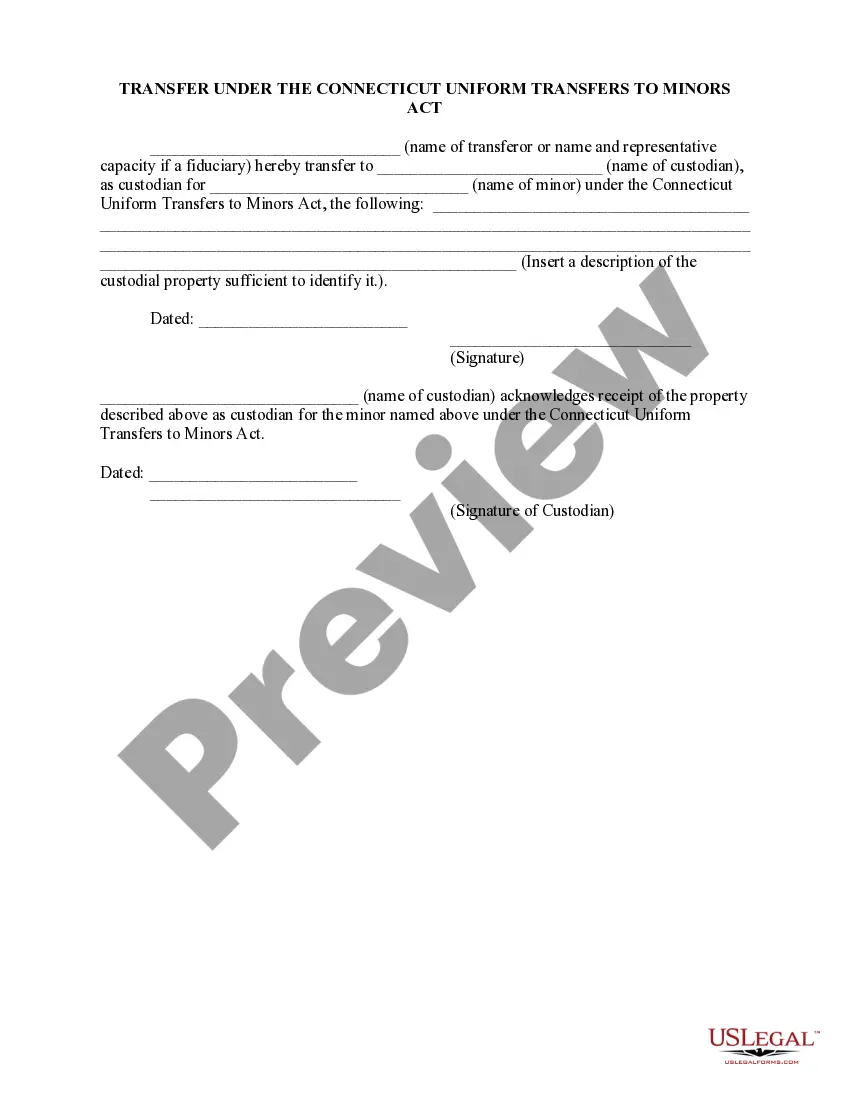

Section 45a-558f: Creation and Transfer of Custodial Property: This document is used when transfering property to a minor. In reality, the Transferor is transfering the property to a Custodian for the minor child. That Custodian will take care of the property for the minor child until such time the child becomes of legal age. This form is available in both Word and Rich Text formats.

Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property

Description

How to fill out Connecticut Sec. 45a-558f. Creation And Transfer Of Custodial Property?

The greater the number of documents you need to prepare, the more anxious you become.

You can locate countless Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property templates online, yet you are unsure which ones to rely on.

Eliminate the stress and make finding samples much easier by using US Legal Forms. Acquire expertly crafted documents designed to comply with state regulations.

Provide the required information to create your account and complete your order using PayPal or credit card. Choose a convenient file format and obtain your template. Access each document you receive in the My documents section. Simply navigate there to fill out a new version of your Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. Even when utilizing professionally drafted templates, it's still crucial to consider consulting with a local attorney to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you have a US Legal Forms subscription, Log In to your account, and you will see the Download button on the Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property’s webpage.

- If you haven’t utilized our platform before, complete the registration process with the following steps.

- Ensure the Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property is acceptable in your state.

- Double-check your choice by reviewing the description or by using the Preview mode if available for the selected record.

- Click Buy Now to initiate the signup process and select a pricing plan that suits your needs.

Form popularity

FAQ

Connecticut is not classified as a separate property state; instead, it utilizes equitable distribution for asset division. Separate property retains ownership by the individual who acquired it before marriage, but marital contributions can complicate claims. If you're unsure how Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property impacts your assets, considering professional advice can help you make informed decisions. Resources like uslegalforms can assist you in understanding these matters.

Connecticut follows the principle of equitable distribution, not strict joint property. This means that marital assets and debts are divided fairly but not necessarily equally upon divorce. Knowing how Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property affects asset distribution can clarify your rights. Therefore, understanding your financial obligations ahead of time is crucial.

In Connecticut, you may be responsible for your spouse's debt, particularly if the debt was incurred during marriage and is considered joint. However, individual liability can vary based on the circumstances and the type of debt. Understanding Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property can aid in determining asset protection during separation. It's wise to seek legal guidance to navigate these complex issues effectively.

In Connecticut, adultery can be a factor in divorce proceedings, but it does not necessarily dictate the outcome. The courts primarily focus on the best interests of any children involved and the distribution of assets. Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property helps clarify how custodial assets may be handled during divorce. Consulting with a knowledgeable attorney can provide insights specific to your situation.

The legal owner of a custodial account is the minor child for whom the account was established, as dictated by Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. However, until the child reaches a certain age, a designated custodian manages the account on their behalf. This arrangement ensures the minor's interests are safeguarded while allowing for responsible asset management.

When the child reaches the age of 18, the custodial account typically transfers to them as per Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. At this point, the young adult has full control over the account and can decide how to manage the assets. It's essential to prepare the child for this transition, so they understand their rights and responsibilities regarding the funds.

Transferring a custodial account involves a few straightforward steps. According to Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property, you must initiate the transfer with the current financial institution. This typically includes completing a transfer request form and providing details about the receiving institution. Make sure to verify all requirements for the new account to avoid delays.

To transfer ownership of a custodial account, you will need to follow the guidelines set forth in Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. Start by obtaining a transfer form from your financial institution. Complete the form with the required information about the new custodian and submit it along with any necessary documentation to ensure a smooth transition.

The UTMA rule in Connecticut supports the management of custodial property through a straightforward process outlined in Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. This rule allows custodians to handle assets responsibly, benefiting minors until they reach maturity. Utilizing a platform like uslegalforms can help you navigate these regulations and set up your UTMA accounts accurately.

Uniform Transfers to Minors Act (UTMA) accounts are governed by specific rules that ensure custodial property is managed for the benefit of minors. Under Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property, these accounts allow custodians to make investment decisions until the minor reaches a certain age. It's important to follow the guidelines for contributions, expenditures, and documentation to maintain compliance.