Colorado Sample Letter for Debt Collection for Client

Description

How to fill out Sample Letter For Debt Collection For Client?

Are you in a circumstance where you require documents for occasional business or specific reasons almost every day.

There are many legitimate document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers a vast array of document templates, such as the Colorado Sample Letter for Debt Collection for Client, designed to meet federal and state requirements.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of Colorado Sample Letter for Debt Collection for Client whenever necessary. Just click on the desired template to download or print the document.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and prevent errors. This service provides professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Colorado Sample Letter for Debt Collection for Client template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/state.

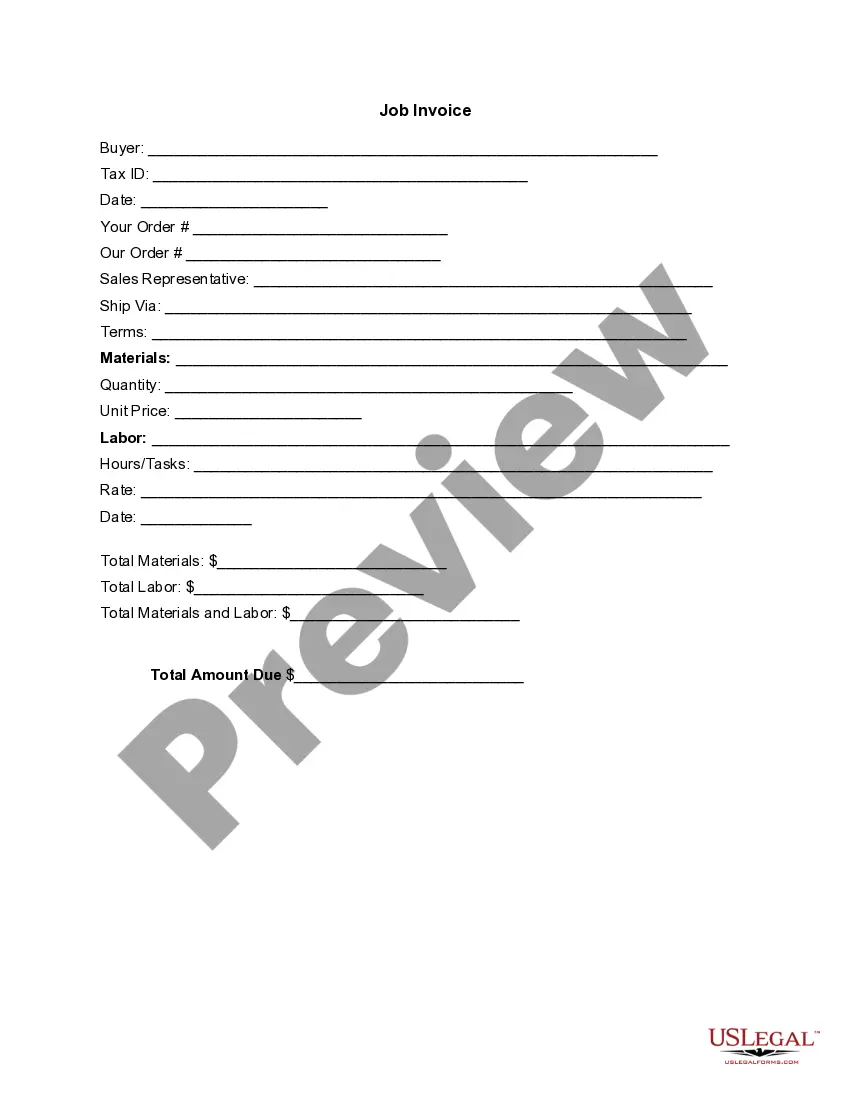

- Use the Preview option to review the document.

- Read the description to confirm that you have selected the right template.

- If the document is not what you are looking for, use the Search box to find the template that suits your needs.

- Once you obtain the correct template, click Acquire now.

Form popularity

FAQ

Here are some steps you can take: Send a written demand for payment. File a case in the small claims court. Hire a lawyer to file a case in the appropriate court. File a police complaint if you think you have been cheated. Get an order from the court to attach the person's property.

How to write demand letters Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment. Description of the nature of the agreement and breach of contract.

Here's the following details that your letter must contain: The amount of money owed by the debtor. The settlement of a debt (initial due date) The newly recommended due date for debt repayment. Instructions for the payment of the debt.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

You should consider sending the letter by certified mail or another method by which you can establish when the letter is received by the intended recipient. Send this letter as soon as you can -- if at all possible, within 30 days of when a debt collector contacts you the first time about a debt.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.