Colorado Chef Services Contract - Self-Employed

Description

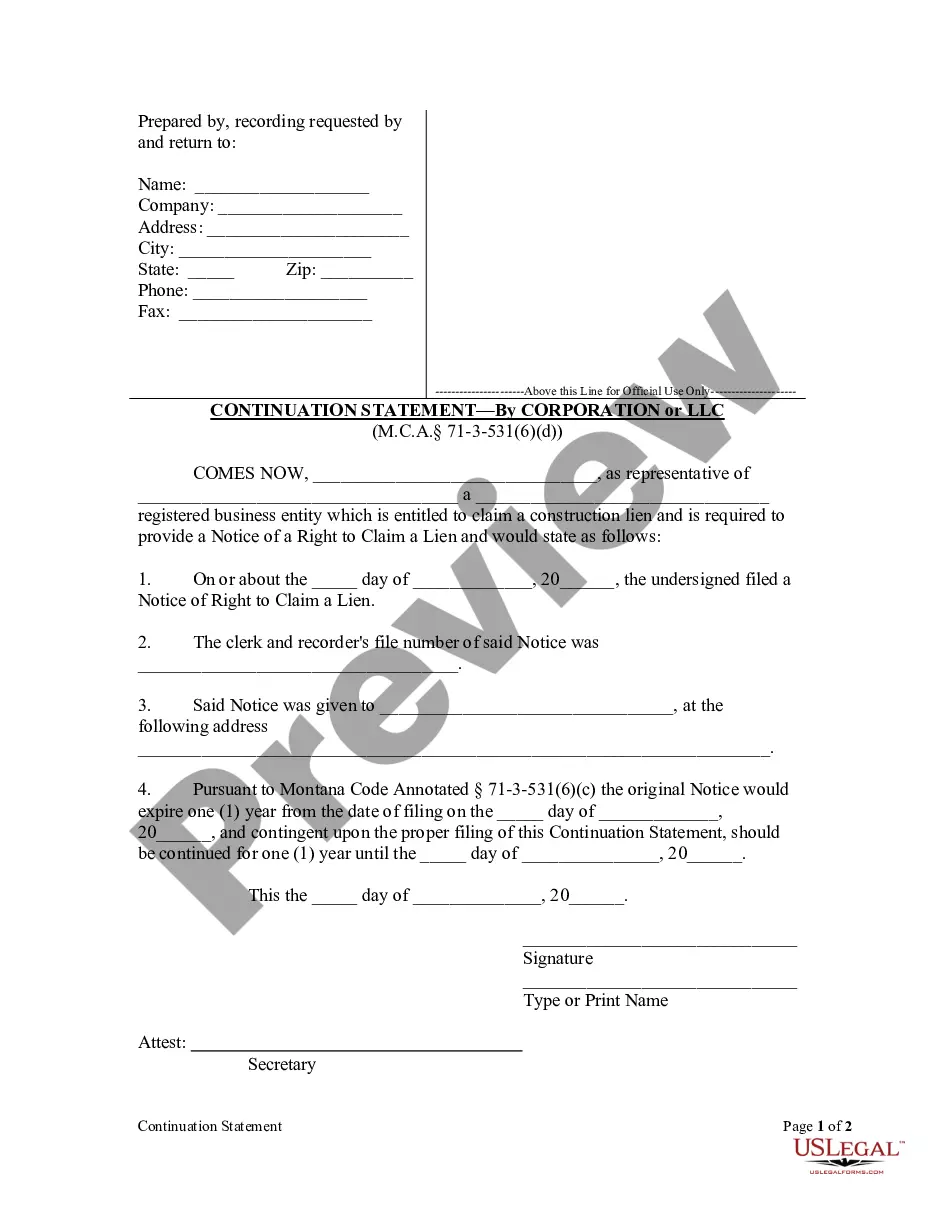

How to fill out Chef Services Contract - Self-Employed?

If you need to fill, download, or create authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to find the documents you require. Various templates for business and personal purposes are categorized by types and keywords.

Use US Legal Forms to acquire the Colorado Chef Services Contract - Self-Employed in just a few clicks.

Step 6. Choose the format of the legal document and download it to your device.

Step 7. Fill out, edit, and print or sign the Colorado Chef Services Contract - Self-Employed. Each legal document template you obtain is yours to keep permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Stay competitive and download, and print the Colorado Chef Services Contract - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Colorado Chef Services Contract - Self-Employed.

- You can also access forms you have previously downloaded in the My documents section of your account.

- Step 1. Ensure you have chosen the form for the correct state/region.

- Step 2. Utilize the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the page to find other versions in the legal form format.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

Yes, personal chefs are considered self-employed as they provide tailored cooking services for individual clients. This arrangement allows personal chefs to build strong relationships with their clients while managing their own business operations. A Colorado Chef Services Contract - Self-Employed can assist in formalizing your arrangements and ensuring clear communication with your clients.

Absolutely, you can be a self-employed chef, allowing you to create your own schedule and choose your clients. This freedom can lead to greater job satisfaction and financial independence. A Colorado Chef Services Contract - Self-Employed can help you manage your business effectively and highlight important operational elements.

Yes, many chefs operate as independent contractors. This arrangement allows chefs to offer their services on a freelance basis, providing flexibility in their work. Utilizing a Colorado Chef Services Contract - Self-Employed can ensure you properly define your contractor status, payment terms, and responsibilities.

While you can call yourself a chef, it's essential to have the skills and experience that come with the title. Consider obtaining some culinary training or certifications to establish credibility. A Colorado Chef Services Contract - Self-Employed can elevate your professional standing by outlining your qualifications and services in writing.

Yes, private chefs are typically self-employed. They often work independently, offering personalized cooking services to clients in their homes. A Colorado Chef Services Contract - Self-Employed can help outline the terms of service, payment, and other important details, solidifying your relationship with clients.

Yes, you can cook meals to sell from home, but you must comply with local health regulations and obtain proper permits. A Colorado Chef Services Contract - Self-Employed can help formalize your business arrangements and clarify your responsibilities. Adhering to these guidelines ensures you can operate safely and legally.

Yes, a personal chef generally operates as an independent contractor. This means they manage their own business, set their own hours, and work with clients directly. Using a Colorado Chef Services Contract - Self-Employed can provide clarity about the working relationship, outlining responsibilities and expectations for both parties. This contract protects your interests and helps ensure a smooth engagement.

Filling out an independent contractor agreement involves several steps. Begin with the names of both parties, followed by a detailed description of the services to be provided. Outline payment terms, including amounts and schedules, and finalize with the signatures of both parties. Using a Colorado Chef Services Contract - Self-Employed template from US Legal Forms ensures you include all necessary details in a legally sound manner.

To fill out an independent contractor form, start by entering your personal information and the client's details. Next, describe the services you will provide and any relevant deadlines. Be sure to indicate payment terms and conditions. By using a Colorado Chef Services Contract - Self-Employed from US Legal Forms, you can access a straightforward format that guides you through this process.

Writing an independent contractor agreement involves defining the relationship between you and your client clearly. Include details such as the scope of work, payment structure, and any deadlines. It is beneficial to specify that the agreement is a Colorado Chef Services Contract - Self-Employed to ensure it meets legal requirements. Using a template from US Legal Forms can help streamline this process.