New York Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Overview of this form

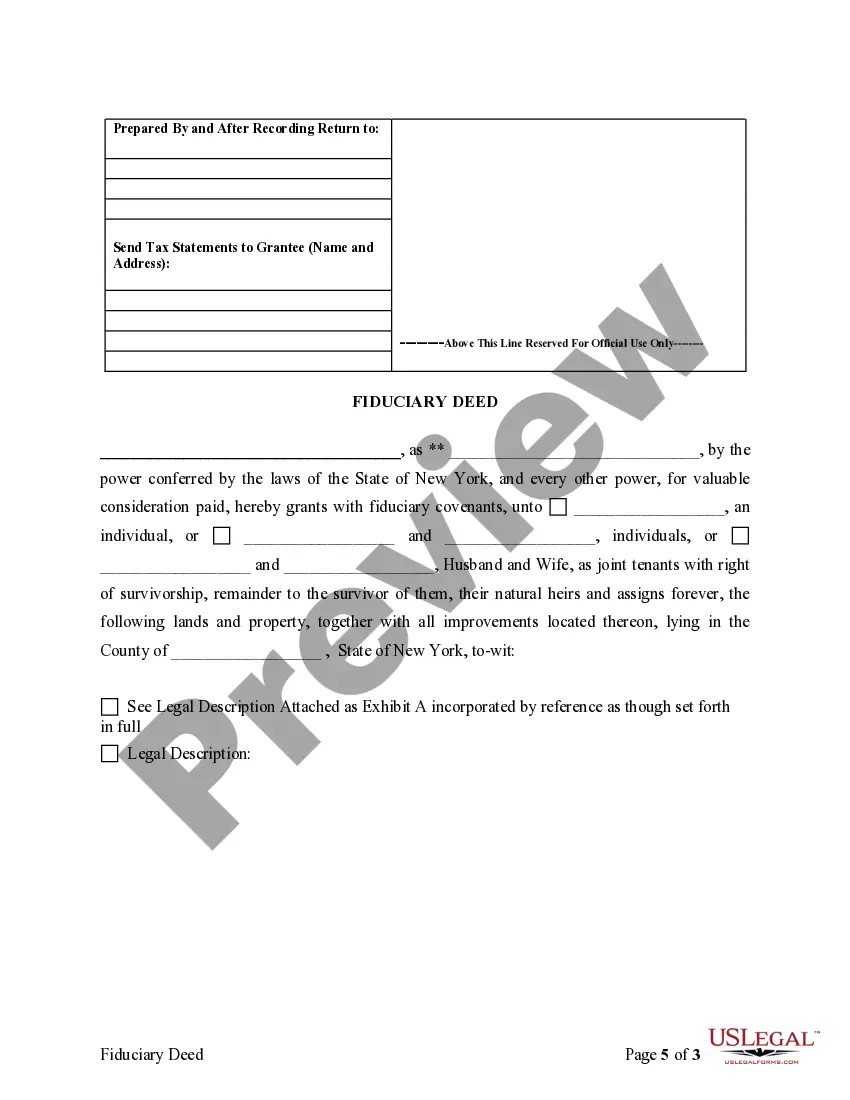

The Fiduciary Deed is a legal document used for transferring property when the grantor is a fiduciary, such as an executor of a will, trustee, guardian, or conservator. This form is essential for ensuring that the transfer of property is executed according to the grantor's authority under the law. Unlike standard warranty deeds, this form explicitly acknowledges the fiduciary role of the individual transferring the property, thus offering clarity and legal protection in real estate transactions.

Key parts of this document

- Identification of the fiduciary (executor, trustee, etc.)

