Colorado Venture Capital Package

Description

How to fill out Venture Capital Package?

Are you presently in the place the place you need files for both company or person functions almost every time? There are a lot of lawful document templates available on the net, but getting versions you can rely on is not easy. US Legal Forms offers 1000s of develop templates, such as the Colorado Venture Capital Package, which can be written to satisfy state and federal requirements.

If you are presently informed about US Legal Forms website and possess a free account, simply log in. Following that, you may acquire the Colorado Venture Capital Package design.

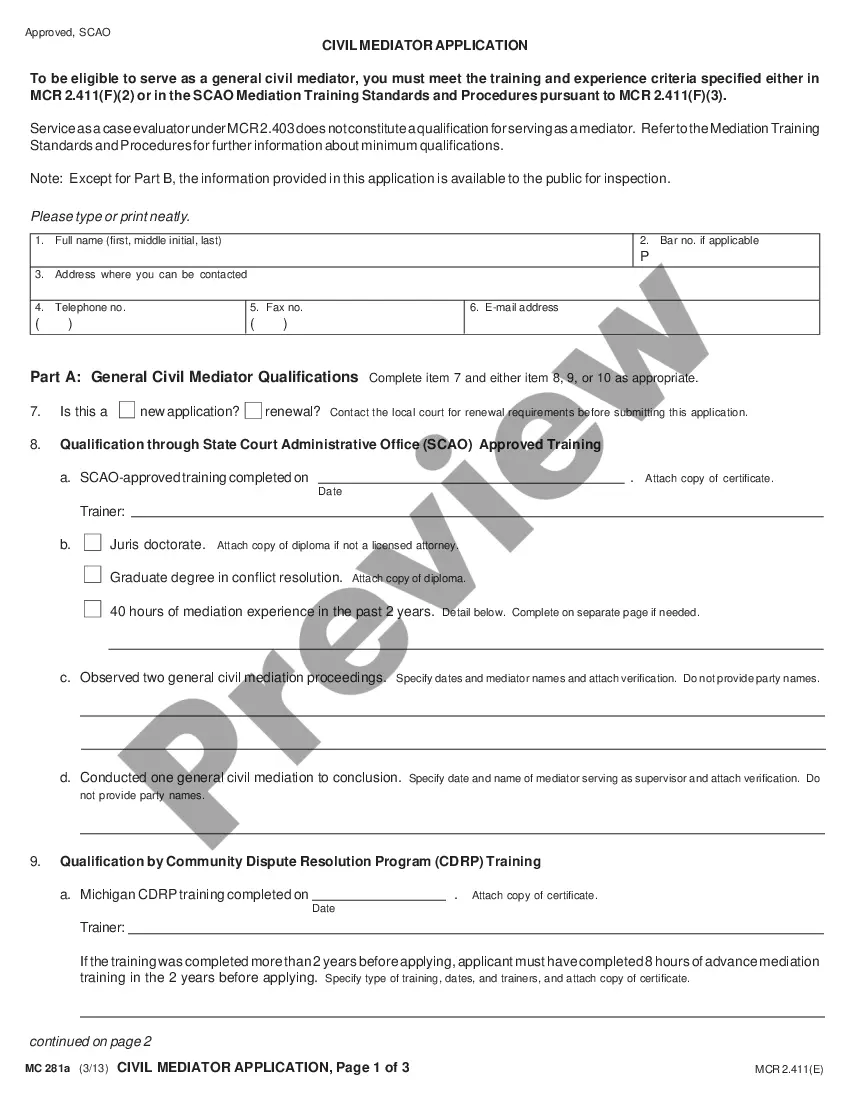

Unless you have an account and wish to begin using US Legal Forms, abide by these steps:

- Find the develop you require and ensure it is to the appropriate metropolis/region.

- Utilize the Preview key to examine the shape.

- Browse the information to ensure that you have selected the proper develop.

- When the develop is not what you`re seeking, make use of the Search discipline to get the develop that fits your needs and requirements.

- Whenever you obtain the appropriate develop, simply click Acquire now.

- Pick the prices plan you want, submit the required information to create your account, and buy the order using your PayPal or bank card.

- Choose a hassle-free document file format and acquire your backup.

Discover all the document templates you may have purchased in the My Forms food list. You can obtain a extra backup of Colorado Venture Capital Package any time, if required. Just click the essential develop to acquire or printing the document design.

Use US Legal Forms, probably the most comprehensive variety of lawful forms, to save some time and steer clear of blunders. The support offers appropriately created lawful document templates which can be used for an array of functions. Generate a free account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

The Venture Capital Funding Process Deal Origination. The first step of the funding process has to be getting deals to come into your company who need funding. ... Introductory Meeting. ... Due Diligence/Internal Analysis. ... Negotiation and Investment.

Firstly, look for the companies these venture capitalists have invested in. If those companies match the niche, you are about to enter; then it's a green signal for you to approach these venture capitalists. Secondly, identify what stage of funding these venture capitalist likes to do.

Many venture capitalists will stick with investing in companies that operate in industries with which they are familiar. Their decisions will be based on deep-dive research. In order to activate this process and really make an impact, you will need between $1 million and $5 million.

Venture capitalists rely heavily on trusted connections to vet deals. While some VCs will take pitches from an unsolicited source, it's best bet to find an introduction through a credible reference. Every pitch to a venture capital firm starts with an introduction to someone at the firm.

How to Get Venture Capital Funding in 10 Steps in 2023 1) Determine Your Business Valuation. The amount of venture capital funding investors will potentially give you, and your business is directly tied to your startup's current valuation. ... 2) Determine How Much Capital You Need. ... 3) Determine the Best VCs for Your Business.

While many VCs earn their MBA, many others join venture capital firms before getting an MBA. Most pre-MBA hires have worked in prestigious management consulting, investment banking, or operational roles within successful startups or tech companies (e.g. sales, business development, or product management).

Begin Reaching Out Begin with Tier II prospects. Select 10 of them and for each one, use LinkedIn and consult your advisers and angels to figure out how you can get a warm referral. Referrals are critical. VCs are swamped by mediocre pitches and eager to ignore founders who do not have sales skills.

If you want to break into VC but have no experience, here are five ways to start padding that resume. Learn the business. Okay, maybe this may not jump off the page of your resume. ... Join a startup. ... Try Your Hand at Investing. ... Start networking. ... Try to lock in an internship.