Colorado Bill of Sale of Goods or Personal Property with Covenants

Description

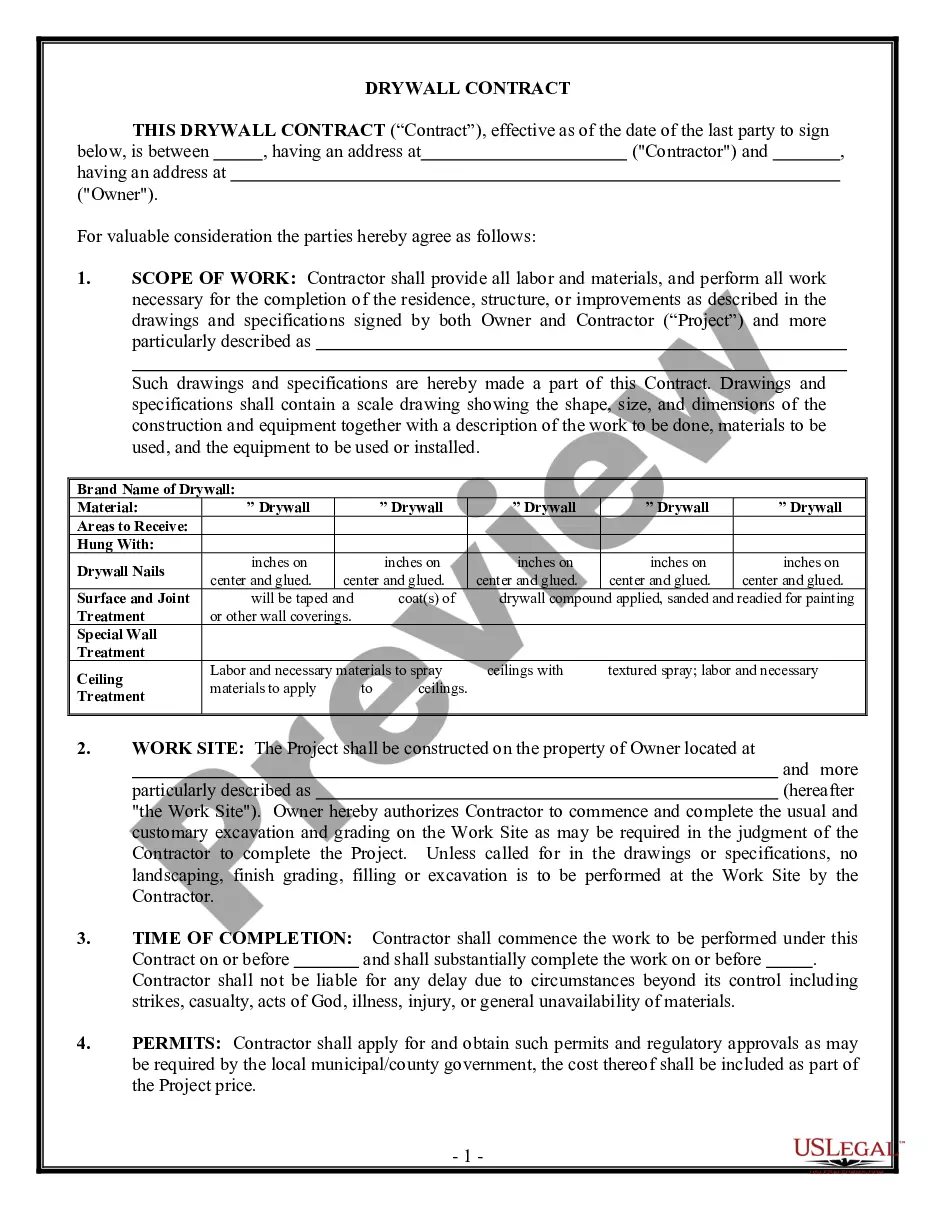

How to fill out Bill Of Sale Of Goods Or Personal Property With Covenants?

You may invest hours online looking for the legal documents template that meets your state and federal requirements.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can download or print the Colorado Bill of Sale of Goods or Personal Property with Covenants from the service.

If available, take advantage of the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can fill out, edit, print, or sign the Colorado Bill of Sale of Goods or Personal Property with Covenants.

- Every legal document template you purchase is your own forever.

- To obtain another copy of any purchased form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow these simple steps.

- First, ensure that you have selected the correct document template for your location/area of interest.

- Read the form description to confirm you have selected the correct form.

Form popularity

FAQ

Yes, Colorado does impose personal property tax on certain vehicles, primarily those that are registered with the state. This may include cars, trucks, and trailers that are not exempt. However, it is important to acknowledge that using a Colorado Bill of Sale of Goods or Personal Property with Covenants when buying or selling a vehicle assists in establishing ownership and compliance. This legal document can serve as a crucial tool in ensuring that your vehicle transactions are smooth and legitimate.

A personal property declaration is a formal document submitted to the assessor's office, detailing the personal items you own that are subject to tax. In Colorado, this is a critical step if you own taxable personal property since it helps the state assess its value. While personal property tax may not apply to all assets, utilizing a Colorado Bill of Sale of Goods or Personal Property with Covenants can clarify ownership during this process. Ensuring you file this declaration properly can protect your interests as a property owner.

In Colorado, tangible personal property includes items that you can physically touch and move, such as furniture, vehicles, and equipment. When you buy or sell such items, it is recommended to use a Colorado Bill of Sale of Goods or Personal Property with Covenants to outline the transaction. This bill of sale clearly documents the change in ownership and helps protect both the buyer and seller during the transaction. Understanding what qualifies as tangible personal property can help you better manage your assets.

If you are looking for states with no personal property tax, you will be pleased to know that Colorado does not impose a personal property tax on most personal items. This includes goods and personal property that you might transfer using a Colorado Bill of Sale of Goods or Personal Property with Covenants. Therefore, you can enjoy the freedom of managing your personal assets without the burden of tax liabilities on them. Always check local regulations, as they may vary by county.

In Colorado, personal property refers to any movable item that is not permanently affixed to land or buildings. This includes items like vehicles, furniture, electronics, and personal belongings. Whether you are buying or selling these items, utilizing a Colorado Bill of Sale of Goods or Personal Property with Covenants can simplify the transaction and provide legal protection for both parties involved. Understanding what qualifies as personal property is essential for ensuring a smooth and successful sale.

To fill out a bill of sale consideration, clearly state the amount being exchanged for the goods or personal property. This section should include the exact dollar figure to confirm the value of the item being sold. Using a Colorado Bill of Sale of Goods or Personal Property with Covenants template from uslegalforms can simplify this process, ensuring all necessary details are included.

Business personal property in Colorado refers to items used in a business that are not attached to real estate. This includes equipment, furniture, and vehicles essential for operations. Understanding what constitutes business personal property is vital for proper documentation and taxation. The Colorado Bill of Sale of Goods or Personal Property with Covenants can streamline the sale or transfer of such items efficiently.

You are welcome to write your own bill of sale in Colorado. It is straightforward as long as you capture all the important details related to the sale. To make your document legally sound and clear, consider utilizing the Colorado Bill of Sale of Goods or Personal Property with Covenants, which provides a ready-made template.

In most cases, a Colorado bill of sale does not need to be notarized. However, certain transactions, especially those involving higher-value items or requiring registration, may benefit from notarization. Using a Colorado Bill of Sale of Goods or Personal Property with Covenants can help clarify if notarization is necessary for your specific situation.