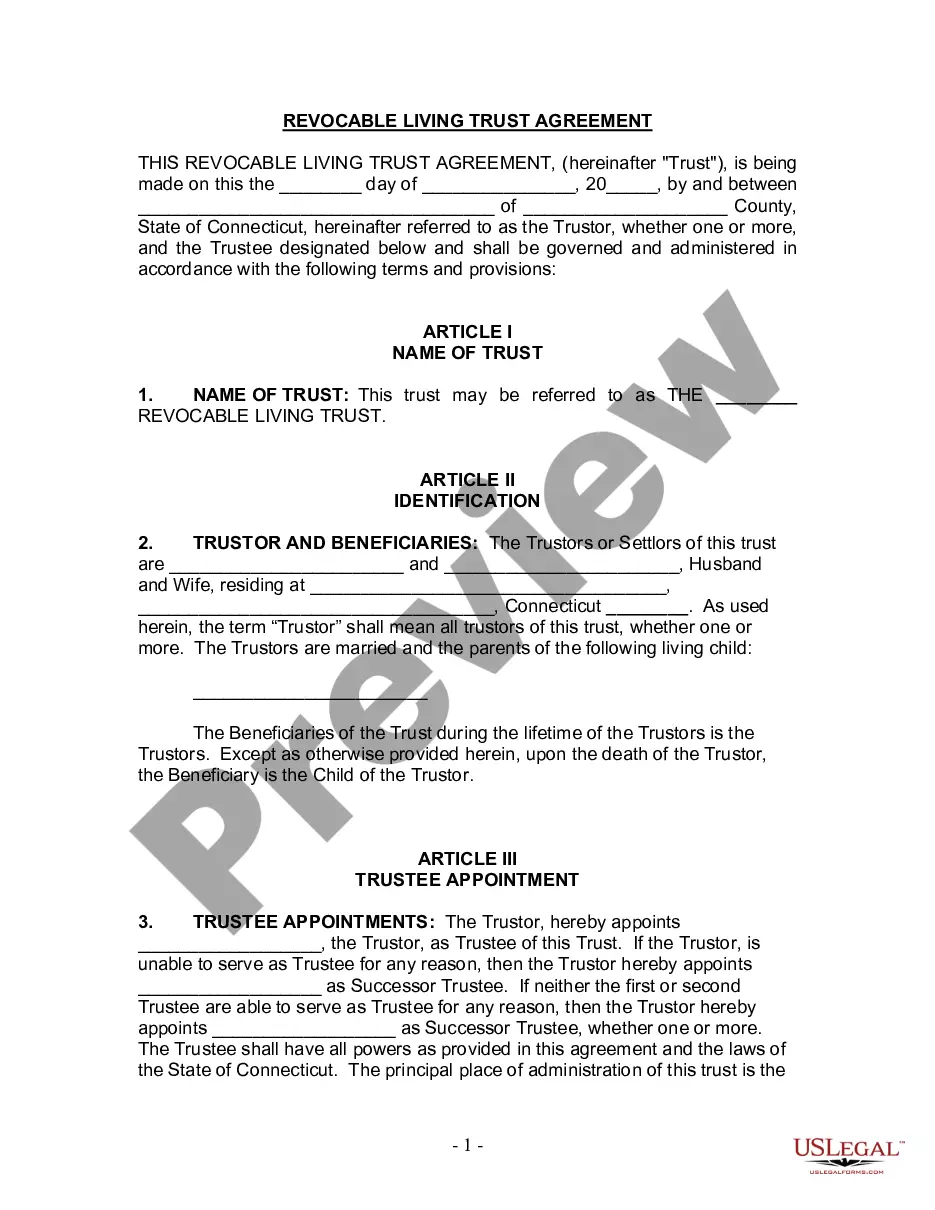

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Connecticut Living Trust for Husband and Wife with One Child

Description

How to fill out Connecticut Living Trust For Husband And Wife With One Child?

The greater number of documents you need to prepare - the more anxious you become.

You can discover a vast array of Connecticut Living Trust for Husband and Wife with One Child templates online, but you're unsure which ones to rely on.

Eliminate the inconvenience and simplify the process of acquiring samples with US Legal Forms. Obtain professionally drafted forms designed to comply with state regulations.

