Colorado Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

If you wish to obtain, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and convenient search feature to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Colorado Design Agreement - Self-Employed Independent Contractor. Each legal document template you purchase is yours permanently. You will have access to every form you downloaded with your account. Click on the My documents section and select a form to print or download again. Finish and download, and print the Colorado Design Agreement - Self-Employed Independent Contractor with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to obtain the Colorado Design Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to locate the Colorado Design Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your correct city/state.

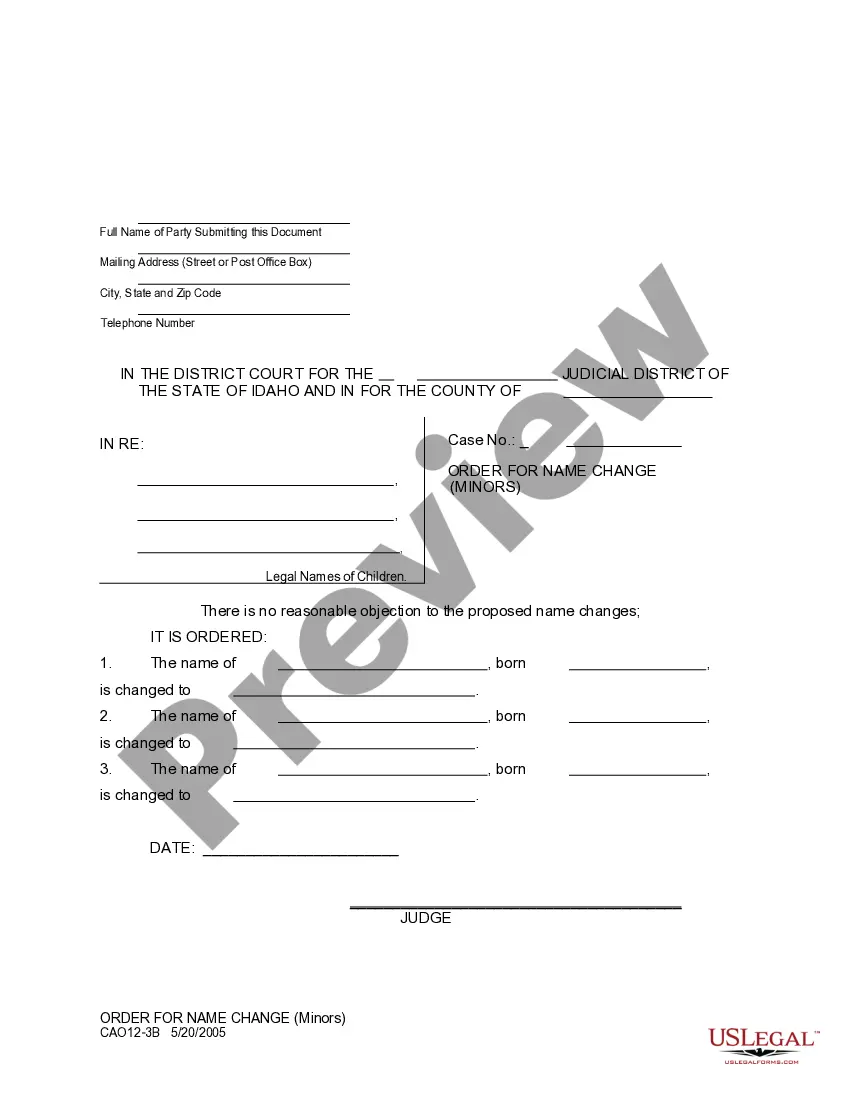

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

Form popularity

FAQ

To create an effective independent contractor agreement, start by identifying the scope of work, payment terms, and confidentiality issues. Clear communication is key to a successful contract. You may find the Colorado Design Agreement - Self-Employed Independent Contractor template provided by uslegalforms to be a valuable resource in drafting a thorough and professional agreement.

Yes, you can write your own legally binding contract as long as it meets legal requirements. Your contract should detail all essential terms and conditions, and both parties must agree to them. To ensure your contract clearly conveys your intentions, consider using the Colorado Design Agreement - Self-Employed Independent Contractor from uslegalforms for guidance and structure.

Independent contractors in Colorado must follow specific regulations which include obtaining necessary licenses and permits. They are responsible for managing their taxes, including self-employment tax. Additionally, having a Colorado Design Agreement - Self-Employed Independent Contractor solidifies this relationship, ensuring both parties understand their obligations and rights.

Creating an independent contractor agreement requires outlining the terms of the relationship between the contractor and the client. You should specify project details, compensation, and deadlines. Utilizing a structured approach is essential, and the Colorado Design Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process.

In Colorado, independent contractors must adhere to specific rules that determine their classification. This includes providing their own tools, setting their own hours, and working independently. It is crucial for independent contractors to maintain control over the work they perform to qualify as such. Understanding the Colorado Design Agreement - Self-Employed Independent Contractor can help clarify these rules.

Yes, independent contractors do file as self-employed individuals. When you work under a Colorado Design Agreement - Self-Employed Independent Contractor, you report your earnings through Schedule C on your tax return. This process establishes your status as a self-employed worker. Additionally, using the US Legal Forms platform can help simplify the process of filing your taxes without missing essential details.

Filling out an independent contractor agreement requires you to include relevant details such as project specifics, duration, and payment arrangements. Make sure both parties sign the agreement, and consider adding clauses that explain termination and dispute resolution. This structured approach can strengthen your Colorado Design Agreement - Self-Employed Independent Contractor, facilitating a smooth working relationship.

To write an independent contractor agreement, begin by outlining the scope of work and responsibilities of both parties involved. Include key elements such as payment terms, timelines, and confidentiality clauses. By drafting a comprehensive Colorado Design Agreement - Self-Employed Independent Contractor, you help ensure a mutual understanding and protect your interests throughout the duration of the contract.

Filling out an independent contractor form involves gathering essential information like your personal details, project scope, and payment structure. Be clear and precise about the services you will provide and the compensation terms agreed upon. A well-completed form as part of your Colorado Design Agreement - Self-Employed Independent Contractor is vital for setting clear expectations between you and your client.

To fill out a declaration of independent contractor status form, start by providing accurate personal details such as your name and address. Next, clearly state your business activities and confirm your status as a self-employed independent contractor. It's crucial to ensure that your information aligns with your Colorado Design Agreement - Self-Employed Independent Contractor to avoid any inconsistencies.