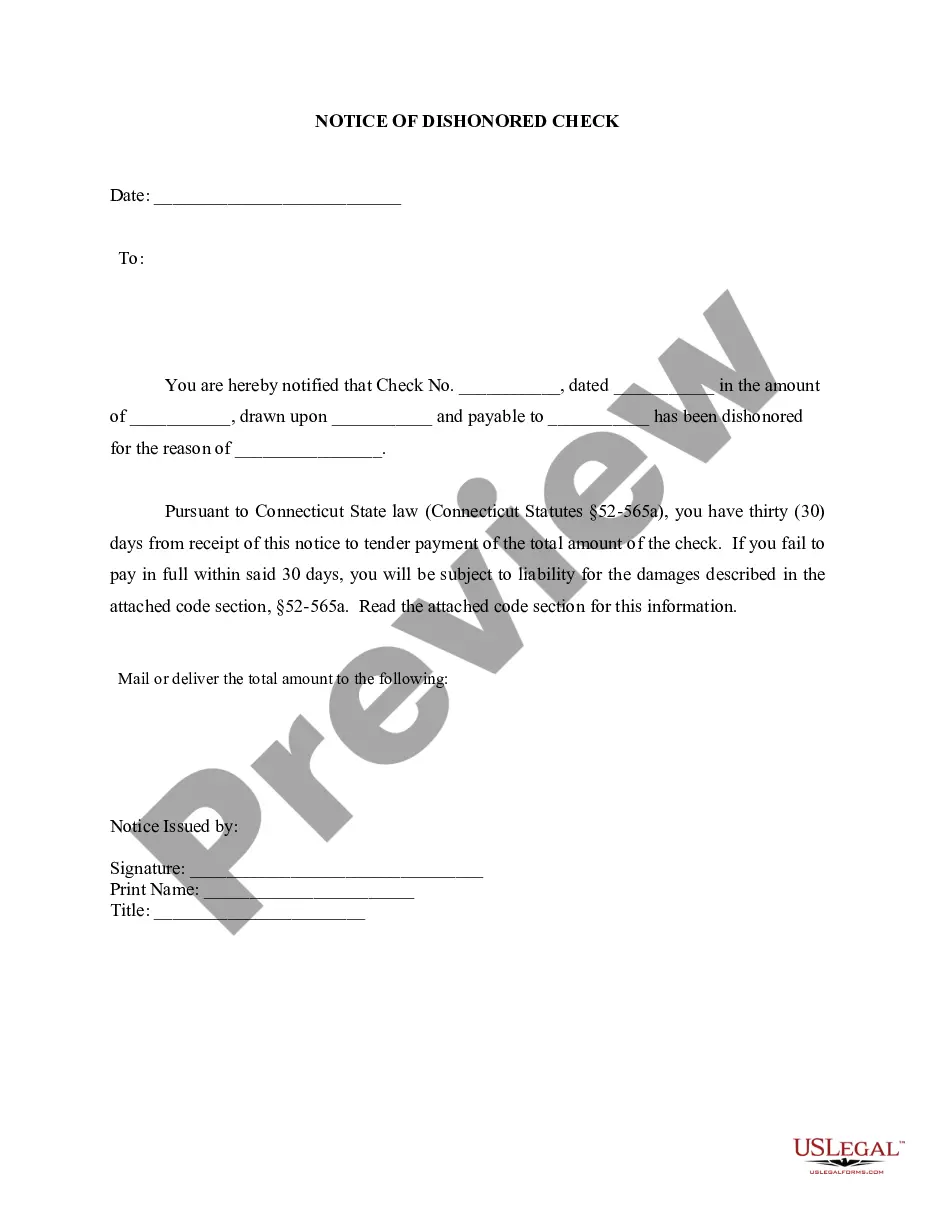

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

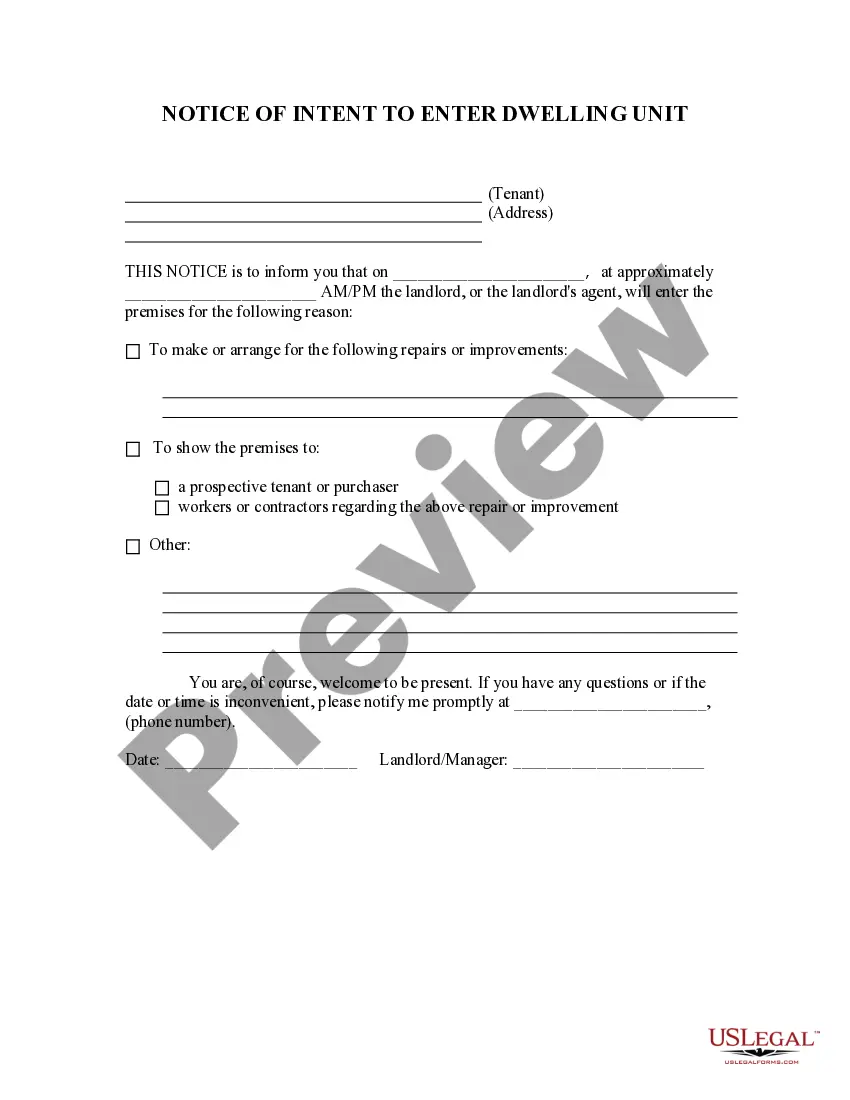

How to fill out Connecticut Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

The more documents you need to produce - the more anxious you become.

You can discover countless Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check templates online, but you may not know which ones to trust.

Eliminate the stress of locating samples with US Legal Forms. Obtain expertly crafted documents designed to meet state specifications.

Provide the required details to create your account and pay for the order using your PayPal or credit card. Select a convenient file format and download your template. Access each document you obtain in the My documents section. Simply visit there to prepare a new copy of the Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Even with well-prepared templates, it’s still important to consider consulting your local attorney to verify that the completed form is accurate. Achieve more for less with US Legal Forms!

- If you are already a subscriber of US Legal Forms, Log In to your account to access the Download button on the Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check’s page.

- If you have not used our website before, complete the registration process by following these steps.

- Make sure the Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is applicable in your state.

- Verify your selection by reviewing the description or using the Preview option if available for the chosen document.

- Click Buy Now to initiate the registration process and choose a pricing plan that fits your needs.

Form popularity

FAQ

Reporting a bounced check typically involves contacting your bank and the check issuer. You may also want to file a complaint with your local authorities, as this falls under a Connecticut Notice of Dishonored Check. Gather all related documentation, including the bounced check and any communication with the issuer, to support your case. Platforms like US Legal Forms can guide you through the reporting process efficiently.

If a cheque bounces due to insufficient balance, the recipient may experience delays in payment and possible financial repercussions. Such an event is recorded as a Connecticut Notice of Dishonored Check, which could lead to legal action against the issuer. It is essential for both parties to communicate to resolve the issue amicably. Seeking help from professionals can streamline the resolution process.

