Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

Are you presently in a situation where you frequently require documents for either professional or personal reasons.

There are many legal document templates accessible online, but locating ones you can rely on is not easy.

US Legal Forms offers a vast selection of form templates, such as the Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor, designed to meet federal and state standards.

Once you find the right form, just click Get now.

Select the pricing plan you desire, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor form.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

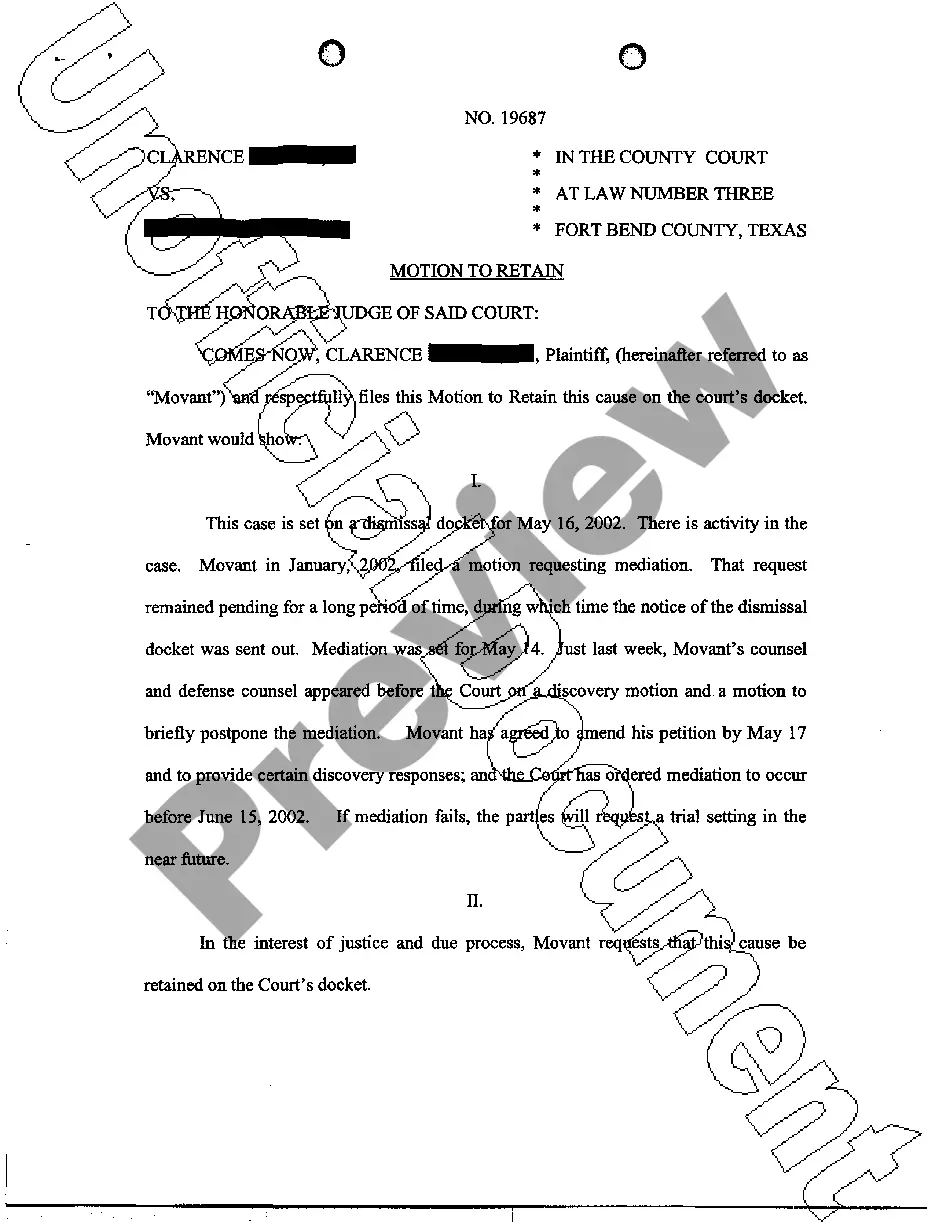

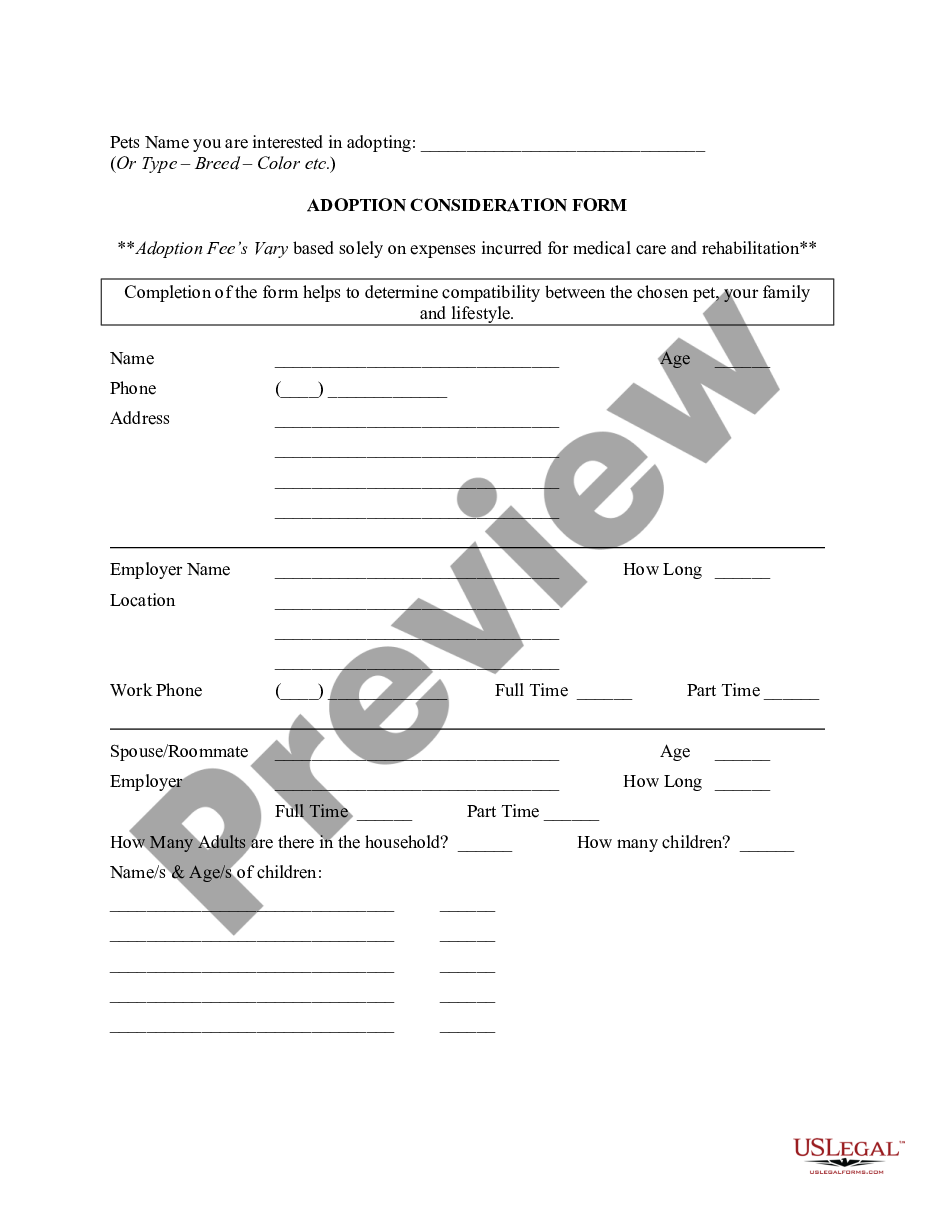

- Use the Review button to inspect the form.

- Read the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Independent contractors typically need to fill out forms such as W-9 for tax purposes, and potentially a contract form specific to their services, like the Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor. Additionally, depending on the nature of the work, you may need to provide proof of insurance or licensing. Always check local regulations to ensure you meet all necessary requirements.

Writing an independent contractor agreement involves several key steps. Start with a title that reflects the nature of the contract, such as the Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor. Next, define the relationship between the contractor and the client, then include sections on scope of work, payment terms, and confidentiality. Finally, make sure to have both parties review and sign the document to ensure mutual understanding.

Filling out an independent contractor form requires you to provide detailed information about the services you will offer. Include your name, contact information, and the specific tasks you will perform. Reference the Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor to ensure you capture all necessary details. Always double-check the form for completeness before submission.

To fill out an independent contractor agreement, begin by identifying both parties involved: the contractor and the client. Clearly outline the scope of work, payment terms, and deadlines. Use the Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor as a guide to ensure you include essential clauses such as confidentiality and termination conditions. Don't forget to review the completed agreement for accuracy before both parties sign.

