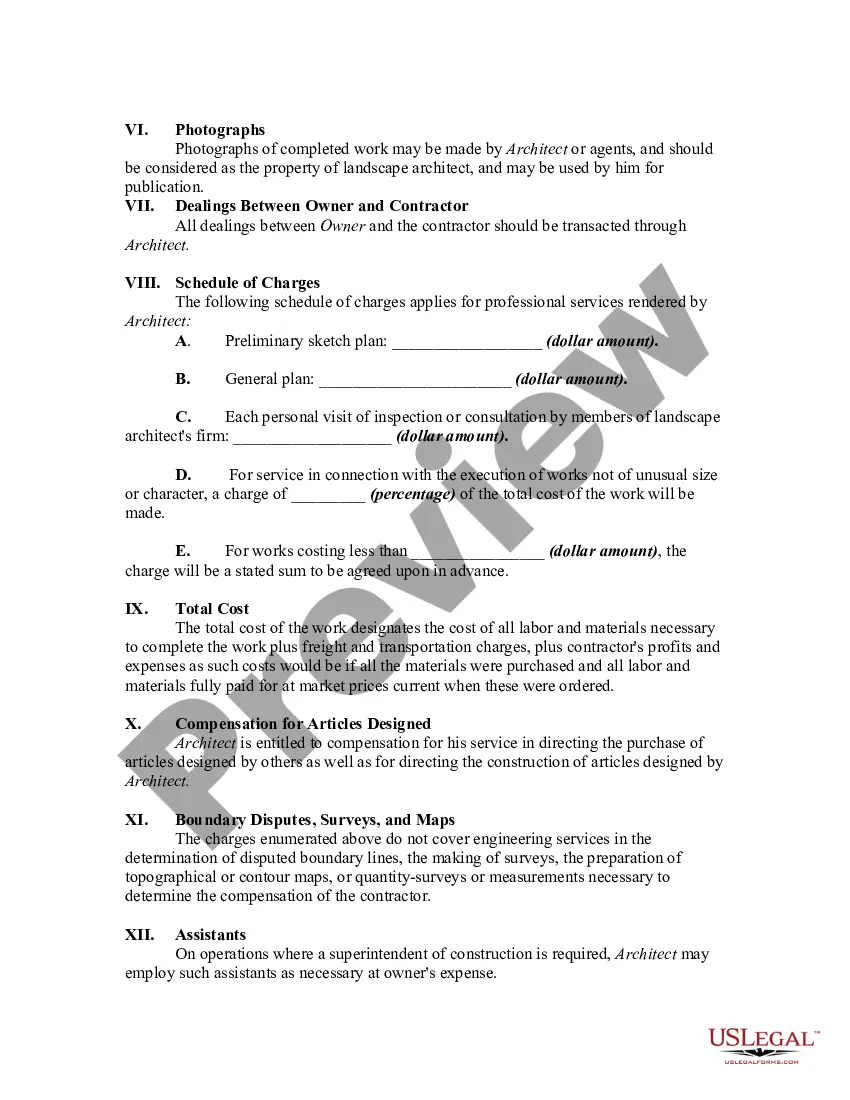

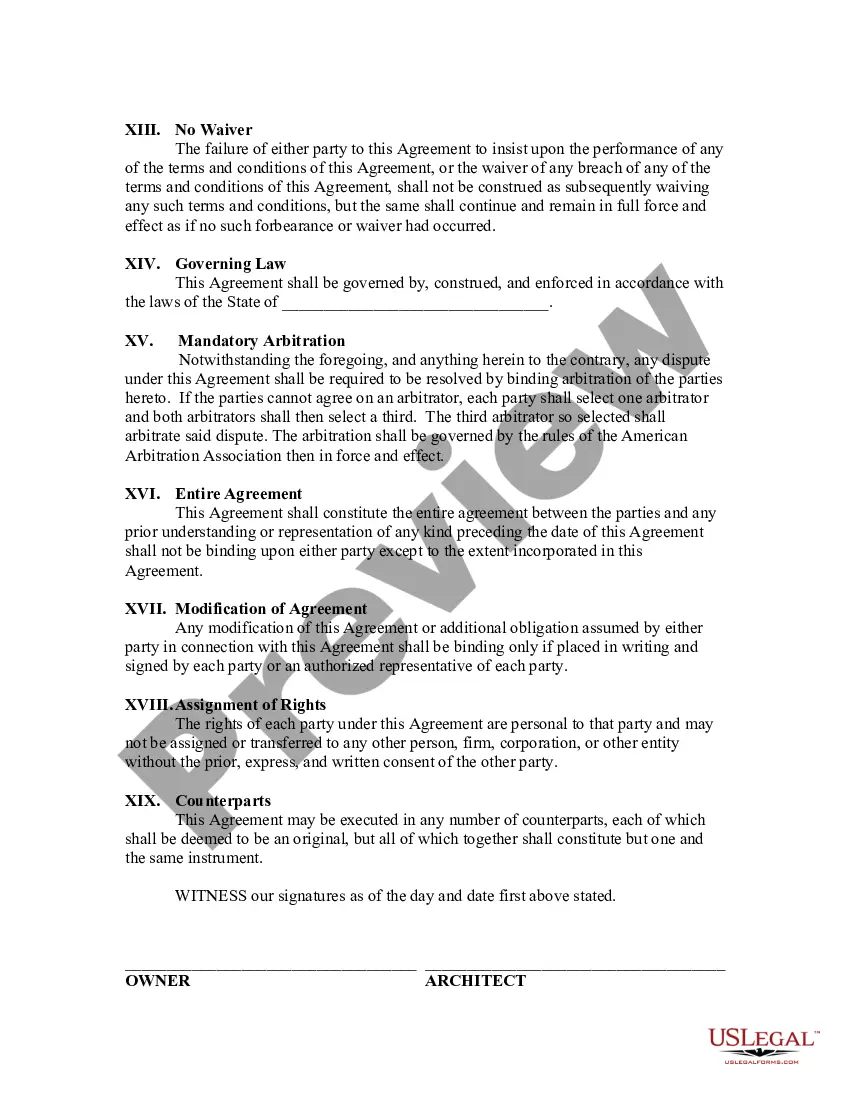

The following form is an agreement with an landscape architect for a particular project. The landscape architect is acting as an independent contractor.

Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor

Description

How to fill out Agreement For Employment Of Landscape Architect As Self-Employed Independent Contractor?

Selecting the finest legal document template can be a challenge. Obviously, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor, which can be used for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you already have an account, Log In and click the Download button to access the Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor. Use your account to search for the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have selected the correct form for your city/county. You can review the form using the Review button and examine the form description to confirm that it is suitable for your needs. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click on the Get now button to retrieve it. Select the pricing plan you wish to use and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal forms, where you can find a variety of document templates.

- Utilize the service to obtain professionally prepared documents that adhere to state regulations.

Form popularity

FAQ

Setting up an independent contractor agreement requires careful planning and clear communication. Begin by drafting the terms using a template, such as the Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor, to cover key elements like responsibilities and payment. Once drafted, review the agreement with both parties to ensure understanding and agreement before signing.

To write an independent contractor agreement, start by clearly defining the parties involved and the nature of work to be performed. Include essential details like payment terms, deadlines, and liability clauses. Consider using the Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor template available at US Legal Forms to simplify the process.

The term of a contractor agreement typically specifies the duration of the project or the timeframe for a specific service. In the case of a Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor, it can vary based on project needs or certain milestones. It is vital to establish clear terms to avoid disputes and ensure timely project completion.

A Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor outlines the working terms between a landscape architect and a client. It clarifies the scope of work, payment structure, and responsibilities of both parties. This agreement helps protect the rights and outlines expectations, ensuring a smooth working relationship.

