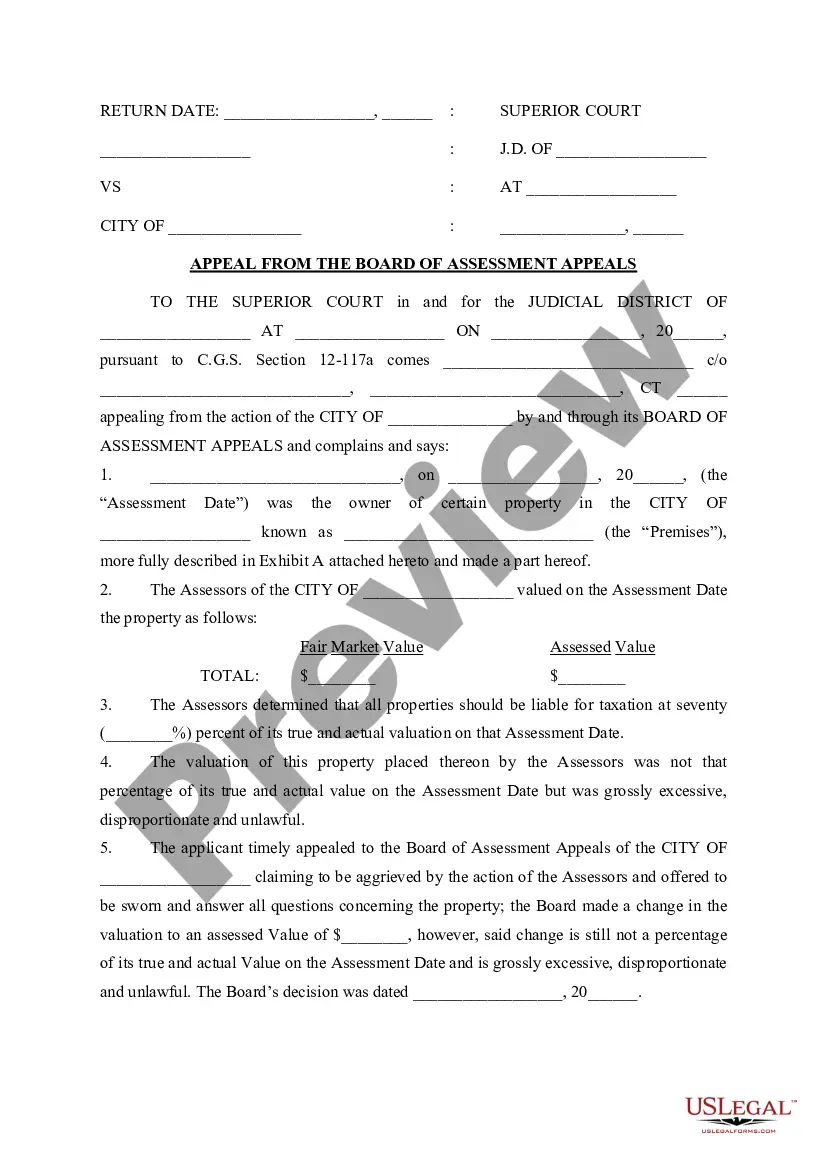

Connecticut Appeal from the Board of Assessment Appeals

Description

How to fill out Connecticut Appeal From The Board Of Assessment Appeals?

Utilize US Legal Forms to obtain a printable Connecticut Appeal from the Board of Assessment Appeals.

Our court-acceptable forms are formulated and routinely revised by expert attorneys.

Ours is the most comprehensive forms collection available online and offers reasonably priced and precise samples for individuals, legal representatives, and small to medium-sized businesses.

US Legal Forms offers a vast array of legal and tax templates and bundles for business and personal requirements, including the Connecticut Appeal from the Board of Assessment Appeals. Over three million users have successfully utilized our service. Choose your subscription plan and access high-quality documents with just a few clicks.

- Templates are categorized by state-specific groups.

- Some templates may be previewed prior to download.

- To download samples, users need to hold a subscription and sign in to their account.

- Click Download next to any desired form and locate it in My documents.

- For those without a subscription, follow these steps to find and download the Connecticut Appeal from the Board of Assessment Appeals.

- Ensure you select the correct template according to the required state.

- Examine the form by reviewing its description and utilizing the Preview feature.

- Press Buy Now if it is the template you require.

- Create your account and make payment via PayPal or credit card.

- Download the form to your device, allowing for multiple uses.

- Employ the Search field if you seek another document template.

Form popularity

FAQ

Completing an appeal involves several steps, including gathering necessary documentation, drafting your appeal letter, and submitting it within the designated timeframe. Ensure that you follow all local guidelines specific to your state and municipality. For instance, in Connecticut, this means adhering to the procedures set by the Board of Assessment Appeals. Platforms like US Legal Forms can provide streamlined processes to simplify this task.

To write a property assessment appeal letter, begin with a brief introduction stating your intent to appeal. Clearly outline the reasons for your appeal, supporting your claims with factual evidence. It’s important to be concise yet comprehensive to ensure your case is understood by the Board of Assessment Appeals. Using resources from US Legal Forms can help you create a compelling appeal letter.

Writing a property assessment appeal involves a systematic approach. Start with your property information, state the exact assessment amount, and provide reasons for your appeal. Ensure you include any documentation that supports your position, such as property appraisals or market comparisons. Consider visiting US Legal Forms to access templates tailored for property assessment appeals.

To challenge a property tax assessment in Michigan, start by reviewing your assessment notice for errors and gather evidence supporting your claim. You may need to file a formal appeal with your local Board of Review. While this process differs from a Connecticut appeal from the Board of Assessment Appeals, the fundamental steps of gathering supporting documentation remain the same.

One common reason for protesting the assessment of property is believing the valuation is higher than the market value. Property owners may argue that comparable properties have sold for less or that there are inaccuracies in the property description. This is especially relevant in the context of a Connecticut appeal from the Board of Assessment Appeals, where presenting clear evidence can make a significant difference.

When protesting property taxes, articulate your concerns about the accuracy of your property’s assessed value. Start with your property details, explain why you believe the assessment is incorrect, and include supporting evidence. A well-crafted letter can influence the Board of Assessment Appeals during your Connecticut appeal. Utilizing US Legal Forms can streamline crafting this letter with the right language and format.

Writing a property assessment appeal letter involves clearly stating your disagreement with the assessed value of your property. Begin by including your property details and the reasons for your appeal. Be sure to cite any evidence you have, such as recent sales of similar properties or errors in the assessment. If you need guidance, consider using resources like US Legal Forms to help structure your appeal effectively.

When appealing a property taxes letter, express your concerns clearly and directly. State the reasons for your dispute, and provide any documentation that supports your position. Be sure to reference any specific laws or guidelines that back your claim. Utilizing a platform like uslegalforms can streamline your appeal process, making it easier to navigate your Connecticut Appeal from the Board of Assessment Appeals.

Writing a property assessment appeal involves clearly stating your position and submitting your evidence. Begin with a concise introduction that outlines why you believe the assessment is incorrect. Provide supporting documents, such as property comparisons and valuation reports, to strengthen your case. When ready, submit your appeal through the appropriate channels, including the option for a Connecticut Appeal from the Board of Assessment Appeals if needed.

Appealing a court decision in Connecticut requires a structured approach. Start by obtaining the judgment or decision that you wish to challenge. Then, file a notice of appeal within the specified timeframe, which usually is 20 days from the decision date. You can enhance your appeal process by seeking help with the Connecticut Appeal from the Board of Assessment Appeals to ensure your filing meets all necessary requirements.