Colorado Fence Contractor Agreement - Self-Employed

Description

How to fill out Fence Contractor Agreement - Self-Employed?

If you wish to accumulate, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Capitalize on the platform`s user-friendly and convenient search to locate the documents you require.

Diverse templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Colorado Fence Contractor Agreement - Self-Employed. Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Navigate to the My documents section and choose a form to print or download again. Act decisively and download, then print the Colorado Fence Contractor Agreement - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Colorado Fence Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to obtain the Colorado Fence Contractor Agreement - Self-Employed.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you’ve selected the form pertinent to the correct city/state.

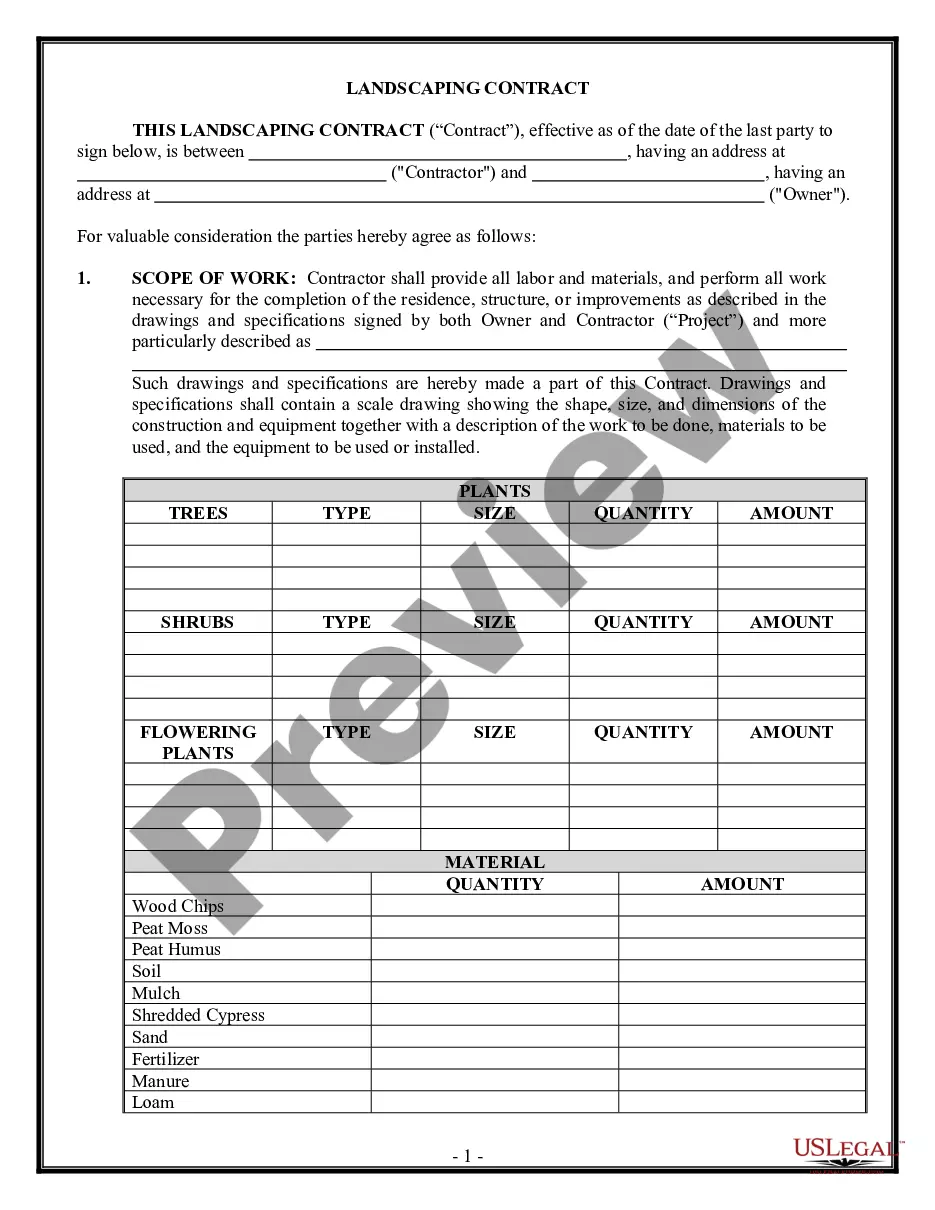

- Step 2. Utilize the Review option to examine the contents of the form. Be sure to go through the details.

- Step 3. If you are unsatisfied with the form, make use of the Search field at the top of the screen to discover alternative versions of the legal form type.

- Step 4. After you’ve found the form you need, click the Buy now button. Choose your preferred payment method and enter your details to register for your account.

