are required to compile - the more anxious you become.

You can obtain a vast quantity of Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution templates online; however, you are unsure which ones to trust.

Eliminate the trouble of making sample detection simpler by using US Legal Forms. Acquire professionally prepared forms that are designed to meet the state requirements.

Provide the required information to create your account and process payment using PayPal or credit card. Choose a preferred file format and download your copy. Find each template you receive in the My documents section. Simply navigate there to complete a new version of your Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution. Even when using expertly drafted templates, it's still wise to consider consulting with a local attorney to verify that your completed document is accurate. Do more for less with US Legal Forms!

- If you currently possess a US Legal Forms subscription, sign in to your account, and you will find the Download button on the Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution’s page.

- If this is your first time using our website, complete the registration process with these guidelines.

- Ensure that the Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution is valid in your jurisdiction.

- Confirm your selection by reviewing the description or utilizing the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

A motion for Judgment serves as a formal request to the court, allowing a plaintiff to seek a legal ruling in their favor. In the context of Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution, this motion helps enforce a judgment against the debtor's assets. By filing this motion, you can initiate the process of collecting owed debts more effectively and ensure compliance with court orders. Utilizing platforms like US Legal Forms can simplify this process, providing you with the necessary forms and guidance needed to file the motion properly.

In Connecticut, the statute of limitations on enforcing a judgment is twenty years, aligning with the length of time a judgment is valid. This means that a creditor has two decades to take action under Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution. After this period, the creditor would lose the right to enforce, making it essential for both debtors and creditors to be aware of these timelines. Utilizing tools from platforms like uslegalforms can provide clarity and assist in navigating these legal aspects.

A judgment typically remains on your credit report for seven years after the date it was entered. However, while it affects your credit score, it does not disappear from record keeping within Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution until twenty years have passed. Understanding this timeline is critical for managing your financial reputation and planning your future. Parties seeking to further assist you with these nuances can turn to resources like uslegalforms.

CT bank execution refers to a specific enforcement action taken by creditors to collect debts through a debtor's bank accounts in Connecticut. This process is a key part of Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution. When executed, it allows creditors to freeze and withdraw funds directly from the debtor's bank account, effectively securing payment. It is essential to understand your rights in this scenario.

In Connecticut, a judgment is valid for twenty years from the date it is rendered. This period allows creditors ample time to enforce their rights under Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution. If a judgment is not collected within this duration, it will no longer be enforceable. However, creditors may renew the judgment to extend their timeframe for collection.

