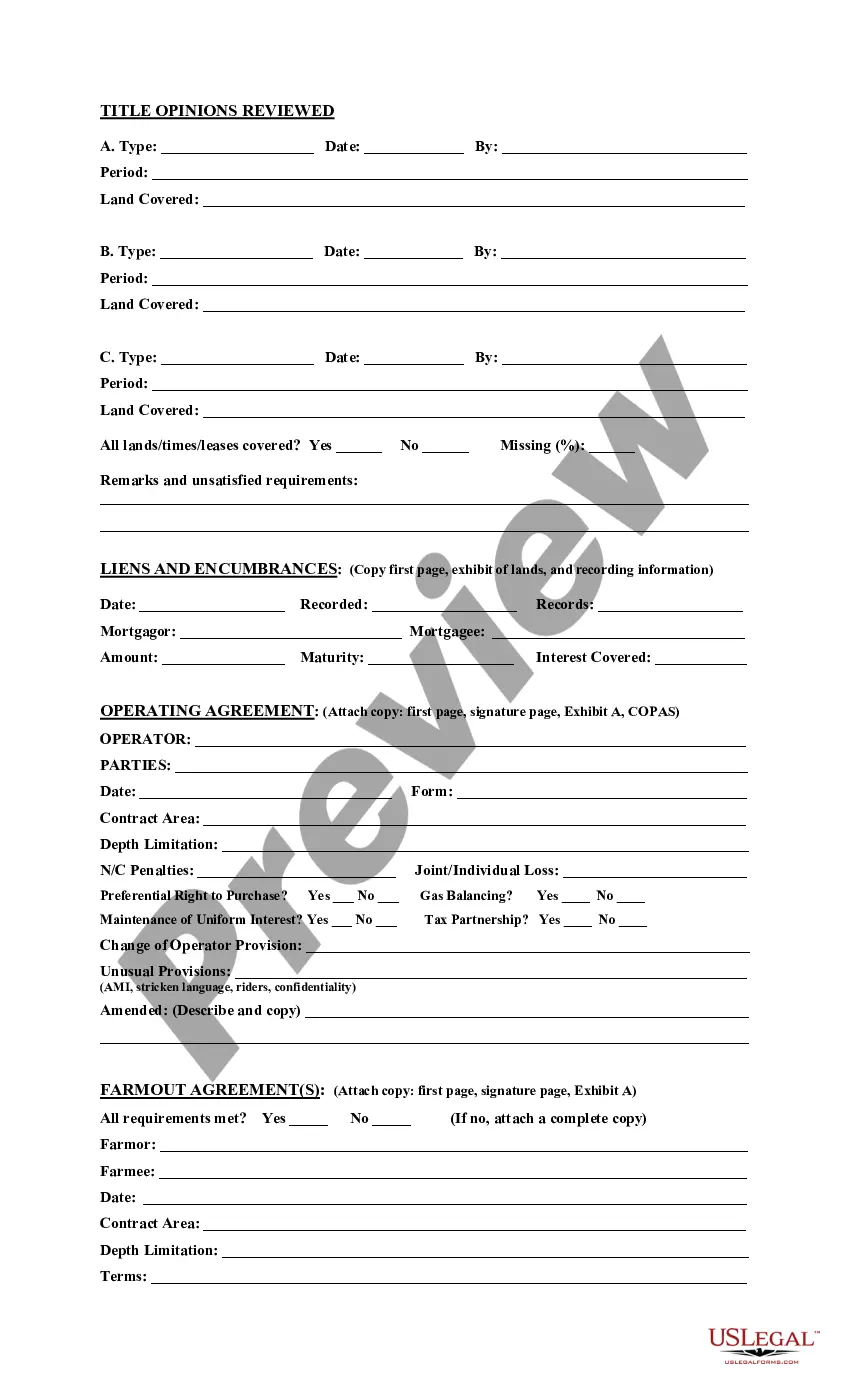

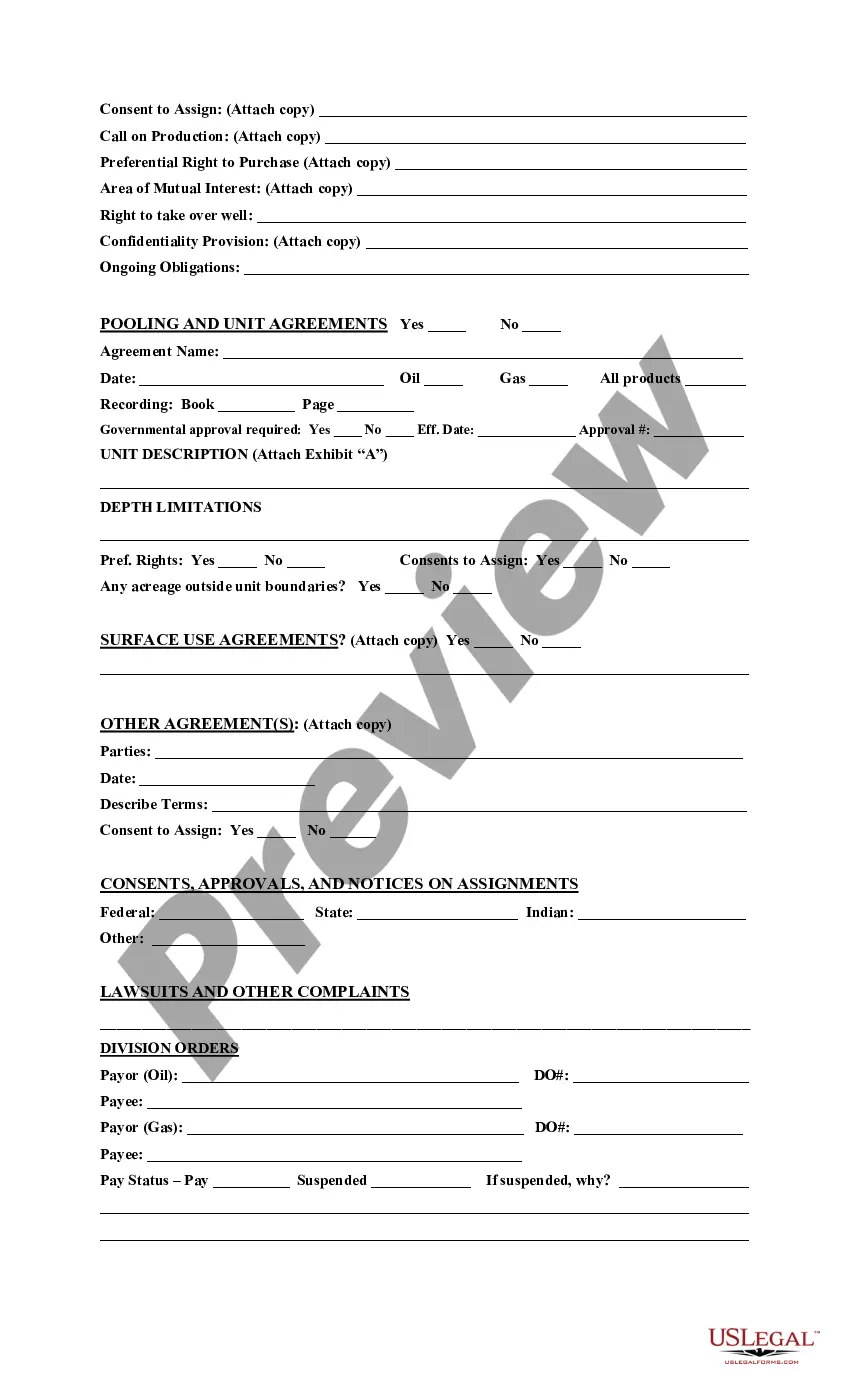

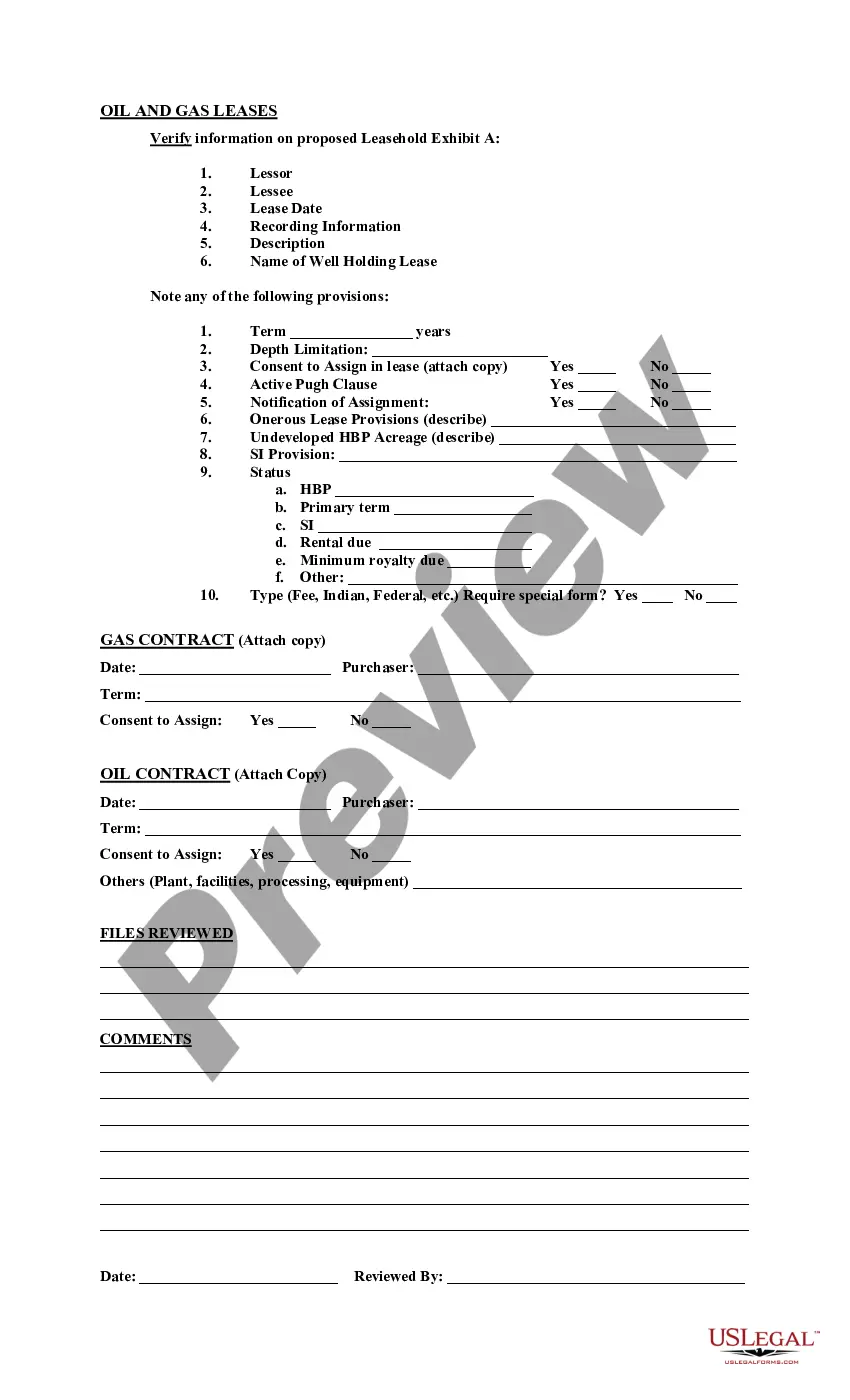

Colorado Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

Are you currently inside a placement the place you need to have files for possibly company or specific purposes almost every time? There are a lot of legal papers templates available on the net, but getting ones you can depend on isn`t simple. US Legal Forms offers a large number of type templates, like the Colorado Acquisition Due Diligence Report, that happen to be published to satisfy federal and state specifications.

In case you are presently familiar with US Legal Forms internet site and get your account, simply log in. After that, it is possible to acquire the Colorado Acquisition Due Diligence Report web template.

