Colorado LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Are you in a situation where you need documentation for both business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but locating reliable ones isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the Colorado LLC Operating Agreement for S Corp, designed to comply with federal and state regulations.

Once you’ve found the right form, just click Buy now.

Select the pricing plan you prefer, enter the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Colorado LLC Operating Agreement for S Corp at any time, if required. Click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Colorado LLC Operating Agreement for S Corp template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is suitable for your specific city/state.

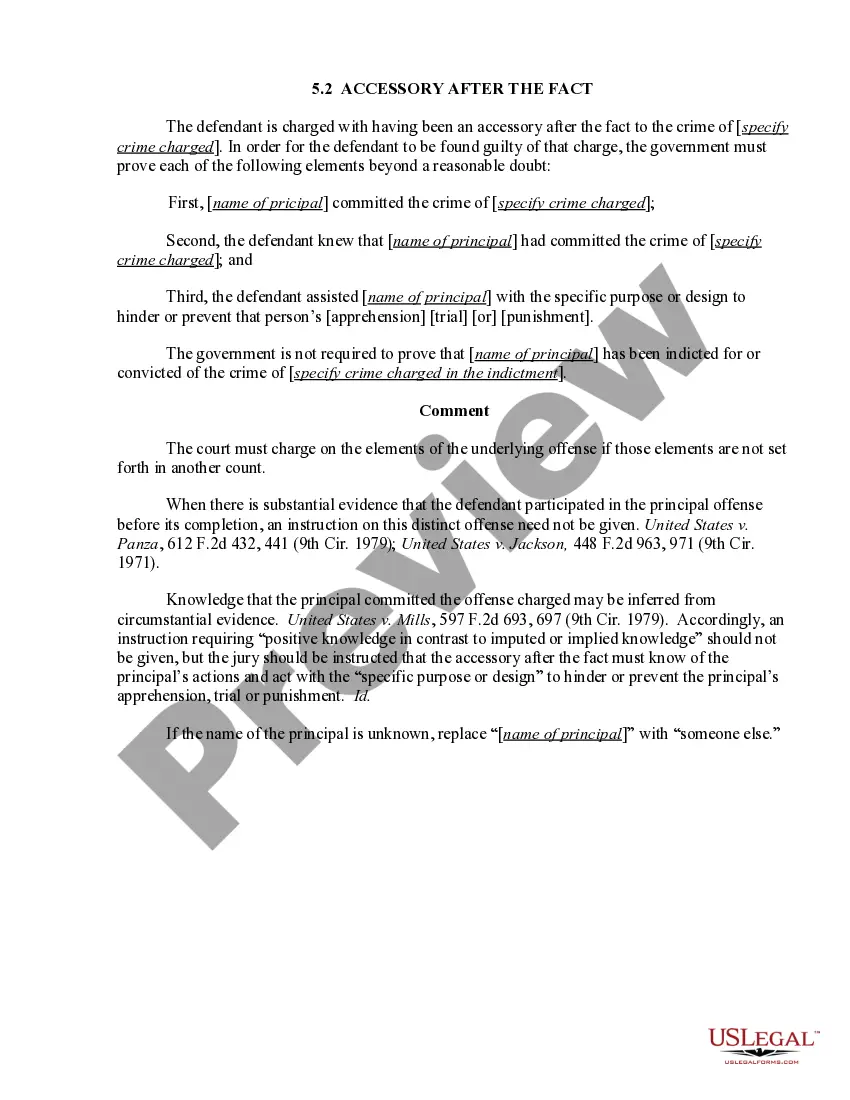

- Utilize the Review button to examine the form.

- Read the description to confirm you have chosen the correct form.

- If the form isn’t what you’re seeking, use the Search field to find the form that meets your needs.

Form popularity

FAQ

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

A Colorado LLC operating agreement is a legal document that is used to establish rules and regulations that, once agreed upon by the members, shall govern relationships between all of the managing members of the company and set specifics pertaining to the operations of the company.

To keep your Colorado LLC in good standing with the state, you'll need to annually: Submit your LLC's Periodic Report. File any Colorado State Taxes....Step 1: Choose your LLC Name.Step 2: Select Your Registered Agent.Step 3: File Your Articles of Organization.Step 4: Create and Sign Your Operating Agreement.More items...

An LLC operating agreement is not required in Colorado, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

The state of Colorado does not require you to provide an Operating Agreement when you file your Articles of Organization with the Secretary of State. Still, the document is recognized by Colorado law and can be used to solve legal disputes.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Once the document is complete, it should be filed and recorded. All members (including sole proprietors) must take the time to carefully review all aspects of the document. If the language is unclear, a consultation with a knowledgeable attorney may be needed. This document will not require notarization.