Form popularity

FAQ

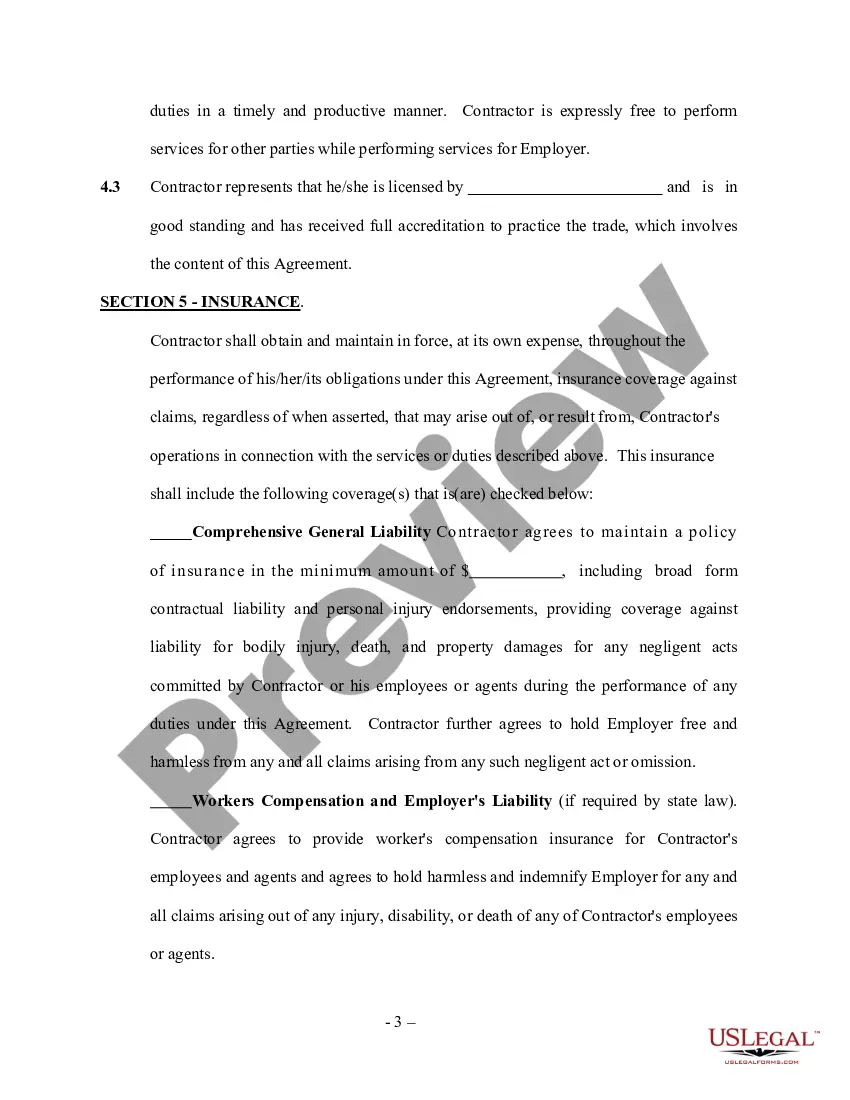

Protecting yourself as an independent contractor involves several key steps. First, clearly define the terms of your work in a written agreement, such as a Colorado Fence Contractor Agreement - Self-Employed, to set expectations and responsibilities. Additionally, maintain communication with clients and document all interactions to ensure transparency. Finally, consider obtaining liability insurance to cover unexpected issues that may arise during your projects.