Input the requested information to create your account and complete your purchase using your PayPal or credit card. Choose a suitable document format and receive your sample. You can find every sample you download in the My documents section. Go there to fill out a new copy of the Connecticut Living Trust for Husband and Wife with One Child. Even when using professionally drafted templates, it’s still important to consider asking your local attorney to double-check the completed form to ensure your file is correctly filled out. Do more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you will see the Download option on the Connecticut Living Trust for Husband and Wife with One Child's page.

- If you’ve never accessed our website before, complete the sign-up process by following these steps.

- Confirm that the Connecticut Living Trust for Husband and Wife with One Child is applicable in your state.

- Verify your choice by reading the description or using the Preview feature if it’s available for the particular file.

- Simply click Buy Now to initiate the sign-up process and select a pricing plan that fits your needs.

Form popularity

FAQ

The most appropriate type of trust for married couples is typically a revocable living trust. A Connecticut Living Trust for Husband and Wife with One Child allows couples to retain control over their assets while specifying distribution preferences. This trust type offers flexibility, adapting to changes in family dynamics or financial circumstances. Consulting a skilled attorney ensures that the trust aligns with your goals.

Married couples may choose to have separate trusts based on their unique situations. A Connecticut Living Trust for Husband and Wife with One Child may serve better when both spouses want to manage individual assets or protect personal wealth. However, combining assets into a joint trust can simplify processes and reduce administrative burden. Weighing these factors is crucial to making an informed decision.

A trust for a married couple works by designating assets and outlining the distribution process. With a Connecticut Living Trust for Husband and Wife with One Child, one or both spouses can manage the assets during their lifetimes. Upon a spouse's passing, the trust facilitates the automatic transfer of assets to the surviving spouse and, ultimately, to the child. This process minimizes probate and ensures the couple's wishes are fulfilled.

For married couples, a revocable living trust usually emerges as the best option. A Connecticut Living Trust for Husband and Wife with One Child can provide transparency and flexibility. This trust type allows couples to adjust the terms as circumstances change while ensuring a seamless transition of assets to their child. Seek advice from professionals to help design the trust that fits your family structure.

The best living trust for a married couple often is a revocable trust, like a Connecticut Living Trust for Husband and Wife with One Child. This type of trust allows both partners to maintain control while establishing clear guidelines for asset distribution. It ensures that your child inherits your assets smoothly. Consulting with a legal expert can help tailor the trust to your family's needs.

Choosing between a revocable and irrevocable trust involves understanding your goals. A Connecticut Living Trust for Husband and Wife with One Child is typically revocable, allowing for flexibility in managing assets during your lifetime. On the other hand, an irrevocable trust can provide tax benefits and asset protection. Assess your priorities to determine which option serves you best.

Whether a husband and wife should have separate living trusts depends on their individual circumstances. A Connecticut Living Trust for Husband and Wife with One Child can often simplify inheritance and estate planning. However, separate trusts might offer benefits in certain situations, such as managing personal assets or tax considerations. It’s essential to evaluate your specific needs before making a decision.

While a Connecticut Living Trust for Husband and Wife with One Child offers many advantages, there can be downfalls if not managed correctly. One significant concern is the potential loss of control over assets once they are placed in the trust, as the appointed trustee will manage them. Furthermore, some may assume a trust will always guarantee privacy, but certain situations may require disclosure. To navigate these issues, platforms like uslegalforms can provide valuable resources to simplify the trust setup and management process.

A common mistake parents make when establishing a Connecticut Living Trust for Husband and Wife with One Child is failing to fund the trust properly. If the assets are not transferred into the trust, it won't function as intended, potentially leading to complications after their passing. Additionally, neglecting to update the trust as life circumstances change can cause confusion and disputes among heirs. Therefore, ongoing communication and legal guidance are vital to ensure the trust operates as envisioned.

Creating a Connecticut Living Trust for Husband and Wife with One Child can be highly beneficial for your parents if they wish to streamline the distribution of their assets. This trust structure can help avoid probate, ensuring that assets go directly to you without lengthy court processes. Moreover, it provides flexibility for managing assets during their lifetime, which can bring peace of mind. Ultimately, it’s essential for them to consult with a legal expert to determine the best course of action.