If you do not come with an account and want to begin using US Legal Forms, adopt these measures:

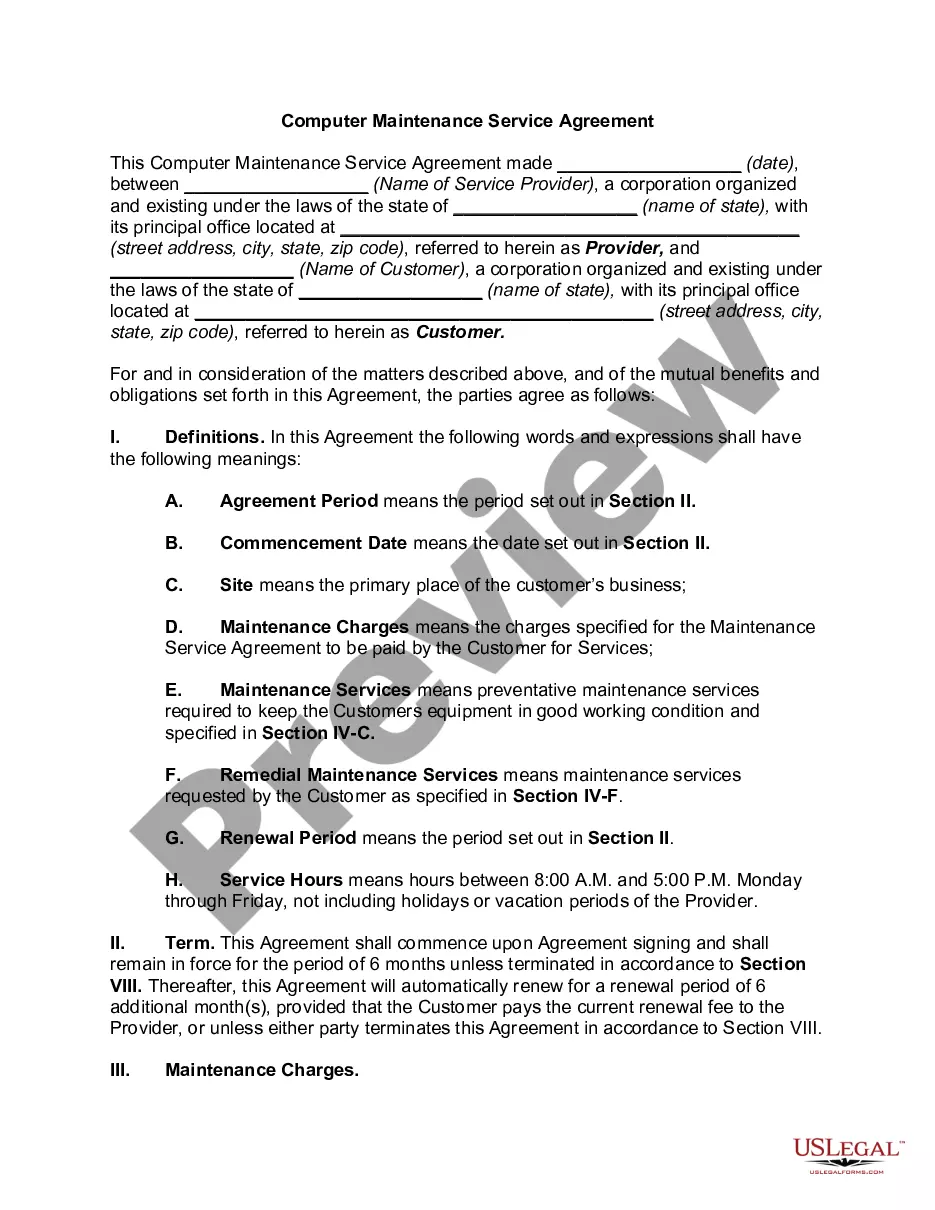

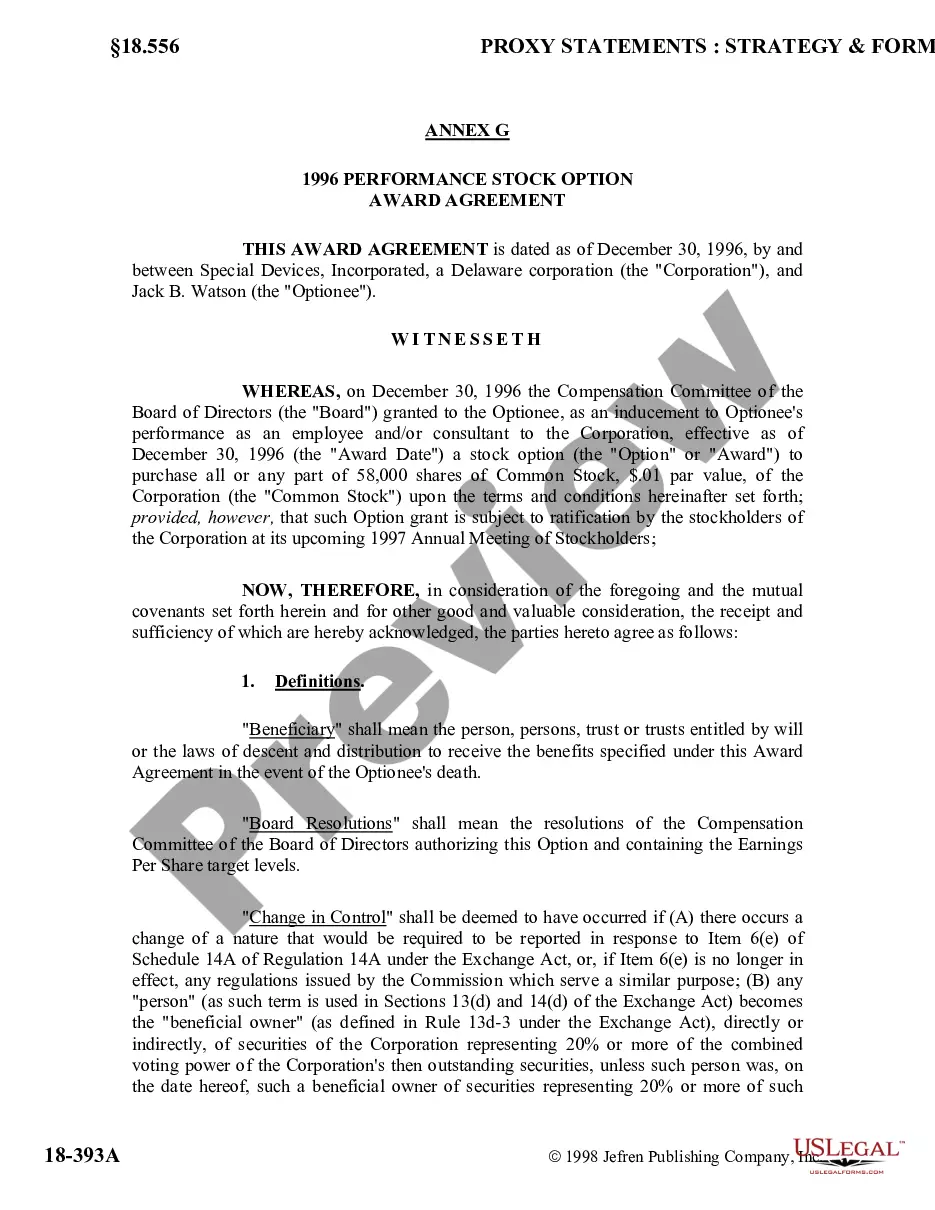

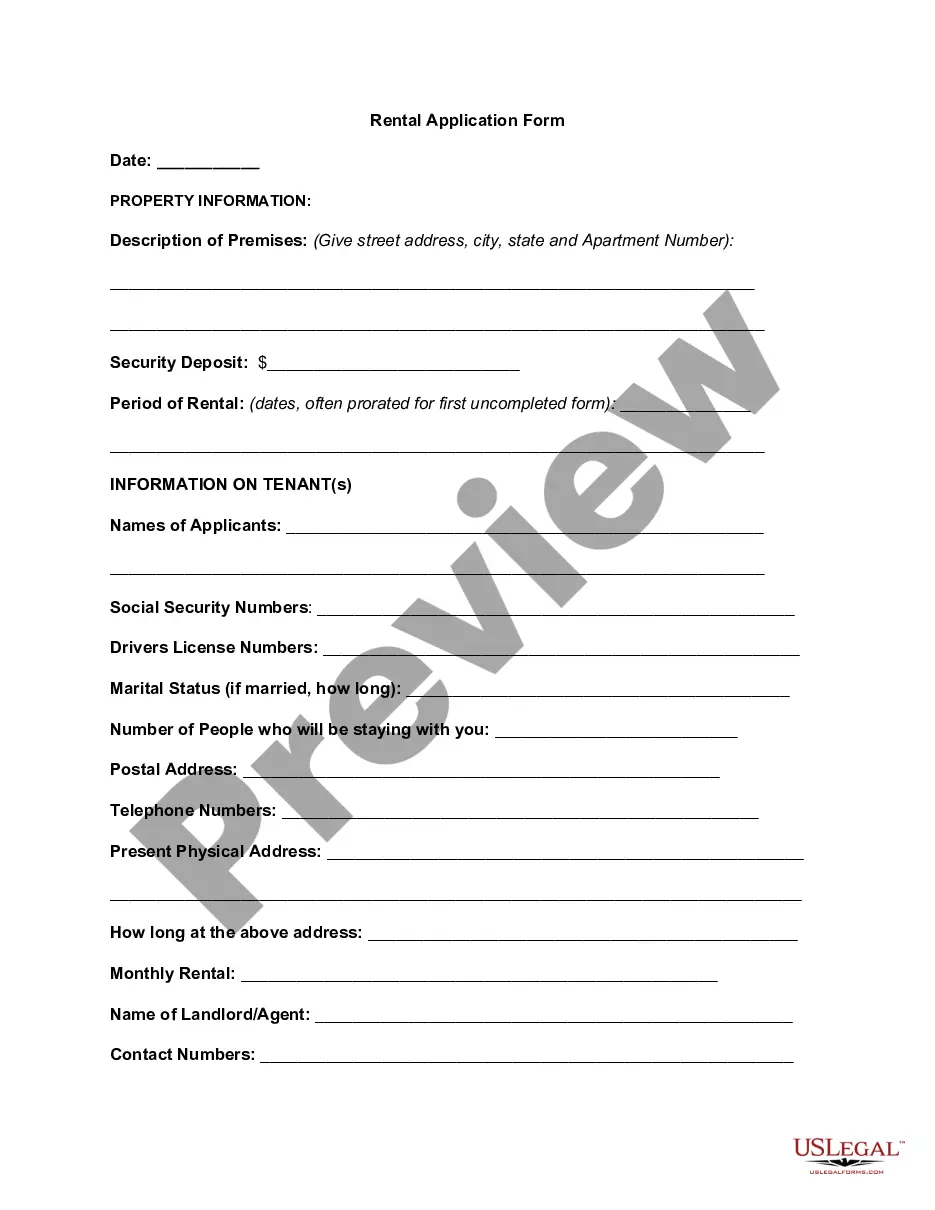

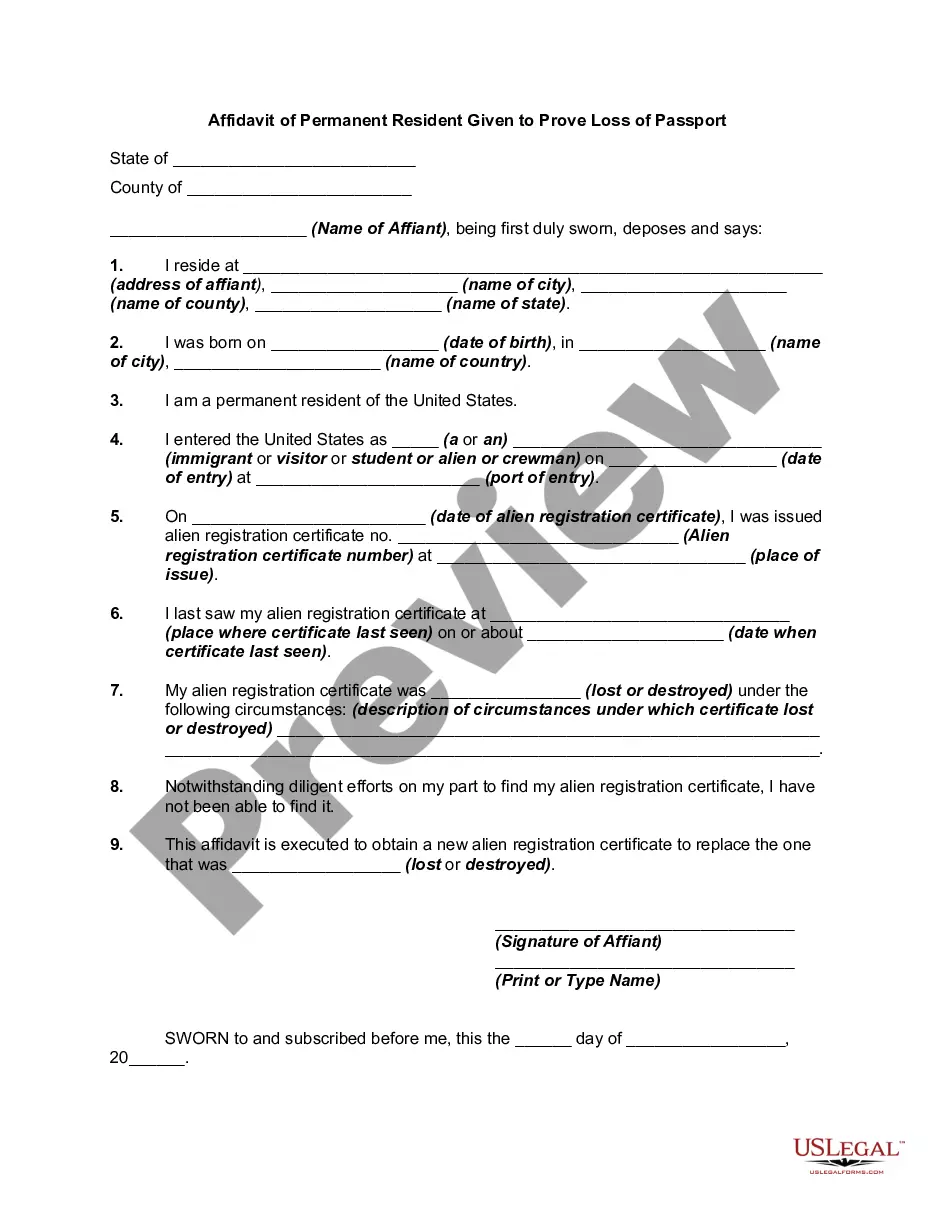

- Get the type you will need and make sure it is for that correct town/region.

- Utilize the Preview key to analyze the form.

- Read the information to ensure that you have chosen the correct type.

- If the type isn`t what you`re looking for, utilize the Lookup area to discover the type that meets your needs and specifications.

- When you discover the correct type, click Buy now.

- Choose the rates plan you desire, complete the desired information to create your account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Select a convenient data file structure and acquire your copy.

Discover each of the papers templates you might have purchased in the My Forms menus. You can get a more copy of Colorado Acquisition Due Diligence Report anytime, if needed. Just go through the required type to acquire or print the papers web template.

Use US Legal Forms, probably the most comprehensive collection of legal forms, to save efforts and stay away from errors. The service offers expertly made legal papers templates which you can use for a selection of purposes. Generate your account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