In Colorado, an independent contractor agreement does not typically require notarization to be enforceable. However, having it notarized can provide an extra layer of validation. Ensure your Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor is signed by both parties to solidify the agreement.

To create an independent contractor agreement, start by outlining the scope of work, payment terms, and deadlines. Ensure that both parties agree on the particulars and include clauses for confidentiality and termination. Consider using a Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor template for a clear and comprehensive foundation.

Yes, an independent contractor is considered self-employed since they operate their own business and are not classified as an employee. This designation offers them greater flexibility but also comes with the responsibility for their own taxes and benefits. A Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor can help formalize this relationship and clarify obligations.

In Colorado, independent contractors are required to maintain a business license, follow tax laws, and ensure compliance with labor regulations. They must manage their work independently and provide their own tools and materials. Having a Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor is essential to establish the terms of engagement and safeguard both parties.

Yes, a self-employed person can and should have a contract to define their services and protect their interests. A well-drafted agreement outlines the expectations and responsibilities of both parties. Utilizing a Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor helps ensure clarity and compliance with applicable laws.

Independent contractors must adhere to both federal and state regulations, including tax requirements and business licensing. In Colorado, they do not receive employee benefits and are responsible for their own insurance and taxes. It's crucial to clearly define the working relationship through a Colorado Personal Shopper Services Contract - Self-Employed Independent Contractor to avoid classification issues.