Yes, you can be your own contractor in Colorado. Many professionals choose to operate as self-employed independent contractors, allowing them flexibility in their work. A Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor provides the legal structure for such arrangements. This agreement clarifies responsibilities and payment terms, empowering you in your career.

Colorado is not a no contract state. Contracts, including a Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor, are legally enforceable. It is important to have a contract that outlines the terms of your work to protect both parties involved. Clear agreements can prevent misunderstandings and ensure smooth operations.

Independent contractors in Colorado are responsible for paying their own taxes, which includes self-employment tax. They must report their income and expenses on their federal tax return and may need to make estimated tax payments throughout the year. The Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor often includes stipulations about income reporting to ensure compliance. Seeking advice from a tax professional can help navigate this process smoothly, ensuring all obligations are met.

Generally, independent contractors in Colorado are not required to carry workers' compensation insurance; however, it is strongly advised. Since these individuals manage their own projects and business affairs, having coverage can protect them against work-related injuries. The Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor outlines the responsibilities each party holds, emphasizing the need for contractors to consider this insurance for their safety. Checking with a legal expert can provide clarity on individual circumstances.

In Colorado, an employee is typically defined as an individual who works under the control and direction of an employer. Employees are entitled to certain benefits, such as unemployment benefits, health insurance, and workers' compensation, which independent contractors do not receive. The Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor explicitly highlights this separation, making it clear that such contractors manage their own business operations and do not fall under employer control. Understanding this distinction is crucial for both employers and contractors in Colorado.

One key factor in distinguishing between an employee and an independent contractor is the level of control a business has over the worker. Independent contractors, such as those under the Colorado Agreement for Employment of Landscape Architect as Self-Employed Independent Contractor, typically operate with greater autonomy regarding how they complete their work. In contrast, employees usually follow specific guidelines set by their employer. This distinction affects various aspects of employment law and the benefits associated with each classification.