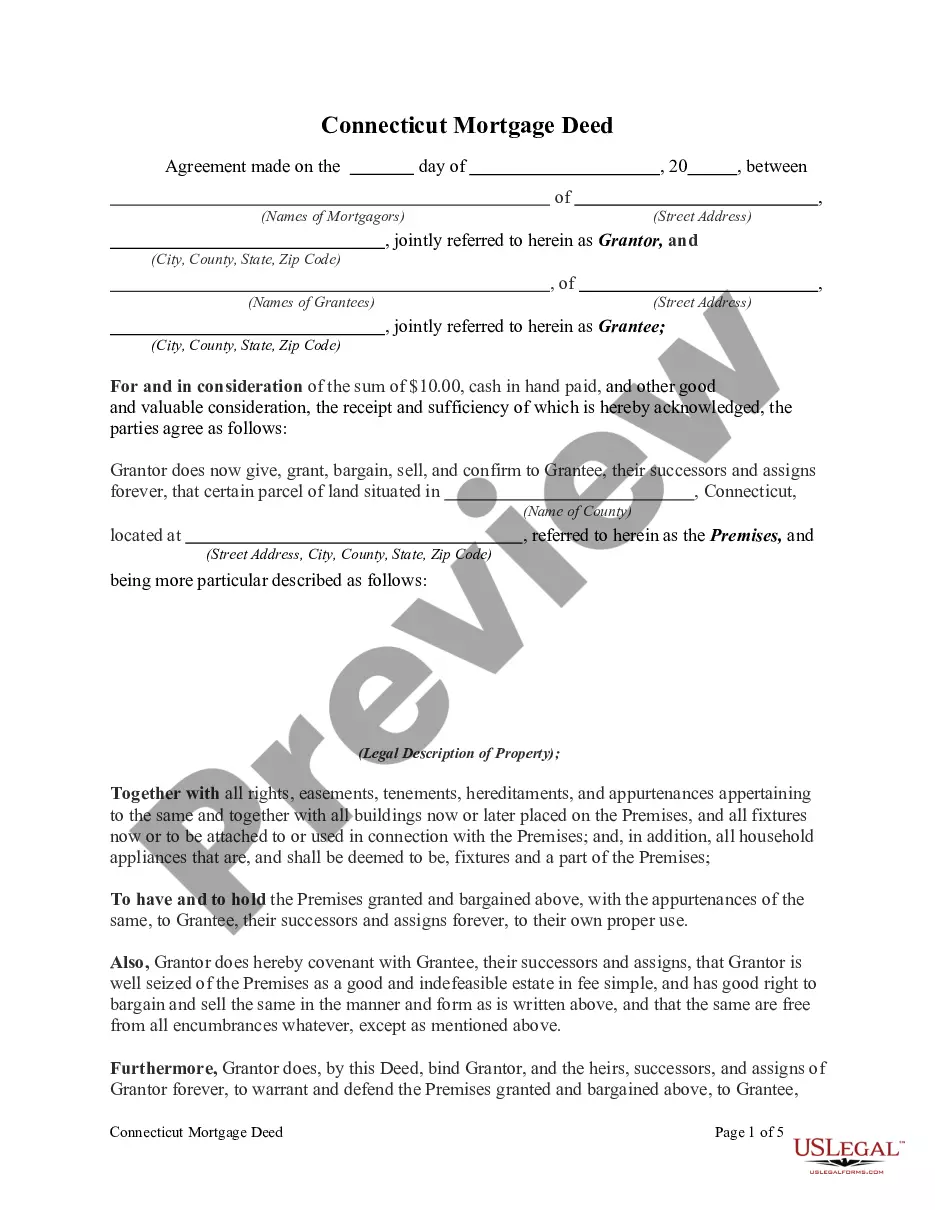

A Connecticut Mortgage Deed is a document that is used to secure a loan for the purchase of real estate. It is a written agreement between a borrower and a lender that outlines the borrower’s promise to repay the loan. The mortgage deed outlines the amount of the loan, the interest rate, the terms of repayment, and any additional provisions. In Connecticut, there are two types of mortgage deeds: a general mortgage and a special mortgage. A general mortgage deed is a standard form of mortgage deed that is used to secure a loan for the purchase of real estate. It can also be used to secure the repayment of a loan that was used for the purchase of real estate. A special mortgage deed is used to secure a loan for a specific purpose, such as the purchase of a particular piece of real estate or the improvement of a property.