- Details regarding the property being transferred

- Clauses indicating the authority and powers of the fiduciary

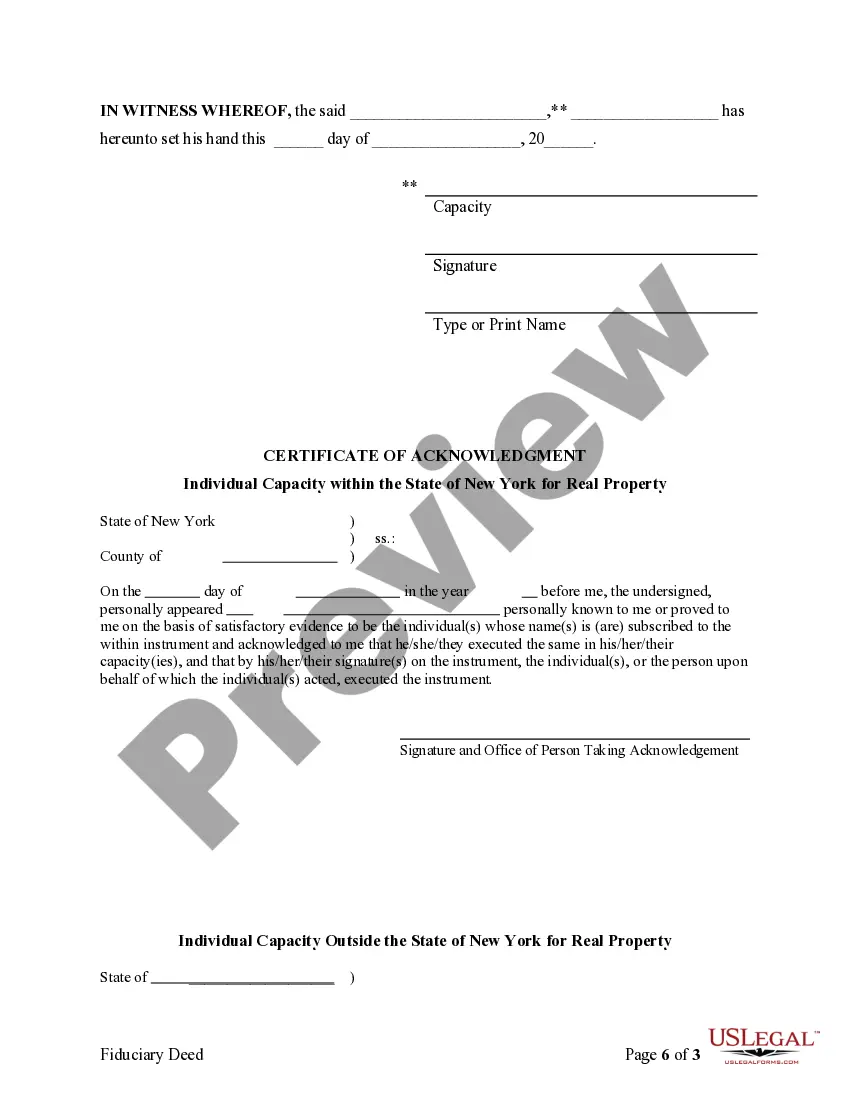

- Spaces for signatures and acknowledgments by the relevant parties

- Legal description of the property included as an exhibit

When to use this document

This Fiduciary Deed should be used when a fiduciary is authorized to transfer property as part of their duties, such as after the death of an individual, in administering a trust, or managing an estate. If you are selling or transferring real estate held in a trust or by an estate, this form will document that process legally and correctly.

Intended users of this form

- Executors of estates who need to transfer property according to a will

- Trustees managing trust-owned real estate

- Guardians or conservators acting on behalf of incapacitated individuals

- Administrators of an estate who are responsible for handling property transfers

