Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Connecticut Discharge and Release of Lien by Corporation or LLC

Description

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

The more documentation you must prepare - the more uneasy you feel.

You can find a vast selection of Connecticut Discharge and Release of Lien by Corporation or LLC templates online; however, you are unsure which of them to trust.

Remove the stress and simplify finding samples with US Legal Forms. Obtain precisely drafted documents that comply with the state requirements.

Submit the required information to create your account and pay for the order using your PayPal or credit card. Choose a convenient file format and obtain your copy. Find all documents you download in the My documents section. Simply go there to prepare a new copy of your Connecticut Discharge and Release of Lien by Corporation or LLC. Even when using well-crafted templates, it remains important to consider consulting a local attorney to verify the completed sample to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you'll discover the Download option on the Connecticut Discharge and Release of Lien by Corporation or LLC’s page.

- If this is your first visit to our site, complete the registration process by following these steps.

- Verify if the Connecticut Discharge and Release of Lien by Corporation or LLC is legitimate in your state.

- Reassess your choice by reviewing the description or by using the Preview mode if available for the selected document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

To file a lien in Connecticut, you first need to prepare a lien form that includes basic information about the property and the debtor. You will then file this form with the town clerk or local land records office in the area where the property is located. Keep in mind that understanding the process of Connecticut Discharge and Release of Lien by Corporation or LLC can be helpful for businesses. If you need assistance, consider using the US Legal Forms platform to access the necessary forms and guidance.

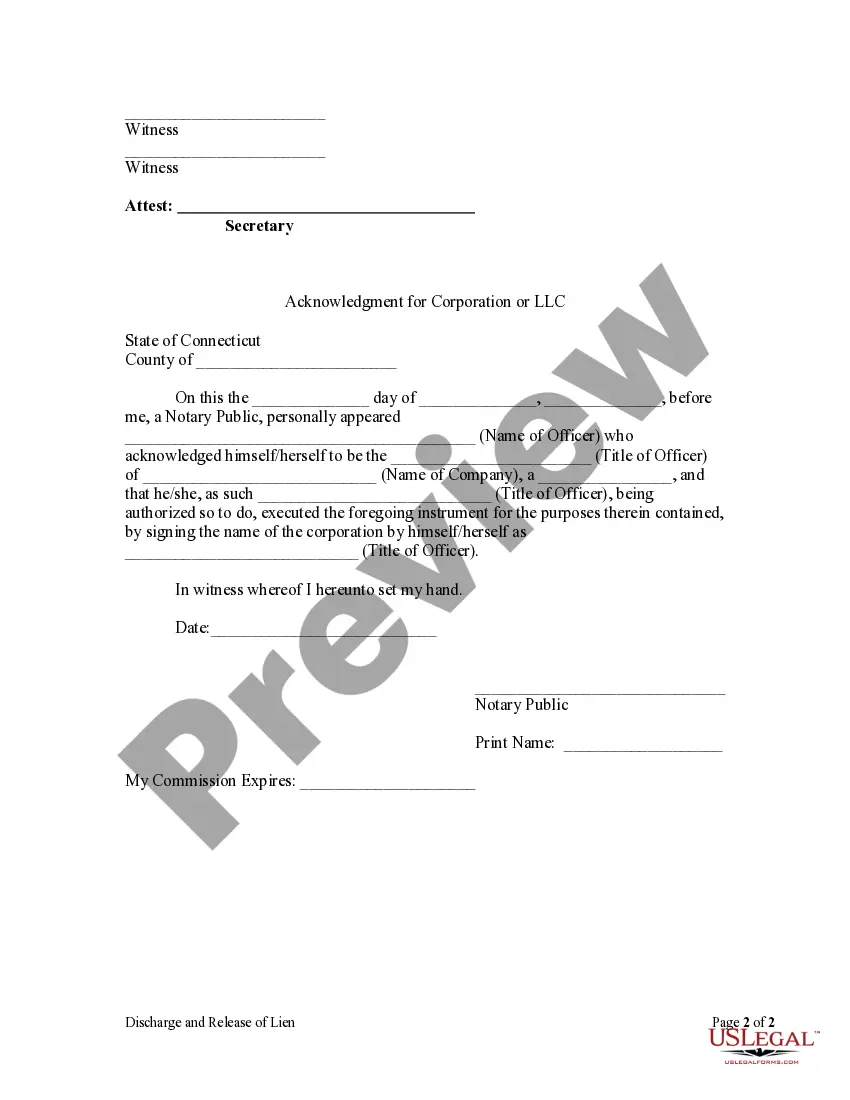

Creating a release of lien involves drafting a document that specifies the lien details and certifies its removal. It's essential to include accurate information such as the lien amount and the relevant parties. For a smooth experience, refer to the resources available through USLegalForms, which can guide you in preparing a Connecticut Discharge and Release of Lien by Corporation or LLC according to the law.

You can obtain a lien release form through local government offices or online resources that provide legal documents. It’s advisable to use platforms like USLegalForms, where you can find a reliable Connecticut Discharge and Release of Lien by Corporation or LLC form tailored to meet state requirements. This ensures you get the correct template and guidance for your needs.

Filling out a lien affidavit requires careful attention to detail. You will need to provide specific information about the lien, including the parties involved, the amount owed, and the property description. Using the Connecticut Discharge and Release of Lien by Corporation or LLC guidelines can help streamline this process, ensuring you complete the affidavit accurately.

A lien release statement is a legal document that confirms a lien has been removed from a property. This statement is crucial for property owners or businesses in Connecticut, as it officially clears any claims against their asset. Understanding the Connecticut Discharge and Release of Lien by Corporation or LLC is important to ensure the document meets all legal requirements.

To file a lien against a corporation in Connecticut, you need to prepare the lien document, ensuring it complies with state laws. Include the corporation's name, address, and details related to the debt. Once ready, file the lien at the appropriate county clerk’s office. Using services from US Legal Forms can streamline the creation and filing of your lien, making the process more manageable.

Filing a lawsuit against a corporation in Connecticut begins with drafting a complaint that outlines your claims. You must file this document with the appropriate court and serve it to the corporation. It's crucial to adhere to specific legal procedures and deadlines. Platforms like US Legal Forms can provide resources and templates to simplify the filing process.

To enforce a judgment against a corporation in Connecticut, you can initiate collection procedures such as garnishment or seizing assets. Your judgment must be properly recorded, and you may need to file additional documents to enforce it effectively. It's advisable to consult legal experts if you encounter challenges. They can also assist in understanding the Connecticut Discharge and Release of Lien by Corporation or LLC if needed.

In Connecticut, a lien generally remains in effect for five years from the date it was filed. However, if the lien is not enforced within that time, it may be subject to discharge. It's essential to monitor the status of your lien, especially if you are looking into a Connecticut Discharge and Release of Lien by Corporation or LLC. Consulting with an attorney can provide clarity on specific situations.

To create a lien release in Connecticut, you must prepare a formal document stating the intention to discharge the lien. Ensure you include relevant details such as the property description and the lienholder's information. After you complete the document, file it with the appropriate registry of deeds. Utilizing platforms like US Legal Forms can help streamline this process with their easy-to-use templates.