The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Colorado Nonemployee Director Stock Option Plan

Description

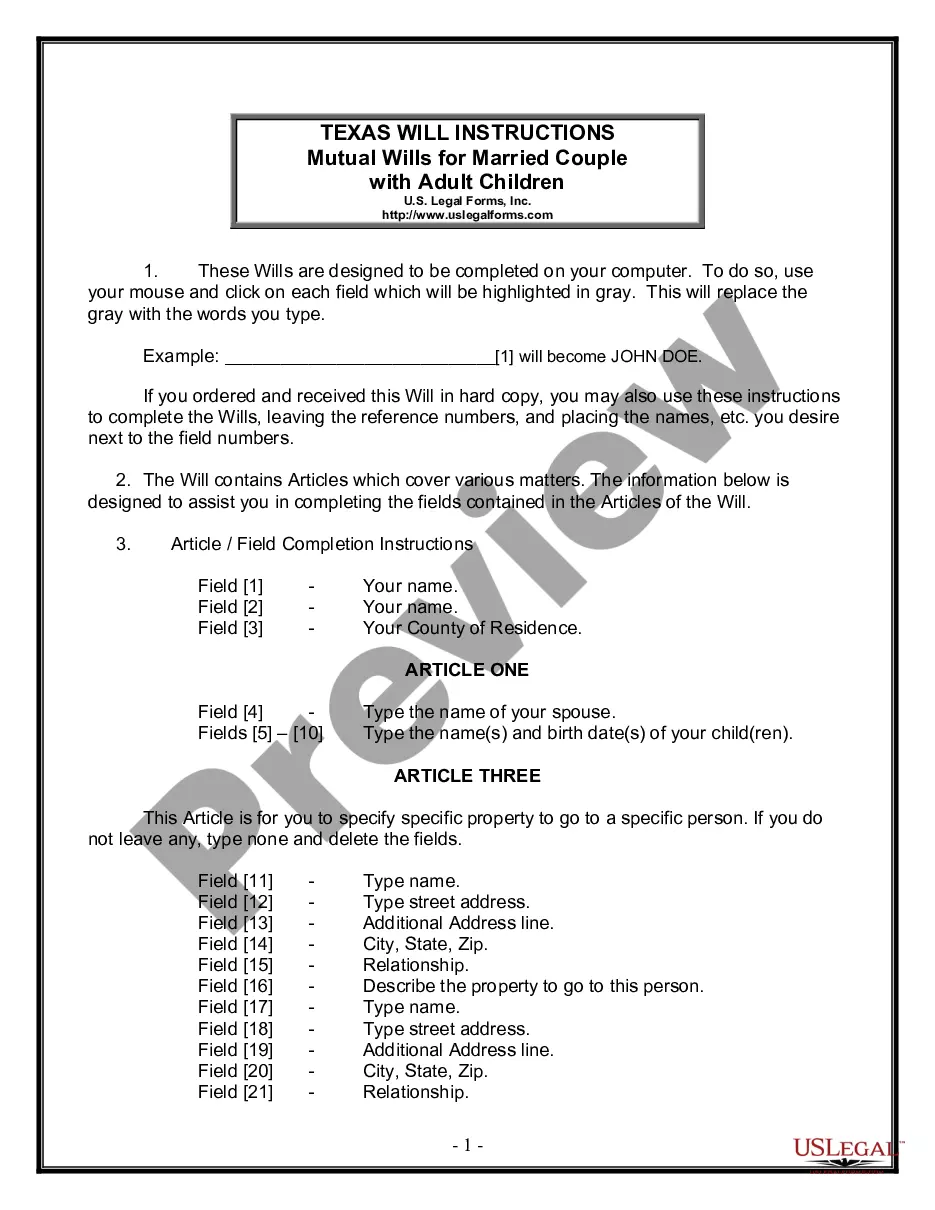

How to fill out Nonemployee Director Stock Option Plan?

If you want to comprehensive, download, or print lawful document templates, use US Legal Forms, the greatest variety of lawful types, that can be found on-line. Make use of the site`s basic and practical search to get the files you require. Different templates for enterprise and personal functions are categorized by types and suggests, or keywords. Use US Legal Forms to get the Colorado Nonemployee Director Stock Option Plan in a few mouse clicks.

In case you are already a US Legal Forms consumer, log in in your accounts and click the Acquire switch to find the Colorado Nonemployee Director Stock Option Plan. You can even gain access to types you in the past downloaded from the My Forms tab of your accounts.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper metropolis/land.

- Step 2. Take advantage of the Preview solution to examine the form`s articles. Don`t forget about to read the description.

- Step 3. In case you are not satisfied together with the type, take advantage of the Lookup area at the top of the display to find other variations of your lawful type format.

- Step 4. Once you have identified the shape you require, go through the Purchase now switch. Select the costs strategy you like and put your accreditations to register on an accounts.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal accounts to finish the purchase.

- Step 6. Pick the structure of your lawful type and download it on the device.

- Step 7. Full, edit and print or indicator the Colorado Nonemployee Director Stock Option Plan.

Each and every lawful document format you purchase is your own eternally. You might have acces to every type you downloaded within your acccount. Select the My Forms area and select a type to print or download again.

Compete and download, and print the Colorado Nonemployee Director Stock Option Plan with US Legal Forms. There are millions of professional and status-particular types you may use to your enterprise or personal requirements.

Form popularity

FAQ

A share option gives the holder the right, but not the obligation, to purchase a specific number of shares in the company at a predetermined price, known as the 'exercise price', or the 'strike price'.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

Allotment of ESOP Grant: Grant means the issue of stocks to the employees. It means informing the employee that he is eligible for ESOP. ... Vest: Vest means the right of the employees to apply for the shares granted to them. ... Exercise: The exercise period is where the employees can exercise the option of buying the shares.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

For example, Directors of Sales at companies that have raised Over 30M typically get between 0 and 250K+ shares. However, smaller companies that have raised Under 1M are more generous with their stock compensation as it ranges between . 1 and 1%+ for Directors of Sales.

Share option plans have become a popular form of employee compensation in the corporate world. These plans provide employees and directors with the opportunity to purchase company shares at a predetermined price within a specified timeframe.

Director's Shares means a number of Equity Securities of the Company not in excess of 600,000 in the aggregate that are owned by present or former directors of the Company or by present or former directors of any predecessor of the Company who also are or were Affiliates of any of the Stockholders, i.e. Andrew D.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.