Colorado Window Contractor Agreement - Self-Employed

Description

How to fill out Window Contractor Agreement - Self-Employed?

Have you ever found yourself in a situation where you need documents for business or other specific purposes frequently.

There are numerous legal document templates accessible online, but finding forms you can trust is challenging.

US Legal Forms offers a vast array of document templates, including the Colorado Window Contractor Agreement - Self-Employed, which can be tailored to meet state and federal requirements.

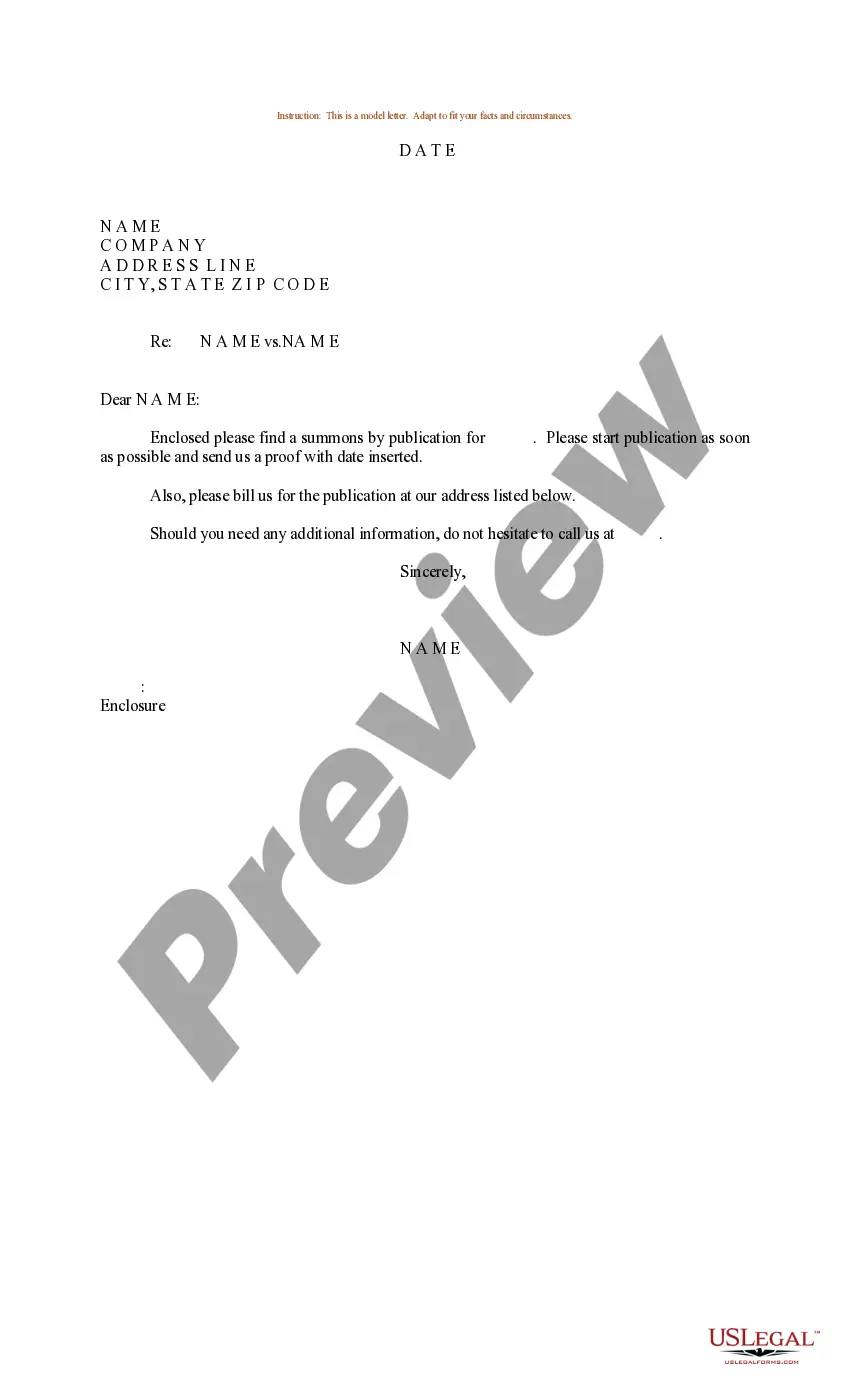

Once you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Colorado Window Contractor Agreement - Self-Employed anytime if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Colorado Window Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review option to inspect the form.

- Check the summary to confirm that you have selected the correct document.

- If the form is not what you’re looking for, use the Lookup field to find the document that meets your needs.

Form popularity

FAQ

Writing an independent contractor agreement requires outlining clear terms and responsibilities. Start with the scope of work, payment details, and deadlines, ensuring both parties understand their commitments. Utilize templates available through platforms like uslegalforms to create a comprehensive Colorado Window Contractor Agreement - Self-Employed. This not only saves time but enhances the legal integrity of your agreement.

A contract becomes legally binding in Colorado when it includes an offer, acceptance, and consideration, along with mutual consent from both parties. The Colorado Window Contractor Agreement - Self-Employed must be clear and specific to protect all interested parties. Additionally, any agreements must align with state laws and regulations. It’s advisable to review contracts carefully or seek professional guidance.

You can earn up to $599 from a single client without receiving a 1099 form. This threshold allows for some flexibility in managing your income. However, it’s wise to maintain accurate documentation of all earnings. Your Colorado Window Contractor Agreement - Self-Employed should outline payment terms to prevent any confusion.

Independent contractors must earn at least $600 from a single client to receive a 1099 form. This form is used for reporting income to the IRS and helps ensure correct tax obligations are fulfilled. It’s important to communicate openly with your clients about payments. Your Colorado Window Contractor Agreement - Self-Employed should clarify any payment expectations.

The $600 rule from the IRS states that if you earn $600 or more from a single client in a calendar year, that client must provide you with a 1099 form. This rule is essential for categorizing your income accurately for tax purposes. By maintaining proper records, you can simplify your tax preparation. Incorporating this understanding into your Colorado Window Contractor Agreement - Self-Employed can aid clarity.

An independent contractor can make up to $600 in a year from a single client without receiving a 1099 form. This is important to keep in mind when managing your earnings. If your income surpasses this amount, the client must issue you a 1099. It is wise to track your earnings closely.

Yes, even if you earn less than $5000 self-employed, you may still be required to file taxes. The IRS requires reporting all income. However, if you earn below this threshold, you might not owe any taxes. It's crucial to consider your overall financial situation and consult with a tax professional for personalized advice.

To create an effective independent contractor agreement, start by defining the scope of work that the contractor will complete. Include important details such as payment terms, deadlines, and responsibilities. It's essential to ensure that the agreement complies with the laws in your state, especially when drafting a Colorado Window Contractor Agreement - Self-Employed. You can utilize platforms like uslegalforms to simplify this process, providing you with templates and legal guidance to create a comprehensive and enforceable agreement.

To create an independent contractor agreement, start with a clear title, such as 'Colorado Window Contractor Agreement - Self-Employed.' Include essential elements like the contractor's information, job description, payment terms, and duration of the contract. You can also use tools like USLegalForms to guide you through the process, ensuring you cover all necessary aspects.

In Colorado, a Colorado Window Contractor Agreement - Self-Employed does not typically need to be notarized for it to be legally binding. However, notarization may add an extra layer of credibility, especially for larger projects. Always ensure both parties sign the agreement to confirm their acceptance of the terms.