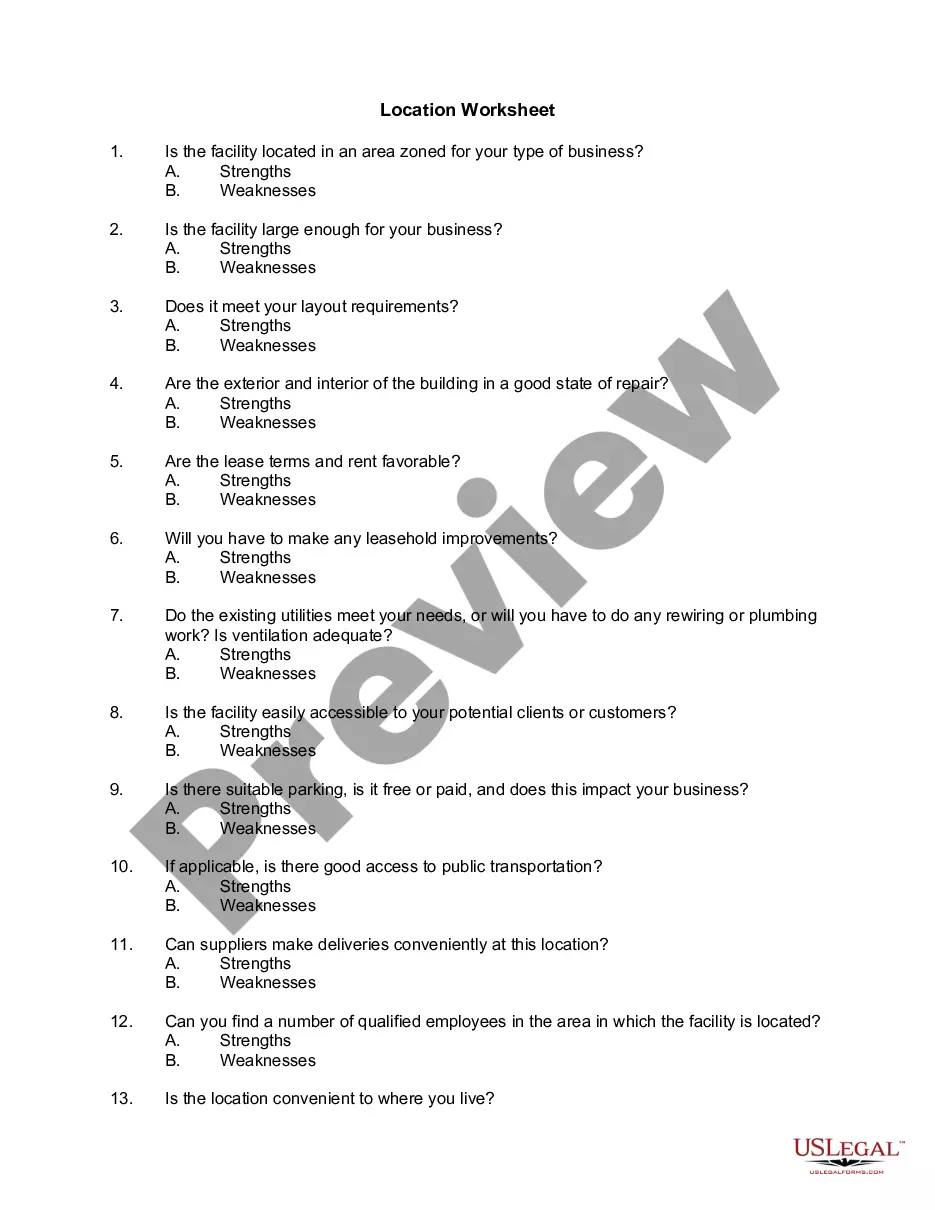

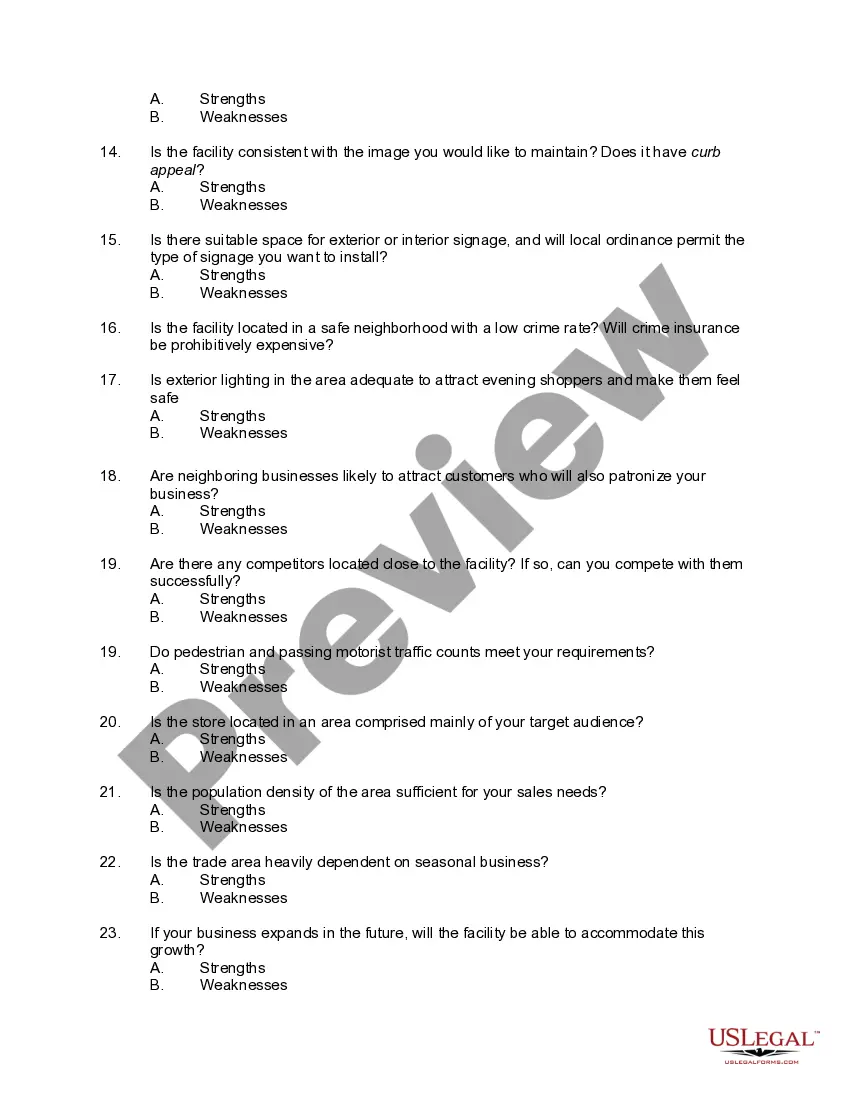

Colorado Location Worksheet

Description

How to fill out Location Worksheet?

Selecting the appropriate authorized document format can be a challenge.

Clearly, there are numerous templates available online, but how can you acquire the legal document you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Colorado Location Worksheet, suitable for business and personal needs.

You can review the form using the Preview button and read the form details to confirm it meets your needs.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Obtain button to access the Colorado Location Worksheet.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

To submit your W-2 to Colorado, include it with your state tax return as specified in the Colorado Location Worksheet. Depending on your choice of filing, you can either print and attach it or upload it during electronic filing. Make sure you retain a copy for your records. This submission confirms your income and supports your tax calculations.

You can attach a copy of your W-2 to your tax return without any issues. Be sure that the copy is clear and legible, as this permits a seamless review of your income information. Using the Colorado Location Worksheet simplifies identifying where to place the W-2 in your return. Thus, make this attachment a priority to alleviate any processing problems.

Yes, attaching your W-2 to your Colorado tax return is necessary for accurate reporting of your income. By including this document, you help ensure the Colorado Department of Revenue has all the required details to process your return smoothly. The Colorado Location Worksheet will guide you on how to include your W-2, so make sure you follow it closely. This step ultimately aids in avoiding any delays.

When attaching your W-2 to your state tax return, ensure that it is included in the proper location of the Colorado Location Worksheet. For electronic submissions, follow the prompts to upload your document. If filing by mail, attach the W-2 behind the first page of your return to avoid any confusion during processing. This method guarantees all relevant tax information is available for review.

