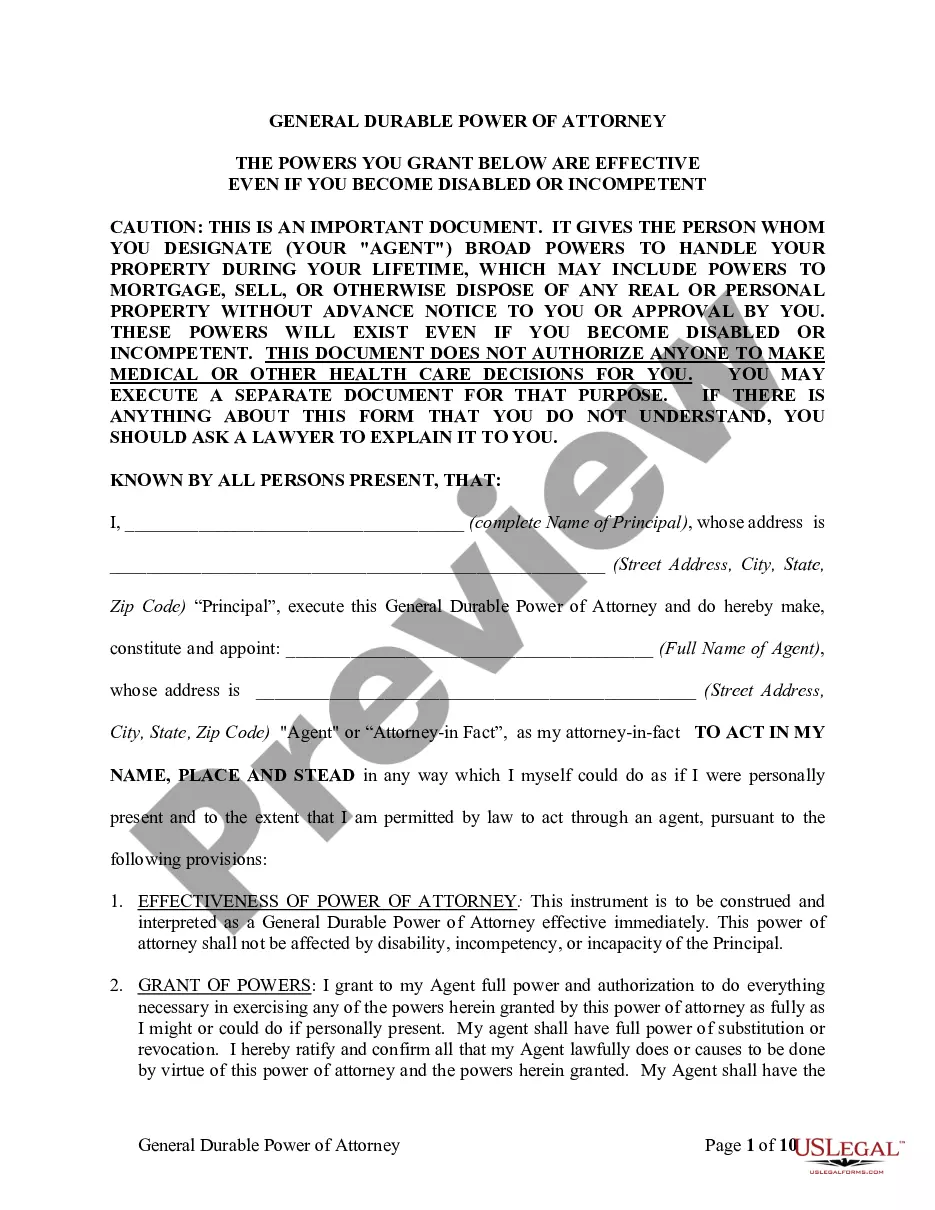

A Connecticut Certificate of Amendment (Stock Corp) is a legally-binding document used to make changes to a Connecticut-based corporation's existing articles of incorporation. The amendment must be submitted to the Connecticut Secretary of State for approval. Common changes include changes to the corporation's name, purpose, authorized shares of stock, board of directors, or voting rights. There are two types of Connecticut Certificate of Amendment (Stock Corp): the Standard Amendment and the Restated Amendment. The Standard Amendment is used to make changes that don’t involve a complete restatement of the corporation’s articles of incorporation. The Restated Amendment is used to make changes that involve a complete rewriting of the corporation’s articles of incorporation.