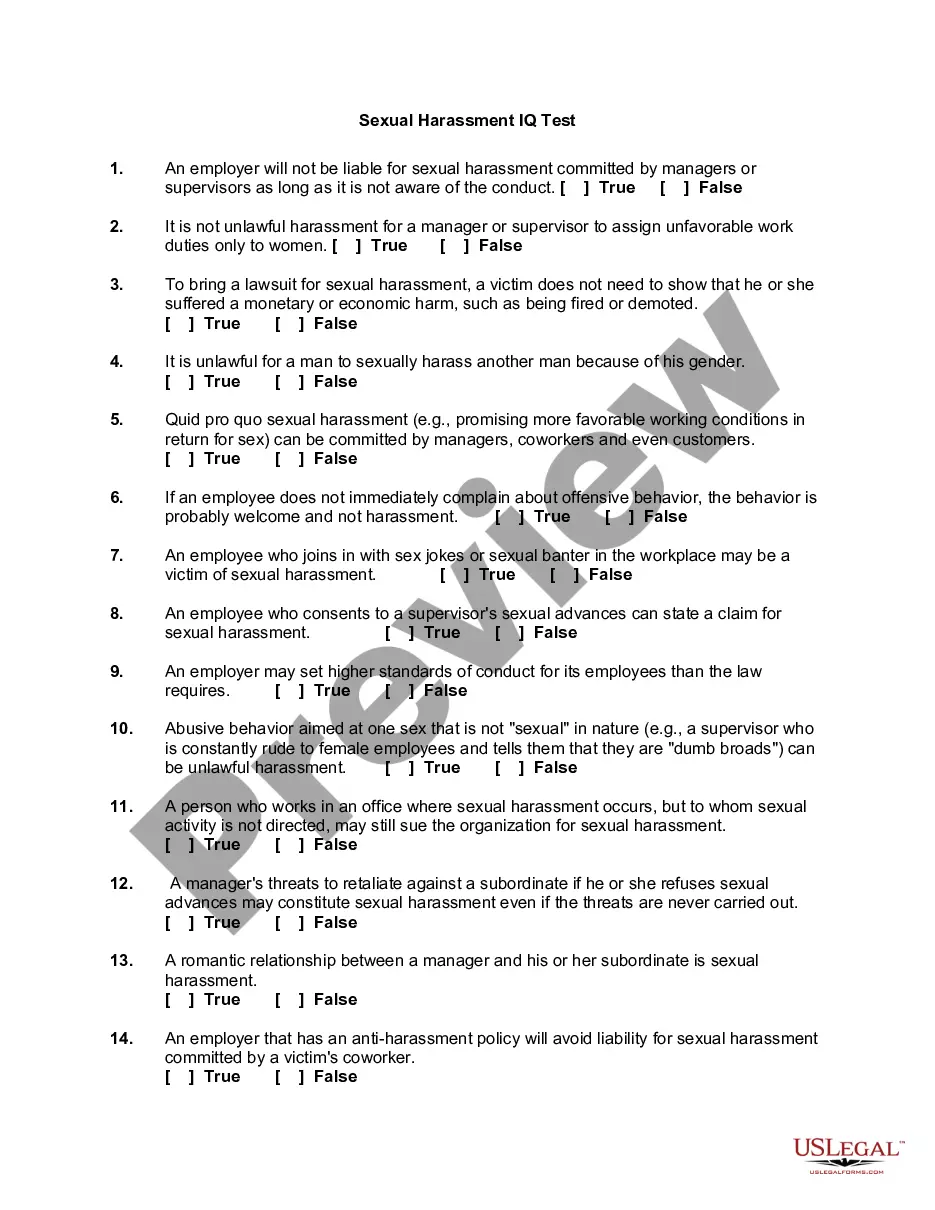

What is HR due diligence? HR due diligence is where the target company's HR processes and human capital are put under the microscope. The culture of the company, as well as the roles, capabilities and attitudes of its people are investigated.

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Due diligence involves taking reasonable steps to make sure that you are not making risky or poor decisions, paying too much or breaking any regulations or rules. When purchasing a business, you are responsible for assessing the business thoroughly to confirm that it is as ethical, compliant and profitable as claimed.

Legal due diligence is the process of collecting and assessing all of the legal documents and information relating to the target company. It gives both the buyer and seller the chance to scrutinize any legal risks, such as lawsuits or intellectual property details, before closing the deal.

1. Company information. This should be the first bullet in your due diligence checklist because this information will provide you with insights into the business's decision-making processes, strategic direction, management style, priorities, labor relations, and potential issues. Who owns the company?

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

The primary objective of due diligence in mergers and acquisitions is to validate and verify the seller's critical information, including financials, contracts, and compliance standards.