Connecticut Mortgage Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Mortgage Deed?

Engaging with legal documentation necessitates focus, precision, and utilizing correctly-prepared templates.

US Legal Forms has been assisting individuals nationwide accomplish precisely that for 25 years, so when you select your Connecticut Mortgage Deed template from our collection, you can be assured it adheres to federal and state laws.

All documents are designed for multiple uses, like the Connecticut Mortgage Deed you see on this page. If you need them again, you can complete them without additional payment - just access the My documents section in your profile and finalize your document whenever necessary. Experience US Legal Forms and prepare your business and personal documentation quickly and fully in legal compliance!

- 1. Verify the form content and its alignment with general and legal standards by reviewing it or examining its summary.

- 2. Look for another official template if the one previously accessed doesn't fit your circumstances or state laws (the section for that is located in the top page corner).

- 3. Sign in to your account and download the Connecticut Mortgage Deed in your desired format. If it is your first visit to our site, click Purchase now to continue.

- 4. Establish an account, choose your subscription option, and settle the payment using your credit card or PayPal account.

- 5. Specify the format you wish to save your form in and click Download. Print the document or upload it to a professional PDF editor to prepare it digitally.

Form popularity

FAQ

To record a deed in Connecticut, you must take your completed and notarized deed to the town clerk's office where the property is located. Ensure that you have all necessary information, including tax identification numbers. The recording process officially documents the deed, making it a matter of public record, which is critical for future ownership verification.

To file a quitclaim deed in Connecticut, you must first prepare the deed form with all required information, including the legal description of the property. After signing the document before a notary, you must submit it to the local town clerk's office for recording. By following these steps, your quitclaim deed will be officially recognized, which is crucial for property transactions in Connecticut.

Yes, you can file a quitclaim deed yourself in Connecticut. However, it is important to understand the legal requirements to avoid errors that could complicate your ownership claims. While the process may be straightforward, using a service like USLegalForms can guide you through the specific steps and requirements, making the process smoother and more efficient.

To file a quitclaim deed in Connecticut, you need to complete the deed form with the relevant property details and the names of the parties involved. Once you have filled out the form, you should sign it in front of a notary public. After notarization, file the quitclaim deed with the town clerk's office where the property is located. This process helps ensure your claim to the property is legally recognized.

You can get a copy of your Connecticut Mortgage Deed from your mortgage lender or your local clerk's office. The lender keeps a record, and the clerk's office will have the deed available in public records. For ease, consider using platforms like US Legal Forms to help streamline your request process.

To obtain a copy of your mortgage deed, you can reach out to your lender, who maintains a record of it. Additionally, visit the local clerk's office where the deed was recorded to request a copy. Having this document is vital, as it outlines your obligations to the lender regarding your property.

If you lost your original Connecticut Mortgage Deed, do not panic. You can obtain a certified copy from the local clerk's office or the recorder of deeds. It’s important to have a copy since this document validates your ownership. Many people find US Legal Forms helpful in navigating these processes.

You can find the title deed to your house in several places. First, check with your attorney or the title company that handled your closing. Alternatively, you can visit the local clerk's office or their online system to access public records. This way, you can obtain the Connecticut Mortgage Deed efficiently.

After closing, you usually receive the Connecticut Mortgage Deed through your attorney or title company. They will record the deed with the local clerk's office on your behalf. Once recorded, the clerk will send you a copy of the deed. Keep this document safe, as it proves your ownership.

To obtain a copy of your Connecticut Mortgage Deed, you can start by contacting your local town or city clerk's office. They maintain public records and can provide you with the necessary documents. Additionally, if you need help navigating the process, you may consider using platforms like USLegalForms, which can guide you in obtaining the right documentation efficiently.