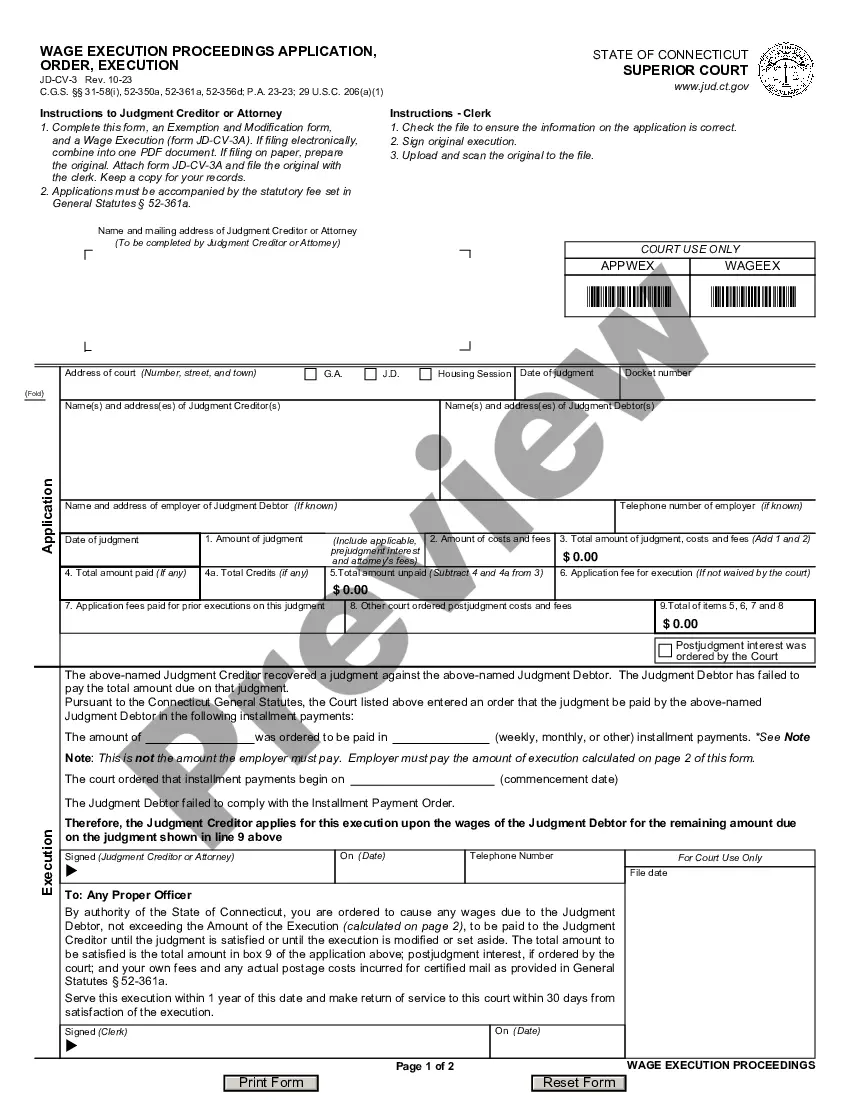

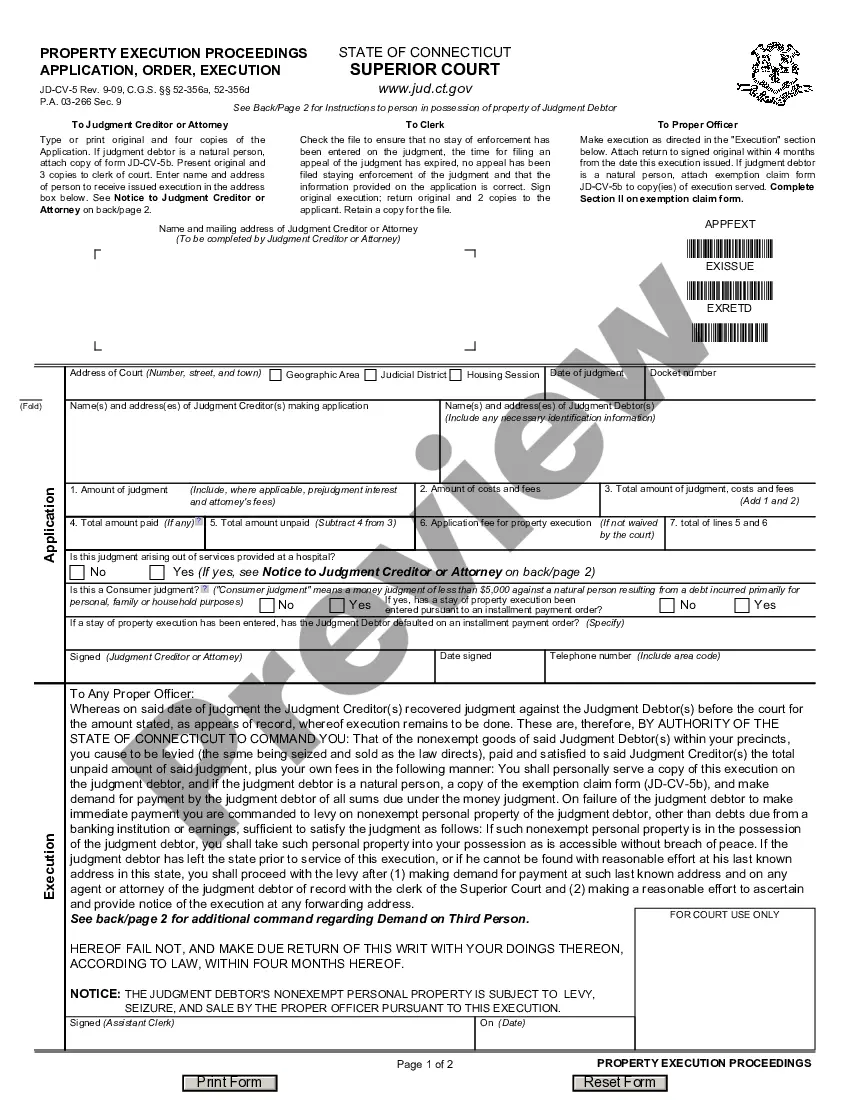

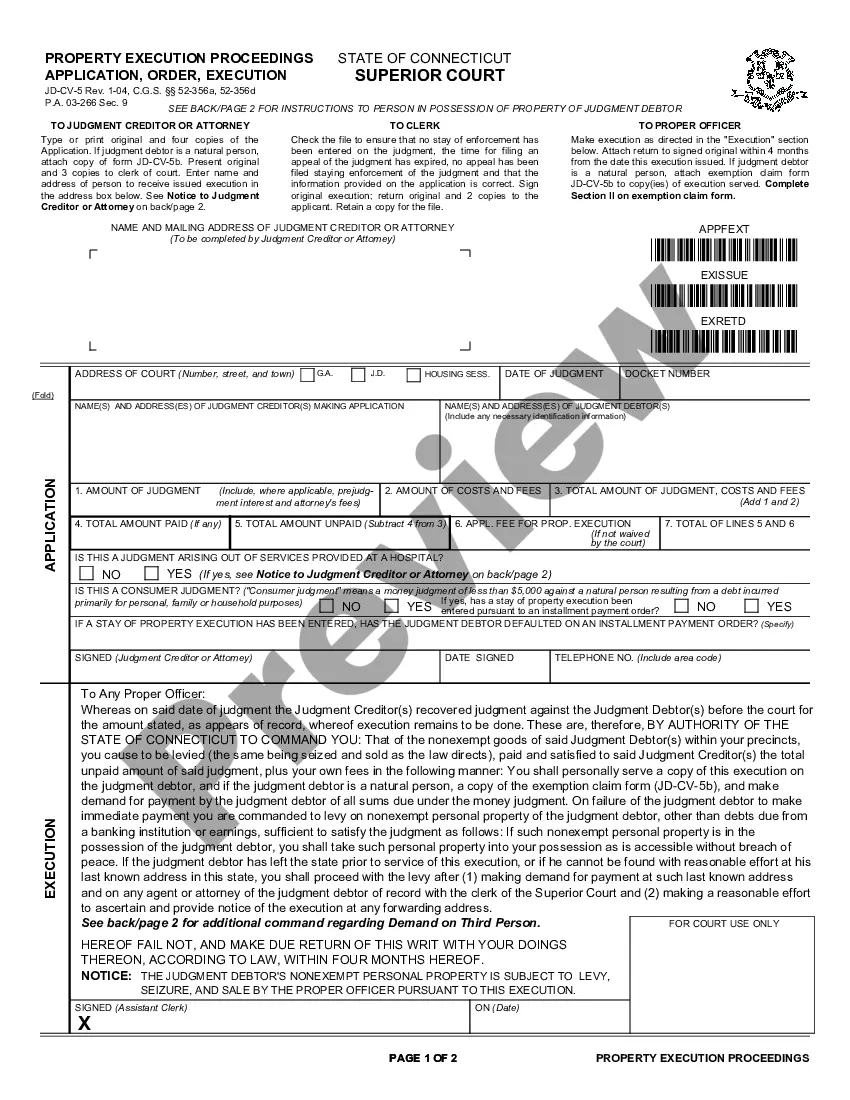

An execution on a judgment is a legal process in which a creditor seeks to collect what is owed after winning a court case. In Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution, this typically involves garnishing wages or seizing assets. The process ensures that the creditor can obtain payment directly from the debtor's financial institutions. Understanding this can help you navigate your responsibilities effectively.

Executed by bank means that a bank has carried out a specific transaction or instruction, usually following a legal process. In the case of Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution, this term signifies that the bank has enforced a court order, such as transferring funds from a debtor's account. Clarity on this term is vital for those involved in financial or legal matters affecting their assets.

A CT bank execution refers to a legal process where funds are seized from a bank account under Connecticut law. This typically occurs when a judgment has been rendered against a debtor in Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution. The execution allows creditors to collect what is owed through the debtor's financial institution. Understanding this process can help individuals manage their financial liabilities responsibly.

In banking, CT typically stands for Connecticut, a state in the U.S. It is often referenced in financial documents, especially when dealing with Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution. Knowing that CT represents Connecticut helps clarify the jurisdiction and legal processes applicable to banking and financial institutions. This understanding is essential for anyone involved in these proceedings.

When a bank transfer is executed, it means that the bank has completed the transaction as instructed. In the context of Connecticut Financial Institution Execution Proceedings - Judgment Debtor Who Is a Natural Person, Application and Execution, such transfers often relate to obligations of debtors. This can involve the transfer of funds from an account to satisfy a court judgment. It's important to understand this process to navigate financial obligations effectively.