Colorado Deck Builder Contractor Agreement - Self-Employed

Description

How to fill out Deck Builder Contractor Agreement - Self-Employed?

Are you in the location where you need documents for both business or personal usage almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of template forms, such as the Colorado Deck Builder Contractor Agreement - Self-Employed, that are designed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you want, enter the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Colorado Deck Builder Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

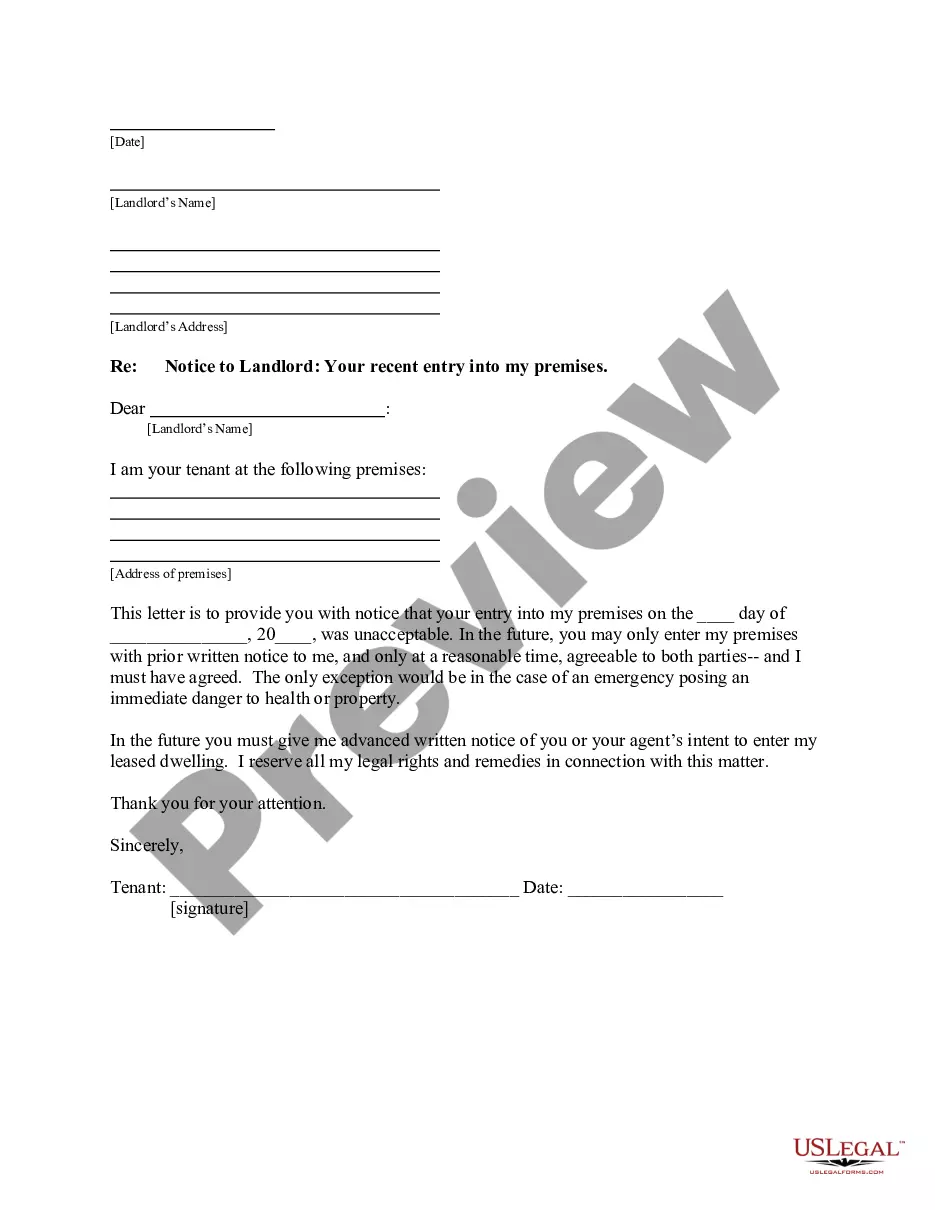

- Utilize the Review option to check the form.

- Read the details to make sure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Independent contractors in Colorado must adhere to various state requirements, including securing necessary licenses and permits for their work. Additionally, they need to maintain accurate records of their earnings and expenses. Utilizing a Colorado Deck Builder Contractor Agreement - Self-Employed is highly beneficial, as it clearly lays out the expectations and legal requirements necessary for compliance in the state.

As an independent contractor in Colorado, you must file a few essential documents for tax purposes. This includes submitting a Schedule C form along with your personal income tax return and keeping track of your expenses. Using a Colorado Deck Builder Contractor Agreement - Self-Employed can help you organize your financial responsibilities and understand what you need to file.

Creating an independent contractor agreement involves several key components. Start by defining the scope of work, payment terms, and duration of the project. Using a Colorado Deck Builder Contractor Agreement - Self-Employed template from USLegalForms can simplify this process, ensuring that all necessary legal aspects are covered.

Independent contractors in Colorado must follow specific guidelines set forth by both federal and state laws. They should provide their own tools, set their own hours, and maintain a degree of independence in how they complete their work. If you are a Colorado deck builder needing clarity on an agreement, consider a Colorado Deck Builder Contractor Agreement - Self-Employed to outline your responsibilities and ensure compliance.

The terms self-employed and independent contractor can often be used interchangeably. However, saying self-employed can convey a more general status of working for oneself. If you are pursuing a Colorado Deck Builder Contractor Agreement - Self-Employed, using either term is acceptable; it often comes down to personal preference and the context of your work.

Receiving a 1099 form typically indicates self-employment status, as it reports your income earned from clients. If you sign a Colorado Deck Builder Contractor Agreement - Self-Employed, you'll likely receive a 1099 at year's end. This form is essential for tax purposes, ensuring you properly report your earnings.

Writing an independent contractor agreement involves outlining the terms between the contractor and client clearly. Start by defining the scope of work, payment terms, and responsibilities. When creating your Colorado Deck Builder Contractor Agreement - Self-Employed, consider using templates available on platforms like uSlegalforms for guidance.

Yes, independent contractors count as self-employed individuals. They provide services on a contractual basis, allowing them to operate independently. If you are looking to secure a Colorado Deck Builder Contractor Agreement - Self-Employed, being regarded as self-employed can provide flexibility in your professional engagements.

To qualify as self-employed, an individual must work for themselves rather than for an employer. They typically have control over their work hours and processes, which aligns with entering a Colorado Deck Builder Contractor Agreement - Self-Employed. Furthermore, self-employed individuals usually report their income using a Schedule C form during tax season.

Yes, an independent contractor is indeed considered self-employed. This classification allows them to manage their own business operations while providing services to clients. If you are entering a Colorado Deck Builder Contractor Agreement - Self-Employed, it's crucial to understand how this label impacts your taxes and business structure.