Colorado Dividend Equivalent Shares

Description

How to fill out Dividend Equivalent Shares?

Are you inside a position where you need files for either organization or personal functions nearly every working day? There are a lot of lawful file layouts available on the Internet, but getting ones you can depend on is not straightforward. US Legal Forms delivers a large number of type layouts, like the Colorado Dividend Equivalent Shares, which are created to satisfy state and federal specifications.

Should you be already knowledgeable about US Legal Forms internet site and possess an account, merely log in. Afterward, you can obtain the Colorado Dividend Equivalent Shares web template.

Unless you come with an accounts and need to start using US Legal Forms, adopt these measures:

- Discover the type you want and make sure it is to the proper area/area.

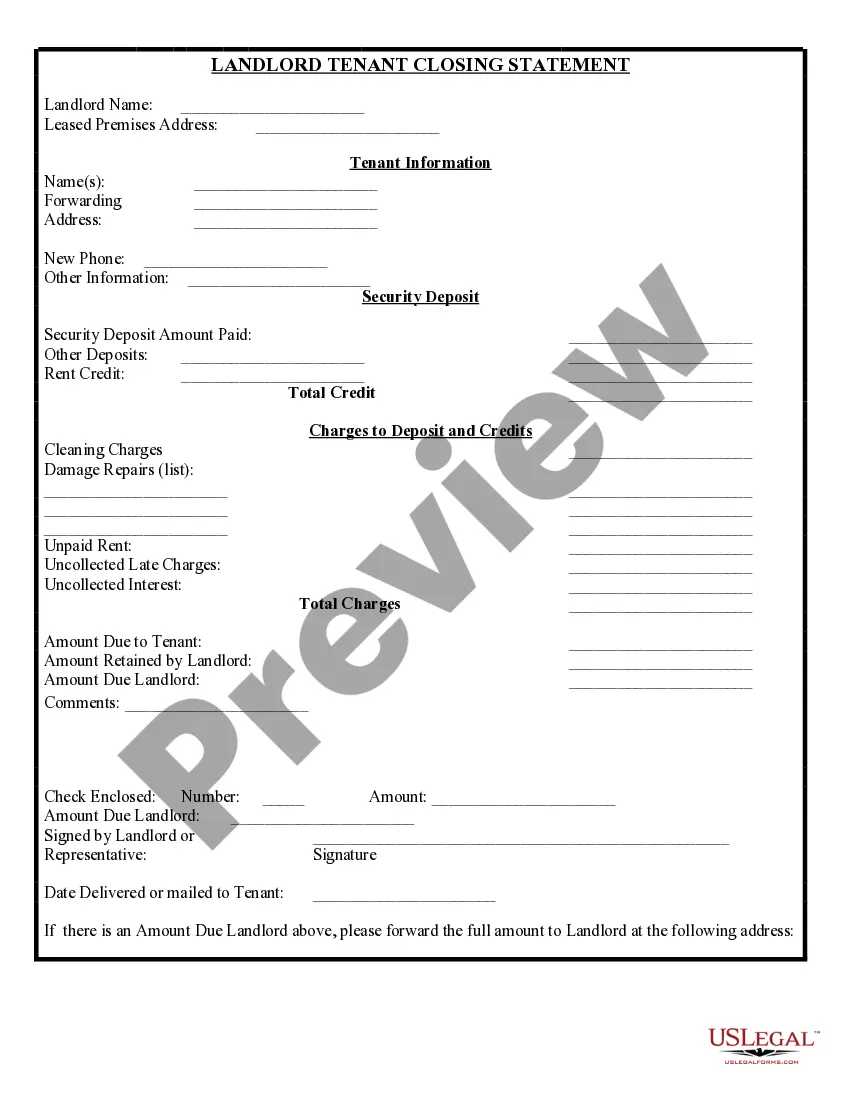

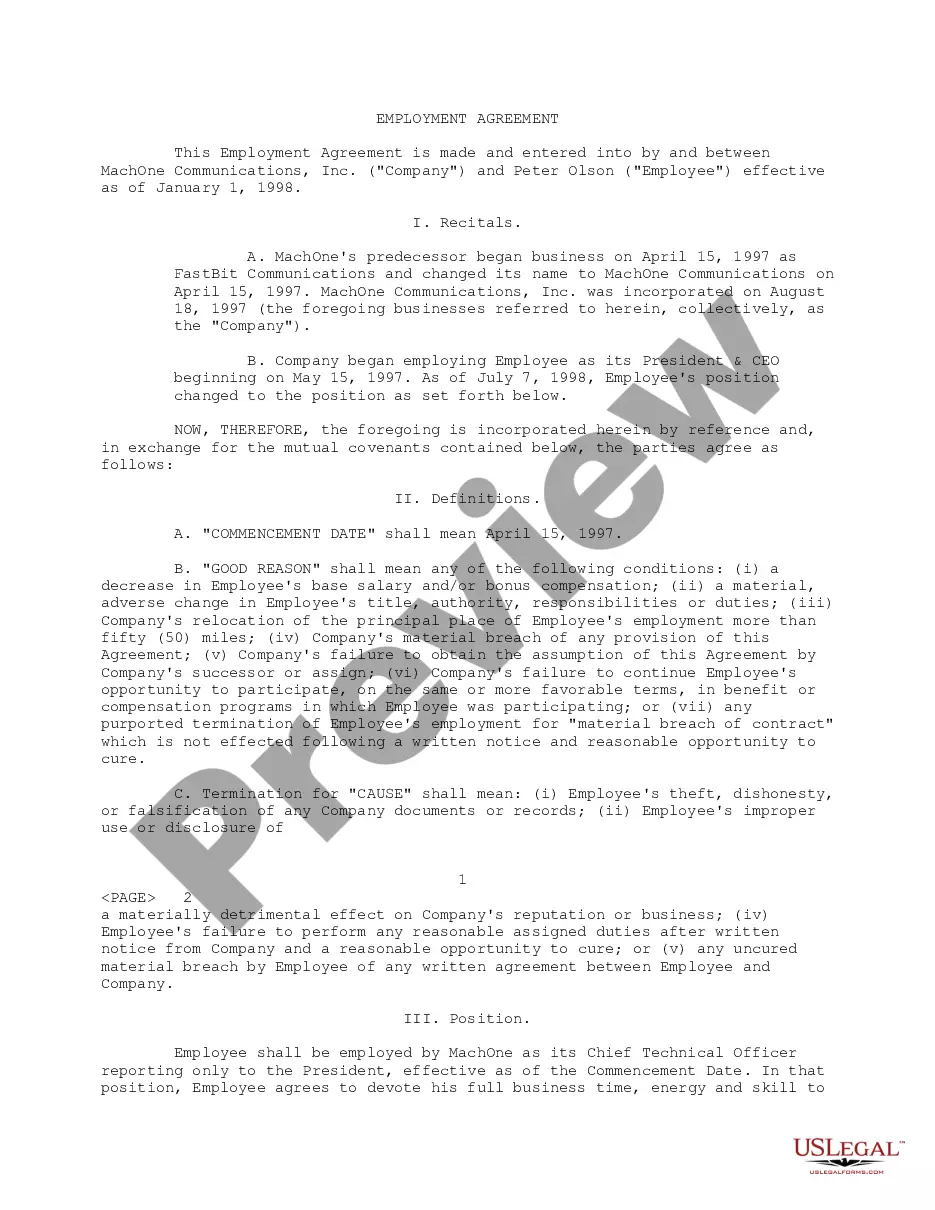

- Make use of the Review key to check the shape.

- Browse the information to ensure that you have chosen the appropriate type.

- In the event the type is not what you are trying to find, take advantage of the Look for field to obtain the type that suits you and specifications.

- Whenever you find the proper type, just click Purchase now.

- Select the costs prepare you desire, fill in the specified information to create your bank account, and pay money for the order utilizing your PayPal or charge card.

- Pick a convenient paper formatting and obtain your copy.

Get all the file layouts you possess purchased in the My Forms menu. You can obtain a further copy of Colorado Dividend Equivalent Shares whenever, if required. Just click the essential type to obtain or produce the file web template.

Use US Legal Forms, one of the most extensive selection of lawful kinds, to save time and avoid faults. The services delivers skillfully created lawful file layouts that you can use for a variety of functions. Make an account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

Dividend withholding tax is the tax a company must take off a dividend before the payment is made to the shareholder. This is then passed onto the government in which the share is domiciled. The tax rate will depend on where the share is registered.

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

The dividend equivalent amount is the amount of the foreign corporation's effectively connected earnings and profits for the tax year with certain adjustments for changes in the value of the equity of the foreign corporation's U.S. trade or business.

A dividend equivalent payment is treated as a dividend from sources within the United States. ingly, the dividend is subject to a flat 30-percent withholding tax, or lower tax rate provided by a treaty if received by a nonresident alien individual or a foreign corporation.

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

Withholding tax is payable at a rate of 0%, 12.8% or 26.5% (25% in 2022), depending on the relevant shareholder's situation. An 88% tax exemption is available for certain parent companies. Dividends are subject to withholding tax at 26.375% (except in special cases).

Holders of RSUs have no voting rights nor do they receive any dividends paid. Some companies may elect to pay dividend equivalents. For example, they may let dividends accrue and allocate those funds to cover some of the taxes due at vesting. Usually, vesting halts if the employee is terminated.