Colorado Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

US Legal Forms - one of many greatest libraries of legitimate varieties in the States - offers an array of legitimate papers templates you may obtain or printing. Using the site, you can get 1000s of varieties for company and person reasons, sorted by groups, suggests, or keywords and phrases.You will find the most up-to-date models of varieties like the Colorado Joint Filing of Rule 13d-1(f)(1) Agreement in seconds.

If you already have a monthly subscription, log in and obtain Colorado Joint Filing of Rule 13d-1(f)(1) Agreement in the US Legal Forms catalogue. The Down load switch can look on each kind you view. You have access to all previously acquired varieties from the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, listed below are easy guidelines to obtain began:

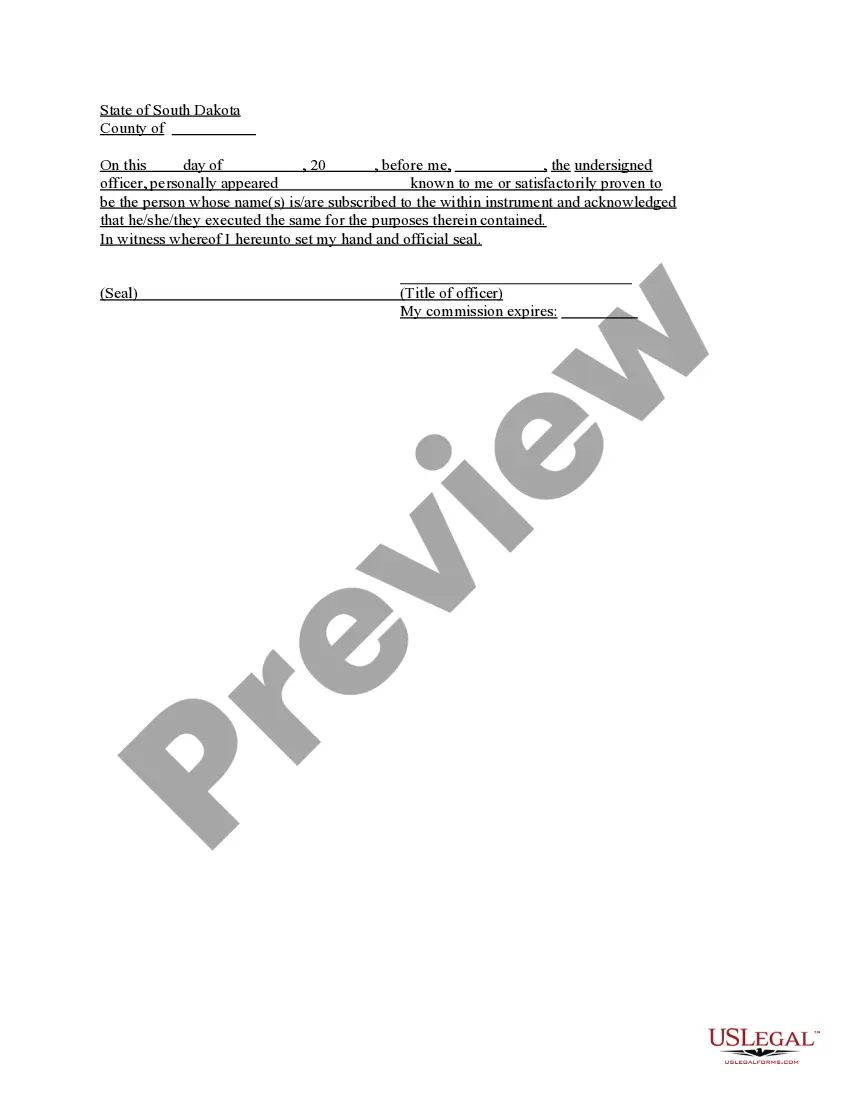

- Be sure to have picked the best kind for your metropolis/state. Click on the Preview switch to examine the form`s content material. Read the kind explanation to ensure that you have chosen the appropriate kind.

- If the kind doesn`t fit your requirements, use the Search area at the top of the display screen to discover the the one that does.

- If you are content with the shape, verify your selection by clicking the Get now switch. Then, select the rates prepare you want and give your qualifications to sign up for the account.

- Approach the purchase. Use your credit card or PayPal account to complete the purchase.

- Select the format and obtain the shape in your gadget.

- Make changes. Fill up, change and printing and signal the acquired Colorado Joint Filing of Rule 13d-1(f)(1) Agreement.

Each web template you put into your account lacks an expiration day which is yours for a long time. So, if you want to obtain or printing an additional copy, just visit the My Forms area and then click around the kind you want.

Gain access to the Colorado Joint Filing of Rule 13d-1(f)(1) Agreement with US Legal Forms, by far the most substantial catalogue of legitimate papers templates. Use 1000s of expert and express-distinct templates that meet up with your organization or person needs and requirements.

Form popularity

FAQ

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

An investor with control intent must file Schedule 13D, while ?Exempt Investors? and investors without a control intent, such as ?Qualified Institutional Investors? and ?Passive Investors,? file Schedule 13G.

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility.

Section 13(d), for example, requires those acquiring a stake of 5% or more to make certain disclosures. Section 14(d) governs tender offers. And, Section 16(a) requires, among other things, 10% shareholders to make certain disclosures.

(a) Any person who, after acquiring directly or indirectly the beneficial ownership of any equity security of a class which is specified in paragraph (i) of this section, is directly or indirectly the beneficial owner of more than five percent of the class shall, within 10 days after the acquisition, file with the ...

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

Item 4: Purpose of Transaction. This section of Schedule 13D alerts investors to any change of control that might be looming. Among other disclosures, beneficial owners must indicate whether they have plans involving a merger, reorganization, or liquidation of the issuer or any of its subsidiaries.

Exchange Act Sections 13(d) and 13(g) and the related SEC rules require that an investor who beneficially owns more than five percent of a class of voting equity securities registered under Section 12 of the Exchange Act ("covered securities") report such beneficial ownership and certain changes in such ownership by ...