A Connecticut Statement of Denial is a document used to deny responsibility for a debt. It is typically produced by a consumer in response to a debt collection notice. The Connecticut Statement of Denial is used to dispute the debt and assert that the consumer does not owe the money. The denial statement must be signed by the consumer and sent to the creditor or debt collector. There are three types of Connecticut Statement of Denial: General Denial, Specific Denial and Partial Denial. A General Denial is used to deny responsibility for the entire debt. A Specific Denial is used to dispute certain parts of the debt while accepting responsibility for other portions of the debt. A Partial Denial is used to deny responsibility for part of the debt while accepting responsibility for the remainder.

Connecticut Statement of Denial

Description

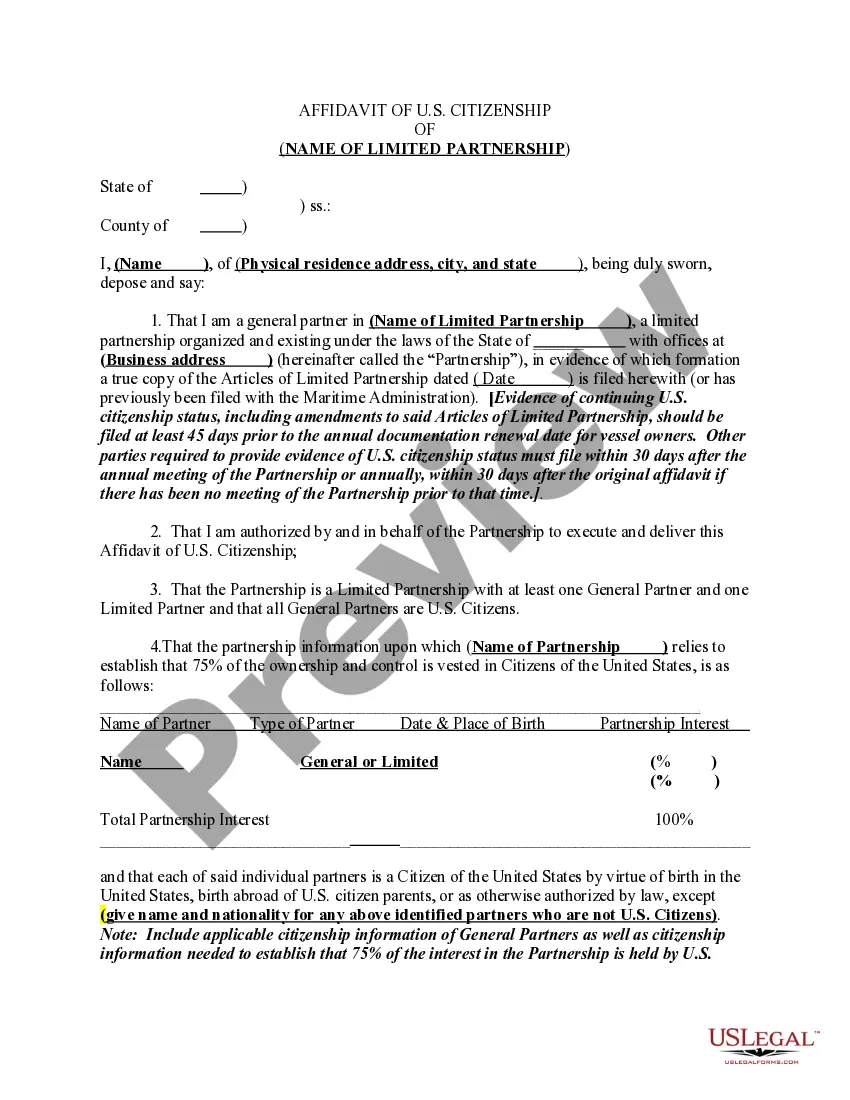

How to fill out Connecticut Statement Of Denial?

How much time and resources do you usually allocate for drafting formal documents.

There’s a more advantageous opportunity to obtain such forms than employing legal experts or dedicating hours searching the internet for an appropriate template.