Instructions for completing this form

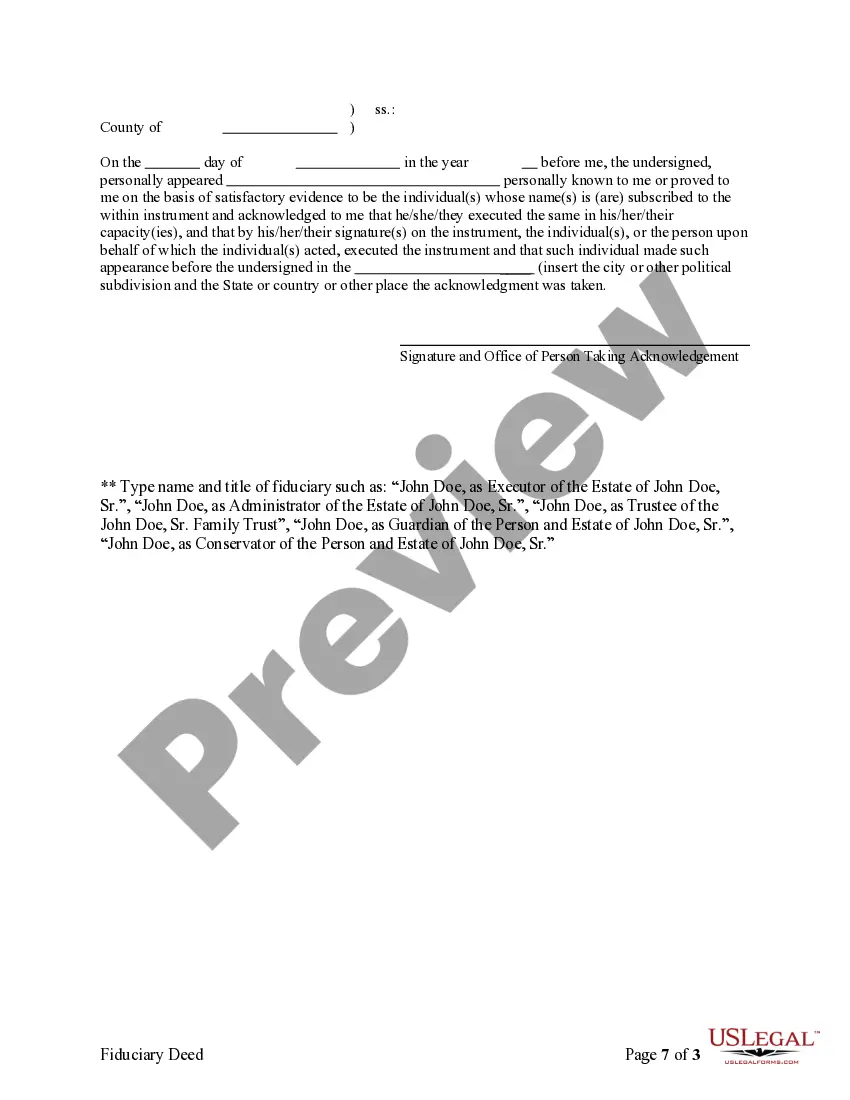

- Identify the fiduciary by filling in their name and title (executor, trustee, etc.)

- Enter the details of the property, including its legal description

- Specify the grantee (the person or entity receiving the property)

- Complete the sections regarding consideration (any payment made for the property)

- Sign the deed in the presence of a notary if required

- Check for any required additional forms and submit all documents to the County Clerk

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include a legal description of the property

- Not specifying the fiduciary's authority correctly

- Forgetting to sign the deed or have it notarized

- Missing accompanying forms required by the state

Why use this form online

- Convenient access from any device at any time

- Edit and fill out the form without manual effort

- Reliable templates drafted by licensed attorneys

- Secure storage and easy retrieval of your completed forms

Looking for another form?

Form popularity

FAQ

An executor of a will cannot take everything unless they are the will's sole beneficiary.However, the executor cannot modify the terms of the will. As a fiduciary, the executor has a legal duty to act in the beneficiaries and estate's best interests and distribute the assets according to the will.

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons.The fiduciary is required to act only in the best interests of the owner.

Fiduciary Deed: A deed given by a court-appointed fiduciary. This usually happens with a guardian, executor, receiver, or administrator. It may or may not include a warranty. Usually, it includes only the right title and interest of the person whom the fiduciary represents.

A fiduciary deed is for use by a fiduciary such as an executor or administrator of an estate or a trustee of a trust. In this type of deed there is a warranty, but only as a fiduciary. A fiduciary does not own the property, rather they essentially manage it for another.

In many cases, unfortunately, if the Grantor is deceased or incapacitated and the trust does not state that co-trustees can act independently, the co-trustees may be powerless to act on the account without legal action to amend the Trust or signing some agreement with the bank and contravenes the explicit terms of the

Fiduciary - An individual or bank or trust company that acts for the benefit of another. Trustees, executors, and personal representatives are all fiduciaries.

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

A fiduciary deed is used to transfer property when the executor is acting in his official capacity. A fiduciary deed warrants that the fiduciary is acting in the scope of his appointed authority but it does not guarantee title of the property.

Fiduciary - An individual or trust company that acts for the benefit of another.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.