Colorado Joint Filing Agreement

Description

How to fill out Joint Filing Agreement?

Choosing the right legitimate record format might be a battle. Of course, there are a lot of web templates available on the net, but how can you get the legitimate develop you require? Use the US Legal Forms web site. The services offers a large number of web templates, like the Colorado Joint Filing Agreement, that can be used for organization and private demands. Every one of the types are checked by experts and meet up with state and federal needs.

If you are currently registered, log in to the profile and click the Obtain button to obtain the Colorado Joint Filing Agreement. Use your profile to search with the legitimate types you possess purchased previously. Proceed to the My Forms tab of your respective profile and have yet another duplicate from the record you require.

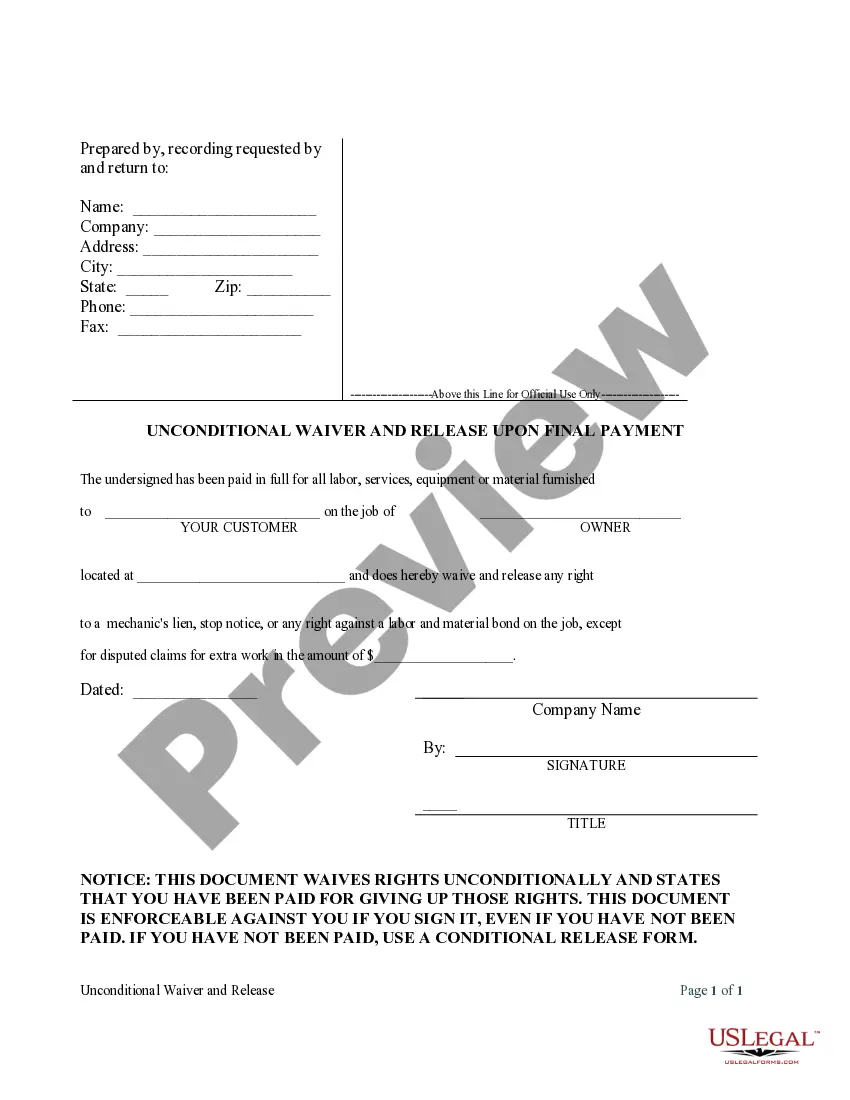

If you are a fresh consumer of US Legal Forms, here are basic instructions that you can adhere to:

- Initial, make sure you have chosen the proper develop for your city/area. You are able to look through the shape while using Review button and look at the shape information to make sure this is the best for you.

- If the develop is not going to meet up with your needs, use the Seach industry to find the appropriate develop.

- Once you are sure that the shape is acceptable, click the Buy now button to obtain the develop.

- Opt for the pricing prepare you need and enter in the needed details. Make your profile and pay for an order with your PayPal profile or charge card.

- Choose the file formatting and acquire the legitimate record format to the device.

- Total, change and print out and sign the attained Colorado Joint Filing Agreement.

US Legal Forms is definitely the greatest local library of legitimate types where you can discover a variety of record web templates. Use the company to acquire expertly-produced files that adhere to condition needs.

Form popularity

FAQ

Colorado currently uses the ?Joyce method.? HB 1311 modifies the definition of an ?affiliated group? to ?includable C corporations connected directly or indirectly through stock ownership.? The requirement that the common parent be an includable C corporation remains in place.

In Colorado, any partnership that's required to file a federal partnership income return must also file a Colorado partnership income tax return if any of the partnership's income comes from Colorado. This can be done online at the Colorado Department of Revenue's website. How to form a Colorado partnership | .com ? articles ? how-to-form-a-c... .com ? articles ? how-to-form-a-c...

Under certain circumstances, the Colorado income tax for multiple affiliated C corporations may be determined collectively, with the filing of a combined, consolidated, or combined/consolidated return.

Colorado 2% Withholding (DR 1083) This law affects non-Colorado residents or those parties moving out-of-state and not purchasing another primary residence. The amount, if withheld, shall be the lesser of 2% of the sales price of the property or the net proceeds. Colorado 2% Real Estate Withholding Tax amonteam.com ? colorado-2-real-estate-with... amonteam.com ? colorado-2-real-estate-with...

Food and beverage expense deduction In general, the allowable federal deduction is limited to 50% of the expense. However, for tax years 2021 and 2022, section 274(n)(2)(D) of the Internal Revenue Code generally permits deduction of 100% of the expense for food and beverages provided by a restaurant. Colorado Individual Income Tax Guide colorado.gov ? sites ? tax ? files ? documents colorado.gov ? sites ? tax ? files ? documents

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders. Nonresident Partners & Shareholders - Colorado Department of Revenue colorado.gov ? nonresident-partners-sharehold... colorado.gov ? nonresident-partners-sharehold...

Home Office Summary: If you use part of your home for business, you may be able to deduct expenses for the business use of your These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation.

Colorado's SALT Cap Workaround It's an annual election that can be taken made for tax years beginning on or after January 1, 2022, and would apply to all pass-through owners of an entity, with the exception of a C-corporation partner that is unitary with the partnership.