Connecticut Certificate of Amendment (Stock Corp)

Description

How to fill out Connecticut Certificate Of Amendment (Stock Corp)?

US Legal Forms is the simplest and most cost-effective method to find suitable legal templates.

It represents the most comprehensive online repository of business and personal legal documents created and verified by attorneys.

Here, you can discover printable and fillable templates that adhere to both national and local laws - just like your Connecticut Certificate of Amendment (Stock Corp).

Review the form description or preview the document to confirm you’ve found the one that meets your requirements, or search for another using the search bar above.

Click Buy now when you’re confident about its suitability with all demands, and choose the subscription plan that serves you best.

- Acquiring your template involves just a few straightforward steps.

- Users who already hold an account with an active subscription merely need to Log In to the site and download the document onto their device.

- Subsequently, they can find it in their profile under the My documents section.

- And here’s how you can obtain a properly prepared Connecticut Certificate of Amendment (Stock Corp) if you are using US Legal Forms for the first time.

Form popularity

FAQ

To dissolve a corporation in Connecticut, you must first gather approval from the board of directors and shareholders. After gaining the necessary approvals, submit the Certificate of Dissolution to the Secretary of State. It is important to ensure all financial obligations are addressed before this step. Using the Connecticut Certificate of Amendment (Stock Corp) ensures that all changes are legally recognized and documented.

Companies incorporate in Connecticut for various reasons, including its business-friendly environment, strong legal protections, and favorable tax structures. The state offers a strategic location coupled with access to skilled professionals, making it appealing for many entrepreneurs. By choosing Connecticut, businesses can take full advantage of the benefits provided, including the use of the Connecticut Certificate of Amendment (Stock Corp) to ensure legal compliance as they grow.

A certificate of organization in Connecticut establishes a business as a legal entity. This document includes essential information about your corporation, such as its name and registered agent. Filing this certificate is vital for legal recognition and can provide a foundation for further business operations and adjustments. Be sure to consider how the Connecticut Certificate of Amendment (Stock Corp) can facilitate changes later on.

There are several methods for dissolving a corporation, including voluntary dissolution, where the owners decide to cease operations, and involuntary dissolution, initiated by state authorities due to noncompliance. Additionally, stakeholders may agree to dissolution through board meetings or shareholder votes. Ensuring compliance throughout this process can be simplified by utilizing the Connecticut Certificate of Amendment (Stock Corp).

To file an S Corporation in Connecticut, start by registering your business with the Secretary of State. After establishing your corporation, you will need to file Form 2553 to elect S Corporation status with the IRS. It is crucial to meet the necessary requirements, such as having the appropriate number of shareholders. The Connecticut Certificate of Amendment (Stock Corp) can play a role when updating or modifying any of your business details.

Corporations might dissolve for various reasons. Commonly, they may choose to close due to financial difficulties or because the business no longer meets its operational goals. Other reasons might include changes in strategy or ownership, leading to the decision to halt operations. When the time comes, using the Connecticut Certificate of Amendment (Stock Corp) is essential to finalize such decisions.

Dissolving a corporation in Connecticut involves several steps. You must first obtain the necessary approvals from your board and shareholders, then submit a Certificate of Dissolution to the Secretary of State. Additionally, settle all outstanding debts and obligations before filing, to avoid complications down the line. The Connecticut Certificate of Amendment (Stock Corp) can assist you in ensuring all legalities are properly handled.

To notify the IRS about the dissolution of your corporation, complete and file Form 966, Corporate Dissolution or Liquidation. Ensure you include information about the corporation, such as the name and EIN. Additionally, provide any final tax return filings, emphasizing compliance with regulations. Understanding the process helps in maintaining a proper record for your Connecticut Certificate of Amendment (Stock Corp).

The purpose of a Certificate of Organization is to officially register your corporation with the state of Connecticut. It provides legal recognition and outlines your business structure, rights, and obligations. This document is essential for conducting business activities and protecting your limited liability. To streamline this process, consider using the services of USLegalForms for insightful guidance.

A Certificate of Organization is a specific document that establishes a corporation, while incorporation refers to the overall process of forming and registering a business. Incorporation involves filing the Certificate of Organization along with other necessary paperwork to create the corporation legally. Both are crucial steps in ensuring your business is recognized by the state. For clarity on these processes, USLegalForms can be a valuable resource.