An additional advantage of our service is that you can access previously downloaded documents securely stored in your profile under the My documents tab. Retrieve them at any time and redo your paperwork as often as needed.

Save time and effort managing formal paperwork with US Legal Forms, one of the most reputable online solutions. Join us today!

- Browse through the form content to ensure it adheres to your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template does not meet your requirements, find an alternative by using the search feature at the top of the page.

- If you already possess an account with us, Log In and download the Connecticut Statement of Denial. Otherwise, continue to the following steps.

- Click Buy now once you identify the correct document. Choose the subscription plan that best fits your needs to access the full range of our library’s services.

- Establish an account and pay for your subscription. You can complete the transaction with your credit card or via PayPal - our service is completely trustworthy for this purpose.

- Download your Connecticut Statement of Denial to your device and fill it in on a printed copy or electronically.

Form popularity

FAQ

Connecticut General Statutes Section 52 57 is a law related to the service of process in civil cases, establishing how legal documents should be delivered. This section is crucial for ensuring that all parties have proper notice of legal actions, particularly in situations where a Connecticut Statement of Denial may apply. Knowing how this statute functions can empower you when pursuing or responding to legal claims.

Section 52 584 of the Connecticut General Statutes addresses the statute of limitations for certain civil actions. It specifies the time limits for filing complaints related to professional malpractice and negligence claims. For individuals dealing with the aftermath of a denial or dispute, understanding this statute can help determine your legal options following a Connecticut Statement of Denial.

Section 52 57 of the Connecticut General Statutes governs the limitations on actions in civil lawsuits. This section specifies the time frames within which individuals must file claims, including personal injury and property damage cases. Whether you are preparing a lawsuit or responding to a Connecticut Statement of Denial, staying aware of these limitations is essential.

Connecticut General Statutes 53a 57 pertains to the laws surrounding the offense of robbery in Connecticut. This law defines the conditions under which robbery is classified and the potential penalties for such actions. If you are involved in a legal matter related to robbery, understanding this statute will be critical, especially in cases where a Connecticut Statement of Denial may be issued.

To file a complaint with the insurance commissioner in Connecticut, you must gather relevant information about your policy and the grievance you wish to report. You can submit your complaint through the Connecticut Insurance Department's website or via a written letter, clearly outlining the issues. Utilizing resources like US Legal Forms can simplify this process, providing forms and guidance tailored to your situation, including matters involving a Connecticut Statement of Denial.

Section 52 59b of the Connecticut General Statutes outlines the process and requirements for serving process on a corporation. It details how and when a legal document can be delivered to a corporation, ensuring that the Connecticut Statement of Denial and other legal actions are properly addressed. Understanding this section can help you navigate legal proceedings effectively, particularly if you are facing disputes with a corporation.

To fill out the back of a Connecticut title, clearly print the buyer's name and address, ensuring accuracy in every detail. You will need to sign in the seller's area to finalize the transfer of ownership. If there are any complications, the Connecticut Statement of Denial may provide essential guidance. We can help you navigate this process with resources that simplify filling out the title accurately.

The back of a car title typically contains sections for the buyer's information, seller's signature, and odometer disclosure statement. It also may include spaces for notifications related to the Connecticut Statement of Denial if any issues exist. Understanding this section can help facilitate the transfer and ensure compliance with state requirements. Our services offer guides to help you interpret these segments correctly.

When filling out a Connecticut registration and title application, include your personal details, vehicle information, and any liens on the vehicle. Make sure to attach necessary documents like the previous title and proof of identity. In case of title issues, consider using the Connecticut Statement of Denial to state your case. Our platform offers templates to assist you in assembling these documents efficiently.

To fill out the back of a Connecticut title, start by entering the buyer's name and address in the appropriate fields. Sign the title in the seller's signature area; this indicates your approval of the transfer. If any discrepancies arise, refer to the Connecticut Statement of Denial as a vital resource to clarify or confirm details about the transfer. Our website provides simple instructions and forms to streamline this process.