West Virginia Option For the Sale and Purchase of Real Estate - Commercial Lot or Land

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Commercial Lot Or Land?

US Legal Forms - one of the largest repositories of valid documents in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the most up-to-date forms such as the West Virginia Option For the Sale and Purchase of Real Estate - Commercial Lot or Land within moments.

If you have a subscription, Log In and download West Virginia Option For the Sale and Purchase of Real Estate - Commercial Lot or Land from the US Legal Forms library. The Obtain button will appear on each form you view. You have access to all previously electronically submitted forms from the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded West Virginia Option For the Sale and Purchase of Real Estate - Commercial Lot or Land. Each template you added to your account has no expiration date and remains yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Access the West Virginia Option For the Sale and Purchase of Real Estate - Commercial Lot or Land with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your locality/state.

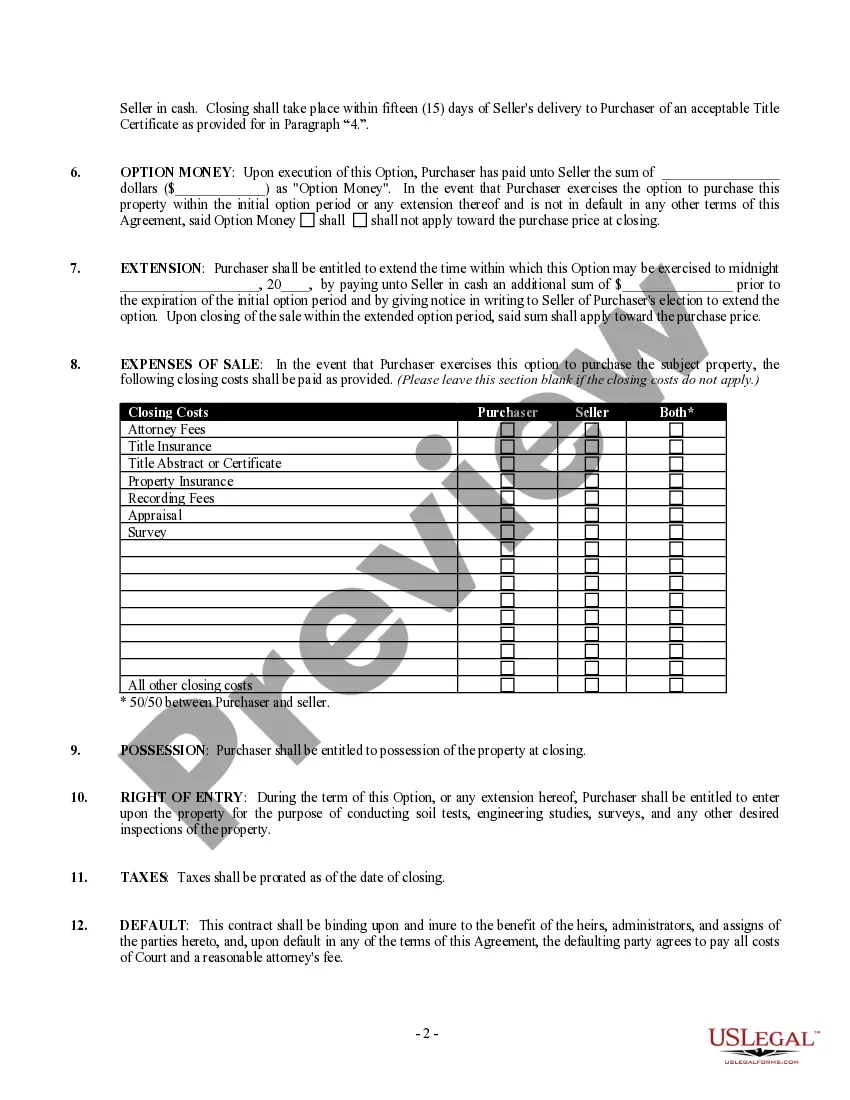

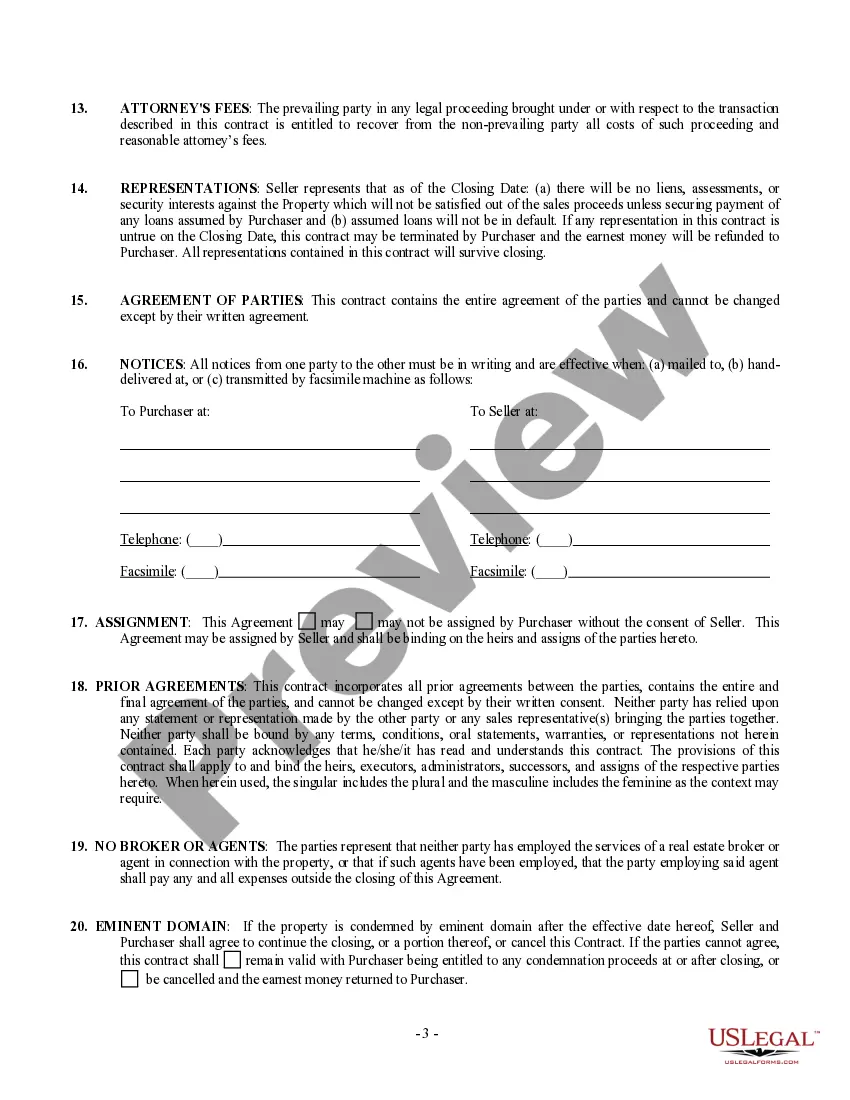

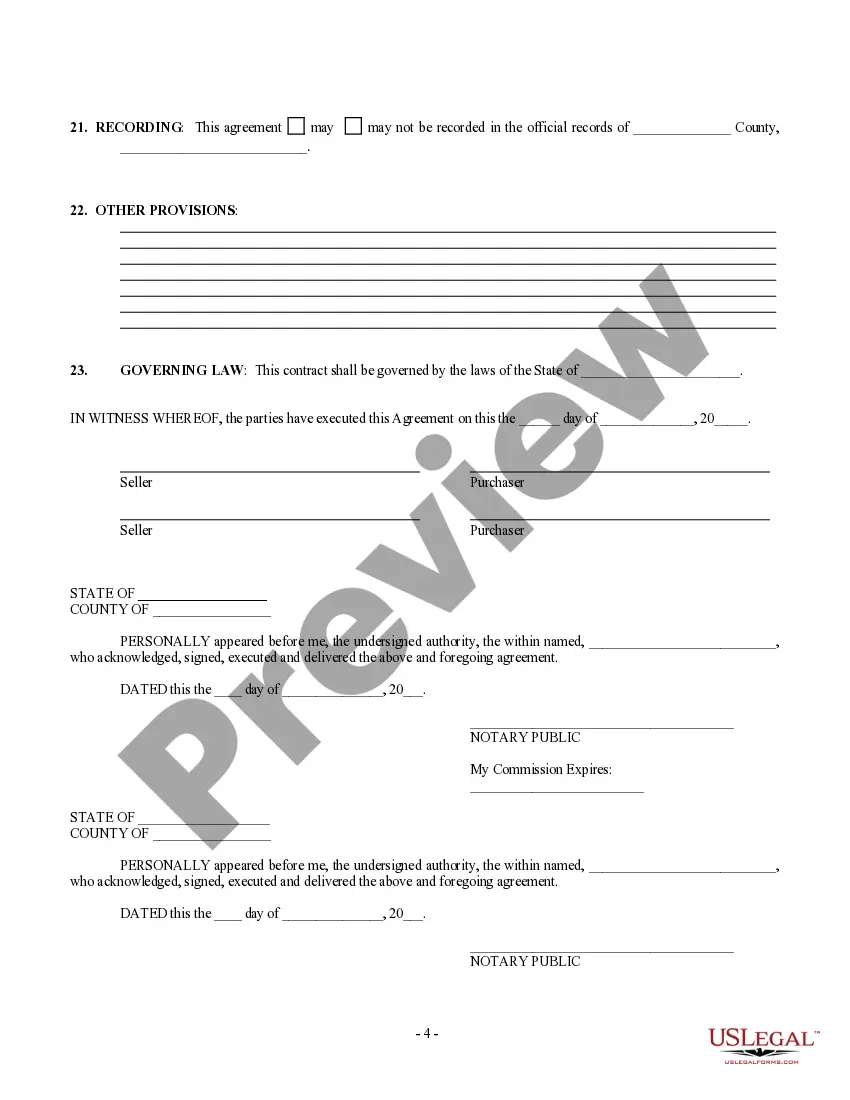