Filling out your Colorado W-4 requires you to provide accurate personal information and adjust your withholding as needed. Start with your name and identification details at the top of the form. Next, refer to the instructions on the Colorado Location Worksheet to determine your allowances based on your specific tax situation. This approach ensures that your withholding aligns with your expectations at tax time.

To attach your W-2 to your Colorado tax return, begin by ensuring you have a copy of your W-2 ready. You can either print it out or include it if you are filing electronically. For paper submissions, place the W-2 in the designated spot on the Colorado Location Worksheet. Using the correct method helps streamline your filing process.

No, you do not need to file a federal tax return to file a Colorado tax return. However, the information from your federal return may be useful when completing your Colorado Location Worksheet. It is always beneficial to consult with a tax professional for personalized guidance.

To obtain a Colorado resale certificate, you need to complete the official application form found on the Colorado Department of Revenue website. Once submitted, this certificate will allow you to make tax-exempt purchases for resale purposes. Using a Colorado Location Worksheet can also help streamline the process of organizing relevant information for your application.

To change your address with Colorado Revenue, visit their website and navigate to the forms section. You need to fill out and submit an address change form, either online or by mail. This change is crucial for the accurate processing of your taxes and for receiving updates, especially regarding your Colorado Location Worksheet.

Changing your address with revenue involves completing a form that you can find on the Department of Revenue's website. Make sure to provide all required information to avoid delays. Keeping your address current is essential so that you stay informed about your Colorado Location Worksheet and any related tax matters.