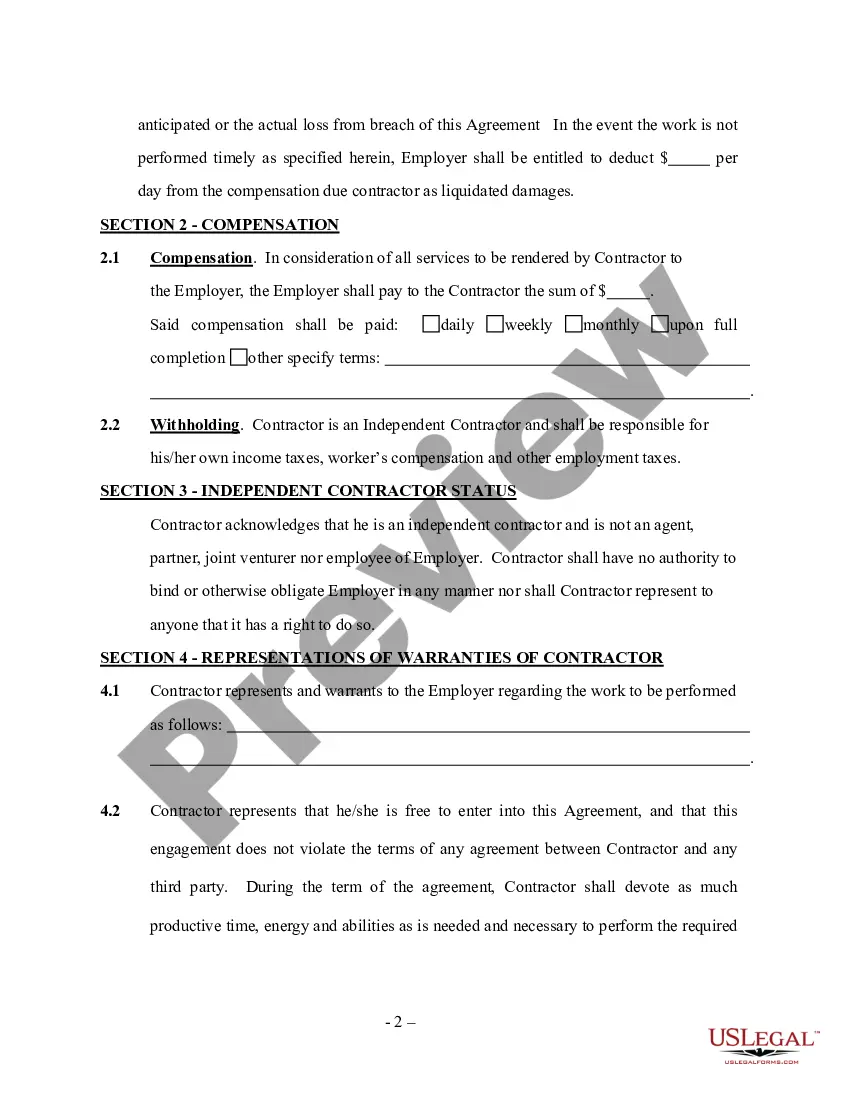

To create an independent contractor agreement, begin by outlining the project's scope, including the specific services the contractor will provide. Next, clarify the payment terms, including amounts, deadlines, and invoicing procedures. You should also include confidentiality clauses and termination conditions to protect both parties. Utilizing a platform like USLegalForms can simplify this process by providing templates specifically designed for a Colorado Fence Contractor Agreement - Self-Employed.

Yes, independent contractors can face lawsuits just like any other business entity. Proper agreements, such as the Colorado Fence Contractor Agreement - Self-Employed, can minimize risks by outlining terms and expectations clearly. It's important to maintain professionalism and adhere to contractual obligations. If you face legal action, consulting a legal professional is advisable.

Contractors can protect themselves by using clear contracts, such as the Colorado Fence Contractor Agreement - Self-Employed. This document sets clear expectations and protects against potential disputes. Ensure you have proper insurance and maintain open communication with clients. Regularly review your contracts to ensure they remain relevant and enforceable.

The new federal rule for independent contractors focuses on simplifying classification and ensuring fair compensation. It is crucial for you to understand the implications on your work as a self-employed contractor. The Colorado Fence Contractor Agreement - Self-Employed can help you navigate these regulations. Stay informed about any changes to ensure compliance.

Yes, having a contract as an independent contractor is essential. A Colorado Fence Contractor Agreement - Self-Employed can help protect your interests and clarify expectations. This agreement outlines deliverables, payment schedules, and confidentiality clauses. A well-drafted contract minimizes misunderstandings and legal disputes.

Writing an independent contractor agreement involves clearly defining roles and responsibilities. You can use a Colorado Fence Contractor Agreement - Self-Employed as a template, which includes key elements like payment details, project timelines, and termination conditions. Make sure to include any specific requirements related to the fence project. Always consult legal resources or professionals to ensure compliance.

To protect yourself when paying a contractor, consider using a Colorado Fence Contractor Agreement - Self-Employed. This contract outlines the scope of work, payment terms, and deadlines. Always document payments and retain receipts to provide proof of transactions. Additionally, ensure you verify the contractor's licensing and insurance.

Legal requirements for independent contractors include proper classification for tax purposes, filing a W-9, and maintaining liability insurance if necessary. They should also adhere to any state-specific regulations, especially those relevant to construction or fencing. A well-crafted Colorado Fence Contractor Agreement - Self-Employed addresses these aspects and protects both parties involved.

An independent contractor in Colorado must meet certain requirements, such as operating under their business name and setting their schedule. They should also hold the necessary permits and licenses specific to their trade, like fencing. Additionally, establishing a Colorado Fence Contractor Agreement - Self-Employed can help clarify expectations and responsibilities.