- Click the Review button to examine the form's content.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Lookup field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The West Virginia (WV) state sales tax rate is currently 6%. Depending on local municipalities, the total tax rate can be as high as 7%. Amazon.com owns and operates a customer service center in West Virginia.

Persons who are 65 years of age or older, or permanently and totally disabled, are entitled to an exemption from property taxes on the first $20,000 of assessed value on their owner- occupied residence.

The fee for obtaining a Business Registration Certificate is $30.00. A separate certificate is required for each fixed business location from which property or services are offered for sale or lease or at which customer accounts may be opened, closed, or serviced. The Business Registration fee cannot be prorated.

Remote seller means a person selling tangible personal property and/or services for delivery in West Virginia who does not have a physical presence in West Virginia and who has not voluntarily agreed to collect West Virginia sales and use taxes.

Buyer Beware (§30-40-19) The state of West Virginia falls under the category of a Caveat Emptor which effectively translates to let the buyer beware. The term refers to the protection granted to the seller of the property after a transaction has taken place and the property has changed hands.

By Lee Breslouer March 7, 2022. If you buy products exclusively to resale in the state of West Virginia, you can avoid paying sales tax on your purchases by presenting a West Virginia resale certificate at checkout.

West Virginia collects a 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in West Virginia may be subject to other fees like registration, title, and plate fees.

The general rule is that the transaction is sourced to the location where the purchaser receives the tangible personal property purchased or makes first use of the service purchased. The hierarchy of sourcing rules is found in West Virginia Code § 11-15B-15(a).

No Seller Disclosure Regulations in West Virginia Under the doctrine of caveat emptor ("let the buyer beware"), judges ordinarily refuse to compensate buyers for home defects found after the purchase unless the seller did something to actively prevent the buyer from inspecting the property to find all of the defects.

West Virginia Death DisclosureWest Virginia does not have a law requiring disclosure of death on a property. The state does not consider death to be a material fact requiring disclosure.