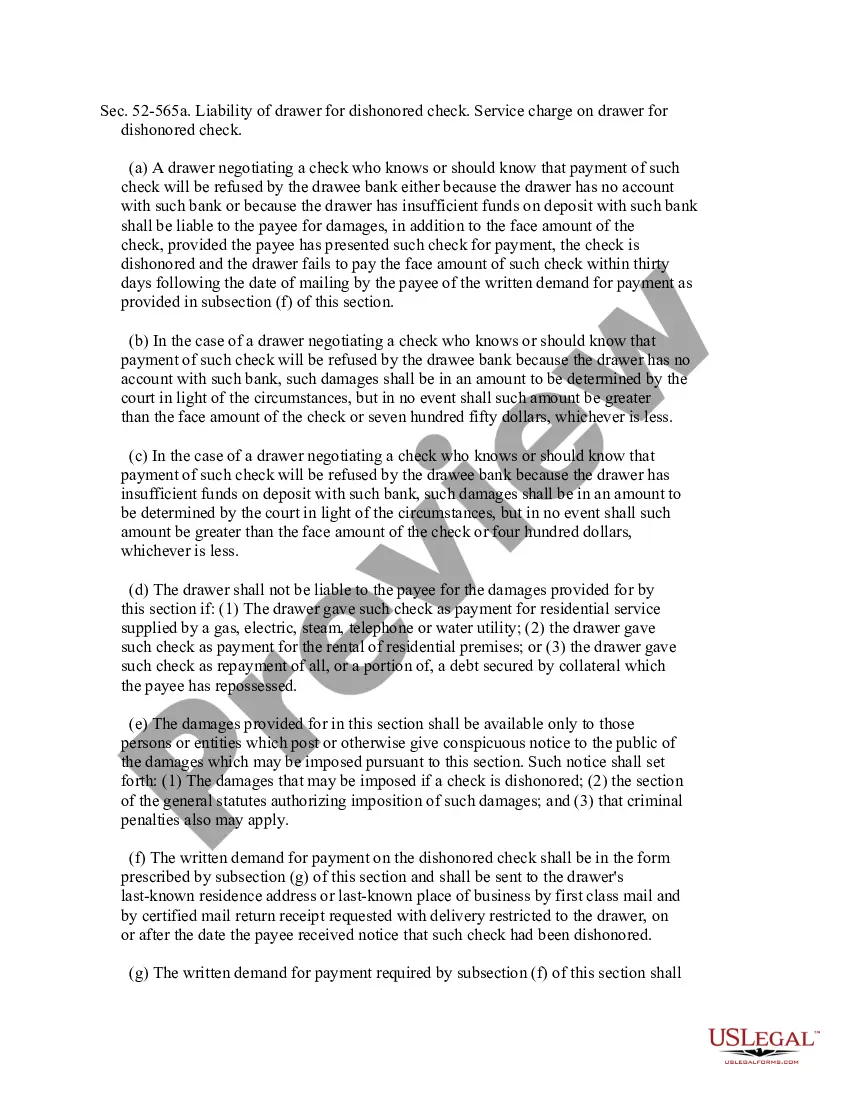

Statute 53a-128 in Connecticut addresses the criminal implications of issuing bad checks. This law states that writing a bounced check with knowledge of insufficient funds can lead to penalties. Individuals who fall under this statute may face fines or even imprisonment. Understanding this law is vital if you deal with dishonored checks.

When a check is returned due to insufficient funds, it is considered a Connecticut Notice of Dishonored Check. This situation indicates that the account has no available balance to cover the payment. The payee may face financial issues, and there could be potential legal consequences. You may want to consult a legal expert for guidance on resolving any disputes related to a bad check.

A check is dishonored due to insufficient funds when the account linked to it has a lower balance than the check amount. This results in the bank marking the check as a bounced check. In Connecticut, receiving a Connecticut Notice of Dishonored Check can help you navigate the legal aspects of this situation effectively.

A check that cannot be cashed due to insufficient funds is known as a bounced check. This occurs when the checking account balance falls below the amount needed to cover the check. If you've issued a bounced check, it may lead to a Connecticut Notice of Dishonored Check, which could have legal implications.

Yes, typically, if a check bounces, the bank or financial institution notifies the individual or business that issued the check. This notification may arrive in the form of a direct communication or through an official notice regarding the bounced check. If you receive a Connecticut Notice of Dishonored Check, it's important to respond appropriately to avoid legal complications.

There are several reasons a bank may dishonor a check. Common factors include insufficient funds in the account, a closed account, a post-dated check, a signature that does not match the bank's records, and a check that exceeds the amount limit for a specific account. This situation can lead to a Connecticut Notice of Dishonored Check, often referred to in cases involving bad checks and bounced checks.

Another name for a dishonored check is a bad check. This term covers checks that are returned due to insufficient funds or because the issuer has closed the account. Knowing these alternatives aids in understanding legal documents and financial communications. If you find yourself dealing with such a situation, using resources like uslegalforms can provide valuable assistance.

It is called a bounced check because it cannot be processed and effectively 'bounces' back to the sender. This term visually represents the check's journey, from being presented to the bank to its return due to insufficient funds. Recognizing this term helps individuals understand the serious nature of bad checks in financial transactions. Being informed can help prevent situations that lead to a Notice of Dishonored Check in Connecticut.