Connecticut Request For Action — Administrative and Tax Appeal— - Not For Use In Land Use Appeals is a process by which individuals, businesses, or organizations can file an appeal with the state of Connecticut regarding administrative and tax laws or decisions and regulations. This process does not cover any appeals related to land use. Types of Connecticut Request For Action — Administrative and Tax Appeal— - Not For Use In Land Use Appeals include: • Appeal of a decision of a state agency • Appeal of a decision of the Board of Tax Review • Appeal of an assessment, penalty, or other tax related issue • Appeal of a decision of the Department of Revenue Services • Appeal of a decision of the State Board of Equalization and Review • Appeal of a decision of the Department of Labor regarding the assessment of penalties or other enforcement actions.

Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals

Description

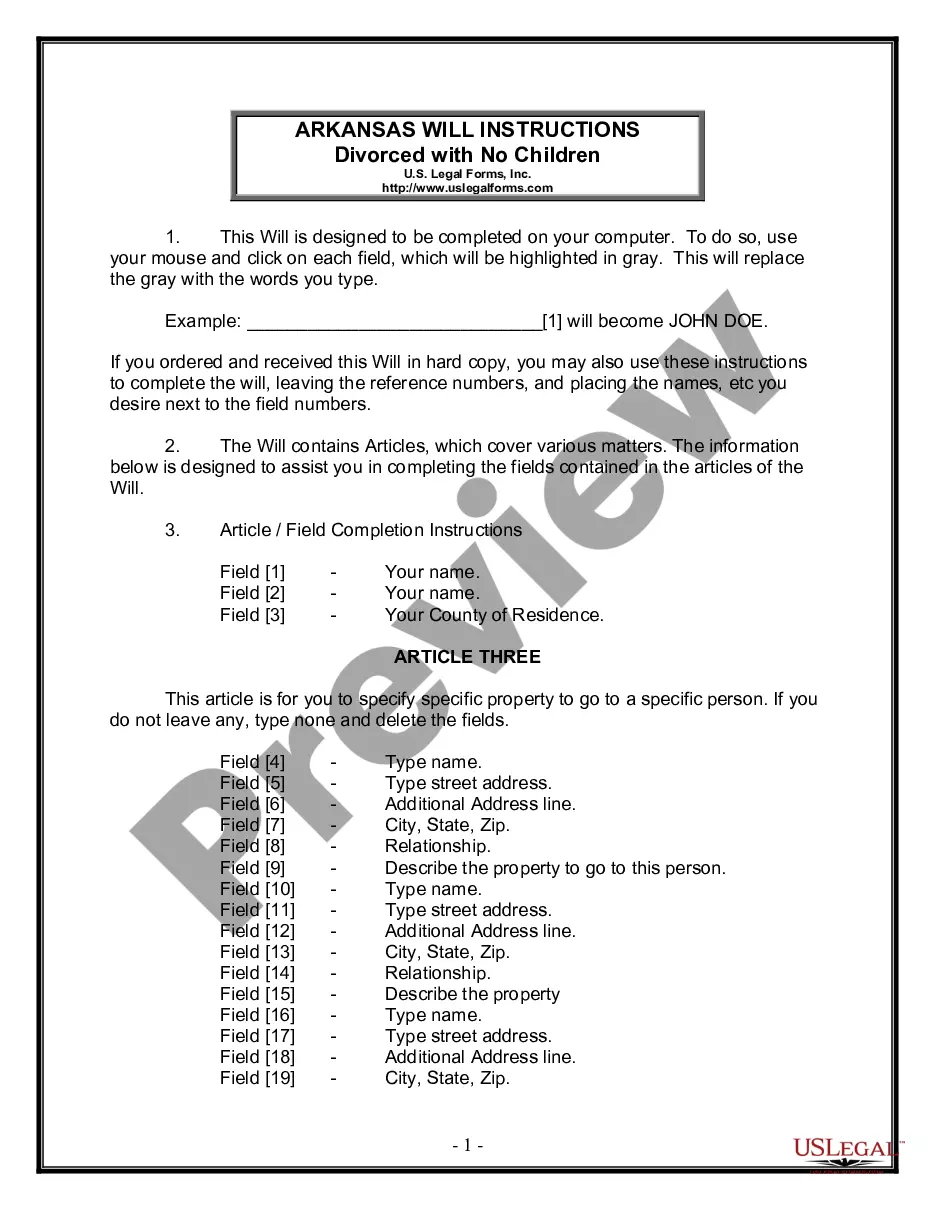

How to fill out Connecticut Request For Action - Administrative And Tax Appeals - Not For Use In Land Use Appeals?

US Legal Forms represents the simplest and most lucrative method to find suitable formal templates.

It boasts the largest online collection of business and personal legal documents crafted and verified by attorneys.

Here, you can discover printable and fillable forms that adhere to national and local regulations - just like your Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals.

Examine the form description or preview the document to ensure you’ve located the one that matches your needs, or search for another using the search bar above.

Click Buy now when you’re confident of its alignment with all the specifications, and select the subscription plan that suits you best.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription merely need to Log In to the site and download the form onto their device.

- Subsequently, it can be located in their profile under the My documents tab.

- And here’s how to obtain a correctly drafted Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

To dispute car taxes in Connecticut, start by reviewing your tax bill and the assessment of your vehicle’s value. If you believe the assessment is incorrect, you can file a Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals. This process allows you to challenge the assessment formally. Additionally, consider using USLegalForms to access resources and templates that can help you navigate the appeals process effectively.

To appeal your property tax assessment in Connecticut, first, review your assessment notice for accuracy. You then need to file a Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals with your local board of assessment appeals. It's advisable to gather any supporting documents, such as property comparables, to strengthen your case. Using uslegalforms can help you navigate this process smoothly and efficiently.

The tax session of the Connecticut Superior Court addresses various cases related to taxation. This includes appeals regarding property tax assessments, disputes over tax liability, and other tax-related matters. When filing, it's important to prepare your Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals accurately, as the court relies on clear documentation. Uslegalforms provides templates that can assist in this preparation.

You file your appeal with the Connecticut Superior Court, focusing on the tax session specifically. This process involves submitting your Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals in the appropriate court. It's crucial to ensure that your documentation clearly states your dispute. Consider using online platforms like uslegalforms to streamline this process.

In Connecticut, the timeline for filing an appeal typically allows for a few weeks once you receive your assessment notice. It is crucial to adhere to the deadlines set forth in the Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals. Using the USLegalForms platform can help you understand the necessary steps and timeframes, streamlining your filing process so you can focus on your appeal rather than worrying about deadlines.

To write an appeal for property taxes in Connecticut, start by gathering your property assessment documents and any evidence supporting your claim. Clearly outline your reasons for believing the assessment is incorrect, referencing the Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals. Consider using our platform, USLegalForms, to access templates and information that guide you through the process, ensuring your appeal is well-structured and compelling.

The time limit for filing an appeal in Connecticut varies, but for many administrative and tax decisions, it is 45 days after the notice of the decision is sent. When considering a Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals, you should clearly understand this timeline to ensure you do not miss your chance. You can use platforms like US Legal Forms to simplify and expedite your appeal process, making sure you follow all necessary steps.

In Connecticut, the appeal period for administrative and tax appeals typically spans 45 days from the date of the decision you wish to challenge. This timeframe is crucial for filing a Connecticut Request For Action - Administrative and Tax Appeals - Not For Use In Land Use Appeals. If you miss this deadline, you might lose your right to contest the decision. Therefore, it is essential to act quickly and gather your documents.